Tuesday, September 30, 2008

Yes, this is working out well!

The reports on NPR this morning were excruciating, with "liquidity" "greasing the wheels" so the "cogs of business" did not "seize up". I would love for someone, anyone, to show me a cog that needs greasing.Source.

I know this may be pointing out the obvious, but I think it needs to be said: Lenders have to lend, just as much as borrowers have to borrow.Source.

"I {heart} liquidation."

The cost of borrowing overnight dollars on global money markets soared on Tuesday despite central banks pumping billions into the banking system to prevent it seizing up further after US lawmakers� rejection of a $700 bn financial rescue bill panicked markets.

The scramble for cash as banks sought to square their books over the end of the quarter saw the European Central Bank lend $30 bn dollars overnight at a huge rate of 11% � more than five times the Federal Reserve�s 2% target rate � and call for bids for an additional $50 bn.

Meanwhile, the London interbank offered rate (Libor) for overnight dollars jumped by a record 430 basis points to 6.87%, the highest in at least 7-1/2 years.

Enjoy that stock market rise today.

Labels: economics

What's a free marketer to think?

The mote in your own eye

... it is largely false that taxpayers have not profited from the sub-prime craziness that has matured into a crisis. The vast majority of Americans own their homes, and all of us have seen our values go up as a result of precisely the lax lending standards that stoked the market. Those in California or Connecticut who sold their houses in the last couple of years have hundreds of thousands of dollars in windfall profits that are precisely due to the problems now afflicting Wall Street. Indeed, everybody who received dividends from real estate funds or high-yielding bond accounts juiced with mortgage-backed securities has reaped profits.h/t: Tim. Emphasis mine.

There�s more. Almost 100 percent of income tax is paid by the top earning 50 percent of the American population. These are the folks most likely to buy stocks, have 401k and IRA accounts, and own other sorts of financial assets in addition to their houses. The housing bubble and the financial shenanigans associated with financing real estate was the single most important support for financial markets after the technology bubble burst in 2000. In other words, the net worth of all Americans who have stock and bond-based assets was supported by exactly the economic dynamics that have produced the mess that we�statistically the very same people�are now going to pay to unwind in what I hope is an orderly fashion. My friends, most of us did profit from the sub-prime debacle.

Henry Paulson�s $700 billion plan may be poorly conceived. The plan may be corruptly executed. It�s very hard to see how any government-run bailout can avoid the sort of cronyism and log-rolling and set-asides that characterize government expenditures in general. Think bridge-to-nowhere on steroids. And who knows, it may not work.

So, when it comes to the details, there is and will be plenty to criticize. We need to pay very close attention. The Paulson plan, no matter what its final form, will be huge. And because it�s huge, it will be fatefully consequential for our future economic and political system. We need to get this right, or at least as right as possible. That�s all the more reason to focus on the details rather than grandstanding about Wall Street greed and bellyaching about the supposed unfairness of a government bailout.

Labels: economics

Classic Media Bias

"A READER AT A MAJOR NEWSROOM EMAILS: "Off the record, every suspicion you have about MSM being in the tank for O is true. We have a team of 4 people going thru dumpsters in Alaska and 4 in Arizona. Not a single one looking into Acorn, Ayers or Freddiemae. Editor refuses to publish anything that would jeopardize election for O, and betting you dollars to donuts same is true at NYT, others. People cheer when CNN or NBC run another Palin-mocking but raising any reasonable inquiry into Obama is derided or flat out ignored. The fix is in, and its working." I asked permission to reprint without attribution and it was granted. (Glenn)

It will be the mainstream media (MSM) who are the cause of our loss of freedoms. When they, along with their buddies in the classrooms, choose favorites (think teacher's pet) and "report" only one side of an issue we all lose. When the MSM condones name calling and unsubstantiated attacks of people of one side of the political spectrum, while refusing to address real issues, we all lose. When the MSM ignores facts that are counter to their bubble beliefs, we all lose,

The saddest irony is that if this bias continues unchecked, the "truth" squad will run DC and there will be no stopping this "truth" squad from turning on the very MSM they used to gain power, that is, after the "truth" squad has eliminated any voice that does not buy into their agenda.

Americans are smart enough IF given the necessary information. When Americans get only one viewpoint, it becomes very difficult to make a wise decision. One cannot choose well without facts.

Labels: Media

Monday, September 29, 2008

Don't banks do that?

As its parent company faces legal troubles, Sun Country Airlines announced it is deferring 50 percent of its employees� wages through the end of the year.In a normal financial market, Plan B would be to go to a bank for short-term liquidity. Not now.

Sun Country CEO Stan Gadek sent a letter to employees Monday saying, �we must now become financially independent of our parent company.�

Sun Country is a unit of Petters Worldwide Group. Last week, authorities raided Petters� headquarters and several homes.

...Sun Country is in its slowest period of the year and Gadek says under normal circumstances, the company would request a short-term loan from Petters Worldwide. Now, he says, that option isn�t available.

Today's tally

May you want what you get

Because they got what they wanted. �Robert Bruner, co-author of The Panic of 1907, a book I read over the weekend, quoted Yeats.

Turning and turning in the widening gyreI'm with Podhoretz: Perhaps.

The falcon cannot hear the falconer;

Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

Labels: banking, economics, politics

A local icon in trouble?

Late Friday afternoon the federal government revealed what FBI, IRS and other federal agents were looking for Wednesday when they raided the Petters Group headquarters and Tom Petters' home.MPR has a copy of the warrant, and includes these details:

They were seeking evidence of a scheme to lure investors into funding a company based on tens of millions of dollars in purchases and sales that never occurred.

The primary method of effectuating the fraud scheme involves PETTERS, his employees, and his associates creating fictitious documents and then providing these documents to potential investors as evidence that PCI is buying and selling substantial goods and merchandise which PCI will then resell. In many instances funds from investors are sent directly to the purported supplier of the merchandise, NIR or ENCHANTED {companies controlled by Petters --kb}. In turn, NIR or ENCHANTED direct the funds to PCI (less a commission) without any merchandise. PETTERS and other persons then fraudulently pledge the non-existent goods and merchandise as security for the investments.Sun Country says it will continue to operate as usual.

Petters is well known in the area as a philanthropist who recently gave $8.3 million to a fundraising campaign recently completed at the College of St. Benedict (and $3 million some years ago.) CSB has an auditorium named after him and a center for global education. He has always dressed as a successful guy who came up from humble roots here. I gauge local community reaction here as varying degrees of shocked. They have a cooperating witness in the case who was involved in the scheme, who appears to have worn a recording device in meetings with Petters, so it looks bad. But many here will hope this turns out not to be true.

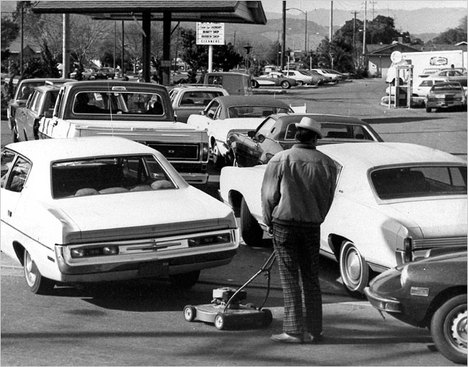

In case you forgot the gas problem

There's still a shortage going on, and might for awhile longer, in the southeast.

There's still a shortage going on, and might for awhile longer, in the southeast.Atlanta�s chaotic gasoline shortage should be back to normal by Columbus Day, Oct. 13, at the latest, said Randy Bly of AAA South. That means about two more weeks of uncertainty, desperate searches for stations with gasoline and long lines at stations that do.More thoughts on inventories at The Oil Drum. I agree with their comment, "why haven't gas prices risen more?"

Bly said Nashville had fuel shortages similar to those in metro Atlanta, but now 70 to 80 percent of the city is being supplied.

