Friday, August 31, 2007

A hot day at the Fair

Tomorrow, we have John and the Fraters 11-1, Mitch and Ed 1-3, and then we're back 3-5, for our usual NARN turn. Below is video from a food eating contest two years ago created by Saint Paul, featuring Mitch and former Patriot program director Patrick Campion.

So stop by us at the Fair, or listen, on AM 1280 the Patriot.

Labels: AM1280, Minnesota state fair, NARN, Northern Alliance Radio Network

A rather silly letter

Prices are rising because the value of the dollar is falling.

Yes, the dollar has fallen, but if that made prices rise, why didn't the dollar fall a whole lot when we had the dollar rising in the 1990s?

He goes on:

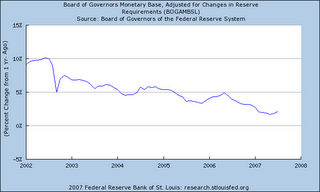

Why is the value of the dollar falling? The Federal Reserve is printing money to pay for the Iraq war so the money in circulation loses value. The housing loan industry was bailed out by the Federal Reserve, who printed several billion dollars to bail them out so the stock market would stop falling.That graph to your right is monetary base,

We teach classes that help you with this, sir. Our door is open.

Labels: economics

A sprinker under every roof

But the requirement for businesses is far more odious. Small business owners who wanted to expand would face a new required expense. The rule is utterly indifferent to the use of the building -- is this a chemical manufacturing facility or a coffee shop? Who is in the best position to determine the value of a sprinkler system, anyway? Wouldn't it be the insurance company selling fire coverage to the business owner?

This is just one more example of how ignorant people generally are of how businesses operate.

Thursday, August 30, 2007

Tribute to MN's Iraqi Heros, 9/2/2007

By clicking on this link, Veterans' Lake Park, you will find directions to the ceremony location, 8702 181st Ave., Ramsey, MN. Ave/Cty Rd 22).

If you can attend this commemoration or just stop by to pay your respects, this Sunday, please do.

Questions or donations can be addressed by contacting:

Pete & Darla Hagan, 612.282.2066, pndhaugen@comcast.net

John and Bonnie Enstrom, 763.441.4086, enstrom@msn.com

No More Tag - Hello - Life is not Risk Free

Were the students harassed? (I taught elementary school for nine years; I never recall hearing a student use the word "harass" even though I taught in at least one very multi-ethnic school). A couple of students complain, no one checks to establish the legitimacy of the complaint, but voila, the game of tag is now banned. The vice principal feels justified because only a couple of parents complained about the ban.

Let's consider this event in a larger context. First, life is competitive. No amount of coddling on the part of parents or schools can remove this fact. Sometimes people win, sometimes they lose. Tag has numerous benefits including releasing energy, yelling, and temporarily being "it." If you were "it," you went after someone else and they became "it."

Second, parents who complain on behalf of their children or children who have learned to use certain words (oppress, harass, bother, etc.) will have a huge awakening in the real world. Then again, they may never figure it out.

Third, life is not risk free. People have accidents, get hurt, and all of us will die. We are doing our youth an incredible disservice by protecting them from all things negative.

Fourth, we are teaching our children to be irresponsible. If they do not learn accountability for their actions, they will lose.

Fifth, as indicated in this post, we are also giving the school systems a free pass on enforcing rules, teaching accountability, and helping students deal with uncomfortable situations. We teach the whiners and complainers that they can get away with their form of bullying.

I would hope the parents in this school would challenge this ruling and that the vice principal would look for the culprits instead of punishing an entire school. Who knows, the whining bullies may have made up the charges. And we wonder why juvenile diabetes and obesity are on the rise?

Labels: education

Back to the Fair

If you're not at the Fair, listen in.

Labels: AM1280, Minnesota state fair, NARN, Northern Alliance Radio Network

Broken Glass, Not

A key sign of hope that things are improving is that small business people are opening shops. These shops are not being vandalized nor are they being targeted by those thugs who wish the Iraqi chance at representative government to fail. As the author of Badgers Forward notes, "There at the first corner, I see it. New glass. Someone has put new glass in a shop. Someone only installs new glass when they think it won't get broken. New glass is confidence."

Read the entire, short post.

Net, new glass equals new hope equals new chance for freedom.

Labels: Iraq

The Moving Wall - Veterans' Memorial

The Moving Wall will be open to the public 24 hours a day during its stay on the VA campus, 4801 Veterans Drive, St. Cloud.

I hope many of you in the St. Cloud area will take the time to pay a visit of respect to our greatest Americans. If you have any questions or wish to obtain additional information, please feel free to contact Dennis Erie, of the VA at 320.255.6365.

Fabrications and Journalistic Standards

An update on the story of the specialist at FOB Rusty: she took me for a ride. I'm pretty sure now she fabricated much of what she told me, which I'm pretty pissed about; when a soldier invents a story, no matter why, they denigrate the real sacrifices of their comrades, and through my gullibility I was complicit in that. Several soldiers of 2nd BCT, 2nd ID have raised very serious doubts about her story; apparently she has a tendency to do this. I'm on my way home right now and will not be able to visit the FOB to look into this further. Suffice it to say that the specialist, like many other soldiers, went through a lot, but not all that she said. I apologize for relaying the story -- I was so dumbfounded by it that I tried to convey the experience even though it was a passing conversation and not part of an embed, which I should not have done.There are two lessons here.

First, no reporter is totally free from the normal human desire to believe stories that reinforce our view of the world. This sometimes reduces our skepticism about what people tell us they have experienced or observed in person.

Second, we readers want to be able to rely upon the reporters and news organizations that serve as our sources of information. We know that people and organizations make mistakes. No one is perfect. What is critical is how those mistakes are handled. Morgan understands that such mistakes must be promptly acknowledged and corrected. Unfortunately, all too many of those who claim to be professional journalists have resorted to sham defenses like "fake, but accurate."

I wrote earlier that

The openness and detail in reporting provided by Morgan stands in vivid contrast to the discredited Scott Beauchamp stories published by The New Republic.Morgan's candid acknowledgment of his mistake makes that contrast even more vivid. I continue to commend Morgan's blog reports, such as those here and here. There is no better source of information about our soldiers than first-hand reports from Iraq.

Labels: Iraq, Media, US Soldiers

Wednesday, August 29, 2007

Another economics blog list

What I should note is that this is not sponsored by SCSU or my department in any way shape or form. Opinions here signed by me are mine alone. At one time it was a group blog of the SCSU Association of Scholars (part of the NAS) but the group dwindled to only me (recently adding Janet, who's not of SCSU but a Scholar nonetheless.)

Quick media note

Labels: economics

Defining "liquidity"

But the real confusion derives from the fact that "liquidity" is a misleading metaphor. This metaphor suggests that there is some "flowing" substance, which could be a "flood", could "slosh around", or could be "pumped" somewhere. But if liquidity were substantive, there could not have been plenty of it a few weeks ago and a shortage now.

...[L]iquidity is about group belief in the solvency of counterparties and the reliability of prices, reminding us that "credit" and "credo" have the same root. When no one is sure who is broke, and there is high uncertainty about prices, we will discover that liquidity has vanished, however plentiful it may recently have seemed.

The point here is that in the world Pollock describes, liquidity simply means it takes longer to find the buyers willing and able to purchase an asset, and this drives down the price of all assets, not just the ones that are more risky. My house isn't any less a good now than it was two months ago -- it still produces the same level of household services -- but if I wish to sell it within 90 days of listing it, I would have to offer it for less money than I would have then even if there are no more houses on the market now than two months ago.

This is why temporary injections of credit by a central bank can help; they may increase the number of buyers who can purchase assets in a normal amount of time by decreasing the number of lenders they would need to visit to obtain funds.

