Thursday, February 18, 2010

Encouraging profligacy

The $400/$800 Making Work Pay tax credit took effect in July 2009. Workers who have taxes withheld from their paychecks will see a decrease in the federal income taxes withheld from each paycheck by about $30 per paycheck every two weeks or $60 for couples.We are encouraging younger people to spend rather than save. And perhaps how this works is by giving the money back in $30 dribs and drabs that they don't notice. Wasn't this how we got into trouble in the first place? Why does government think it should encourage consuming new goods rather than paying off debt?

...The credit will phase out by two percent of any income over $150,000 for couples and $75,000 for others. Couples earning more than $190,000 and individuals earning more than $95,000 will not benefit from the credit.Unlike the 2008 economic stimulus tax rebate checks that were mailed to taxpayers in a lump sum, the government is hoping that offering the $400 Make Work Pay tax credit as a reduction in payroll deductions will encourage taxpayers to spend the credit rather than save the money or use it to pay down debt.

Karl noted a few weeks ago that the government is ending this credit as well, since it was expected to spend $116.2 billion over ten years, quite an expensive program. Perhaps one reason for cutting it was that voters like my son didn't even know they were getting it. When I told my son how he had gotten this credit already, all I got was the cryptic 'K'.

Labels: economics, Obama, taxes

Thursday, February 11, 2010

Tax migration and context

But meanwhile, in a new study released yesterday by the Freedom Foundation of Minnesota, two researchers looked at the IRS' data on income tax filings and returned a strong conclusion:

From 2002-2009 Minnesota lost an estimated 54,113 residents to other states, according to the new report, Minnesota�s Out-Migration Compounds State Budget Woes. These out-migrants also take their incomes with them. Between 1995 and 2007, the total amount of income leaving the state was at least $3,698,692,000 on which state and local governments would have collected an estimated $423,317,000 in additional taxes.For example, in 2007 -- the last year of their study, a net 4,428 taxpaying units left the state, and took $378,757,000 in AGI with them. By aggregating up the thirteen years of study they find that a total of $2.548 billion in additional taxes would have been collected. That's of course over 13 years, a period in which we would spend maybe 80 times that? I would have liked that number put in context, just as the income data should be put in context of state personal income ($216,436,888,000 in 2007, to put it in the same context the FFM study does.)

What caught my eye as well was their ability to identify where the taxpayers moved to. The top five destinations of out-migrants were Arizona, Florida, Colorado, California and Texas. Four of those places are very warm. We talk about the low taxes of South Dakota, though on net 1,322 taxpaying units moved TO Minnesota. But on net more AGI left than came. What was missing here was an attempt to tease out the effects of other factors they identified like weather or cost of housing. The study shows these factors as important, but doesn't get relative importance of these additional factors. That requires a regression analysis, which that study chose not to do.

But this is a very interesting and worthy study. It uses actual tax return data rather than a survey or the loose proxy of moving vans. It can measure income flows separately from people flows. And it fits the theory that people are sensitive to the cost of government.

Labels: economics, Minnesota, taxes

Wednesday, February 10, 2010

I'm persuaded by your argument

"So, son, did you build a road today?" That's a question Ward Cleaver never asked the Beav.He's right of course: Government is NOTHING like a family budget. They're not even alike in how they take money. The editor says the family "takes money", by which he means the family needs an income. It's not just a matter of balancing a budget. Unlike the state of Minnesota, the family can conceivably borrow past the end of a biennium. But in the long run it must balance. And how does it get its income? By persuading someone to hire one of the family's resources -- the labor of one of its members, or its land and buildings, or its savings and perhaps machinery. The person it persuades believes it receives something of greater value for something of less value. So does the family.

But it's a question politicians are beginning to ask as an election year begins.

It seems that many politicians love the analogy of government's revenue and spending plans being like a family budget.

And my response is: Government is nothing like a family budget.

Excuse me. I should say, there is a similarity: They both take money.

The government's budget is nothing like that. It can force others to lend to it, as the current state budget forces school districts and its universities to do so. It can impose taxes, which involve coercion rather than persuasion. Its coercion may take something of greater value and convert it to something of less value; in fact, more often than not, it does. And it can claim some moral high ground while it coerces, claiming to do it for "those less fortunate" or "the children." My family could persuade a few dollars from people through begging. The government does not stand on street corners.

So good job, Winona Daily News.

Labels: it's the spending stupid, Minnesota, taxes

Tuesday, February 09, 2010

Lipstick on industrial policy

I say "get religion" because this is not the Ann Lenczewski I kind of admired last year, when she had this to say in an interview with Steve Perry:

PIM: You�re talking about loopholes and exemptions that principally benefit upper-bracket people. Could you give me a couple of examples?Emphasis added. She is now willing to sponsor legislation that spurs "angel investment" ... but the angels only visit those "in high tech, manufacturing, or green businesses with fewer than 100 employees and less than $2 million in gross receipts." She's now putting "certified historic projects" for rehabilitation ... certified by whom? Who will "government playing king" take money from when she says she will "conform" REIT income to federal taxation? And what kinds of jobs are being created by using state monies for Mall of America? I'm saddened by this because I thought she had seen the light given the Perry interview. I am sure she prefers a higher tax rate than I do, but we both prefer (or preferred) a flatter tax base.

Lenczewski: There are like 25 things that I�m repealing, and they do different things. Some of them aren�t just helping wealthy folks. Some of them aren�t working at all, no matter who they�re intended to help�for example, the long-term health care credit. That�s intended to get people to buy long-term health care, and what it�s really doing is costing the state a ton of money. It�s a net loser, it�s completely not working. I heard a Harvard study at the National Tax Association showing that states doing this are just nuts, because they�re net losers.

So I�m repealing some things that don�t work, and then I�m repealing some things that are discretionary ways of saying, we�ll give you tax credits for certain activities but not for others. It�s sort of government playing king. .And then there�s a whole bunch of things for people who are high income-earners. We�re not getting rid of them entirely; we�re still going to keep them for people of limited means, but we�re going to turn them into a credit.

Gary Gross (whose link to Lenczewski's release inspired this post) properly chastises this effort:

David Strom was right when he told KSTP�s Tom Hauser that tax credits was a new way for government to pick winners and losers. I�ve said before that government�s record at identifying the next Microsoft, the next Fedex or the next Dell has been terrible. Still, the DFL insists that it knows best.Link added. Don Boudreaux also points out the folly of this new wave of industrial policy at the national level, arguing that the government's choice of winners depends on how many jobs it creates or saves rather than how much output is made.

Perhaps that is because a widget doesn't vote, but a worker does.

And worse, when you have a government picking winners and able to solicit donations from the contestants, you have a powerful incentive for corruption. Or at least, a little humor.