...The chaos began when Hurricanes Gustav and Ike temporarily shut down Gulf Coast refineries. As shortages began to become evident, panicked motorists began topping off and filling up gas canisters. That has delayed a recovery, but the flow through major pipelines from the Gulf remains reduced. As of Friday, only three of the Gulf's 56 refineries were still off line, but several open refineries were at reduced production levels.

Next time you hear a liberal yearn for Jimmy Carter (they do!) you can also remember these lines from 1974. Cui bono?

Friday, September 26, 2008

A Visit with Laurie Coleman

She talked about this campaign in particular - anyone following the current US Senate campaign has seen some of the horrible attacks on Norm Coleman and it is expected to get worse, a lot worse. The Democrats have set aside over $6,000,000 to attack Norm. Then she took questions.

Sometimes you wonder if these kind of events are valuable. They are - some attendees were not sure about voting for Norm. After hearing Laurie today, they realized, "Hey, these people are like us. I'll support Norm."

I've watched Norm in small groups over the past few weeks. He really cares about Minnesotans, values, the US, kids, education, and MN history. I have my problems with some of his positions, and I call his office to voice my concerns. But the bottom line is this: he's no millionaire, he did not marry money, he works hard, and yes, he does care.

Continuing disclosure: As I have noted in the past, I am the elected Chair of Minnesota's Second Congressional District Republicans, a volunteer position in Congressman John Kline's district.

And this is what you want?

Most U.S. stocks fell, dragging the Standard & Poor's 500 Index to its worst weekly retreat since February, as the government's $700 billion financial rescue plan stalled in Congress and Washington Mutual Inc. collapsed.Source. OpinionJournal's Political Diary (subscription) is reporting that Eric Cantor and other House Republicans who have balked at the Paulson plan say "there is no way there isn't a vote" and that they have an alternative.

Wachovia Corp. tumbled as much as 31 percent and National City Corp. as much as 60 percent after a group of House Republicans said they wouldn't support the bailout as outlined by Treasury Secretary Henry Paulson and regulators deemed WaMu ``unsound.''

Essentially, the alternative being drawn up by Messrs. Cantor, Ryan and Hensarling aims to free up private capital to buy distressed securities by pushing through a series of tax and regulatory reforms, and by creating government insurance for mortgage-backed securities that are now burning holes in financial firms' balance sheets. Washington has more experience running guarantee programs, they note, than running a hedge fund (the Paulson plan). Their proposal would avoid committing hundreds of billions of taxpayer dollars to the discretion of the Treasury Department to "save" the financial system. And it doesn't turn the U.S. government into a giant (and conflicted) owner of U.S. financial institutions.Details of the amended (by Congressional bargaining) Paulson plan (called Troubled Asset Relief Plan or TARP) are here. There are parts I don't like in that plan -- particularly the phase-in of the money and the uncertainty for financial markets that creates, as well as poison pills for banks that use the facility (you do want banks to use the facility, don't you?) -- but it's better than what Paulson sent them on Monday, and I prefer it to the GOP alternative.

Last year Willem Buiter and Anne Sibert argued that the central bank should take on a more modern role as a market maker of last resort. The Fed has the power to deal in a crisis with a large variety of companies in whatever type of securities it wishes (under the Federal Reserve Act of 1913.) Its decision to work only in Treasury or agency securities, and then only maturities under a year, is the result of agreements and custom. Over the last year the Fed has adopted more of a role as MMLR by allowing banks and some other financial houses to deal in other assets, including some mortgage-backed securities (MBS). The Fed's portfolio, however, now has a lot of this other paper on it, to the point where it may run out of Treasury securities with which it can conduct open market operations. In other words, they may run out of bullets.

TARP would have Treasury working as MMLR for the more illiquid assets. Buiter argues separately that this is no function for the Fed; the Treasury, and therefore the taxpayer, has to bear the credit risk. It is this risk that House GOPers are fighting. Given that there aren't a thousand Warren Buffetts in the world, and that foreign sources are probably not forthcoming (and may not be politically palatable to some), it can cure the banks' insolvency problem with either forced debt-to-equity swaps for banks and their creditors, or by having government purchase preferred stock. The amended TARP has such a provision -- while Buiter would rather see those two items separated, and I would too, the forced provision of warrants to government and government's exercise of them might get it done. Neither of these options will appeal to conservatives, but banks need capital, not just liquidity.

Why do they need capital? Because, as Ed Morrissey pointed out yesterday, they have been incentivized by our regulatory and tax systems, on which many of us profited:

When prices fell, an entire class of overextended borrowers could no longer refinance their ARMs to get affordable mortgage payments, and they began to default. As I wrote earlier, it was similar to the margin calls in 1929, only in slower motion. The bottom fell out of the housing market, and thanks to the massive sale over the previous decade of MBSs based on marginal loans, the collapse didn�t just get limited to the lenders or the borrowers, but investors around the world.Who will be the politician that says the hard truth of that italicized line? Between now and Election Day, don't hold your breath.I�ve written this a couple of times, but this LA Times article from 1999 makes the case clearly � and maybe even more credibly, since it praises all of the stupidity and government intervention that created the bubble and the collapse. Clearly, this was not the fault of a free market out of control. Congress and the executive created this problem by extorting banks into poorly-considered lending practices under the threat of prosecution as �unfair lenders�. They compounded that extortion with an artificial mechanism to incentivize lenders by having GSEs buy the paper and resell it, with government imprimatur as its guarantee.

Normally, I�d say let the lenders drown. Unfortunately, this isn�t completely their fault, and we should have known better. Not too many of us complained about the rapid escalation of our own equity that came from this housing/lending bubble, and in the end most of us will still benefit from it, if not quite as much as it seemed a year ago. Three years ago, Alan Greenspan tried to get Congress to act, and only John McCain, Chuck Hagel, John Sununu, and Elizabeth Dole responded � while politicians of both parties made sure to keep the Ponzi scheme in full swing. And those MBSs were minted at the behest of Congress, the people�s branch of government. We broke it, and we own it.

Unfortunately, the government guarantee program offered by the House GOPers is no more helpful than the Paulson plan at solving this mess, and it does not help provide relief for the Fed as a MMLR. TARP at least takes care of one of these. We might have time to deal with recapitalization later, but not as much time as you think.

P.S. Tim Duy is very wise:

My hope is that a bailout is coming. But it will not change the path the economy is already on, it will only prevent activity from shifting to a new, less desirable path. I don�t quite see how the billions of dollars plowed into this program will be funneled to households. I see instead it will only cushion the process of deleveraging, and thus minimize the quantity of resources stripped from the economy. This is important and necessary, but will not provide a miracle cure for the economy�s travails.It's that or Mellon. Congress chooses this weekend.

Labels: banking, economics, housing

Thursday, September 25, 2008

Not so fast

Despite much hope that the Congress would at least get the energy question right, it appears that the Democrat leadership is up to its old tricks. �Offshore will be OK for now, but not shale, says Sen. Jim DeMint.

We've just been alerted that despite House Democrats relenting on extending bans on offshore drilling and oil shale in the continuing resolution (CR) appropriations bill, Democrat Senate Leader Harry Reid has decided to sneak an extension of the oil shale ban through as Congress fights over the financial bailout. Oil shale in America's West is estimated to hold be between 800 billion and 2 trillion barrels of oil -- that is more than three times the proven oil reserves in Saudi Arabia alone.

Gary is correct: The final victory on energy is still far, far away.

Follow the DeMint link for the exact language.

Even a stopped clock is right half the time

Pittsburgh Public Schools officials say they want to give struggling children a chance, but the district is raising eyebrows with a policy that sets 50 percent as the minimum score a student can receive for assignments, tests and other work....Source, via Best of the Web. Italics added in that last sentence: Do you think that might be the real issue here? That teachers are responding to difficult students who take some weeks off from working on a course and then expect to get a do-over?While some districts use "F" as a failing grade, the city uses an "E."

"The 'E' is to be recorded no lower than a 50 percent, regardless of the actual percent earned. For example, if the student earns a 20 percent on a class assignment, the grade is recorded as a 50 percent," said the memo from Jerri Lippert, the district's executive director of curriculum, instruction and professional development, and Mary VanHorn, a PFT vice president.