One good sentence about the financial crisis

Financial services continues to be very innovative -- even when it is part of cleaning up their own mess.Ken Jarboe, commenting on one way one person got around the difficulties with jumbo mortgages.

Labels: economics

Tuesday, August 28, 2007

Blisters and poles

There will be no confusing me with the NARN metrosexuals like Mitch Berg.

Lest one think that socks were the greatest debauchery of this day, however, we offer the following into evidence.

Case closed.

Labels: MOB

FOMC minutes

Here are some snips:

Demand for housing in the second quarter was restrained by higher interest rates and by tightening credit conditions in the subprime mortgage market. Sales of new and existing homes in the second quarter were down substantially from their average levels in the second half of 2006. In June, single-family housing starts held steady at their May rate, although adjusted permit issuance slipped further. The combination of decreased sales and unchanged production left inventories of new homes for sale still elevated. House-price appreciation continued to slow, with some measures again showing declines in home values.

Outlays for nonresidential construction rose rapidly in the second quarter...Market participants had largely anticipated the FOMC's decision at its June meeting to leave the target for the federal funds rate unchanged, although the accompanying statement expressed greater concern about inflation than investors reportedly had foreseen and caused the expected path for the federal funds rate to edge higher. Expectations for a policy easing diminished somewhat more in the wake of favorable economic news early in the period. Subsequently, the semiannual Monetary Policy Report to the Congress and the accompanying testimony, which reported lower projections for real GDP growth than investors apparently expected, appeared to prompt a downward shift in investors' expected path for the federal funds rate. Later in the intermeeting period, growing apprehension that turmoil in markets for subprime mortgages and some low-rated corporate debt might have adverse effects on economic growth led investors to mark down their expectations for the future path of policy considerably further. At the same time, measures of long-horizon inflation compensation based on inflation-indexed Treasury securities edged down.

Financial market conditions were volatile during the intermeeting period, particularly over the last few weeks of the interval. Yields on nominal Treasury securities fell on balance, possibly reflecting an increased preference by investors for safe assets as well as revisions in policy expectations. Conditions in markets for subprime mortgages and related instruments, including segments of the asset-backed commercial paper market, deteriorated sharply toward the end of the period. Credit conditions for speculative-grade corporate borrowers tightened substantially, as investors pulled back from higher-risk assets. Spreads on speculative-grade bonds increased to near their highest levels in the past four years. A number of high-yield bond and leveraged loan deals intended to finance leveraged buyouts were delayed or restructured, though other high-yield bonds were issued. In contrast, credit conditions for investment-grade businesses and prime households were relatively little affected by the market turbulence. Issuance of investment-grade bonds continued. Yields on investment-grade corporate issues rose relative to yields on Treasury securities, but because yields on Treasuries declined, yields on investment-grade bonds were about unchanged on net. Nonfinancial commercial paper outstanding posted a modest gain in July, while the pace of bank lending to businesses picked up from an already solid clip. Mortgage loans and consumer credit appeared to remain readily available to households with strong balance sheets, although late in the period some evidence pointed to diminishing availability of jumbo mortgages. ...

Participants agreed that the housing sector was apt to remain a drag on growth for some time and represented a significant downside risk to the economic outlook. Indeed, developments in mortgage markets during the intermeeting period suggested that the adjustment in the housing sector could well prove to be both deeper and more prolonged than had seemed likely earlier this year. Participants noted that investors had become much more uncertain about the likely future cash flows from subprime and certain other nontraditional mortgages, and thus about the valuation of securities backed by such mortgages. Consequently, the markets for securities backed by subprime and other non-traditional mortgages had become illiquid, and originations of new subprime mortgages had dropped sharply. While these markets were expected to recover over time, it was anticipated that credit standards for these types of mortgages would be tighter, and interest rates higher relative to rates on conforming mortgages, in the future than in recent years. However, participants also observed that mortgage loans remained readily available to most potential borrowers, and that interest rates on conforming, conventional mortgage loans had declined in recent weeks, providing some support to the housing sector.

...The ongoing adjustment in housing markets likely would exert a restraining influence on overall growth for several more quarters and remained a key source of uncertainty about the outlook. The recent strains in financial markets posed additional downside risks to economic growth. Members expected a return to more normal market conditions, but recognized that the process likely would take some time, particularly in markets related to subprime mortgages. However, a further deterioration in financial conditions could not be ruled out and, to the extent such a development could have an adverse effect on growth prospects, might require a policy response. Policymakers would need to watch the situation carefully. For the present, however, given expectations that the most likely outcome for the economy was continued moderate growth, the upside risks to inflation remained the most significant policy concern.

Labels: economics

Progressivity and inequality

I am impressed by this graph drawn by Political Calculations. It shows that while the level of income inequality has risen in the U.S. in the last five years ever so slightly, the amount of progressivity in the federal tax system has gone up as well. I suppose this is as it should be. Those with income below $25,000 do not pay a positive income tax.

I'd like to see this one re-done with the inclusion of Social Security taxes.

Labels: economics

Gets one right

A Tufts University dean on Monday reversed a campus board's requirement that a student-run conservative journal include authors' names with articles - a rule imposed after the magazine published an unbylined parody that many found racist.It is still pursuing charges of harassment and hostile environment against the newspaper. The paper is also facing charges from a Muslim student group (Mike blogged this last May) that hopefully will also be dispensed with. The harassment charge was discussed in this letter by The FIRE's Greg Lukianoff last May. If the school is truly committed to free speech, it would recognize the difference between actually putting a stick in someone's eye and satire.

James Glaser, the private school's dean of undergraduate education, said the byline requirement was an unfair restriction on free speech, a view echoed by Tufts President Lawrence Bacow in a statement issued before the start of a new school year.

Glaser ruled on an appeal by the publication, The Primary Source, of a decision last spring by the Committee on Student Life. The panel, a board of professors and students that hears complaints against campus groups, took issue with The Primary Source's Christmas carol parody called "O Come All Ye Black Folk."

"Imposing such a (byline) provision on one publication in the context of a judicial decision can only be construed as punishment of unpopular speech," Glaser wrote in his decision. "To protect freedom of expression at Tufts, I must reverse this aspect of the outcome."

Labels: higher education

The problem you throw money at

[T]he prospect of a 10% to 15% fall in house prices is being treated as if it would constitute the end of the world. Yet as we pointed out, quite a few economies have endured 25% or more housing price falls. They did not go into an economic black hole. They had short bad recessions.Fear of a recession is leading some to argue that we need to throw money at this problem, in the many variety of ways Smith elucidates. Fortune itself has an article in which Jerry Useem is calling for Washington to take on "the scarier role of leader" to avoid a panic, predicting dire consequences if we do not do something about.The fear of recession in this country has gotten so bad that the Economist ran a story this week arguing that America needs a recession. I have no doubt they did that mainly to be provocative, but the horrified reactions from some quarters proves the point. This fear of recessions, and tendency to paint a recession in the dark colors of a depression, is dangerous and distorts policy decisions.

a nebulous concern about income disparities, assets obtained with easy credit, the use of novel financial instruments that seep into the mainstream, and above all, the lack of what Henry James called the "imagination of disaster."Yet that has been just what has been done: The Fed has acted in as close to a Bagehot-ine fashion as possible without yet firing all the bullets in its holster. It has certainly given the impression that it will use those bullets if needed. It has gone so far as to let banks borrow against sound collateral to finance their brokerage affiliates; some see this as a bad sign for the commercial paper market, but it does demonstrate that there has already been a robust response from Washington.

Fiscal solutions do what John Palmer fears: When you shield losers from losses while letting winners keep their gains, you encourage a greater-than-optimal amount of risktaking. Be it own to rent (helping borrowers) or expanding Fannie and Freddie into jumbos to help lenders as Larry Summers supports, or some other bailout like that Bill Gross suggests. In each case you are encouraging people with little financial cushion to purchase highly-leveraged assets.