Labels: economics, Minnesota, taxes

Monday, January 18, 2010

Taxapalooza

- Increase the individual income tax to 9 percent (House) and 9.25 percent (Senate) on the top tier of earners

- Increase the current income tax rates for all income taxpayers (Senate)

- Eliminate the tax deduction for mortgage interest for many homeowners; replace the deduction with a targeted credit

- Eliminate the tax deduction for real estate taxes

- Eliminate the tax deduction for charitable donations; replace with targeted credit

- Eliminate the tax credit for education expenses

- Double the gross-receipts tax and increase the excise on alcohol and beer, and more than double the excise tax on cigarettes

- Impose a surcharge on lenders charging interest greater than 15 percent

- Increase commercial and industrial property taxes by a projected $300 million in the 2010-11 biennium

- Allow counties to exercise the option to impose a � cent sales tax to compensate for loss in county aid

- Eliminate the tax exemption for interest on municipal and 501(c)(3) bonds

- Eliminate the foreign royalty subtraction and foreign operating company provision in corporate income tax

- Eliminate the credit for organ transplants

- Tax as income a portion of most tax increment financing and tax abatement subsidies

- Tax sales of remote sellers by expanding the definition of a company's nexus

- Impose a sales tax on digital downloads

- Eliminate some of the incentives for JOBZ, or eliminate the program entirely

- Allow the creation of "street improvement districts" by cities to assess fees at uncapped levels for transportation improvements

Tuesday, December 29, 2009

More on income and wealth

The importance of the study, John writes, is that by use of IRS records Auten and Gee can track the same individuals over time:

By tracking the same people over time it can answers questions like: how has income changed for people that were in a particular income quintile in 1996 by 2005 (adjusting for inflation)? This is a different question than comparing people in a particular income quintile in 1996 with the set of people in the same income quintile in 2005. Some of the same people will be in the same income quintile, but some will move up or down.John suggests you look at Table 4 (scrolling the table link), which is also the basis for most of the presentations slides. It is a little too hard for me to format, but this should do:

Percent Change in:

1996 Income Mean Median

Quintile Income Income

Lowest 186.8 77.2

Second 60.4 36.9

Middle 40.0 24.4

Fourth 31.7 17.9

Highest 25.8 8.6

Tap 10% 26.6 0.3

Top 5% 27.8 -10.6

Top 1% 10.1 -30.9

All Income Groups 37.1 22.7

Their main conclusions (quoting from the introduction):

- There was considerable income mobility of individuals in the U.S. economy over the 1996-2005 period. More than half of taxpayers (57.5 percent by one measure and 55 percent by another measure) moved to a different income quintile over this period. About half (56 percent by one measure and 42 percent by another) of those in the bottom income quintile in 1996 moved to a higher income group by 2005.

- Median incomes of taxpayers in the sample increased by 24 percent after adjusting for inflation. The real incomes of two-thirds of all taxpayers increased over this period. Furthermore, the median incomes of those initially in the lowest income groups increased more in percentage terms than the median incomes of those in the higher income groups. In contrast, the real median incomes of taxpayers who were in the highest income groups in 1996 declined by 2005.

- The composition of the very top income groups changed dramatically over time. Less than half (39 percent or 42 percent depending on the measure) of those in the top 1 percent in 1996 were still in the top 1 percent in 2005. Less than one-fourth of the individuals in the top 1/100th percent in 1996 remained in that group in 2005.

- The degree of relative income mobility among income groups over the 1996-2005 period was very similar to that over the prior decade (1987-1996). To the extent that increasing income inequality widened income gaps, this was offset by increased absolute income mobility so that relative income mobility neither increased nor decreased over the past 20 years.

- Upward and downward mobility is affected by many factors. Based on a regression analysis, we find that initial position in the income distribution and changes in marital status are among the more important factors associated with changing positions in the income distribution.

I found this fact quite interesting: For the top 1/100th of 1% of the income distribution -- the 11,700 wealthiest tax filers in 1996 -- their 1996 income was $11.6 million and their 2005 income was $4.1 million. Not suffering at all, but still a fall in median income of near 65%.

Thursday, December 24, 2009

Another reason to not tax Minnesotans: A congressional seat

Minnesota would just barely miss keeping its eight Congressional seats, based on an analysis of new state population estimates from the U.S. Census Bureau.I hope we don't have to depend on California continuing its slow slide to oblivion in order for us to keep eight seats, but that might be what it comes down to.

The Congressional reapportionment forecast by State Demographer Tom Gillaspy projects Missouri would receive the last seat apportioned, with Minnesota just missing by about 1,100 people � a difference of less than one month�s population change for Minnesota. The difference between California, Texas, Missouri and Minnesota for the last three seats is about 2,200 people, which is well within the potential estimating error.

�Basically, this is a dead heat,� said Gillaspy. �Remember, these are just estimates by the Census Bureau, and our chances of retaining eight seats are improving every day. What will decide the issue is getting everyone in Minnesota counted in the 2010 Census.� Every household in the state will receive the 10-question Census form in mid-March 2010, which should then be returned to the Census Bureau by April 1.

North and South Dakota each grew faster than Minnesota. In 2008 there were almost the same number of moving vans coming here as leaving, according to United Van Lines. I've got some students needing senior projects this spring; maybe to help settle the old discussion Charlie Quimby and I have had on this issue we should get one to play with the data. (Or maybe with the IRS data. I've wanted to have someone do this for awhile. Off to check references on Google Scholar. So far I find [1], [2], [3]. [4] papers worth reading; not all appear to go in the same direction regarding the outcome. This note is a placeholder for that lucky student.)

Labels: DFL legislature, Minnesota, taxes

Tuesday, December 08, 2009

A parable

Suppose a man has a drinking problem. He decides to repent of his evil ways and, to make the commitment more binding, tells all his friends to come to his home at some appointed time. At that time he announces "I will not drink any more at all, and to prove it I will now have Dr. Smith implant this device in my arm. If I should take a drink, this implant will assure that I get very sick for 24 hours, with no lasting effects."

The man's friends divide in two groups. One thinks it laudable that the man is using a commitment device to assume he doesn't drink any more. The other group says "this is an extreme and inflexible tool that takes decision-making power out of your hands."

You say, "but that's the point. I need the power taken out of my hands because I'm helpless to prevent myself of drinking without some enforcement mechanism."

Your friend says "but you had the ability to do this before and you didn't."

"I know. That's why I'm starting now, before the bar opens again."

---------

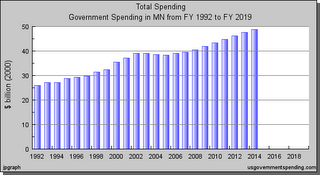

For more, see Barry Weingast's 1990 review of Margaret Levi's Of Rule and Revenue. Countries that did constrain the state's revenue collection abilities fared better than those that did not, he argues. Note that the graph at top is in real 2000 dollars.

Friday, December 04, 2009

Death and taxes, together again (updated)

The Senate may decide to just patch it over for one year at the 2009 rate, leaving the threat of the higher rate and lower exemption hanging into next year. Republicans might like to have that as a campaign plank, but I can't remember when I last saw a tea party for the estate tax.The bill passed 225 to 200, with 26 Democrats joining all Republicans present in voting no. If Congress does not act, the estate tax will disappear in 2010, then return in 2011 under the higher rates -- 55 percent and a $1 million exemption -- that existed before President George W. Bush took office.

The tax is one of several bills and expiring laws that require attention from Congress by Dec. 31, even as the Senate expects to devote much of its time to the marathon health-care debate.

Nonetheless, this is a pretty big deal.

The Obama Administration supported the House bill at the beginning of this year. Someone in the White House press corps should ask Press Secretary Gibbs whether they still do and if they would like the Senate to take up the estate tax bill before finishing with the health care bill.

UPDATE: Well, that was bad! I missed the decimal in front of the 23 in the Post article. For the current year, the share of filers affected would be 0.23%. But a federal report from earlier this year shows that the number would rise to 2.5% of all returns, including 10% of farms, if we revert to the 2001 rates. About 3% of farms currently have assets over $3.5 million.

Thanks to Charlie Quimby for finding my mistake.

Labels: economics, Obama, taxes

Wednesday, December 02, 2009

Now the real budget fun begins

General fund revenues are now forecast to fall $1.156 billion (3.7 percent) below earlier estimates for the 2010-11 biennium. After adjusting for actions taken by the Governor following the legislative session, general fund expenditures are $44 million lower. When combined with a $91 million reduction in the ending balance from FY 2008-09, a budget deficit of $1.203 billion is now projected for FY 2010-11. About 70 percent of the projected deficit is due to a reduction in expected income tax receipts.The loss in revenues is pinned on mostly a fall in wages (income from interest and capital gains "changed little".) The previous forecast was drawn in up February, was little changed from the November 2008 forecast except for the calculation of the effects of the Obama stimulus. Nine months between forecasts in this environment is an eternity, and there was no way anyone expected even this summer that the number wouldn't revise down by a billion or so. So I don't think this report is a shock or a sign that the economy is any more terrible than what I thought it was yesterday.