In each subject, a student's percentage scores on tests and other work are averaged into a grade for each of the four marking periods. Percentages for marking periods later are averaged into semester and year-end grades.

A student receives an "A" for scores ranging from 100 percent to 90 percent, a "B" for scores ranging from 89 percent to 80 percent, a "C" for scores ranging from 79 percent to 70 percent, a "D" for scores ranging from 69 percent to 60 percent and an "E" for scores ranging from 59 percent to the cutoff, 50 percent. ...

the 50 percent minimum gives children a chance to catch up and a reason to keep trying. If a student gets a 20 percent in a class for the first marking period, Ms. Pugh said, he or she would need a 100 percent during the second marking period just to squeak through the semester.

"We want to create situations where students can recover and not give up," she said, adding a sense of helplessness can lead to behavior and attendance problems.

Of course this works in the other direction. A student has 78% after three marking periods. If he obtains a zero in the last marking period he fails the class; under Pittsburgh's rule he ends up with 71. A C for zero work. Students respond to incentives.

Labels: education

Graphs of the day: Excess reserves and borrowed reserves

Quote of the day

There are two people -- you've heard me say it before -- two groups that stand between us and the barbarians at the gate. It's you and organized labor. That's it. That is it. So, mark my words, mark my words, if we lose this election, you are going to continue to see a continuation of the onslaught on everything we care about. For real. For real. So, I'm not only thanking you for your help. I would think you're all absolutely brain-dead if you didn't help. And I mean it.Joe Biden, speaking to The Artists Formerly Known as The American Trial Lawyers Association.

How could he forget community organizers? Hillary'd've never made THAT mistake!

Labels: politics

Wednesday, September 24, 2008

When markets were left to clean their own messes

His doom should quick be knelled;

He should not be allowed to grow,

If grown he should be felled,

But when a city's bonds fall flat,

And no one cares for them,

Who is the man who saves the day?

It�s J.P.M

When banks and trusts go crashing down

From credit�s sullied name,

While Speechifying Greatness adds

More fuel to the flame,

When Titan Strength is needed sore

Black ruin�s tide to stem,

Who is the man who does the job?

It�s J.P.M

Is Buffett the new J.P.M.?

Is that 10% drop in per capita GDP the deal you want to make in order to let them fail?

Egg probes

Federal prosecutors have opened separate criminal probes into possible price-fixing by major egg producers and California tomato processors, the latest in a series of U.S. investigations of alleged collusion in food and agriculture.

The investigations, which have not been previously reported, add to concerns that beyond the rising cost of fuel and feed, a hidden factor may be driving food prices higher: collusion among farmers, food processors or exporters.

...The Justice Department wouldn't disclose how it believes processors manipulated the prices of egg products. There's no indication that the department is looking into the larger market for fresh eggs, where prices have increased more than 40% in a year.

But producers of fresh eggs have coordinated their efforts to raise prices, according to industry participants and a Wall Street Journal review of industry documents.

Fresh-egg farmers acted together through a series of export shipments, organized by United Egg Producers, an industry cartel whose 250-plus members include virtually all of the nation's big egg producers. By removing a small fraction of eggs that would have been bound for U.S. sales and arranging instead for their export, United Egg helped tighten domestic supply and drive up the price of eggs across the country, according to newsletters and other documents that United Egg sent to its members.

After three years without significant exports, United Egg shipped nearly 100 container loads, or 24 million dozen fresh eggs, to Europe and the Middle East at the end of 2006 and early 2007, industry participants say. Each member was required to provide a share of the sale, prorated by flock size. The orders were sold at below the prevailing U.S. price for fresh eggs, United Egg said.

Two Minnesota producers are included in the investigation.

Golden Oval Eggs and Michael Foods � noted in filings with the SEC this spring that they had been subpoenaed by the U.S. Attorney�s Office in the Eastern District of Pennsylvania.Farmers have always had scope to engage in coordination of marketing through a series of antitrust exemptions. Interesting that the Bush Administration is choosing to test how far those exemptions go.

The subpoenas requested documents for the period between Jan. 1, 2002 through March 27, 2008 relating �primarily to the pricing, marketing, and sales of our egg products,� both companies wrote in their 10-Q filings.

Labels: economics, food, Minnesota

Sign of the times

Source. Investment banking isn't dead, yet. But interesting that two of the new top five are privately-held firms.Minneapolis-based Piper Jaffray (NYSE: PJC) is now the fifth-largest investment firm in the country ranked by market capitalization. At the start of the year, it had been No. 10, but the year�s shakeup has basically cleared the top five spots: New York�s Lehman Brothers filed for bankruptcy; Merrill Lynch and Bear Stearns were bought by Bank of America and JP Morgan Chase, while Goldman Sachs Group and Morgan Stanley � formerly the two largest investment banks � restructured themselves into bank holding companies Monday.

The realignment created a new top list of largest investment banks - which is now led by St. Petersburg, Fla.-based Raymond James Financial. Jefferies & Co. is the second-largest firm now, followed by Greenhill & Co. (No. 3) and Keefe Bruyettte & Woods (No.4).

I don't suspect this is the kind of growth Raymond James was expecting when they named that stadium.

The most beautiful words I read this month

This email is simply to confirm that we've now sent the final files of "The Design and Use of Political Economy Indicators" to Palgrave for printing. So the next thing that you should see is a bound printed book hot off the press.Oh happy day.

Janet adds: "Yahoo! Congratulations! Way to go!!

Not as beautiful, but I'll be on The Ed Morrissey Show at 2pm to discuss the current financial situation. (I'll update the link to the show page when it's up.)

Tuesday, September 23, 2008

More thoughts on the Paulson, McCain and Obama plans

Nothing better to do while sitting in a dry faculty senate meeting...

I'd like to thank the discussants of the post I made yesterday for plain speaking, and I'd like a chance to respond to requests therein. I'd also like an opportunity to comment on the McCain and Obama plans as well as the Paulson (or Paulson-Bernanke) plan. (McCain and Obama links are from Friday, but I have seen nothing on either page to indicate deviation from these, though both are carping on the Paulson plan.) I am going to hold off on the reply to the discussants that don't come in this post for tomorrow, since it's already late in the day and this post got long without answering those questions. The question of "what went wrong", in my opinion, can be answered at leisure.

First off, let's dispense with the idea that the Paulson plan is a "$700 billion bailout." It isn't. We are borrowing $700 billion from world markets at the rates the U.S. government gets, to buy mortgage-backed securities from banks that want to sell them. We would hold them for some time, during which we pay interest on that $700 billion, and then we sell the MBSs when we believe we can fetch a good price. It's conceivable we could earn a profit on this, though I won't even bet my lunch money on that eventuality. But we won't get zero for those loans. Recall that when the savings and loan crisis broke we read estimates as high as $500 billion to bail out all the failed thrifts (with assets over $500 billion.) The total cost, estimated by FDIC in 2000, was $152.9 billion. In the case of RTC, the money bought actual houses that had to be sold, something more expensive than moving MBS paper. They got about $.70 on the dollar. I was in Indonesia in 2000 when a bailout of the Jakarta real estate market had put trillions of rupiah of foreclosed commercial real estate in the hands of their trust operators. As badly handled as that one was, they still got more than $.22 on the dollar. So the cost will not be $700 billion (or 5% of GDP.) It will be substantially less than that.

Second, the proposals do not involve a free lunch for the banks. It appears Sen. Dodd has put forward a proposal that requires a dollar of equity from any bank that gives a dollar of its assets to the feds. Such a payment was part of the McCain proposal as well, in seeking warrants from those who come forward for assistance. As Prof. Litvin indicates, these proposals involve dilution of shareholder equity therefore, and thus are the haircut that one would think shareholders would take. Some bloodletting, then, though not enough to kill the patient. It appears Paulson is willing to agree.