Mark Thoma argues that heads do not need to roll to prevent this from happening again because it will happen again, and it does without anyone necessarily committing fraud. (Those who do, we agree, should be punished according to law.) Yet it is in the interest of a well-functioning market that people understand we live in a profit-and-loss system, and that those who do not appropriately treat and take precaution for the risk of their investments will not use scarce resources that could have gone to other, potentially more valuable investments. That is, a way to view this crisis is as an overinvestment in housing. While we may not be able to prevent overinvestment, that's no reason to encourage it.

Monday, August 27, 2007

Do we need a special session?

First off, we are echoing the sentiments of our friends and neighbors who just watched this Legislature fritter away a $2.2 BILLION DOLLAR budget surplus on"optional" expendatures [sic] --none of which was scheduled to go toward bridges and roads. Money went to just about everything else.OK, but that was then and this is now. Priorities respond to circumstances. I agree as well with Gary that the DFL looked at transportation issues and saw only gas-tax-increase; what I don't agree with is that this is a reason to do nothing now.

I have a roof on my house. I look at it in spring and say, "it appears OK, it should be fine for another year," and I don't call the roofing company. After the tornado passes through and my roof fails because I didn't replace it (assume it would have been fine if I had replaced it in spring), do I not get to collect on my insurance to pay for a new roof? Do I not get to change priorities?

Second - the money is already there for use not only for the bridge but for the flood zones. Drew Emmer at Wright County Republican has the breakdown of the emergency funding access that the Governor has.He has the power to get the money now, certainly, but that doesn't mean there wouldn't be a tax called for to pay for it later. It is my preference to have a regular session later and have all spending and tax options available, and a little more information about the 2008-09 biennium. I would prefer to wait. But you can read the July budget forecast which says the outlook for the economy is slightly weakening, and then look at the subprime/credit crisis, and argue that at some point we might need the rainy day fund for general obligations of the budget. Yes, they may have spent too much in May, but that's a sunk cost now. The alternative, of course, is unallotment after the emergency spending; for both political and economic reasons, that's an unattractive alternative.

Lastly, as Representative Seifert stated after the bridge collapse, the latest budget forecast shows an even bigger surplus than we had previously expected. The final numbers are due in November.Tell you what, LL, let's have a bet. You can take the side that we'll have a bigger surplus in November than projected in July. I'll take the under. If the Global Insights weighted forecast (which the state uses for budget forecasting) had 20% on the pessimistic scenario in July, you don't think it'll be less in November, now, do you?

Labels: Final Word, legislature, Minnesota, NARN, Northern Alliance Radio Network

Leveraging earmarks

The dirty little secret of earmarks is that they're not the true cost of the projects. In many, many cases it only partially funds a project. In most cases, and I certainly experienced this as a state administrator, we had to take more money out of the rest of our programs to supplement the earmark in order to build that project because the earmark was rarely, if ever, the total cost of the project.Of course the last transportation bill included the Bridge to Nowhere and overall 6400 earmarks that diverted 9% of $285 billion allocated in 2005. It is fair to say that earmark reform has been a failure of both parties (you need only a few minutes of Porkbusters to get that message loud and clear), but I think Peters agrees with Michael in his call for a thorough review of spending priorities. Peters says:

What that did was usurp the other priorities, the priorities that were set by state departments of transportation and local governments that went out in the public process and established priorities based on trying to take care of the systems they had. And, instead, that whole process begins to get usurped by these earmarks. I would hazard to guess that maybe earmarks, at most, would give you about a third of the project costs, and that's on the high side. The fact is that the cost of earmarks is really understated in terms of what it really takes out of the program.

It's the time to start talking about not just how much money is spent, but how and where that money is being spent. Before someone makes the argument that there isn't enough money, we need to say, "How are we spending the money today? Are we getting the best return on investment for the decisions we're making and where are we spending money today?" And I think one could argue that some of the places that money is going, whether it's because of earmarks or the proliferation of new programs, is not necessarily the highest and best use of that money.

Labels: legislature, Minnesota

Minneapolis taxi case goes to trial

As a byproduct of government intervention, a secondary market arose in which government-conferred benefits were traded by the cartel. In 2006, Minneapolis had only one cab for every 1,000 residents (compared to three times as many in St. Louis and Boston), which was especially punishing to the poor who lack cars.

That fact -- and Paucar's determination and, eventually, litigiousness; he is a real American -- helped persuade the City Council members, liberals all (12 members of the Democratic Farmer-Labor Party, one member of the Green Party), to vote to allow 45 new cabs per year until 2010, at which point the cap will disappear. In response, the cartel is asking a federal court to say the cartel's constitutional rights have been violated. It says the cap -- a barrier to entry into the taxi business -- constituted an entitlement to profits that now are being "taken" by government action.

The Institute for Justice has joined with Paucar and blind Minneapolis resident Blanca Prescott (who pays more for cab services as a result of the cartel) as a third party of interest in the lawsuit to argue for the city's right to remove its own regulation and free the market. It would be a perversion of the Fifth Amendment to use the compensation clause as an argument for making government pay to deregulate.

Such regulations have long been known to kill jobs in a community, as John Fund notes in the WSJ today. The hair braiders story (also picked up by IJ in 2005) is just one example of this. But it's also important to see the other side of the story: the consumers who are denied services because they cannot contract freely with people like Luis Paucar who want to give it. IJ explains how she comes to this lawsuit:

We anticipate having Lee McGrath or Scott Bullock from IJ on The Final Word next weekend to tell us how oral arguments went and how the case might proceed. While we normally would rail against liberals on the show, let's stand in fulsome praise of the Minneapolis City Council's action to remove this barrier to public transportation among the poor of that city.On June 7, 2005, hours before her daughter�s graduation from Head Start, she telephoned Luis Paucar�s company, A New Star, and scheduled a multi-stop trip, involving travel to the local K-Mart and then on to her daughter�s ceremony. A New Star�s driver waited in the parking lot for his blind passenger.

But while the driver was assisting Blanca back into his car for the second leg of the trip, he was cited for operating a taxi in Minneapolis without a government-approved license. The Minneapolis police officer ordered Blanca out of the car, had the vehicle towed and left her in the parking lot to fend for herself. It was 5:30 p.m. and her daughter�s graduation was at 6:30 p.m. No other taxis were in the vicinity, and Blanca eventually arrived late to her daughter�s graduation.

Labels: economics, Minneapolis

We think it's important but we know little about it

�Financial market turmoil has shifted the focus away from terrorism and toward subprime and other credit problems as the most important near-term threats to the U.S. economy,� says Carl Tannenbaum, NABE President and Chief Economist, La Salle Bank/ABN-AMRO. �However, these concerns appear to be somewhat transitory, as the five-year outlook for housing remains positive.�The reading for terrorism as a the top short-term concern dropped to 20% of respondents from 35% in March and 34% last August. 18% listed subprime loan defaults and 14% listed excessive household or business debt as their top concern. And yet the survey, which ran from late July to August 14, shows 72% of respondents still think monetary policy has been "about right", down from 81% last March. 16% thought it now "too restrictive." Most interestingly, 19% say they preferred more stimulative monetary policy for the next six months and 12% more restrictive. It would be interesting to hear if that opinion has changed over the last two weeks (mine has not, though I did indicate I expected a 50 bp decline in rates over the next six months -- I would take that to 75 now.)

That's all quite reasonable, but what bothered me was this paragraph:

Despite the prevalence of NABE members holding advanced degrees in economics and other business-related disciplines, substantial percentages admitted to having little or no familiarity with the structure, activities, and risks associated with hedge funds (45%), private equity funds (40%), asset-backed securitization (48%), credit default swaps (CDS, 68%) and collateralized debt obligations (CDOs, 51%).And yet in the very next paragraph a good number want more regulation of these very same instruments and institutions.