On the other hand, a new hand is dealt to the Legislature and Governor Pawlenty. They will be having press conferences in a while and we can expect DFL legislators to start their call for asking the rich to pay their fair share. Public employee union leader Eliot Seide was on the radio this morning (I listened during the Morning Show) saying the rich only pay 2/3 of their fair share and that getting the right amount from the rich would add $3.8 billion to revenues. For the life of me I can't figure out where either number comes from; what's this "fair share" he keeps talking about? Meanwhile, the governor is offering to talk to legislative leaders saying he doesn't want to use unallotment again. But having demonstrated he is willing to do it and not running for re-election, he undoubtedly feels he bargains from a position of strength. If you thought end of session in May was fun, pop some corn and settle in. This could be a hoot.

A couple of other quick notes while talking state budget. I did read this profile of state economist Tom Stinson and its effort to make him a pain in Governor Pawlenty's side. The article creates controversy where one doesn't exist, and the reporter was calling for weeks trying to dig up dirt on this topic according to people I spoke with. Tom's doing his job; everyone knows he tends to "go low" with the revenue figure, since the cost of underpredicting revenue is a lot lower than the cost of overpredicting (as we will now see; but the overprediction is certainly not an error made by the Minnesota Finance staff. Very few of us had 10% unemployment forecasts back in February.) The only shock in that article that I saw was Tom's age. I thought he was younger.

The other thing is this decision to list a separate estimate of inflation in the out-biennium forecast. I don't like it, I never have, and I wish they would stop it. You cannot assume a cost that doesn't yet exist. The decision to spend a public dollar takes a vote; it is not implied by previous decisions as taxes are.

Labels: DFL legislature, Minnesota, Pawlenty, taxes

Tuesday, November 24, 2009

A U.S. Tobin tax?

Under a bill being drafted by Democratic Reps. Peter DeFazio (Ore.) and Ed Perlmutter (Colo.), the sale and purchase of financial instruments such as stocks, options, derivatives and futures would face a 0.25 percent tax.Treasury Secretary Timothy Geithner has said a �day-by-day� tax on speculation is �not something we�re prepared to support.� Paul Ormerod explained in 2001 why the tax doesn't help in terms of reducing market volatility. Ramkishen Rajan explains that one of two things happens: either it causes a sharp drop in market transactions, reducing economic efficiency and making revenues generated by the tax small, or it doesn't because the elasticity of demand for financial transactions is very low ... in which case the revenue it generates is quite large.

The bill, a copy of which was obtained by The Hill, is titled the �Let Wall Street Pay for the Restoration of Main Street Act of 2009.�

Half of the $150 billion in tax revenue would go toward reducing the deficit, while the other half would be deposited in a �Job Creation Reserve� to support new jobs.

The job fund would be available to offset the additional costs of the 2009 highway bill and other legislation that creates jobs.

The Obama administration and congressional Democrats are looking for ways to create jobs after the nation�s unemployment rate hit 10.2 percent in October and job losses are expected to rise.

Friday, November 20, 2009

Local responsibility for taxes reduces spending

Property taxes would increase an average of 3.5 percent across Minnesota next year if local governments adopt their proposed levies, the state Revenue Department announced Thursday.Source. The cap of property taxes was a bone of contention between DFL legislative leaders and Pawlenty, after Pawlenty cut intergovernmental aids. Giving local control of taxes seems to have reduced spending, rather than have the burden of some paid for by the taxes of others.

That would be less than the 5.6 percent increase in average property taxes this year and the average 6.9 percent increase over the past three years.

"City councils are very well aware of how poor the economy is and are doing everything they can to keep the levies down," said League of Minnesota Cities lobbyist Gary Carlson.

By law, cities and counties could have increased their property tax levies by the full amount that Gov. Tim Pawlenty cut their state aid. But counties appear to be levying for just 40 percent to 50 percent of their lost state funding, said Jim Mulder, executive director of the Association of Minnesota Counties.

The state cut aid to cities by $130 million over the past two years. Cities have levied $95 million in property taxes to replace those funds and absorbed $35 million in cuts, Carlson said.

Notable: Minneapolis property taxes are scheduled to rise almost 12%, highest in the state. Will any DFLer make this an issue in Mayor Rybak's run for governor?

Labels: Minneapolis, Minnesota, Pawlenty, taxes

Declare victory, supply-siders

In [2007] I argued that supply-side economics (SSE) should declare victory and then go out of existence. Everything that was true about it had by then been fully incorporated into mainstream economic thinking and all that was left was a caricature. Continuing to maintain a separate identity for SSE only created unnecessary conflict with mainstream economists, I argued.As someone who learned his graduate economics during the first Reagan Administration, I agreed with this back in the 1980s and still do. There were some taxes at that time, on particular types of equipment and structures, that approached and sometimes even exceeded 100%. Certainly those were on the wrong side of the Laffer curve hill. But others were almost certainly NOT. While I think the brush Bartlett uses to paint Bush is a little too broad, there was certainly some excessive statements about the gains we would find if only we used dynamic scoring.

...All economists today accept the importance of the money supply--perhaps too much; during the recent crisis many asserted that fiscal stimulus was unnecessary because an increase in the money supply was the only thing necessary to restore growth. (How this would have been accomplished when interest rates were close to zero was never explained.) All economists now accept the importance of marginal tax rates to economic decisionmaking, and organizations like the National Bureau of Economic Research publish vast numbers of papers on this topic.

During the George W. Bush years, however, I think SSE became distorted into something that is, frankly, nuts--the ideas that there is no economic problem that cannot be cured with more and bigger tax cuts, that all tax cuts are equally beneficial, and that all tax cuts raise revenue.

But the more important point Bartlett makes is the general acceptance of the disincentive effects of high tax rates. And the reach of that acceptance is even to places generally unreceptive to conservative thought. Witness today's StarTribune:

Yes, go check that link: This was in the StarTribune, in its editorial voice. More supply-side words have not been written.Organizers of last week's program at the TwinWest Chamber of Commerce may have been hoping for a tax policy fight. The lineup featured state Rep. Ann Lenczewski, DFL-Bloomington, head of the House Taxes Committee, and Mark Haveman, head of the business-oriented Minnesota Taxpayers Association.

But instead of an argument, chamber members heard considerable consensus around a key proposition: Minnesota's corporate income tax is too high, and it should be either reduced or scrapped. That would not be the universal view among DFLers at the Legislature. It might not be the first choice of Republicans or of most Minnesota businesses, since many small businesses don't pay corporate tax.

But it's an idea Minnesota policy leaders should seriously consider. State corporate income taxes generally top "worst tax" lists when economists and tax experts from around the country convene to dispense policy advice. State taxes on corporate profits are faulted for several reasons. They're highly volatile, rising and falling dramatically with the economic cycle. They're costly to collect, especially from big businesses that employ high-powered legal talent to dodge them. They're regressive -- invisibly so. They are paid by customers in the form of higher prices and by workers in the form of reduced wages and fewer jobs, all of which hits the poor disproportionately hard.

Minnesota's corporate income tax has one other defect -- its 9.8 percent rate. That's among the highest in the country. It's also deceiving because of adjustments that have been made through the years to the income base that's taxed. The effective rate most businesses pay is a good deal lower, particularly among those with foreign operations or those based in Minnesota with sales elsewhere. But the high rate creates a damaging impression among would-be out-of-state investors.