That said, one issue that has arisen in both the Obama plan and in the plans that some senators want to push is that somehow we should not pay more than the mortgages are worth, or should assure that taxpayers are not at risk.

A key point of the critics was that under the plan Treasury must pay more than the market value for the mortgage assets.

But Bernanke explained that the mortgage securities have two prices - a "fire-sale price" if the mortgage asset was sold quickly today and a "hold-to-maturity" price if the mortgages were held to maturity.

Banks have been paralyzed by this fire-sale price because their precious capital would evaporate overnight.The key to the plan, Bernanke said, was that if Treasury was able to buy the mortgages, it will be able to hold them to maturity. As a result, the fire-sale price could be avoided.

This would remove uncertainty, return liquidity, and credit markets should be able to unfreeze, Bernanke said.

I had drawn a graph about this last year, which I reproduce now.The high price shows the path of a hold-to-maturity price (the top price shown) in both normal and crisis times. The federal government, by dint of its preferred position in borrowing on international markets, can finance the gap between the two prices without fear of having to liquidate its position. The banks, because of the precautionary demand for excess reserves, are induced to liquidate earlier and, in part thanks to Sarbanes-Oxley, have to mark their assets to market not only if they liquidate but if their neighboring banks do so.

The desire to "protect taxpayers" runs the risk of getting the price wrong on how to pay for those loans. The current market price is not the right price -- that's the price banks could get without intervention, and accepting that price ends up causing bank failures. It's also not the hold-to-maturity price -- offer that, and the banks will beat a path to your door offering everything they have. (Banks don't like intermediation; they are paid to do it by borrowing short at lower rates and lending long at higher ones. If you could get the profits without intermediating, everyone would want to be a bank.) We want to get the price right, but in this case liquidation is about as thoughtful as a Reno wedding.

While many on the left and right will still cavil over the details, the basics of the deal are in place, and quick acceptance of the plan (probably with the Dodd amendment, though I have yet to sort through all 44 pages of that thing) is better than any other idea people have out there.

Quote of the day, 19th Century edition

Enterprise, like Icarus, had soared too high, and melted the wax of her wings; like Icarus, she had fallen into a sea, and learned, while floundering in its waves, that her proper element was the solid ground. She has never since attempted so high a flight.Charles Mackay, Memoirs of Extraordinary Popular Delusions and the Madness of Crowds, 1841, 1852, p. 91. He wrote this in the first edition, and noted in the second that the Great Railway Mania of 1844 had occurred in the meanwhile. �And a fair few since...

In times of great commercial prosperity there has been a tendency to over-speculation on several occasions since then. The success of one project generally produces others of a similar kind. Popular imitativeness will always, in a trading nation, seize hold of such successes, and drag a community too anxious for profits into an abyss from which extrication is difficult. Bubble companies, of a kind similar to those engendered by the South-Sea project, lived their little day in the famous year of the panic, 1825. On that occasion, as in 1720, knavery gathered a rich harvest from cupidity, but both suffered when the day of reckoning came.

Labels: economics

Monday, September 22, 2008

The day investment banking died

Justin Fox reports on Ethan Harris, who echoes where my current thinking on the economy and the result of this collapse will be:

The New York Times reported that members of Congress were stunned into silence by the dire picture painted by Treasury Secretary Hank Paulson and Fed Chairman Ben Bernanke of what would happen if they didn't create an agency to take bad debts off bank balance sheets. The picture? Financial breakdown, with banks ceasing to lend and the economy grinding to a halt.Suppose we take out $3 trillion of net worth across the country (that's little more than a SWAG, but I'll remind you of the 'S'.) Not everyone is going to be made whole by the bailouts, which is only transferring some of the losses incurred on Wall Street and elsewhere back to taxpayers. ("Why us?" you cry. Did you have a mortgage that was lower in interest rates thanks to Fannie and Freddie? Did you think that interest rate discount was a free good? Get back to me on that.) What's the net effect of a $3T loss on domestic consumption? Probably somewhere between $40-90 billion. That should be enough, with knock-on or multiplier effects, to take over $100 billion off GDP. Not a cataclysmic loss, but somewhere along the way you get -1% to -1.5% for quarterly GDP growth. I'll bet even money that we get the two consecutive quarters of negative GDP growth before mid-2009. Mr. Kudlow, you hear me?That's clearly really bad. But what will the economy look like if Congress does approve a workable bailout plan, and the worst-case scenarios are averted?

Well, probably still pretty bad. "By the time we�re done here this is going to be equivalent to the big recessions of the past," says Harris. "Similar to the recessions of 1974 and 1982." That's a lot better than a rerun of the Great Depression. But it still means big-time job losses, and lots of painful retrenchment for consumers and business.

This is not, yet, a unanimously held opinion. There is even still some debate over whether this even is a recession. But I'm thinking that's going to fade away soon.

The bailout is bad, except for every possible alternative. One of those alternatives is being explored right now with Senator Doddle, who is insisting on checking the insurance card of the gunshot victim in the emergency room before allowing so much as a blood pressure cup to be applied. Some on the right are also being cold water Yankees. Now is not the time for that, gentlemen. January is a lovely month for hearings. The thing to be sure of now is that financial markets are open enough that we don't have banks holding $90 billion in excess reserves out of fear of what happens next (it's an estimate, but even if it's half-right it's alarming.) That's the number I'm watching for the next month.

St. Cloud area poverty and youth

Friday, September 19, 2008

I'll just have to tell you

I'll post over the weekend on the financial matters of the week. �If you want to hear it instead of read it, I will be on the David Strom Show at 9:20 to discuss matters with David and Margaret, and then I will be flying semi-solo (Matt will be my co-pilot) for Final Word as Michael basks in the glow of his prize. �Please do listen in.

Meanwhile I'm helping to celebrate the inauguration of President Earl Potter here at SCSU. �Congratulations, Earl. �It was a marvelous ceremony, and a word of praise for the SCSU Concert Choir, who sang some beautiful and challenging music.

Labels: AM1280, NARN, Northern Alliance Radio Network, SCSU

What makes a bailout good?

Let's begin with agreeing that a bailout is on, and that it is massive. �There are many critics. �Are they right?

A year ago I posted a quote of Walther Bagehot, from his famous�Lombard Street. �

But that object is not attained if the amount of that reserve when so published is not enough to tranquillise people. A panic is sure to be caused if that reserve is, from whatever cause, exceedingly low. At every moment there is a certain minimum which I will call the 'apprehension minimum,' below which the reserve cannot fall without great risk of diffused fear; and by this I do not mean absolute panic, but only a vague fright and timorousness which spreads itself instantly, and as if by magic, over the public mind. Such seasons of incipient alarm are exceedingly dangerous, because they beget the calamities they dread. What is most feared at such moments of susceptibility is the destruction of credit; and if any grave failure or bad event happens at such moments, the public fancy seizes on it, there is a general run, and credit is suspended.

In order for a bailout to work it has to be large enough to convince EVERYONE WANTING TO WITHDRAW DEPOSITS that it's available and backed by good paper. �Some of the people you bail out have made bad decisions, some of them even criminal. �But there's a sequencing of actions in a financial panic that stop it, and hanging the bankers from the lampposts is hardly a wise first step. �

I also will remind from a conversation also had here last August:

Yves Smith has an outstanding review of four views of how the central bankers have gotten this right or wrong. These are, to summarize: a group that thinks the Fed has not done enough now and must rescue the financial system (and is uncritical of its role leading up to the crisis); "cold water Yankees" who think the financial markets need to bear the pain and should thus go cold turkey; the realists of the financial markets who have been quoting Bagehot at length -- "yeah, mistakes have been made but their sunk costs and lending freely must be done now"; and a group that believes this crisis stems from both a lack of a mandate for dealing with asset bubbles like subprimes, and thereby calling for both more regulation and changing central bank charters.