In terms of regulation and reporting requirements, members were generally split between �fine as is� and �prefer more,� with the greatest need for regulatory and reporting enhancements seen for hedge funds (57%) and CDOs (48%).If you don't understand the instruments, why are you asking for more regulation?

Labels: economics

Embedded Reporter Wesley Morgan

The openness and detail in reporting provided by Morgan stands in vivid contrast to the discredited Scott Beauchamp stories published by The New Republic.

The brief bio on Morgan's blog says that he

is a sophomore at Princeton University, where he writes for The Daily Princetonian. He is blogging from Iraq, where he will spend the month on the invitation of the commander of U.S. forces there, Gen. David Petraeus. Wesley is a member of Princeton's Army ROTC and lives in Watertown, Massachusetts.

Morgan has several excellent earlier posts from Iraq, including a long post about his day accompanying General Petraeus. Read as many of Morgan's posts as you can -- it is outstanding reporting.

Labels: Iraq, Media, US Soldiers

Sunday, August 26, 2007

Coal, China, India and Global Warming/CO2

This aspect of the global warming/CO2 problem has not gotten much attention, yet. Some experts now are asking if controlling these Asian mine fires might be a key to reducing global warming....and controlling these mine fires would be more efficient that offsets. (Economist Diana Furchtgott-Roth).

Both India and China are exempt from having to apply Kyoto Protocol CO 2 emission standards but they are interested in getting help extinguishing these fires. What can be done?

Western technology to the rescue. CAFSCO has developed a nitrogen-laced foam fire retardant that was used to extinguish a coal-mine fire in West VA. IF this retardant can be applied to the Chinese and Indian fires, this could have a positive effect on global warming not to mention air quality, protecting humans and land, etc. Of course we would continue planting trees but eliminating a large CO 2 source would give the planet more time for other activities that take longer to show results.

Labels: global warming

New York Times, one-sided views

But there is another point of view, from a group who really knows what is happening in Iraq. Problem is, they cannot get their op-ed in the New York Times because the NYT refuses to publish anything that even suggests the NYT just might be wrong. To read their thoughtful analysis, go here.

We hear from numerous sources, including other soldiers on the ground that the surge is working. Why? We are doing what we should have done years ago - when you send in a military, let the military do its job and clamp down on all aspects of an enemy. Only when you have the control do you move on to other options like setting up governing units, etc. We forget - Germany and Japan, after being defeated, were not able to hold elections for 10 years and we still have troops stationed in both countries today. Yet to hear the mantra of the New York Times and the left, we are to get out of Iraq now and let the cards fall where they may. Too many on the left ignore the millions of southeast Asians who were murdered, reeducated, or harmed in many ways when our Congress after listening to the defeatist attitude of the western press bailed out on the Vietnamese government in 1973. Our enemies know us well - get our press to do their dirty work, add the Democrats to the equation and they win.

This time, we have other ways of getting out the word. Our press owes it to the free world to do their job. Unfortunately, too many of the defeatists leftist organizations like the NYT, simply want to lose and leave.

Labels: American Heroes, Media

Opus and the Timid MSM

***

The Opus cartoon is a favorite of many Americans (present company excluded). Berkeley Breathed, the author is known for his ability to skewer most any group. He took a light-hearted approach to Islam for Sunday newspaper editions running today, 8/26 and next Sunday, 9/2. Salon has published the strips on line - you can view the 8/26 one here.

Our esteemed mainstream media (MSM), including Breathed's home paper, the Washington Post, along with the New York Times refused to run the cartoon. The St. Paul Pioneer Press ran the cartoon today (thank you) but not the Mpls. (Red) Star Tribune.

Why is it that so many papers on the left are determined to run anything that slams Christianity but play ostrich when it comes to anything other than kowtowing to Islam?

This cartoon cowardice triggered a conversation I had with one of my Muslim students. He informed me that in his home country, Muslim women did not laugh or smile. When he came to the US, it took quite an adjustment on his part to get used to women laughing. A sense of humor on the part of this particular group would help tremendously.

Labels: censorship, Media

Saturday, August 25, 2007

An Error at the Counterterrorism Blog

Cat Stevens� conversion to Islam and his relocation to Iran is now common knowledge...

Reader "Missy" took me to task in the comments to my post:

Cat Stevens never relocated to Iran. He has lived in London, England his entire life. He has never even visited Iran. How can you say this is common knowlege when it is not even true?

By the way, Jeffrey Breinholt said Yusuf sued the "Boston Globe". That is not true. The untrue article was printed in the tabloid paper, "Globe", and as you know, they make up alot of what they write. Yusuf sued the "Globe" tabloid and won the lawsuit because the article was untrue.

I responded to Missy by pointing out that this was Breinholt's claim, not mine, and told her that I had requested further information.

Almost immediately thereafter, as readers may know, my husband and I went away on a trip. Upon my return, I noted that my inquiry had generated no response. I finally trucked over to the Dakota County law library (I don't have university access to legal research services) and obtained a copy of the case Breinholt cited, Globe Communications Corp. v. R.C.S. Rizzoli Periodici, S.p.A., 729 F.Supp. 973 (S.D.N.Y.1990).

Breinholt's on-line resume is impressive, with 10 years in the Counterterrorism Section of the U.S. Department of Justice, where he served as the Deputy Chief, so I expected his information to be reliable. Unfortunately, in this case it is not. Here is Breinholt's summary:

"DATELINE - BOSTON - 1984

The Boston Globe publishes an article about Yusuf Islam, the popular musician formerly known as Cat Stevens, describing how he had embraced Islam and moved to Iran. Islam sues the Globe for libel. Globe Communications Corp. v. R.C.S. Rizzoli Periodici, S.p.A., 729 F.Supp. 973 (S.D.N.Y.1990)."

Breinholt�s summary is wrong in almost every respect. Globe Communications publishes the weekly magazine Globe, not the Boston Globe newspaper. The lawsuit was brought by Globe against Rizzoli, the original publisher of an Italian news magazine article about Cat Stevens that Globe had reprinted. Globe wanted to recover from Rizzoli the damages Globe had paid to Stevens because �Globe determined through discovery that many of the facts contained first in the Rizzoli Article and then in the Globe article were false.� 729 F. Supp. at 975. This totally undercuts Breinholt�s later assertion that �of these cases I list above, there was only one that was not dismissed in favor of the defendants - the oldest one, involving the Arab Sheik looking to acquire an American wife.�

I now regret my original description of Breinholt�s post as �a great piece of research.�

New York Times, one-sided views

But there is another point of view, from a group with Iraq experience. Problem is, they cannot get their op-ed in the New York Times because the NYT refuses to publish anything that even suggests the NYT just might be wrong. To read their thoughtful analysis, go here.

We hear from numerous sources, including other soldiers on the ground that the surge is working. Why? We are doing what we should have done years ago - when you send in a military, let the military do its job and clamp down on all aspects of an enemy. Only when you have the control do you move on to other options like setting up governing units, etc.

We forget - Germany and Japan, after being defeated, were not allowed to hold elections for 10 years and we still have troops stationed in both countries today. Yet to listen the mantra of the New York Times and the left, we are to get out of Iraq now and let the cards fall where they may. Too many on the left ignore the millions of southeast Asians who were murdered, reeducated, or harmed in many ways when our Congress after listening to the defeatist attitude of the western press bailed out on the Vietnamese government in 1973. Our enemies know us well - get our press to do their dirty work, add too many Democrats to the equation and they win.

Today we have other ways of communicating. We forget we still are the beacon of freedom for the rest of the world. Our press owes it to the world to do their job. Unfortunately, too many of the defeatists leftist organizations like the NYT, simply want to lose and leave. For some reason they think they are immune to any negative ramifications based on their behavior.

Our military is finally building the personal security the Iraqis need as the foundation for political stability. Iraqis want it and they can make it happen but they need time.