Rep. Lenczewski, who has also had her eye on tax expenditures, is in a strong position to make this argument from her position on the tax committee. While I fear her colleagues will not let her cut any tax when they face a tremendously high projected deficit in the next biennium, it would be wise for the long-run growth of this state for Republicans to focus their attention on that. And if it means killing a few tax expenditures that create corporate welfare, so be it. Along with it you could include eminent domain reform, which also strikes at corporate welfare.

Monday, November 16, 2009

Increase taxes or reduce spending 4%, lose GDP

Assuming no major changes in federal government tax and spending policies, the federal deficit and debt picture looks bleak. The picture is similar to that of the CBO (2009b) and Auerbach and Gale (2009), although in the present case all the macroeconomic endogeneity has been accounted for.From a new paper by Ray Fair, of FAIRMODEL fame. I use FAIRMODEL in some of my teaching in forecasting. His latest iteration is a little higher in terms of debt-to-GDP than in the paper but not appreciably so. The emphasis is mine. Both those runs of his model show negative GDP growth in Q4 of 2011, which would appear to suggest that fixing the debt problem means a W recession pattern. Fair assumes the tax increase or transfer payment reduction to fix the recession begins in the first quarter of 2011.

...Personal income tax increases and transfer payment decreases have similar effects on the economy. A tax increase or spending decrease of 4 percent of nominal GDP is enough to solve the debt problem. The real output cost is about $300 billion per year.

A national sales tax is more contractionary in the model than are personal tax increases and transfer decreases, due in large part to decreases in real wealth and real wages. A national sales tax thus does not look like a good idea, although there is more uncertainty here regarding the ability of the model to deal with this case.

Would the federal elected officials risk the W to get the debt issue off the 2012 agenda? It depends on whether they can impose the taxes fast enough and get the pain out of the way before the summer of 2012 when voter decisions for November are being made. Losing $300 billion a year means losing 1-2% of GDP per year, which will cost many jobs.

Labels: economics, politics, taxes

Monday, November 09, 2009

Enough to make me want to move to Canada

No, the story that caught my eye over the weekend was Gordon Brown, the British PM, arguing for a tax on "day-to-day financial transactions" and getting it thrown back in his face by just about everyone there. Even Tim Geithner. But the very best reply came from Jim Flaherty, the Canadian finance minister:

We are not in the business of raising taxes, we are in the business of lowering taxes in Canada. It is not an idea we would look at.Mr. Flaherty notes that his country has not had the financial experience of London or New York. He has regulated banks much more. Now I would argue regulation is a form of taxation, but still, if Mr. Flaherty says his government is "in the business of lowering taxes", roll me in maple syrup and call me Canadian.

Alas, while the "Tobin tax" idea might be scotched by everyone but the British, they still want to tax banks for their own cowardice in letting one fail. Bernie Sanders has introduced a bill that says, if you're identifying all these banks as too whatever to fail, how about you just break them up? Forget the sand in the gears -- Mr. Sanders wants to throw a spanner.

Wednesday, October 28, 2009

I did not know ...

I say let's make a deal: Your parent wants $2.8-5.6 billion more money in stimulus dollars? Stop the damn ads.

Labels: it's the spending stupid, Obama, taxes

Thursday, October 22, 2009

Lord make me virtuous, but not just yet

The estimates indicate that as of August, the ARRA had raised employment relative to the baseline by between 600,000 and 1.5 million jobs. (p. 7)Second,

Since the recession began in December 2007, payroll employment has fallen by 7.2 million. Given that employment growth of nearly 100,000 per month is necessary to keep up with normal labor force growth, employment is currently about nine million below its normal trend level. (p. 11)Third,

A second challenge that we face is clearly the budget deficit. The final numbers just released show that the fiscal 2009 deficit reached $1.4 trillion, or about 10 percent of GDP. Excessive moves toward fiscal policy tightening could lead to a return to output decline and a reacceleration of job losses. The current policies that have generated a dramatic turnaround of the economy need to be seen through to their completion. The Mid-Session review released in August predicted a similarly large deficit in 2010, and substantial structural deficits even once the recession is over and the economy is fully recovered. Such long-term deficits are unacceptable and need to be dealt with. Over the long run, sustained deficits crowd out private investment and reduce long-run growth.They say they are nine million jobs below trend for full employment. Regarding my post yesterday, to get back there you have to get GDP growth (at least in real terms) to be faster than trend growth (around 2.5-3%), which is why I question whether the shock to nominal GDP is permanent. But think about what this says -- the stimulus is working, but not nearly sufficient such that we can avoide the crowding out and private investment decline and decrease in real GDP. If we reduce investment you will get a permanent shock. So if they continue to keep the stimulus going they could create a permanent loss, but that would be OK in return for buying 600,000 to 1,500,000 jobs "saved or created" now. How much of a price does Prof. Romer believe we should pay for those jobs?

Given the current precarious state of the economy, substantial near-term spending cuts or tax increases to reduce the deficit would threaten the recovery. (p. 18)

Labels: economics, Obama, taxes

Wednesday, October 21, 2009

A temporary shock, a permanent bias

State Economist Tom Stinson told the Subcommittee on a Balanced Budget � part of the Legislative Commission on Planning and Fiscal Policy � that tax collections for the first quarter of Fiscal Year 2010 (the state�s fiscal year begins July 1) came in below the original forecast by $52 million, or approximately 1.7 percent. ...The latest edition of the Tom and Tom presentation is here. It has been a staple on the St. Paul fiscal policy circuit for about three years now. But the recession has changed how they present this, and I'd like to suggest it's lead them to one positive statement or forecast that is contentious and one normative statement that I think we should question.Stinson said Minnesota will likely begin the 2012-13 biennium with a budget deficit of at least $4.4 billion; however, House Chief Fiscal Analyst Bill Marx said the true number could be as high as $7.2 billion, once inflation and the impacts of Gov. Tim Pawlenty�s 2009 unallotments and vetoes are factored in.

Beyond 2013, Stinson said long-term demographic trends will reduce the state�s tax revenue base. In particular, he said the state�s aging population will create a situation where revenue growth will decrease just as demand for government services is going up.

�The demographics are going to make tax increases more difficult,� Stinson added, explaining that Baby Boomers trying to save money for retirement will likely resist proposals to raise taxes.

State Demographer Tom Gillaspy said the Baby Boomers will also require more state health care spending as they get older, making it more difficult to fund education and other government services. He suggested the key to getting out of this �fiscal trap� would be to increase the productivity of the state�s workforce. Stinson noted that this in turn requires new public investments, like infrastructure and education, creating what he called a �fiscal Catch-22.�

To see the positive, let's look at a graph in the presentation (at page 9.)

This is a representation of the Global Insights forecast for nominal GDP at two different points in time. Nominal GDP is a driver of the revenue model Department of Finance uses to project tax receipts. If you forecast nominal GDP to be lower, your tax revenues will go down, and your budget deficit looks higher, all other things equal. Dept. of Finance uses Global Insights' forecast.

They project a permanent decline from the recession. A textbook description of recessions, however, would not normally show a permanent shock to GDP from its trend values. This would normally be the result of a negative productivity shock. But has that happened? Multifactor productivity in the US rose 1.2% in 2008. Why would we not get a period of above-average growth? Real earnings are up. Casey Mulligan has sounded this theme for awhile, and it's plausible -- not that it's beyond debate, just that it's a real possibility that there has been no permanent shock, and that nominal GDP can return to its previous path. That would imply that the Minnesota budget deficit for 2012-13 is possibly not nearly as bad as predicted by Tom & Tom.