Who here is a realist now, fourteen months later? Clearly a number of conservative commentators have become cold water Yankees. If you could accurately tell us how much pain there would be and who would bear it, that might be wise advice. The government has made a decision that it knew where the pain of Lehman would fall; in that case, it threw cold water on it even though it meant a bankruptcy like none we've ever seen. But in many other cases it is not possible to know, such as the connection between AIG and the credit default swap market. So it turns back to the realist camp.

I'll say this until everyone agrees with me :) �You aren't promised a certain price, you're only promised the market will be open so that you can find a price. �The financial markets have worked. �And to do that the Fed must lend freely, and it has. �Meanwhile we will get either a new RTC from the Bush Administration, a MFI Trust from a possible McCain Administration, or something so far undefined by the Obama Administration. �The question for Team Obama: �Realist, Yankee, Rescuer or the end of the Fed? �Do they know yet? �This flowchart is unhelpful. �Hint: �Don't bother asking Raines and Johnson.

Thursday, September 18, 2008

Quick media note

Who do you think I am? Mark Olson?

Further campaign announcements forthcoming.

What's playing on campus?

It seems timely and logical to address issues of public policy and politics during a presidential election year. Consequently, the Women�s Center chose this topic for the Fall 2008 theme for Women on Wednesday, a signature noon-hour lecture series with an 18-year history at SCSU. As in the past, this series seeks to address the issues that students, faculty and staff have identified as important and of interest to them. These issues include many areas of public policy that affect the lives of women, as well as men and children, on a daily basis, including violence against women, reproductive rights, immigration, sex education and teen pregnancy, citizenship, human rights, and women in the military.Well certainly, that seems like a neat list. And one might think that given Governor Palin's own response to teen pregnancy and reproductive rights one might get a talk about this, and there it is "Reproductive Rights" on October 22. What do you want to bet we'll have someone speaking from the National Down Syndrome Society or maybe some research on teen pregnancy. That'd be nice. But I'm not hopeful given the list of other topics: Maze of Injustice; Citizenship for Equity and Social Justice; GLBT Civil Rights during a Presidential Election Year; and Let�s Get Real: Race and Sex in the 2008 Election.

Likewise we got notice of a talk being offered by "the Social Responsibility Masters program, in conjunction with the Women�s Center, Multicultural Student Services, the Department of Theatre, Film Studies and Dance, and the Department of Mass Communication" of the movie Uncounted. There will be no reading from John Fund; instead, the Secretary of State Mark Ritchie will be there. This is Mark Ritchie who ACORN's founder calls his "organizing colleague this April."

Minnesota Secretary of State Mark Ritchie, a long time organizing colleague from the nonprofit sector, addressed the Board and told the story not only of his partnership with ACORN in Minnesota and nationally in deciding to run for this seat, but also of the work he has done with us on our key issue of Election Protection.I plan to see one of the showings of the movie; I'd like to ask Secretary Ritchie how he plans to prevent the registration of dead people and people in prison that has been happening in Milwaukee last month. I've invited Secretary Ritchie's #1 fan to join me.

UPDATE: More "timely and logical" addressing of "public policy" at Metro State in Denver.

Labels: higher education, politics, SCSU

Behold! I am trying socialism! Again!

Our friends at ISAIAH are once again trying to inject religion in politics. But you never hear the media complain about this kind of injection.

Our friends at ISAIAH are once again trying to inject religion in politics. But you never hear the media complain about this kind of injection.We believe that it is time to create an agenda that truly responds to the challenges of our generation � global climate change, endemic racism, crumbling public infrastructure, schools failing to educate large portions of our children and increasing economic insecurity.Would you mind just leaving me alone?

Our current politics are not sufficient to respond to these profound challenges. We must eliminate racial inequities in our state, chart a course for environmental renewal, revitalize our economy for the benefit of all, and transform our government and public institutions to enable a democracy fit for a challenging future.

Every generation must decide what legacy they will leave. We are making our decision.

To create our health and the health of our democracy, major societal change is necessary.Guess not.

We will move our democracy and public institutions to:

This breathtaking list calls for nothing less than the collectivization of the means of production and the end of a country's ability to define its own citizenry, its own borders.

- Create Racial and Economic Equity with Reparation for Past Harms

- Expand and Protect that Which Must Belong to All of Us

- Pool our Collective Resources into Public Investments for the Common Good

- Create Deep Democratic Participation in All Aspects of Our Common Lives

- Ensure that �Citizenship� Extends to All Stakeholders in Our Democracy.

We must also act to Transform Our Own Hearts:We know who you are, you haven't reckoned with your own past, nobody called you, and I'm sure you believe you are doing the right thing. But ignorance of history is no excuse.

- We Must Know Who We Are

- We Must Reckon With Our Past

- We Must Know We Are Called

- We Must Act As If We Believe It

ISAIAH will pursue Racial and Economic Equity in:It is remarkable, I think, that from such lofty ideals ISAIAH ends up with an "issues agenda" that just happens to mimic the DFL. Do we think this is entirely coincidental? Hardly. These are, after all, the people who transformed their hearts with $6.6 billion of your money.

- Health and Health Care

- Job Creation and Transportation Equity

- Comprehensive Immigration Reform

- Education and Housing

- Environmental Renewal

Labels: Minneapolis, politics

The meaning of fundamentals

But I have to note the following. It appears that some people want to call John McCain's comment that "the fundamentals of the economy are strong" a "gaffe". But what does it mean to say "fundamentals." Contemplate for the moment, please, the idea that two of the major four investment banks that existed a week ago no longer do. The large insurance company that provided credit insurance to major financial players is now in virtual receivership. And yet the stock market remains open, people wanting to withdraw money can without waiting, and we still haven't had a negative quarter of GDP (though I'll bet this quarter is the one.) The fundamentals of Russia -- which has lots of good resources in oil -- are not nearly so.

Run through the history of manias and you will find many examples of countries that experienced them. Some fail to grow afterwards, some do. The ones that do, are fundamentally sound in the structure of their institutions and laws.

An economy can have strong fundamentals while still experiencing relatively mild recessions, and calls of the recession are still speculative rather than definitive. Everybody exhale slowly, please. The end is not at hand.

Labels: economics

Wednesday, September 17, 2008

More of the Classless and Clueless Feminists

NOW comes out for Obama (I thought NOW was for the advancement of women - oops, only if the woman is a Democrat).

This article by Jeff Jacoby of Boston Globe identifies more of the feeding frenzy against Palin and her family. They can keep trying but she's made of far tougher stuff than any of them. Her internal gyroscope is stable - she's got a soul of steel.

Labels: Sarah Palin

Best line I heard at breakfast today

You know what John McCain should say? "We can't even figure out what's going on with our own books and can't even balance our own budget, so why should we want to get further control of the financial sector's?" That would be a sharp contrast with Obama.This after I read to the assembled this from the WSJ.

Given that Carly Fiorina seems to be as adept a public spokesperson on economics as Phil Gramm -- what with her "greed overcoming common sense" line on Hugh's show and now saying none of the four candidates can be CEO of a large corporation (both statements could be true, but demonstrate that a CEO's bluntness is not fit for politics) -- it's unlikely we'll hear my friend's suggestion soon."Under my reforms, the American people will be protected by comprehensive regulations that will apply the rules and enforce them to the full," Sen. McCain said in Florida Tuesday. "There will be constant access to the books and accounts of our banks and other financial institutions. By law, it will reduce the debt and risk that any bank can take on. And above all, I promise reforms to prevent the kind of wild speculation that can put our markets at risk, and has already inflicted such enormous damage across our economy."

The sentiment is a far cry from Sen. McCain's antiregulation record. On the stump, he didn't explain how he would distinguish legitimate investment from "wild speculation" or exactly what steps he would take to eliminate the latter.

McCain's economic policies might be better than Obama's, but it's not his long suit.

(BTW, here's what Obama has said. Exit question: What's the diff?)

Tuesday, September 16, 2008

Could we have made them smarter?