Labels: Iraq, US Soldiers

Friday, August 24, 2007

Vets for Freedom - Washington, DC

If you are an Iraqi or Afghan veteran, and support the mission, you are invited to attend the gathering in Washington DC to show support to our soldiers still there. Your travel and lodging will be covered by Vets for Freedom. Please visit their website for details.

Thank you in advance for your support.

A good day is golf

Now to see if Yost has game; please note that KARNation has arranged teams in order to subvert the competition.

Labels: MOB

Find the non sequitur

Watch for the non sequitur in the first three paragraphs:

Did you see it? Why do we need to address "larger infrastructure issues"? What in these sentences indicate that a special session is needed to deal with "larger issues"?A recent St. Cloud Times Our View argued against the need for a special session to address the Interstate Highway 35W bridge collapse and the overall decay and safety of our bridges and roads. Since that time Minnesotans have suffered through another huge setback. People drowned in flooding in southern Minnesota. Raging waters destroyed homes, businesses, roads and bridges.

There is no longer a debate about whether we need a special session; rather the question is what critical issues we should take care of during that session.

We are at risk of losing entire towns in southern Minnesota. The metropolitan area has a huge hole in its transportation system that has a daily effect on people's lives and commerce. We must act now in both of these areas and also we should address the larger infrastructure issues the bridge collapse has made real.

We have a reserve fund. It pays for emergencies. If there's not enough money, or if you think it draws reserves down too low, pass a bond to pay for what is needed to replace what is lost.

What are her critical issues? I again quote from the SCTimes three weeks ago:

We hoped all along the governor would be willing to compromise and we're glad to see he's willing to be flexible and move Minnesota forward. Hopefully, (a special session) would be about jobs and infrastructure, including transportation, bonding and Local Government Aid.And in today's editorial she does it again, blaming the governor for the failure of bridges:

In each of my two years in the Minnesota Senate, lawmakers passed bills that significantly increased transportation funding. If either bill had been signed, millions of dollars of funds would have already been spent to address those unmet needs. If we were to pass such a bill in a special session, we could begin making our roads and bridges safer much sooner.Look, we all have unmet needs. I've referred to this as my 25% short principle, but in general at any point in time we have limited resources and unlimited wants and needs. Your choice is to limit what you want, or find a way to make resources unlimited. Government fulfills its wants by force through taxation, thus it is an imperative to a nation that it finds a way to limit that force.

Senator Clark does not know these limits. Having already provided prudentially for emergencies with reserve funds, she now wish to take advantage of twin tragedies in Minnesota to attempt the impossible: to satiate her politically class' insatiable appetite for other people's money to satisfy her political supporters. (Follow the money.)

Special sessions are not for investing. They are for fixing, unless you're a political fixer.

Thursday, August 23, 2007

How Mitch does radio

Here, by the way, is the full schedule:

- NARN, the usual shifts, Saturday August 25, 11-5.

- Mitch and Ed Monday and Tuesday, August 27-28, 5-8pm.

- Ed with guest host Col. Joe Repya, Wednesday, August 29, 5-8pm.

- Minnesota Daddy Exposed and me, Thursday and Friday, August 30-31, 5-8pm.

- NARN the Last Fair Shift, Saturday 11-5.

Labels: Minnesota state fair, NARN, Northern Alliance Radio Network

Stealth easing

That would indicate to me that banks are still using the Fed Funds market, where today the Fed put in $14 billion in 12-14 day repurchases. The market there has died down a little as the nearby graph shows (this measures the standard deviation of the rate on trade of Federal funds) but still with volatility well above recent levels. These OMO trades stopped out at around 5% on agency and mortgage-backed securities; Treasuries were discounting at around 3%.

James Hamilton picked up on this point yesterday, wondering if there's been a stealth easing:

...whatever is motivating the Fed's most recent open market operations, it is not an effort to keep the effective fed funds rate right at the announced target. My guess is that it is also not a simple effort to keep the effective funds rate at some other number such as 5.0%, either, but that instead the Fed is responding to specific concerns, perhaps related to the comment I made above about credit rationing. Although Bernanke has a commitment to openness about monetary policy in general, he would not be in a position to give us the details of any such concerns, since the Fed has to be very careful not to let its own announcements become the cause of a panic withdrawal of deposits or lending from institutions facing temporary challenges. Suffice it to say that the Fed likely has some real worries at the moment, and they're not adequately summarized by just looking at the interest rate on a volume-weighted average of fed funds trades over a day.Based on where fed funds have been trading so far this month along with today's closing price of 95.015 for the August fed funds futures contract, the market seems to be expecting an average effective fed funds rate for the remaining days of August of 4.94%. The September contract (95.06) is predicting exactly the same thing for the following month, and lower values as we go on from there. I suspect that the period since August 10 will become one of those episodes where the series for what the fed funds "target" actually was will always be noted by an asterisk by scholars, because the Fed's objective at the moment is something other than achieving any particular value for the effective fed funds rate. But whatever label you want to put on it, we're not going to be seeing fed funds averaging 5-1/4 again any time soon.

That sounds about right.

Labels: economics, Federal Reserve

Investing in uncertain Ukraine

Der Spiegel says you'd be wrong.

Gross domestic product powered ahead by an impressive 8% during the first half of 2007, and economists expect the strength to continue, boosted by a surprisingly diverse economy of services, manufacturing, and raw materials. Metals, mainly steel, account for 40% of exports, but most of the growth is coming from manufacturing and services. Production of heavy equipment rose 22% in 2006. And Ukraine's software houses saw their exports jump by 50% last year, to some $250 million.Countries that are seriously divided like Ukraine typically do not provide investment climates that are conducive to foreign firms. Is that what's going on? I don't know. A look at recent economic data indicates much of the influx of foreign trade has come from resurgent Russia rather than Europe or the USA. Construction has been up and down over the last few years. The Economist forecasts 6% growth for the foreseeable future, but whether the investment is productive for Ukraine's future or shop-building for imported goods -- which both the 'Orange' forces and the current parliamentary leaders of the Party of Regions would be happy to accept -- remains to be seen, particularly in the runup to next month's elections, where everyone promises everything to everybody.

Investors see promise in the growth. The Kiev stock exchange has more than doubled in size this year, and now boasts a market capitalization of $76 billion-a sixfold increase since late 2004. And a real estate boom has pushed up housing prices by 60% in 12 months. "We joke that as long as all these disputes are going on, [politicians] don't have time to interfere in business," says Taras Kutovyy, chief financial officer at XXI Century Investments, a leading developer that in May raised $175 million in Eurobonds to finance new apartments, hotels, and hypermarkets.

The ways of the rich and the Chinese

Capitalism doesn't create misers; it turns their ways toward productive good. Hetty hurt no one but herself and perhaps her son with a wood leg. The market economy localized the effects of her sins and contained them. In the market, she created massive value to society and was rewarded for it; one shudders to think what she might have done with power under a socialist tyranny.The problem of teaching economics or history is that most writers hold up images of the rich that paints them as Hetty Greens. While there are other misers, most of them benefited from using government for rent-seeking. Many others though used the market to make money by offering consumers more of what they wanted at a lower price. We can deride the Vanderbilts and Rockerfellers, but we may do so while riding a cheap flight on Southwest Airlines, which makes money the same way. (Coyote Blog makes this point more fully.)

It is even hard to argue that she hurt herself. She was as happy as she could be just the way she was, and no amount of forcing her to be otherwise could have improved the situation. She embodied traits that we think of as being awful but she worked in an industry that allowed these traits to be turned to good for all. That is a credit to the market economy! Indeed, it is the highest praise of the free market that it can find a place even for someone so awful as this.