Their final slide includes this statement, emphasis added:

If we don�t make the necessary public investments in human capital, research and infrastructure, then we won�t have the productivity gains needed to provide the resources to make those investments.I would hope that's a misprint, or a hasty slide. (Given it's the last one, quite possible.) Human capital formation does not require public investment. I buy my child a private education. A private university raises funds to permit faculty time to create new basic research. Infrastructure has both private and public components -- and more of it could be private if we made that choice. There is nothing necessary about "public investments" other than a lack of imagination of what the private market could do if permitted.

The decision to invest "other people's money on other people" is a normative decision with disastrous consequences.

Nobody spends somebody else's money as carefully as he spends his own. Nobody has the same dedication to achieving somebody else's objectives that he displays when he pursues his own."a feeling of childlike dependence" -- from your trash service to your college to your health care.Beyond this, the programs have a insidious effect on the moral fiber of both the people who administer the programs and the people who are supposedly benefiting from it. For the people who administer it, it instills in them a feeling of almost Godlike power. For the people who are supposedly benefiting it instills a feeling of childlike dependence. Their capacity for personal decision making atrophies. The result is that the programs involved are misuse of money, they do not achieve the objectives which it was their intention to achieve. But far more important than this, they tend to rot away the very fabric that holds a decent society together.

Labels: economics, Minnesota, taxes

Thursday, October 15, 2009

Ruh-roh

In little over 10 years, debt held by the public as a percent of GDP under our Alternative simulation is projected to exceed the historical high reached in the aftermath of World War II and grow at a steady rate thereafter.From a new report by the Government Accounting Office. Using the baseline numbers extending out for 75 years, you would need to raise an additional $37 trillion (5% of GDP) to have the debt/GDP ratio equal what it is today. Using the alternative scenario, that would be $62 trillion. In the baseline model revenues as a share of GDP are 20.2% from 2019 forward; the alternative sets that figure at its 40-year historical norm of 18.3%. Unless you get serious control of spending now, you are looking at much higher taxes going forward, or much higher inflation in the long run.

These fiscal challenges are driven by health care cost growth and demographic trends. Absent reform, Social Security, Medicare, and Medicaid will account for a growing share of the economy in coming years. The longer action to deal with the nation�s long-term fiscal outlook is delayed, the larger the changes will need to be, increasing the likelihood that they will be disruptive and destabilizing.

...While this is similar to the results of previous simulations, the sense of urgency has increased. Beginning in 2009, our Alternative simulation shows persistent annual budget deficits in excess of 7 percent of GDP�levels not seen since the aftermath of World War II.

Friday, October 02, 2009

Mrs. S writes

During the past 20 years it has seemed harder to get bipartisan agreements. When you lose an election, you feel like you lost everything. There may be something dangerous in that.The piece features my fellow St. Cloud bloggers Gary Gross and Leo Pusateri, without whose work the local gathering would not have been possible.

There is concern that voters are becoming more polarized � coastal elites versus heartland conservatives (TEA Parties) � and there is more homogeneity in both parties. Both parties are losing their �INOs� (Republicans/Democrat in name only) yet, as Gross observed, �common sense isn�t a partisan issue.�

Labels: Mrs. S, other people's money, taxes

The governor made me do it!

While I was holding up a pedestrian on the street, the victim asked me why I was doing this. "Well, it's my parents' fault. They stopped buying my dinner. They had always done it, and now just because one of them is out of work and I turned 30, they stopped. What ingrates."

Of course the above story is farce, unless you're the Hennepin County Board of Commissioners.

So rather than have property owners in Hennepin County pay for the poor in Hennepin County, the people in the entire state of Minnesota should pay for the poor in Hennepin County? The county had already planned to raise taxes. Commissioner Jeff Johnson writes about the negotiations earlier this month.County Administrator Richard Johnson presented a $1.6 billion budget Tuesday to the county board for next year, down about 6 percent from this year's $1.71 billion.

But even after cutting 163 jobs and reducing capital improvements, the county still needs to raise property taxes by 3 percent solely to pay increased costs at Hennepin County Medical Center, Johnson said.

Those higher costs were caused by the state's cancellation of General Medical Assistance for poor adults, he said.

Hearing that, county commissioners began their budget deliberations by blasting Gov. Tim Pawlenty again for shifting the state's budget problems to them. The county estimates that 40 percent of the state's poor adults who were covered by General Medical Assistance live in Hennepin County.

The tax increase is required "just because the governor cut the legs out'' from under thousands of low-income adults who depended on General Medical Assistance, Commissioner Gail Dorfman said.

I�ve heard a lot of talk the past few weeks about the needs of county government, the needs of HCMC and the needs of those who receive government benefits. I�ve heard much less talk about the needs of the taxpayers who fund county government, HCMC and the government programs that provide those benefits. I�m hopeful as we move forward toward a final levy decision in December we place a little more emphasis on the well-being of Hennepin County taxpayers.But it's not their fault, Jeff! It's the mean parent in the governor's mansion done made them do it! When you decide it's the right of one person to live at the expense of another, it's little surprise that you make a villain of those that do not.

Labels: health care, Minneapolis, Minnesota, Pawlenty, taxes

Wednesday, September 23, 2009

ACORN - Why Do They Need Our Money?

Recently, there have been videos of undercover work done by two rather rookie reporters (as compared to the NYT, LA Times, Washington Post, along with the alphabet soup group of television networks) exposing ACORN for giving "advice" as to how to set up brothels with underage girls yet avoid taxes and being caught.

The US House of Representatives voted to totally stop the flow of all federal money to ACORN and the US Senate requested the Dept. of Health and Human Services to stop that funding.

Now, it seems that within a week of supposedly losing all their funds, ACORN distributes a fundraising letter to its lists requesting money. On top of this, they have a mystery donor who promises to match all new donations up to $20,000.

My question? If ACORN can raise this kind of money on its own, why are we taxpayers footing the bill for any of their activities?

Hat tip - Ed Morrissey, Hot Air.

Tuesday, August 18, 2009

Heavy burden

It's sensible, though higher than I thought. Using Ironman's tool, it appears that if you think the deadweight cost is 100%, you can even use the Obama Administration's assumption of a multiplier and still show that stimulus doesn't stimulate.

Meanwhile, another tax the Administration is thinking about, cap and trade, turns out to be really bad for poor people. Corbett Grainger and Charles Kolstad in a new paper from the National Bureau for Economic Research (abstract here for free; this appears to be an ungated version):

For a tax of $15 per ton CO2, an average household in the lowest income quintile would pay around $325 per year, while an average household in the wealthiest quintile would pay $1,140 annually. Although wealthier households would pay more in absolute terms, as a percentage of annual income, lower income groups bear a disproportionate share of the burden. The poorest quintile�s burden (as a share of annual income) is 3.2 times that of the wealthiest quintile�s. The burden as a share of annual income for the lowest income group ($7,500-9,999) is almost four times higher than the burden-to-income ratio for the highest income group in the data ($200,000-250,000).You can use a tax instead of cap-and-trade specifically in the analysis, as the effect should be identical in either case. You could compensate lower income families for cap-and-trade with, say, a reduction in payroll taxes (which as just as regressive), but when you decide to give away most of the permits, you don't have any money to transfer.

Labels: economics, Energy, other people's money, taxes

Tuesday, August 04, 2009

He didn't walk it ALL the way back

Q But if economists, including the President's own economists, don't necessarily think that it's possible to do so without raising taxes on the middle class, how is that dealing candidly with the American people?According to CBO:

MR. GIBBS: Well, again, Jake, there are a series of things that have to be done. I think you'll actually hear an announcement from Treasury later this afternoon about how much money has to be borrowed versus what they thought was going to have to be borrowed and what will have to be borrowed as a result of financial stabilization.