Some months ago San Francisco Fed president Janet Yellen spoke at the annual Community Reinvestment conference. I am not going to get into, in the following, the responsibility of federal regulation through the Community Reinvestment Act and the encouragement of lending for these loans to Freddie and Fannie. There's plenty of that analysis out there, and I have little to add that I didn't say yesterday. But I note two paragraphs in which Fed president Yellen describes how to promote homeownership for low-income families.

As a first step, there is a need to develop new strategies that help low-income borrowers�particularly those that may not have extensive financial knowledge�make better and more informed credit choices. Additional investments in financial education and homeownership counseling must be a key component of this strategy. Financial education has been shown to help households manage their finances more prudently, especially in decisions concerning credit, saving, and investment, and it has been shown to reduce the likelihood of default. Calling for more financial education is not a new idea, but challenges remain in funding educational programs and developing appropriate curricula and delivery channels for diverse audiences. Later this morning, you will have a chance to see one new fun approach to teaching children about financial management skills.

Now think about this a minute -- she is calling for more education of adults so that they know how to "make better and more informed credit choices", and her example ends with a "new fun approach to teaching children" financial literacy proposal. Do parents learn from their children? Sure, but what do they learn? I have read many proposals for teaching financial and economic literacy, and they are almost always of that nature -- teach the kids, and they'll teach the parents. The teachers (public school ones, mainly -- you see very few such programs in private schools) of course support that notion, since it provides them new programs, new mandates and new resources. Are we convinced that talking to Johnny about the Stock Market Game helps his parents understand the traps in an option ARM mortgage?

Yet this is what they seem to believe. Stan Liebowitz noted a few months ago that the Boston Fed had promoted rules for mortgage lenders that substituted education for objective lending criteria:

[T]he Boston Fed, clearly speaking for the entire Fed, produced a manual for mortgage lenders stating that: "discrimination may be observed when a lender's underwriting policies contain arbitrary or outdated criteria that effectively disqualify many urban or lower-income minority applicants."

Some of these "outdated" criteria included the size of the mortgage payment relative to income, credit history, savings history and income verification. Instead, the Boston Fed ruled that participation in a credit-counseling program should be taken as evidence of an applicant's ability to manage debt.

Emphasis in original. See this manual for one. Returning to Yellen:

Second, we need to expand access to affordable homeownership opportunities. The gap in homeownership affordability�especially in states like California�is as high as it has ever been. As long as an adjustable rate, interest-only or high LTV subprime loan is the only way to afford a house, low-income families will continue to take on loans that they cannot sustain over the long term, and may be at greater risk of falling prey to unscrupulous lending practices. In stark contrast to the results we are seeing in the subprime market, the vast majority of new homeowners who have gone through affordable homeownership programs�which often involve pre- and post-purchase counseling and support as well as a savings component such as an Individual Development Account�have not defaulted on their loans.Read that which I emphasized again: As long as homes are so high priced that lower income families cannot get in without a special mortgage vehicle, they will try to use that vehicle. So they must be foolish? Did we do the job the previous paragraph says we should do? If not, why would you recommend education again?

The last sentence refers to Individual Development Account, which is just a savings program where the participant's savings is matched at a 1:1 to 3:1 ratio, with withdrawal limited to the sole purpose of buying an asset like a home, a small business, or higher education. Well yes, of course that would help, but people willing to participate in an IDA self-select for the very attributes that make their chances for successful homeownership more likely: sound budgeting and a willingness to delay consumption. (There's an argument here one could have over personal discount rates, but we could get lost in the weeds there.)

The rest of it boils down to this: as long as we try to push homeownership for the poor -- which confuses the correlation of homeownership and financial stability with a causal link from homeownership to financial stability -- we will face the problem that the poor will take advantage of riskier mortgage vehicles. We will encourage them to have higher leverage in their houses. (Yes, sir, nobody put a gun to their heads. We just put dreams in them, encouraged with itemized tax deductions. Yes, it's still their fault in the end. Yes, but what would you like to do now?) And that will feed back into the banks and mortgage firms and insurance companies and the GSEs, etc.

Can economic education or financial literacy have stopped this? Maybe, but if so we need some different programs.

Women's studies faces the market test

Source. I suggest a bake sale.Bitch magazine is in trouble. The 12-year-old quarterly publication, which bills itself as a �feminist response to pulp culture� and has a following among women�s-studies scholars, says on its Web site that it needs $40,000 by October 15, or it will stop publishing. That�s what it costs, the editors say in a video posted on the site, to put out an issue of Bitch.

News of the magazine�s financial difficulty was posted today on a women�s studies e-mail list. One member of the list said the magazine�s title originally offended her, but she said she had come to appreciate it, calling the publication �courageous� and �refreshing.�

Labels: fill-in-the-blank studies, higher education

Maybe that's it!

Monday, September 15, 2008

Classless, Clueless Feminists

Instead, this post will focus on the incredibly narrow and one-sided view of "educated" feminists. These women would have praised Sarah's accomplishment to the skies IF she'd been a Democrat. However, she's a Republican, has five kids, is happily married, goes to a Christian church, and has succeeded where they could only dream of succeeding. Here goes:

1 - From Mary Mitchell in the Chicago Sun Times: "Palin makes me sick.....I hate that she was able to steal Barack Obama's mojo...Frankly Sarah Palin scares me.....etc." These comments along with Mary's use of selective data are the latest in the storm over Sarah Palin. If a conservative were to write like this about Obama, the conservative would be skewered by the mainstream press.

2 - Cintra Wilson, Salon.com. Here we have a feminist attacking Sarah Palin's real femininity. The language in this article is foul, foul, foul. It shows the author to be oblivious that many of us are not enamored with women who think like Wilson does or that her crass description of the world matters.

3 - Wendy Doniger (O'Flaherty), professor of History of Religions at the University of Chicago's Divinity School, writing here accuses Sarah Palin with these words: "Her (SP) greatest hypocrisy is her pretense that she is a woman.... because she has a womb and makes lots and lots of babies.... She has no sympathy for the problems of other women, particularly working class women." Oh, really? And Professor Doniger does? Sarah Palin is not a working class woman?Doniger goes on to slam Palin because Palin does not buy 100% into the mantra of mandmade global warming, and the rest of leftist opinions; that Palin forces her beliefs on others. Palin's record shows that not to be true. ButDoniger's university environment is overwehlmingly of one mindset when it comes to views of women, the environment, men, politics, etc. and it's not an open mindset.

4 - A final example is the comment made by Carol Fowler, chariman of the South Carolina Democratic Party. She said that Palin's "primary qualification seems to be that she hasn't had an abortion." Excuse me - how crude can you get? It's obvious Fowler took heat for this statement because she issued a clarification of what she meant here. But she said it, it got quoted and Fowler back-pedaled.

These are just four of the numerous articles slamming Palin and her family. They omit any data that would counter their pre-disposed dislike of Sarah. The authors come across as angry people who cannot get over the fact that the Republicans picked a true leader for tomorrow.

Yet, none can deny that Sarah made her way on her own, she earned it. No one "gave her a break" because she is a mom, female, etc. She worked for her degree, married her high school sweetheart, worked on her husband's fishing boat, volunteered where her talents were needed. She obviously has a talent for leadership, decision making and juggling many jobs. But, hey, she's no feminist as defined by today's feminists because Sarah is tough, she's no victim and she doesn't blink.

Labels: Sarah Palin

Right on Target

Some speculate the value of the naming rights at $4-6 million; given that Target would also get the pedestrian mall between the park and downtown as "Target Plaza", I am going to bet on the high side of that figure.The club announced on Monday morning that they have reached an agreement in principle on a 25-year deal that includes the naming rights for Target Field. The ballpark is scheduled to open in 2010.

Financial terms of the pact were not released.

Compared to the disaster going on with the football stadium naming rights in New York City, we should be relieved to have this done quietly. It interests me though that Target would decide the experience with the Wolves and Target Center have been good enough to double its bet on naming sports stadia. The evidence out there suggests naming rights are profitable to the teams that sell them (though it doesn't appear to encourage spending more on players) but show no effect on the profits of the firms that buy them. (Enron Field, anyone?) Did Target value it higher because it didn't want another park named after some other firm so close to the arena it had already named?