The term robber baron is simply name-calling regarding competition; it's what the losers call the winners among the sellers, without any regard for the benefits provided the buyers. Don Boudreaux points out this fallacious thinking regarding the effects of trade between China and Africa. The fear of China as the world's largest exporter has always struck me as an odd fascination: if China wants to subsidize trade and transfer wealth from itself to the US and other trading partners, why are we complaining? I'd think it would be the Chinese themselves who should complain; alas, they live in a country where complaining is, um, not rewarded.

The inability to think clearly about trade, and to understand that the creation of wealth is just a marker for the creation of value for the others participating in the transaction, is what leads to threats of bad economic policy. For our part, universities need to teach better what the products of the market transaction are for society. Here's one example.

Labels: economics

Wednesday, August 22, 2007

Special session line of the day

It's like a joyride in a fire truck. There's no fire. But it sure is fun to drive around town with the lights and sirens on!Drew Emmer, commenting on reports that the special session is on for more than just a bridge.

UPDATE: He's not just blowing smoke. Apparently there is a meeting today with the Governor and legislative leaders in which property tax relief is a topic for discussion, along with the items of the August 10 memo, a limited bonding bill and emergency funds for the flooding in southeastern MN.

Flashback:

"They threw property tax relief under the bus in an instant so they could fuel their appetite for social service and welfare spending,"Pawlenty said. "That is out of whack with the message and priorities they said they were going to stand for during the campaign, and it's out of whack with where the state should head."The answer is not to feed them more.

Disturbing and quieting signs

U.S. banking giants Citigroup Inc., J.P. Morgan Chase, Bank of America and Wachovia Corp. said on Wednesday that they borrowed $2 billion from the Federal Reserve as part of a new program set up last week to pump cash into the creaking financial system.Using the banks as go-betweens for paper that mortgage companies and hedge funds need to use is part of the strategy. The banks may be better judges of the paper's value than Fed officials. There's no doubt this jawboning, as Bill Polley calls it, is working with those banks. I'm reminded of the Knickerbocker crisis of 1907, when NYC banks did act as a lender of last resort before there was a Fed. (See Tallman and Moen for more.)

Citibank, a unit of Citigroup, said it took out a $500 million, 30-day loan from the New York Fed's discount window program for its clients. The company didn't identify those clients.

"Citibank stands ready to continue to access the discount window as client needs and market conditions warrant," the bank said in a statement. "Citi is pleased to inject liquidity into the financial system during times of market stress and to support creditworthy clients.

There are stories all over of mortgage bank units being closed.

I don't see any stories of people jumping from windows (though an abandoned Maserati of some hedge fund official is rather humorous.) I am not necessarily calling this bad news; it's part of what has to happen when some people take risks that go sour.

It may be that they took more risks than we realized, if this story from Barry Ritholz bears out.

What happens if a lender fails to comply with the TILA [Truth in Lending Act] rules? The borrowers are allowed to RESCIND THE LOANS AND VOID THE MORTGAGES ON THEIR HOMES. The mortgage lender is then just another unsecured creditor, who must get in line behind everyone else who may have filed a lien on the property. Who ever files first (Credit card, auto finance, doctors, etc.) has first priority.It's not clear to me whether judges are going to allow borrowers to get out of the first liens on their homes by this, but it doesn't sound entirely implausible. This could be part of that information problem we've discussed -- the collateral the lenders think they have might not be good.

Here's the one that will have to go down as bad news:

The number of troubled assets among federally regulated thrifts rose rose 49% in the second quarter from 12 months before to the highest level since the savings and loan crisis, the Office of Thrift Supervision reported Tuesday.I think this is as much a symptom of the bursting of the housing bubble as it is the fault of subprimes. (h/t: Calculated Risk.)

The agency also reported that the number of "problem thrifts," or companies rated poorly by regulatory standards, had risen to 10, up from just 4 in the second quarter of 2006.

Thrifts are federally regulated banks that originate one out of every four mortgages. The companies largely originate prime or jumbo loans, so their stressed loan portfolios suggest that more loan types - not just subprime mortgages - are under pressure.

The thrift industry had $14.2 billion in troubled loans, which are either noncurrent loans or repossessed assets, the OTS said. That's up from $9.5 billion in the second quarter of 2006. This is the highest level of troubled assets since 1993, though as a percentage of total assets its only the highest level since 1997. Noncurrent loans include mortgage delinquencies, which have grown precipitously as the adjustable-rate mortgages that were very popular during the recent housing boom reset into much higher monthly commitments.

"This is what is keeping us as regulators up at night," James Caton, director of financial monitoring and analysis, said at a press briefing to discuss the data.

The OTS attributed the growth in noncurrent loans to two business lines - one-to-four family mortgages and construction and land loans. For one-to-four family mortgages, 1.26% were considered noncurrent as of June 30, up from 0.78% on June 30, 2006.

For construction and land loans, 1.61% were noncurrent at the end of June, compared with 0.47% on June 30, 2006. Troubled loan levels are expected to continue rising in the third quarter, OTS senior deputy director Scott Polakoff said.

Of course the most worrying thing: Congress wants to get involved and do more for borrowers.

Sen. Charles Schumer (D., N.Y.) is pushing federal regulators to raise portfolio caps at Fannie Mae and Freddie Mac and ask banks to help with workouts for borrowers hit by the mortgage lending meltdown.

�The Federal Reserve Bank has taken good steps to restore liquidity to the financial system, but there is still much more that needs to be done to address the risks that we face to our broader economy caused by the ongoing turmoil in the mortgage market,� Schumer wrote in a letter to federal regulators.

Schumer, a member of the Senate Banking, Housing and Urban Affairs committee, asked Treasury Secretary Henry Paulson, Federal Reserve Chairman Ben Bernanke and other federal regulators to get behind a plan to provide $100 million to not-for-profit housing groups to help borrowers refinance their subprime loans, spokesman Brian Fallon said. Fallon said that 20% to 40% of borrowers hit in the subprime lending crisis should have qualified for prime-rate loans.

To see why that probably won't help, read the post just below this.

Encouraging ownership of highly leveraged assets

OK. Now recall a quote I posted here:

When you buy a house you are doing two things: 1) paying rent to yourself instead of someone else (and forgoing the opportunity for someone else to pay that rent to you), and 2) taking a long position in the asset class that is real estate in your local area. The type of mortgage you take out has no bearing on the rent you are "saving" (or forgoing) but it has everything to do with how levered your long position is in the asset class that is real estate. While the details of ARMs, neg-am mortgages, NINJA loans, no-money down deposits etc. are complex, essentially they all add leverage to that position. This is fine when prices are rising, but it also means you will lose all of your money (equity) when prices fall. Historically, home prices have never fallen, but they have never had such leveraged financing either.Dean Baker (with an approving nod from Andrew Samwick, from whom I got the link) has been pushing the idea of a repurchase agreement between the holders of subprime mortgages, who are in their homes but can't afford the higher payments. In short, the lender gets back the house in a foreclosure but then rents the house to the former borrower at "fair market rent", to be determined by a government entity, perhaps a judge, and adjusted as market conditions change. The now-renter "could then remain in their home as a renter for as long as they liked," and the now-owner-former-lender "the mortgage holder would now own the house and be free to sell it to another person, but the former homeowner would still have the right to remain as a renter, regardless of who owned the house."

I think this is a bad proposal for two reasons. First, it assumes in some way that you can shift the risk of house prices from the borrower to the lender costlessly. But the process of giving the renter a usufructuary right to the home removes value from the house -- the collateral is damaged by not having the ability to sell to other potential buyers the right to use (or bulldoze) the house. Let me put it this way: If I'm auditing a bank who holds a house under this arrangement, can I use the price of houses in the area not under this arrangement as comparables for setting the value of the asset? I think not. And the bank itself has the same problem. The whole subprime problem in the market has been based on not knowing how to value assets -- this does nothing to solve the information problem. A house that had this put option on it, in short, is going to cost more because the bank knows it bears an extra risk. Hello red-lining.