In terms of cutting the amount of money that's needed, again, I think the President has been clear on this. The first thing that we can do -- the most important thing that we can do right now is get our economy growing again. We know that the deficit -- part of the reason that the deficit is up right now is that the economy has slowed down so much that tax revenues -- because it's what happens in an economic slowdown -- have regressed a lot. I think the President -- obviously we're going to have to make some decisions down the road on some of the President's legislative priorities and some of the things that Congress wants to do to evaluate how we move back towards -- on a path toward fiscal sustainability.

CBO estimates that under the laws in place as of March 2009, the cyclically adjusted deficit will climb from 2.6 percent of potential GDP in 2008 to 9.0 percent in 2009 before falling to 4.7 percent in 2010 and 2.2 percent in 2011. The increase from 2008 to 2009 and the decrease in 2010 are the largest on record, reflecting primarily the effects of the TARP legislation, assistance to Fannie Mae and Freddie Mac, and the American Recovery and Reinvestment Act of 2009 (Public Law 111-5), which together will increase the deficit by $812 billion in 2009 and by $445 billion in 2010. (Without those costs, the cyclically adjusted deficit would be about 3.6 percent of potential GDP in 2009 and roughly 1.9 percent in 2010.)So when we get to 2011, even if the economy is at full employment, there would be a $350 billion deficit. And it then rises, looking at the long-term budget outlooks prepared by former CBO and current OMB director Peter Orszag and current director Doug Elmendorf. According to the latter:

Under the extended-baseline scenario, the fiscal gap [the amount needed to stabilize the debt-to-GDP ratio -- kb] would amount to 2.1 percent of GDP over the next 25 years and 3.2 percent of GDP over the next 75 years. In other words, under that scenario (ignoring the effects of debt on economic growth), an immediate and permanent reduction in spending or an immediate and permanent increase in revenues equal to 3.2 percent of GDP would be needed to create a sustainable fiscal path for the next three quarters of a century. If the policy change was not immediate, the required percentage would be greater.$350 billion about gets you there. So which way do you think the Congress and the Obama Administration will find that $350 billion? Did Gibbs' statements yesterday make that clearer to you?

Labels: economics, Obama, taxes

Thursday, July 30, 2009

The deadweight loss of higher taxes

Consider the combined effect of President Obama's proposal to raise the top tax rate from 35 percent to 39.6 percent and the new surtax. This means high-income households will receive 54 cents rather than 65 cents from every dollar they earn; that is, the after-tax reward from earning income falls by 17 percent. Based on the research mentioned above, with such large increases in tax rates, we can expect taxpayers facing the top tax rates to reduce their reported incomes by nearly 7 percent.According to the SOI Bulletin from the IRS, there were 354,093 returns filed that had adjusted gross income over $1 million. Those returns sum to $1.211 trillion. 7% of that is about $85 billion, or more than 0.6% of 2006 GDP. In economics this is known as the "deadweight loss" of additional government. That is lost each and every year if we allow the Bush tax cuts to expire, and impose the high-income surtax to pay for health care.

In related news, the tax burden of the top 1% of the income distribution now exceeds that of the bottom 95%. Thanks, rich people! (Mankiw notes that this is due to "both changing tax policy and the changing distribution of income.")

Monday, July 20, 2009

Call to arms of the day

The United States is facing an urgent financial crisis that threatens our fiscal and economic stability. Our government is currently borrowing about 50 cents for every dollar we spend. Medicare is already paying out more in benefits than it collects in taxes and Social Security is expected to do the same in less than five years. The individual share of this year�s deficit for every American is $3,500 - by the fall that share will approach $6,000. The national debt currently stands at $11.5 trillion, costing every American $37,600. The total unfunded liabilities for the United States are $60.6 trillion, which exceeds the total net worth of America. Paying off this liability would require every American to write a check to the Treasury Department for $198,000. ...We must put a stop to the spending spree in Washington. The best way to stimulate the economy is to cut taxes and spending drastically.Graph at top courtesy John Rutledge, who was my professor at Claremont Graduate School for about two hours before joining the Reagan White House in 1981.

Labels: economics, it's the spending stupid, taxes

Friday, July 17, 2009

Beggar thy neighbor

But there's a better, more selfish reason for spurning government cheese: the cheese is temporary. It leverages state taxpayers in order to get a two-year benefit. When the stimulus is withdrawn, what will happen to the state's effort? We can just imagine the calls to "stop the cuts" paid for by government employee union dues in 2011 or 2012.

It's not just beggar-thy-neighbor between the states, it's beggar-thy-taxpayer within the state. Governor Pawlenty is smart enough to not fall for that shell game and leave his successor a battle to restrain spending more in the next biennium. One has to wonder why the DFL, already focusing on the size of the 2011-13 projected deficit, would want us to add $62 million or more to the next biennium's deficit and beyond just to get $72 million of OPM now.

Labels: DFL legislature, Minnesota, Pawlenty, taxes

Thursday, June 25, 2009

Obama uncreates and unsaves 495 jobs

Tampa will lose part of its cigar heritage in August when Hav-A-Tampa shuts its factory near Seffner and lays off about 495 employees, closing a factory that has been operating since 1902.I used to carry those Jewels around the golf course back in my 20s, when I needed a cheap smoke that kept the flies off and tasted half-decent. They are a poor person's cigar, and putting an excise tax per cigar was bound to hurt cheaper cigars smoked by modest-income folks more than hurt your $10 stogie. Indeed, most of the cheap cigars you see behind the cashier at your Walgreens or Thrifty Drug are made in the States (the better ones, even those made by U.S. firms, are handrolled with cheaper labor in the Caribbean.

The company announced the closing today.Many employees there make Hav-A-Tampa's iconic Jewels, inexpensive machine-made cigars known for their birchwood tips. Some workers have labored there for two decades or longer, including one who's been there for 50 years, said Richard McKenzie, a senior vice president of human resources for Altadis USA, which owns Hav-A-Tampa. ...

Employees on Tuesday were digesting how they would find work in an economy where more than one in 10 people in the area already are unemployed.

"I've been here 12 years. I know someone's who's been there 20 years, 22 years," said Denise Harrison, an office manager at Hav-A-Tampa. "I'm sure we'll all land on our feet, but it will be harder for some people other than me who may have done nothing else."

...Several things conspired to hurt Altadis' sales, McKenzie said, including the recession and the growth of indoor smoking bans. The bans have especially hurt sales in cold-weather states, where it's impractical to smoke a cigar outdoors in the winter, he said.

However, the company attributed much of its trouble to the State Children's Health Insurance Program, or SCHIP, a federal program that provides health insurance to low-income children. It is funded, in part, by a new federal tax on cigars and cigarettes. McKenzie couldn't say how much sales of Hav-A-Tampa cigars had fallen off, but the numbers have dropped significantly, he said.

Previously, federal excise taxes on cigars were limited to no more than a nickel, said Norman Sharp, president of the Cigar Association of America trade group. The tax increase, which took effect April 1, raises the maximum tax on cigars to about 40 cents, Sharp said.

Labels: cigars, economics, taxes

Tuesday, June 23, 2009

If Maine can do it, why can't we?

This month the Democratic legislature and Governor John Baldacci broke with Obamanomics and enacted a sweeping tax reform that is almost, but not quite, a flat tax. The new law junks the state's graduated income tax structure with a top rate of 8.5% and replaces it with a simple 6.5% flat rate tax on almost everyone. Those with earnings above $250,000 will pay a surtax rate of 0.35%, for a 6.85% rate. Maine's tax rate will fall to 20th from seventh highest among the states. To offset the lower rates and a larger family deduction, the plan cuts the state budget by some $300 million to $5.8 billion, closes tax loopholes and expands the 5% state sales tax to services that have been exempt, such as ski lift tickets.It seems like everyone's running for governor here in Minnesota; support of a flat tax would be one way to distinguish the candidates. And it doesn't have to be just Republicans:

This month the Democratic legislature and Governor John Baldacci broke with Obamanomics and enacted a sweeping tax reform that is almost, but not quite, a flat tax. The new law junks the state's graduated income tax structure with a top rate of 8.5% and replaces it with a simple 6.5% flat rate tax on almost everyone. Those with earnings above $250,000 will pay a surtax rate of 0.35%, for a 6.85% rate. Maine's tax rate will fall to 20th from seventh highest among the states. To offset the lower rates and a larger family deduction, the plan cuts the state budget by some $300 million to $5.8 billion, closes tax loopholes and expands the 5% state sales tax to services that have been exempt, such as ski lift tickets.