Don't leave it to the coin

But of course Denver only got this chance after a blown call by the referee, who had told both coaches at the time he had blown his whistle to stop a play he shouldn't have stopped, but that he couldn't "unblow the whistle", as it were. Listen to Coach Turner of San Diego and this from ESPN:

Now, my friend observed that perhaps this is what Denver coach Mike Shanahan thought as well. Rather than decide the game on the coin flip, it should be decided on one play, on the field. Denver's offense versus San Diego's defense, for the game. (There would have been nearly no time left for the Broncos to get another opportunity to score.) He thought it wasn't courage that motivated Shanahan, it was honor.

For those who wonder why Steve Bartman still can't go to Chicago, that's an angle you should support.

Labels: sports

Principals, agents and bank regulators

So the word seems to be that Lehman will be liquidated � hey, no more taxpayer takeover of risk, no more moral hazard; but to cushion the markets against the shock, the Fed will start accepting lower-quality assets, such as equities, as collateral for its credit lines � hence, more taxpayer takeover of risk, and more moral hazard. Oh, kay.Here are the details of what the Fed has done: More liquidity offered, in return for sketchier paper. Lehman apparently was heavily involved as the guarantor of third-party repos, so the Fed is offering to stand in the breach on Lehman's behalf.

Tyler Cowen makes a good point in yesterday's NYT regarding bank regulation. Rick Mishkin's money and banking textbook is now in its 8th edition. Its banking industry structure chapter has changed very little over the editions (you might want to refresh yourselves on the Gramm-Leach-Bliley Act of 1999, for example, for one of the big changes) but largely the same components of the text -- multiple regulatory agencies; financial innovation; branching laws; erosion of Glass-Steagall -- are not much different from earlier editions.

One interesting change over the years has been the addition of a chapter titled "The Economic Analysis of Banking Regulation." Using the Charles Keating example, he writes:

...the structure of our political system has created a serious principal-agent problem; politicians have strong incentives to act in their own interests rather than the interests of taxpayers. Because of the high cost of running campaigns, American politicians must raise substantial contributions. This situation may provide lobbyists and other campaign contributors with the opportunity to influence politicians to act against the public interest (pp. 296-298)I think this explains Tyler's observation:

You can argue it's an information problem -- how is the bank regulator evaluating Citi going to figure out the pitfalls in Travelers' operations, for example? -- but even if you overcome that there is still an incentive issue.For the regulatory category of finance and banking, inflation-adjusted expenditures have risen 43.5 percent from 1990 to 2008. It is not unusual for the Federal Register to publish 70,000 or more pages of new regulations each year.

In other words, financial regulation has produced a lot of laws and a lot of spending but poor priorities and little success in using the most important laws to head off a disaster. The pattern is reminiscent of how legislators often seem more interested in building new highways � which are highly visible projects � than in maintaining old ones.

Labels: banking, economics, Federal Reserve

Greet John McCain and Sarah Palin

It's our team, they're coming to MN, we need to show them our state is FINALLY moving red. Here's the key info:

Friday, September 19th

Key Air Hanger at the Anoka County-Blaine Airport

10188 Radisson Road NE

Blaine, MN 55449

Doors Open: 9:00 AM

Event Begins: 12:00 PM

CLICK here TO RSVP ONLINE

Labels: McCain, Sarah Palin

Friday, September 12, 2008

Obama and New York City

Today, I went from home to 86th and Central Parkway via subway. I walked across 86th to Broadway, about four blocks. I spent 30 minutes at Zabar's then made the return trip home via the subway.

I saw 1 Obama button, no t=shirts, no signs, etc....?????

Labels: Obama

Energy Independence and Democrats

"Speaker Pelosi (Democratic leader of the US House of Representatives), give the American people an up or down vote on energy." Americans are still waiting for the Congress, controlled by Democrats, to provide a vote on an "all of the above," comprehensive energy plan for Americans.

Beginning in August after Speaker Pelosi shut down Congress for a summer recess, Republicans took the energy issue to the floor of the House of Representatives. Congress resumed this week. Pelosi still refuses to address our energy problems, our gas prices and the related increased costs in home heating fuel, food, and all goods produced.

Yesterday, Democrat Pelosi again refused to address energy. Republicans are continuing the fight for energy independence and jobs for Americans. There is no need for us to send $500,000,000,000-$700,000,000,000 to people who want all of us dead.

We Americans deserve a vote from our representatives or it's time to replace irresponsible energy and job Democrats with responsible energy and job Republicans.

Labels: Energy, John Kline

At least we're friendly

But who is that guy on their summary page of me? It's not me. I haven't had hair that wavy in thirty years.

The Peterson definition of a maverick

Two days after losing his seat in a primary election, Neil Peterson's at the Capitol packing up. He was targeted by his own Republican Party because he's a political maverick.That's not a maverick; that's someone who brings home pork. At least in his case he was successful -- other guys not so much.

'Who is an independent thinker, thinks for themselves, does what's right for public policy and moves on,' Peterson said describing a maverick.

Peterson is one of six Republican mavericks who broke with their party to override a governor's veto, passing a transportation funding bill including a gas tax hike.

He said he'd do it again because of how bad the congestion is in his Bloomington district."

So maybe the Peterson definition of a maverick is "someone who brings projects home to his district regardless of the cost imposed on those outside the district." Hardly a profile in courage.

Labels: legislature, Minnesota

Who gets earmarks?

With all the discussion going on of earmarks and Alaska, I thought I would bring a couple of papers that might clarify the debate. �Melissa Boyle and Victor Matheson of Holy Cross recently wrote a short paper on the determinants of earmark spending. �It fits a few points that are important:

- The party in power gets more earmarks. �Their study looks at 2000 through 2006, and Republican senators were able to get more than Democratic senators.

- The more senior that senator is, the more powerful they are and the more earmarks they can steer home.

- Because, unlike the House, the Senate provides two seats to each state, smaller states will have a larger per capita figure as they have disproportionate power in one half of Congress. �(This is, as they mention, the Constitutional compromise that helped end the Articles of Confederation.) �

Now that description all points to one guy, Sen. Ted Stevens, who happens to be the senator of the state from where Gov. Palin hails. �Regardless of her actions, that state was bound to get a disproportionate share of earmarks, according to the Boyle and Matheson estimates. �They also cite Bernhardt, Dubey and Hughson (2004) and Knight (2004) as providing supporting evidence.

I wrote to Matheson (a Minnesota native, we have a good mutual friend) who indicated that he was supportive of Senator Obama in the presidential race. �I had thought that perhaps density or share of land held by the federal government -- a big issue in the West and in Alaska -- might be an explanatory variable. �He hadn't tested that, but makes the good point that money for federally owned land may come through regular appropriations, not an earmark. �Regarding the small state hypothesis, note that the second highest state in per capita earmarks is Hawaii. �

I asked Matheson if he could check the residuals, which might indicate who is 'porkier' than the others. �The scores kind of surprise me. �Here's what Matheson found:

Arizona has the eighth "best" residual (behind both Joe Biden's Delaware and John Kerry/Ted Kennedy's MA). Alaska is dead last. IL comes in with a residual right around $0. The residents of Alaska averaged about $450 more per year in earmarks than one would expect even despite their small size, Republican delegations, and senior senator tenure. AZ received about $120 less than one would expect. Residents of Delaware received $165 less per person than would be expected. It should be noted that Delaware residents actually receive slightly more than AZ residents but they come out better in the residual comparisons because being a smaller state and Biden having more tenure than McCain, we would expect them to be raking in a lot more.

He's a bit more muted on Obama, who as a freshman senator you would have thought would come up on the short end of the earmark stick (and his state is pretty good sized.) �But the nature of those earmarks -- for projects that helped political backers or for the place his wife works -- might raise some extra scrutiny. �So too are these votes. Matheson also notes that the results might make Republicans look the worse because of Lord Acton:

Thus the real answer may be that absolute power corrupts absolutely and that the Democrats may overtake the Republicans as the biggest crooks once the upcoming election winds up. No way to tell with the current data, however.That's why there are still political analysts.