Second, there appears a moral hazard problem in the housing market by these owners. If prices go up, I can keep the house and pocket gains. If prices go down, I lose the ownership claim on the house but continue to enjoy its services. Does this encourage or discourage risktaking by those least able to afford it? True, they are protected against loss, and they end up with a house they can continue to use. But they lose that extra incentive to maintain the house (not unlike affordable housing.) As the WSJ points out, these schemes have had a poor track record in helping upwardly mobile families get a leg up. Encouraging them to stay in homes they no longer own is hardly going to help.

Tuesday, August 21, 2007

Why do you have reserve funds?

What is the purpose of these funds, if not to provide for emergencies?

What is a flood and a bridge collapse, if not emergencies?

Labels: legislature, Minnesota, politics

Cool tool

I'll see your Bagehot and raise you a Kindleberger

Much has been made in the press over the fact that Federal Reserve Chair Ben Bernanke has read Walter Bagehot (first mentioned on this blog here.) Is this necessarily a good thing?

Yves Smith has an outstanding review of four views of how the central bankers have gotten this right or wrong. These are, to summarize: a group that thinks the Fed has not done enough now and must rescue the financial system (and is uncritical of its role leading up to the crisis); "cold water Yankees" who think the financial markets need to bear the pain and should thus go cold turkey; the realists of the financial markets who have been quoting Bagehot at length -- "yeah, mistakes have been made but their sunk costs and lending freely must be done now"; and a group that believes this crisis stems from both a lack of a mandate for dealing with asset bubbles like subprimes, and thereby calling for both more regulation and changing central bank charters. Smith provides a compelling case for putting people in these four camps.

I think it would be interesting to consider where to place central bankers in those four categories. If Bernanke has Bagehot on the bookstand, does that make him a realist?

I think so, but with a caveat. The general understanding of the Great Depression that Bernanke takes away from his work is that financial crises will have non-financial consequences. Willem Buiter and Anne Sibert argue that the next likely Federal Reserve move -- the cut in the Fed funds rate that Tim Duy takes as a foregone conclusion -- is warranted "only if the Fed were to believe that the recent financial market kerfuffles are likely to have a material negative effect on real activity in the US or on the rate of inflation." I think the statement on Friday has given up the inflation story but put the real activity proviso in play. This is the nature of the Fed's dual mandate (though the ECB, with a sole mandate for price stability, nevertheless intervened quite strongly. Perhaps they're realists too.) So to say, Bernanke is a realist, but he's probably more sensitive to the possibility of spillover from subprime mortgages to the rest of the economy than perhaps Alan Greenspan was.

A fuller understanding of Bernanke should include as well a reading of Charles Kindleberger's Manias, Panics, and Crashes. Kindleberger viewed bubbles as naturally arising in good times, a sign of progress in the economy as new technologies come into vogue; they tend to be overdone, he said. My shorthand for Kindleberger's thesis of how one deals with firms in financial crisis is that there are three choices: you can bail them out; you can let them burn; or you can provide a period over which they work it out for themselves. Yves Smith's first two views fit the first two choices of Kindleberger rather nicely; the third might be the view of the realists, though again one man's realism is another man's bad advice.

Two quotes from Kindleberger may help here (these are from the 4th edition, I do not own the 5th.)

I see no a priori way to answer the question of whether a central-bank policy of holding the money supply constant, limiting the liquidity of the money market, or raising the discount rate at the first sign of euphoric speculation would prevent mania leading ot crisis or correct it after it got under way. ...the weight of historical evidence strongly favors the case that while monetary policy might have moderated booms leading to bust, it would not have eliminated them all. (p. 69)The first quote can be interpreted that while the Fed might have done something to slow down the expansion of the bubble, it could not stop it. While the 2000 stock market peak was about technology, this one was about risk. We learned how to repackage it, move it around. Unfortunately, as Kindleberger would have expected, we got a little ahead of ourselves (Arnold Kling's reference to hide-and-seek would not have surprised him.) I think it's fine if people want to go back and find where the Fed might have moved the funds rate up another 25 or 50 bp, but to think that would have solved the issue is folly. It is the nature of discovery of how to manage risk that someone is going to take too much unknowingly. Even if there were an asset mandate, it is doubtful that we would have gotten policy exactly right, even if it's Stephen Roach running the controls.

If, then, one admits the necessity for a lender of last resort after a speculative boom and believes that it is impossible for restrictive measures to slow down the boom at the optimal rate without precipitating collapse, the lender of last resort faces dilemmas about amount and timing. The dilemmas are more serious with open-market operations than with a system of [discount window operations.] In the latter case, Bagehot specified the right amount: all the market will take -- through solvent houses offering sound collateral -- at a penalty rate. With open market operations the authorities have more of a decision to make, but Bagehot is surely right not to starve the market. Given a seizure of credit in the system, more is safer than less. The excess can be mopped up later.

As for timing, it is an art. That says nothing -- and everything. (p. 178)

The second quote should be viewed as forward-looking to policy. Bernanke has been relatively incremental in his actions so far. He knows timing will be a question, and he's probably going to overshoot the amount of liquidity issued in the long run, to great consternation of Smith's second view holders. Charles Wyplosz, writing over the weekend, thought the discount rate cut last Friday was the right move for the Fed because it kept options open:

By reducing the discount rate, and accepting the infamous mortgage-linked assets as collateral, the Fed is offering markets a very strong reassurance. They can now find cash, and use the hot potato as collateral, in virtually unlimited amounts, at a cost, of course, but a very moderate one. The odds of a meltdown have now decreased.Will that be enough to bring some much needed quiescence? Only time will tell, of course. If it does not, then the Fed can reduce its interest rate, on September 18 or anytime beforehand. Herein lays another great merit in the Fed�s actions today. It has fired a powerful shot, but it kept the heavy artillery in reserve.

This morning's troubles with other mortgage bankers may mean they still need that artillery. But better they still have the shells. Mop-up of the discount loans is also harder than the discount window lending that has been encouraged, and that's why Bernanke may have gone to a little-used policy instrument first.

UPDATED (kind of): After I wrote this I took a last tour of Bloomberg. I found this quote by Richmond Fed president Jeffery Lacker:

``Financial market volatility, in and of itself, doesn't require a change in the target federal funds rate,'' Lacker said at a luncheon of the Risk Management Association of Charlotte. ``Interest-rate policy needs to be guided by the outlook for real spending and inflation,'' and markets can change that assessment if they induce changes in growth or prices.Bernanke has met with Sen. Chris Dodd of the Senate Banking Committee (and a Presidential candidate) and indicates he'll use all tools at his disposal to get through the crisis. Of course he will, and of course he'd say that. But that doesn't mean Bernanke is just speaking Bagehot.

...``Sound discount window policy, I believe, should aim at supplying adequate liquidity without undermining the market's assessment of risk,'' Lacker said.

Labels: discount rates, economics, Federal Reserve

A top twenty finish

We still are, but thanks to you dear reader we have managed to finish 16th out of the 125 economics blogs examined, just behind the excellent Profs. James Hamilton and Menzie Chinn at Econbrowser. That's very esteemed company, and I thank you. There are several excellent writers just behind either with newer blogs or blogging in sub-fields, so if this blog should stay in the top twenty it will be very fortunate.

Chimera in Iowa

There are four views of Iowa, at least according to a local joke: corn on the left and soybeans to the right; soybeans left and corn right; corn on both sides; soybeans on both sides.If we did not have a caucus so early in Iowa, would we have this boondoggle? One suspects voters in, say, Maryland take a different view.

The old joke needs an update, says Bill Sells, production manager at the Hawkeye Renewables ethanol plant in Iowa Falls. Twenty-eight ethanol plants now dot the Iowa landscape, sticking out like spaceships amid the cornfields.