One question is how Democrats in Augusta were able to withstand the cries by interest groups of "tax cuts for the rich?" Mr. Baldacci's snappy reply: "Without employers, you don't have employees." He adds: "The best social services program is a job."

Friday, June 05, 2009

Mrs. S writes

When laws are passed or implemented, it's difficult to remove them. We don't get rid of laws � we just keep adding. The number of pages in the Federal Register � which contains rules, proposals for new or changes to existing rules, and notices of meetings � was 2,620 pages when first issued in 1936. It has averaged over 75,000 pages in this decade. Economist Milton Friedman argued in 2004 that increases in the size of the Register corresponded with decreases in individual liberty. The burden of regulation may be greater than the burden of taxes.

...Like the Boston Tea Party that protested taxation without representation, TEA Parties are a reminder of the importance of economic freedom. The staggering national debt is our crucible and challenge, and the greatest obstacle to the future that we face.

Friday, May 29, 2009

One more reason not to have passed the DFL budget

I hope the governor is watching New Jersey, where a fight over a flat tax is going on in the Republican primary. I don't like the Lonegan proposal only because there should be a zero rate up to some income level. (As you might have told yesterday, I'm an old Hall-Rabushka supporter.) Governor Pawlenty, should he decide to run for a third term, could make fundamental reform -- one bracket, not three or four as the DFL proposed -- the cornerstone of the next campaign.

Labels: Minnesota, Pawlenty, taxes

Thursday, May 28, 2009

VAT plus

He was just off by 27 years or so...

(h/t: Andy.) As a substitute, the VAT has advantages and disadvantages. Technically, VAT works like a tax on production: the amount of GDP produced in an economy is equal to the value added by humans at all levels of the production process. since in the aggregate total production should equal total incomeWith budget deficits soaring and President Obama pushing a trillion-dollar-plus expansion of health coverage, some Washington policymakers are taking a fresh look at a money-making idea long considered politically taboo: a national sales tax.

Common around the world, including in Europe, such a tax -- called a value-added tax, or VAT -- has not been seriously considered in the United States. But advocates say few other options can generate the kind of money the nation will need to avert fiscal calamity.

VATs tend to be rather messy in practice; many flat tax proposals have descended from the original Hall-Rabushka tax plan from the early 1980s. (It was, in fact, part of the discussion at the Reaganomics conference.) William Gale from the Urban Institute has a short primer. One should note that flat tax, VAT and the Fair Tax are three entirely different proposals. But unlike the other two, the proposal of VAT here would be a complication of the tax system that doesn't create any tax reform. There is unlikely to be any tradeoff of income for VAT, since it appears the reason the Obama administration is exploring it is to get additional revenue.

Labels: economics, Obama, taxes

Monday, May 11, 2009

The cost of "get Pawlenty" (UPDATE: Pawlenty compromise spurned)

Both of these leaders are incompetent. So are their lieutenants, Taryl Clark and Tony Sertich. They've had two years to learn their jobs, but the events this past week show no tangible improvement. Again, forget the policies and proposals for the moment. Look at the process and the resulting lack of progress. When even the normally undemanding media is openly complaining, even the DFL must admit they have a problem.Gary Gross is calling it "seat of the pants taxation":

Look at this $ 992 million tax bill, just announced. Gone, suddenly gone, are the "thoughtful" Senate and House bills that made their way through weeks of deliberation. All that work for nothing, replaced by something hurriedly cobbled together, a bill they could have written in January. It needn't have waiting for the February forecast, but OK, they could have written it March. Instead, we see it in May, with two weeks left in the session. I have to believe even a few in the DFL were surprised and disappointed by this. ...

To my untrained mind, this session has only one real purpose for the DFL: get Pawlenty. That's what the "listening" tours were about. That's what all this posturing the past two months has been about. And now it's May, crunch time. As this new tax bill concedes, operation "Get Pawlenty" is headed for the rocks.

What Pogemiller and Kelliher don't understand is that they're no match for Pawlenty in a political duel. They have only their strength in numbers, and those numbers should seriously think about who they're following and why.

The tactic of "get Pawlenty" has focused on his proposal to pull future tobacco settlement revenues forward to cover some current spending that the governor has decided cannot be reformed in the way Gary describes. What the governor does is say "look, I can't cut a billion more here in this biennium: too much, too fast, and unwise in a recession. What I can do is pull money into this biennium and get you to spend less later when the economy improves." A smaller reform, details TBA, starting two years from now. It's not a great plan in my opinion, but it's not bad. (Better would be to identify what you're cutting later, rather than letting the Legislature figure it out for you.)As a result of the DFL�s infighting, they were forced to take the step of rewriting the Tax Increase Bill from scratch, passing it through the House and Senate, then have Gov. Pawlenty veto it before he headed out for the Annual Governor�s Walleye Opener on White Bear Lake.

What�s worse is that the DFL hasn�t shown any inclination towards finding cost savings. There�s no denying that they�ve figured out cuts but that�s a different story. Cutting budgets just means that you�re cutting spending and services. Finding cost savings means that you�re cutting spending but keeping service levels the same.

But the only other options are to find current cuts without cutting services, as Gary describes it, or raise taxes. When Sen. Bakk defeated Rep. Lenczewski in conference and got this tax bill -- which the governor declared DOA before they even passed it -- the leadership put itself in a box: It has said it won't accept the tobacco bonds while agreeing with Pawlenty that the last billion can't be cut. It therefore must act contrary to wishes of its own national leadership either to raise taxes or cut spending in E-12. If it thinks it can do that and also "get Pawlenty", they have yet to show how.

UPDATE AND BUMP: Just before I left I checked the comments email box and got this at the bottom of a statement from Marty Seifert (I assume this is a summary by House GOP caucus staff -- I haven't seen an official letter):

Also today, Governor Pawlenty made the first significant offer to bring the session to an on-time close. In a letter to the Legislature, the governor said he would accept the Senate DFL's position of not funding the budget reserve, accept the House's desire for a larger K-12 education shift, and halve his proposal for appropriation bonds. Democrats responded by calling the offer "not responsible" even though two of the three parts are DFL initiatives. By rejecting their own proposals, Democrats are making it awfully difficult to bring this session to a close by May 18.We might need a corollary to the rule of holes: when you've painted yourself into a corner, stop painting! Because the DFL is still working that brush.

And they might still want to remedy this year's deficit.

Labels: DFL legislature, Minnesota, Pawlenty, taxes

Tuesday, May 05, 2009

A study in contrasts

Something may be wrong with our education system if so many citizens can confuse the legitimacy of the original Boston "tea party," a tax protest preceding the Revolutionary War against a despotic undemocratic monarchy, and the taxes today that are imposed by the most legitimate, democratic and representative governments the world has ever known.ACORN, an activist group that turned in 90,000 completed voter registration forms in Clark County for last year's election, violated state law by setting mandatory quotas for workers who canvassed neighborhoods looking for people to register to vote, according to the state attorney general's office.

...Canvassers were required to register at least 20 people a day, and could be fired if they didn't, officials said. ACORN also instituted a bonus program called "blackjack" or "21 plus" in which a worker could earn an extra $5 per shift by registering 21 or more people.