Labels: earmarks, economics, McCain, Obama

Thursday, September 11, 2008

Fourth and inches

So close...

...The page proofs are dropped in the mailbox.

...There's one more day of radio: �KNSI 6-8am (call-in line is 320-251-1990) and then an hour with Fausta's BTR show at 9am. �Been a while since doing some BTR, should be good.

And then, we celebrate the end of a five-year project to get that book to a publisher, get writers, and get the thing done. �How? �Golf, a cigar, some Scotch. �Rinse and repeat. �

See you in the morning.

(And yes, we're doing NARN Saturday. �Most fun day of the week.)

From Janet: Congratulations!!!! Well done, King!

9-11 audio tribute

Labels: 9/11

Wednesday, September 10, 2008

Nothing from me until tomorrow night

(P.S. I'll have something to say about 9/11 while on the air tomorrow, probably close to 7am.)

Labels: blogging

Tomorrow is September 11

Please offer a moment of silence tomorrow in remembrance of those who lost their lives on September 11, 2001 and also remember those who today are fighting to keep the rest of us free from more attacks.

We will always remember.

Labels: 9/11

Whatever Happened to Obama vs McCain?

For those with a sense of humor, Sarah's line, "You know the difference between a pit bull and a hockey mom? ..... Lipstick." brought down the house. Apparently the Nobama crew shows the only sense of humor it has is to attack someone who is running against Joe Biden.

KING ADDS: Politico notes that it wasn't a single instance. Sen. Obama's comment on its own would be tossed off as coincidence, at worst simply a careless remark. But more than one makes a meme.

JANET ADDS: Michelle Malkin has the killer screen capture: an August 30 post on the website of the Democratic Party with the headline: "McCain's Selection of Palin is Lipstick on a Pig." The tags include "lipstick on a pig" and "Palin."

Labels: Sarah Palin

Tuesday, September 09, 2008

Can't get enough of this radio thing

Media alert: �I'll be hosting the Morning Show on 1450 KNSI for through Friday from 6 to 8am. �Streaming available on the link; the call in number is 320-251-1990. �It gets a little lonely in that first hour sometimes so if you're up and interested, give us a call please.

Best sentence I read today

We need a government-sponsored enterprises to encourage more homebuilding and more debt about as much as we need a government enterprise to stimulate teenagers to want more sex.Arnold Kling.

Labels: economics

Dollars at risk and dollars spent

Ed Morrissey notes this morning the attempt to hang a gaffe on Sarah Palin for saying Fannie and Freddie are too expensive. Apparently, according to her critics, it's a mistake to say money at risk is money spent. I noted in the post just below this that we knew taxpayer dollars were at risk in 2002, for example from this USAToday article from May of that year:

The companies have become so big, their failure could jeopardize the whole U.S. economy. According to the doomsday scenario, failure could drag down a U.S. banking system dependent on Fannie- and Freddie-issued bonds. Taxpayers would be on the hook for a bailout that would dwarf the savings and loan scandal.

It's a distinction without a difference. Just ask Robert Reich:

So who gets stuck with the tab? Investors in Fannie and Freddie have always believed that the loans issued by the two giants were guaranteed by the federal government but technically they aren't. The guarantee has always been assumed but has never been put into law explicitly, and the liabilities have never been carried on the federal books. Yes, the companies' charters give the Treasury the authority to buy as much as $2.25 billion in each of their securities in the event of possible default, and the two companies have access to the Fed's so-called Fedwire payments system allowing them to access funding if needed. But these won't keep the two afloat for long.Perhaps her opponents would like to score a TGO (technical gaffe-out), but I would say this argument barely lays a glove. The dollars were committed many, many years ago, back in its 1960s when the government was put on the hook for this and later legislation which allowed Fan and Fred to take on investments that were never the intent of the original design. The argument being made is akin to saying your home only cost you dollars after you paid the mortgage, not when you signed for the loan.

UPDATE: Welcome HotAir readers! Also to note what both McCain & Palin are saying and what Obama has said yesterday morning:

There is no significant difference in the views of the candidates on this issue, either in causation or in prescription.Barack Obama objected to reports Monday that the ousted heads of mortgage giants Fannie Mae and Freddie Mac may receive lucrative severance packages and asked the Bush administration to ensure their "poor leadership" isn't rewarded.

"Under no circumstances should the executives of these institutions earn a windfall at a time when the U.S. Treasury has taken unprecedented steps to rescue these companies with taxpayer resources," Obama said in a letter to Treasury Secretary Henry Paulson and Federal Housing Finance Agency Director James Lockhart. "I urge you immediately to clarify that the agreement with Fannie Mae and Freddie Mac voids any such inappropriate windfall payments to outgoing CEOs and senior management."

Labels: economics, Sarah Palin

Monday, September 08, 2008

FredFan and fiscal dominance

The nationalization of Fannie and Freddie (see Yves Smith for a good overview of the plan) is simply the recognition of something true since the 1980s: The ability of the private owners to exercise a put option on the U.S. government was an important part of the price of its assets. And the only way to prove that the option was there was to have the option exercised.

There were of course many outside pressures brought to bear on the decision: Chinese bondholders; banks that had preferred stock as part of their capital; the elections. Already, Wells Fargo is announcing a substantial writedown of its investments in Fannie and Freddie preferred stock. �But it puts a number of things at peril, and the one I think is going unnoticed is the pressure placed on the Federal Reserve. In short, we seem to be approaching a point where "fiscal dominance" may hinder the independence of the Federal Reserve. This was foreseen by Guillermo Calvo last March in the aftermath of cleaning up Bear Stearns:

...the present situation suggests that central banks may be about to lose the awesome power that they enjoyed during the Great Moderation. The reason is that central banks are beginning to venture into areas that go beyond standard liquidity management by acquiring assets, some of which could be insolvent or require major rescheduling. These are fiscal operations that might tend to deteriorate the already weak US fiscal stance, for instance. In other words, the fiscal anchor may become much weaker than it used to be, bringing about the specter of �fiscal dominance,� a phenomenon that has wreaked havoc in several developing economies.

...[O]ne of the casualties of poor financial regulation may be a weakening of the central banks� ability to anchor nominal prices. In the short run this may be less noticeable in broad price indexes like the CPI but, in my view, it is already being reflected in, for instance, the dollar/euro exchange rate. Under weak nominal anchoring, market-determined exchange rates could become highly volatile because slight changes in moods or expectations may cause them to veer into wildly different directions. And the solution cannot be found in more sophisticated or better regulated derivatives. Derivatives, if anything, make nominal anchoring even more difficult to achieve.

It will be easy to pillory Bernanke, and I don't consider him blameless. �The problem, though, is a philosophy that treats home ownership as everywhere and always a good thing, regardless of the financial condition and literacy of the home owner. �While those who own homes and can still make their payments might not see a fall of more than 5% in their value, there are still lots of loans due to reprice that will wipe out more value (Daniel Alpert puts the overall number at 10% more price decline from here, and a resulting $1.4 trillion in lost home value.) �But the encouragement of risk in homeowning has propelled the fragility that now leads to bailout. �

And this has put the price stability that two recessions and twenty years of attention to credibility at risk. �It seems to me that this was warned about, if you believe his statements, by none other than Alan Greenspan. His memoir notes opposition to Fan and Fred back to 2002, at which time the Fed stopped buying GSE bonds. Also instructive is this retrospective from the Economist. �

The Fed itself could do more to ensure that its eventual mix of duties does not interfere with its commitment to price stability. Mr Bernanke has long said a numerical inflation target would be a safeguard of the Fed�s independence: sacrificing the target to other priorities would demand explanation. When some colleagues balked at a target, he agreed to a compromise: policymakers would publish three-year economic forecasts, and their third-year inflation number would be a proxy target.