...Three Republican presidential candidates, former Massachusetts Gov. Mitt Romney, former New York Mayor Rudy Giuliani and former Arkansas Gov. Mike Huckabee, all visited the Iowa Falls refinery, where they pledged further investment in alternative energy.

Over the past year, two other candidates, Sen. Hillary Rodham Clinton (D-N.Y.) and Sen. John McCain (R-Ariz.), went from strongly opposing the expansion of ethanol to endorsing it.

Backing ethanol is a political necessity in the state that is the traditionally the first to choose its presidential candidates. Iowa boasts the greatest number of ethanol plants in the country, producing about 30 percent of the U.S. supply. Ethanol is Iowa�s golden, corn-fed goose.

�It would be a mistake for a candidate to come to Iowa and not address renewable energy,� says Carrie Giddins, communications director for the Iowa Democratic Party.

With a presidential contest in Iowa and an energy bill in Congress, ethanol has become the panacea of all political problems. Pro-ethanol politicians offer the fuel as a cure for everything from dependence on foreign oil to global warming to outsourcing.

All of the major candidates bow at the ethanol altar in Iowa, supporting some form of increased subsidies or development.

Labels: economics, Energy, politics

Monday, August 20, 2007

The chimera of energy independence

Calling today�s investment in ethanol production �feedstock,� U.S. Rep. Collin Peterson believes the nation can reach energy independence in 10 to 15 years.(Yes, I know, I laughed at the bicycle reference too!)�The bottom-line goal is for us to get off foreign oil,� Peterson, DFL-7th District, said Friday at an energy conference at Bemidji State University.

He was joined by U.S. Rep. Jim Oberstar, DFL-8th District, who said in his remarks that moving more Americans to public transit � or bicycling � can negate the need to import millions of barrels of foreign oil.

The biggest issue is that it won't. It turns out first of all that in terms of emissions, growing more for biofuels causes a greater net harm than burning more fossil fuels and planting trees with the land you didn't put into biofuel production. Prairie grass might be better, but that wouldn't be bragged about by Rep. Peterson.

Second, it might be nice for Minnesota agriculture to push up prices, but it really makes Hugo Chavez and the poor around the world unhappy. One of those is a good thing. The other is not. Think there's a connection between tortilla prices in Mexico and immigration? Of course, it also turns out increasing developing country wealth has also raised food prices ... but isn't that all the more reason to not divert crops to biofuels, to allow those countries to enjoy their newfound gains?

Corn-based ethanol is only a stepping stone to making ethanol from other sources, such as wood wastes or switch grass, Peterson said, adding that negative press has been �ginned up� by special interests who claim Third World countries are starving because they can�t get American corn, which is now used to make ethanol, a blend of gasoline and bio-fuel.

�There�s a lot of stuff being ginned up out there by some of these people saying that we�re going to starve people in Africa because we�re making all this corn into fuel, which I think is a bunch of baloney,� he said.

�This ethanol, and some extent biodiesel, opportunity has repriced agriculture,� he said. �And it was about time, because we have been selling corn for the last 10, 15 years below the cost of production. We were using the government to finance that benefit, going to the big grain traders to feed and livestock producers, big dairy producers.�

Now with higher corn prices due to ethanol, the government can step out, he said. �One of the positive things is that we�re now seeing a price in the marketplace for corn and soybeans where you can make money without government help, and that�s good.�

Do you think that will come back to us in tax cuts? I wouldn't bet on this. Politics relies on being able to favor one's special interests. Witness two local legislators:

While federal lawmakers talked about pending legislation, Minnesota state legislators talked about three bills they passed and Gov. Tim Pawlenty signed earlier this year.

�We have passed the most forward-looking renewable energy legislation in the country,� Assistant Senate Majority Leader Tarryl Clark, DFL-St. Cloud, told the 200 people attending the energy summit.

Rep. Bill Hilty, DFL-Finlayson, said the three new laws require an increase in renewable energy sources such as wind, while providing loans and grants to meet the goal of producing 25 percent of electric energy from renewable sources by 2025.

They produce cheaper energy, they say, and use the savings to fund loans and grants to produce more renewable energy. We will not see the savings.

They are not interested in energy independence; politicians of both stripes only want to divert dollars spent on a key good to their favored interests. If you want people to be energy independent, just let prices rise and have people learn to conserve as best they can. But then, that doesn't allow the rent-seeking.

FMI: WSJ, Energy Independence, A Dry Hole?

Labels: economics, Energy, Minnesota, politics

That's rather much

- The special session would focus on transportation funding with a dedicated amount to finance bridge inspections repairs and replacements;

- Bonding for trunk highways, roads and bridges only, all other bonding to wait for 2008;

- Dedicating sales tax on leased vehicles to roads and transit;

- Flexibility for congestion-pricing and to reduce red tape;

- In re the gas tax: "A reasonable gas tax increase could be included as part of a comprehensive package to help achieve our goal of safer roads and bridges across Minnesota. It is my preference that all or some of any gas tax increase be temporary and be offset by a rate reduction in the lowest income tax bracket to help offset impacts on low and moderate income Minnesotans."

- There would be a limit on duration of the special session and agreement the agenda.

Yes, yes, it might.

When you have to farm harder

Andy thinks we are "promoting one race over another race." I would say, perhaps. But we live in a time when finding the traditional 18-year-old student from the usual parts of Minnesota and the Dakotas (and a few Wisconsinites) is much harder. Drive along a freeway in the Twin Cities and look at the signs for universities and how far away they are. SCSU has some of those, but there are some from the Dakota state schools. Over the next ten years the number of 15-19 year olds in the state will fall by 29,200, according to State Demographic Center estimates. So too North Dakota.

If you are trying to maintain student population, then, you must recruit harder, and reach into pockets of youth that are traditionally not in the pool of students we reach. Thus I think the efforts of recruiting minority and immigrant populations are probably for the best. The alternative is to lower admission standards, or downsize. The first is clearly wrong; I might argue to downsize instead, but impetus for that is most likely to come from outside the system.

Labels: higher education, Minnesota, SCSU

Zimbabwe -- the denouement?

It's a perfect illustration of the end game for statist economics. When state-created shortages threaten the economy, dictators attempt to stamp out the symptoms through even heavier state action rather than cure the original disease.That's Captain Ed commenting on the collapse of the Zimbabwean economy. And the heavy state actions include a price police that have arrested thousands, wherein the police can say with a straight face "the police are major players in creating a conducive business environment, which bolsters investor confidence." There are opposition reports that the government is using its artificial shortage to steer food to its supporters and away from its opposition. The central bank is so desperate for foreign currency that it is buying them in the black market.

And neighboring countries continue to sit on their hands.

Funny side story in this otherwise sad tragedy -- like the Russians and vodka, Mugabe has learned not to mess with Zimbabweans' beer. Notice how quick the supply response was in this case. Do you think it possible that Mugabe understands he could end famine tomorrow if he would just relax the price controls? If so, why do you think he does not?

Labels: economics

Saturday, August 18, 2007

Read and Weep #5 Rights and Responsibilities

Too many of the so-called teacher colleges began emphasizing self-esteem, the whole person, etc. over content in the 1970's. These institutions were extremely influential. When these "can do no wrong" ideas began, the college population came from homes where books, magazines and papers are readily available. Most came from English speaking homes with trditional work ethics and those who did not understood an earned degree (vs one given to students) would open doors regardless of background. Unless spoiled, these students would succeed. Once the feeling mentality overtook the learning mentality, problems started. Though today's college population is more varied the skills to succeed are the same. Unfortunately too many students are not taught necessary academic or social skills and too many parents overprotect their kids while demanding too little respect for themselves and teachers. The result is: a less educated populace; entry level workers who do not understand that showing up on time and doing what needs to be done are necessary for success; businesses and agencies that hire workers discover these new comers often cannot think, cannot make decisions, and call home when the going gets uncomfortable (note, I did not say the 'going gets tough').