Improvements in civics education might help more people understand at least the possibility of a relationship between taxes and the overall quality of life in society, and the idea of common good.

Source.

Thankfully, polls consistently show that most Minnesotans have a reasonable understanding and acceptance of government taxing and spending.

Minnesotans have little taste for higher taxes that would hit most people's pocketbooks, but two-thirds would offer up the wallets of richer folks to help solve the state's budget woes, a Star Tribune Minnesota Poll has found.

When it comes to a broader increase -- income tax hikes for most Minnesotans -- nearly 60 percent said that would be unacceptable.

Half of the poll respondents said they think the state should use a combination of unspecified tax increases and spending cuts to help erase the state's $4.6 billion deficit, while another 40 percent said the balancing should be achieved primarily through spending cuts alone. Only 4 percent favored squaring the books primarily with tax increases.

"I don't know why people should be punished for being successful," said Sarah Dawdy, 61, a retired business manager in Pequot Lakes. "For me, that's totally against what the free enterprise system is.

...Surveys also have shown that about 60 to 70 percent of Minnesotans favor a balanced approach to our historic $6 billion budget shortfall, or a mix of cuts and reasonable revenue increases. Polls also have shown Minnesotans also support income-tax increases on the top tiers, and especially so if it goes to education and property-tax reductions.

A government that robs Peter to pay Paul can always depend on the support of Paul. 26% of Minnesotans pay no federal income tax, likely also no state income tax.

Thursday, April 30, 2009

South Dakota, behold your future

From the Tax Foundation. Growing up in Manchester, NH (about twenty minutes north of Nashua) meant you heard many of these stories. NH has state liquor stores, many of which are strategically placed near the state borders. I once observed a snow fence being put up near one along I-93 (one of two main highways between NH and MA.) Turns out the fence was to protect the license plates of liquor store patrons from being viewed by MA state patrol on the other side of the border. It's clear who that liquor store markets to.A bill has been passed in the New Hampshire Senate that would protect New Hampshire businesses from being forced to collect sales taxes for other states. The bill, proposed earlier in the year by Governor John Lynch, is a reaction to reports that Massachusetts revenue officials have been bullying New Hampshire small businesses in order to get the businesses to do their bidding and collect sales tax on sales to Massachusetts residents. The bill will probably pass the House without a problem.

The issue stems from the fact that New Hampshire has no state sales tax while Massachusetts has a 5% sales tax. Because of this, Massachusetts residents who live close to the border have an incentive to shop in New Hampshire. Massachusetts is apparently not pleased with all this tax avoidance, and is putting the pressure on businesses to collect sales tax.

That couldn't happen in MN, could it? Maybe.

Labels: taxes

Tuesday, April 28, 2009

Ann of a thousand yachts

I am probably the most sympathetic conservative to the idea of removing tax preferences in legislation, but I think Rep. Ann Lenczewski has missed the main message of tax reform. The lesson from 1986 was that you could only trade their removal for lower tax rates. The 2005 tax reform proposal at the Federal level was an example of this as well. But removing tax preferences makes substantial changes in the tax price of certain economic activities. Removing the tax preference for home ownership raises the cost of it, at a time when the market needs to stabilize. The plan Lenczewski proposes reminds me of nothing so much as the famous yacht tax. The home construction industry is probably in worse shape in 2009 than the boat-building industry was in 1990. Million-dollar mortgages support million-dollar homes which support many electricians and carpenters. A phase-in during a period of robust home construction would make much more sense than the present bill.

I could go on, but time is short. I outsource my own thoughts on tax reform to Alvin Rabushka.

Labels: DFL legislature, housing, Minnesota, taxes

Monday, April 27, 2009

Name the author

I am 61 years old. I have lived and worked in Britain all my life. Not even in the dark days of penal Labour taxation in the Seventies did I have any intention of leaving the country of my birth.

Despite a rumour put around some years back, I have never contemplated leaving Britain for tax reasons. But in the 40-plus years I have been lucky enough to work here, I've seen a bit. So I must draw your attention to what is really proposed in this Budget.

Here's the truth. The proposed top rate of income tax is not 50 per cent. It is 50 per cent plus 1.5 per cent national insurance paid by employees plus 13.3 per cent paid by employers. That's not 50 per cent. Two years from now, Britain will have the highest tax rate on earned income of any developed country.

I write this article because I fear the inevitable exodus of the talent that can dig us out of the hole we find ourselves in. It is inevitable, given that other countries are bidding for entrepreneurs.

Give up? Suppose I said "composer" rather than "author". Link below.

Meanwhile, let's consider what Senator Tom Bakk, whose bill to put up tax rates in Minnesota is now in conference with a competing bill by Rep. Ann Lencewski (she deserves her own post, which will have to be tonight), said about alcohol and income taxes:The new income taxes would raise virtually everything Senate DFLers were looking for in new revenue to help erase a $4.6 billion deficit through the middle of 2011. They are also proposing across-the-board spending cuts and using federal stimulus dollars.So people would drive across the border for alcohol if we raise the tax on booze, but if we raise the tax on work they'd stay put? Not just the top rate either. As Sen. Julianne Ortman pointed out on my show Saturday, the Bakk plan gives us two of the top ten state income tax rates in the U.S. Bakk seems impervious to the idea that life location decisions are as influenced by tax rates as booze purchase decisions.

Senate Taxes Committee Chairman Tom Bakk said tax cuts of the 1990s were unsustainable and the state needs more money for priorities such as schools, even though the Senate voted to cut K-12 education.

Bakk said the reductions would be deeper without new tax dollars.

"It's a huge deficit that the state is facing. Everybody's going to have to participate in the solution," said Bakk, a Democrat from Cook who is preparing to run for governor.

...Bakk said eliminating the current mortgage interest deduction could hurt Minnesota's high rate of homeownership and higher alcohol taxes would drive some liquor shoppers across the Wisconsin border. [Both these provisions are in the House bill --kb]

Bakk said about 85 percent of taxpayers would pay more under his plan, but most of the money would come from people with the highest incomes. ...

The Senate tax bill would raise the lowest rate, 5.35 percent, to 6 percent on income of up to $31,860 for married couples filing jointly. The middle rate would rise from 7.05 percent to 7.7 percent on income between $31,860 and $126,580. The current top rate would climb from 7.85 percent to 8.5 percent on income of $126,850 to $250,000.

The new fourth-tier rate of 9.25 percent would apply to incomes starting at $250,000 for married couples, $141,250 for single taxpayers and $212,500 for single heads of household.

The Briton who doesn't believe this? Andrew Lloyd Webber. H/T: Stephen Karlson. Webber notes a young entrepreneur in the stage construction industry:

Under the new tax regime, he will have to pay 13.3 per cent to employ himself before he pays himself anything. And then he will have to pay 51.5 per cent on what's left.I realize Sen. Bakk lives on the other end of the state, but he might want to pay a bit of attention to Sioux Falls.

This is a guy at the cutting edge of his profession who works all over the world. He is in demand in every major territory where entertainment is produced. He has a young wife and two children. Last Thursday he told me that he and his wife had decided that the UK was no longer where they wanted to live.

His wife thinks the State education system is inadequate. And she fears that a bankrupt Britain will increasingly be a worse place in which to live as the horror of our present financial mess hits us all in the solar plexus.

He says that he is young enough to set up shop somewhere else. The new tax rates were the final straw. These talented young people know they will make it impossible for them to educate their kids privately in the UK.

So Britain plc loses not just the 40 per cent he would have paid in personal taxes under the old regime - plus NI and everything else - but... Come on, I don't need to explain the knock-on effect. It's obviously huge and immensely damaging ...

Labels: DFL legislature, economics, Minnesota, taxes