Monday, December 29, 2008

Greetings from Myrtle Beach

- This place is not immune to the economic downturn. In this very planned community in the north end of Myrtle Beach (not quite into NMB), the number of unsold units must reach into the hundreds (there are easily a thousand units here.) Two single-family structures, priced at $750k, stand at each end of a strip awaiting development, without any signs that there will be additional foundations laid. The golf courses are rather scarcely populated, even with temperatures in the upper 70s yesterday. The beach at 4pm was sparse. We went to a nice fish house in Calabash, NC yesterday after church, and it was doing a good business with a lunch special of $5.95 (two types of seafood and chips or hush puppies -- btw, those are quite good!) The night before at a cheap Mexican place, we had the restaurant to ourselves for 20 minutes. There are bargains here for those with money to spend.

- There was crowding in the airports in MSP and ATL. But that appears to be because airlines are aggressive in cutting flights. The crew on my plane between the two airports had had to rest long enough to delay our flight 90 minutes -- and this two days after Christmas. Family travel was still there. A colleague flying from Asia earlier in the week said the plane was full of ex-pats flying home; they seem less bothered by the economic downturn.

- Gas prices at $1.50 is allowing many cars down here from the north. My brother and sister each drove here with their families; the hybrid car made it here with four passengers for $50. My brother's Impala made it for $65. I suspect this area will do OK because East Coast vacationers will eschew Europe for these destinations.

"Never waste a crisis"

On one side you have the greenies who want to use our current economic crisis to promote their environmental agenda. And on the other side you have the "old economy," union-types who want to use our current economic crisis to attract hundreds of billions of dollars to union construction jobs. (And don't forget the local government officials with visions of bike paths and aquariums and duck ponds dancing in their heads.)He quotes Rahm Emanuel saying that a crisis should never be wasted, lest one misses an opportunity to pass a bill with things that would never be accepted in calmer times. Don't be so fast to think this bill is going to be ready for President Obama after Inauguration Day. The "implementation lag" of fiscal policy is never short, yet again a good reason to rely more on monetary policy to carry out stabilization.

Thursday, December 25, 2008

Merry Christmas 2008

Christmastime around here is always a little hectic. �Academia impinges for those of us on the semester system, with finals coming the week before; my grades are due Friday, but thankfully I got through grading Tuesday afternoon. �That meant Christmas Eve shopping, which found me out by the mall at 9am wondering if I had outsmarted the crowds or if the last day of holiday shopping would disappoint the shopkeepers.

Janet mentioned the snow and cold; it was -4 when we got back to the car after church last night. �Another bit of hecticness -- Mrs. S is not a regular pianist anywhere, so she was at a different church playing on Christmas Eve. �(She could have worked tomorrow morning too, but begged off.) �So Littlest and I sat among friends and some folks we don't often see, some with small kids. �You feel bad for them because they are sure their kids are ruining it for the rest of us. �Our pastor has small kids, so he seems not to mind the noise. �The one who had, um, 'diaper issues' might have put a small dent in the festivities, but it's a joyous time, and the candlelight during Silent Night is as much a highlight as dinner or gifts. �Indeed, the only thing I missed was finding time to sing The Messiah with a chorus this year. �(If you know of one next year with room for a baritone who can bat from either side of the four-part register, drop a line.) �

Our day today is simple -- we take a Jewish friend to breakfast (it's a tradition; we pray for a year a Chinese restaurant here has Christmas dim sum), then presents are opened, phone calls, and finally dinner with Mrs. S's family. �#1 is now engaged and already lost to his fiancee's family, alas, so that dinner happened earlier this week.

Posting from me will be kind of light next week. �I'll be in tomorrow as we release the new Quarterly Business Report. I fear we're going to harsh your post-Christmas buzz. �If you're up early doing the bargain-hunting here in St. Cloud, please tune in to KNSI 6-8am as I give Don Lyons a little time off. �Then I'm meeting up with my siblings and parents this weekend; the first week of January is, as always, the American Economic Association meetings. �(Yes, recruiting again, amazingly.) I'll be for the most part on the road the next ten days, with a luggage change in the middle on New Year's Eve (and another stint on Don's show.) �I'll check in as time and internet connections permit. �

Meanwhile, from Littlest (now a budding 5'6" hoopster in high school), Mrs. S from whatever church or chorale she's playing for -- I've no idea how she keeps it straight -- and our three pets -- Buttercup the dog, Pepper and our newest, Sparkler -- a Merry Christmas to you and your family. �We hope your candles are lit by the spirit of the season.

We'll let the pets do a star turn.

And here they are with us:Wednesday, December 24, 2008

Merry Christmas - To All

Merry Christmas!

Today, Christmas Eve, was very special. We just received a phone call from our son stationed in Korea. The technological advancements made, driven predominantly by the US are mind-boggling. He's half the planet away and we talked as though he were next door.

It's definitely warmer in Korea - he's running around in sweats and jeans. We had expected Korea to be more like MN - now with 4' of snow piled at the edge of our yard and at least a foot in the yard. But, it's warmer there - in the 40's.

We also went to church with our daughter, son-in-law and 11-month old grandson. It was the children's service and was very nice. Our grandson sat, watched, doodled on the "kid's paper," had some snacks and "walked" among parents and grandparents. He's a delightful little boy - we are very fortunate.

I sincerely wish all of you enjoy this holiday of Christmas. We sure do.

Labels: Christmas

Spending and saving at the end of 2008

So there's improvement in cash flow and people making commitments to rebuilding portfolios. While current dollar spending did fall 0.6%, in constant dollars (an iffy calculation here, but probably correct in direction) rose 0.6%. The decline reported is due to falling prices for food and energy.Gasoline prices are down about $2 per gallon since the peak in July ... every $1 drop in gasoline adds about $100 billion to household cash flow � meaning households have an extra $200 billion to spend on items besides gasoline. ...

In addition, heating-oil and natural-gas prices are down since the summer. So the coming winter should prove to be less onerous than was feared when crude oil shot past $140 per barrel.

... Extremely low interest rates, for instance, are great for borrowers. Homeowners in good financial shape and with equity in their homes have rushed to refinance their mortgages now that rates have fallen close to 5% for a 30-year loan.But low rates are a drag for savers. Data from the Federal Reserve show that households � spooked by the stock markets � have boosted their holdings of interest-bearing accounts by about $250 billion so far this year. But interest income has fallen by $25 billion over the same time, hurting retirees and others on fixed incomes.

What may be the biggest plus for the U.S. consumer sector is its ability to look forward. A survey by the Investment Company Institute in October showed that despite market volatility, investors remain committed to saving for retirement. Only 3% of participants have stopped making contributions this year.

the price index for PCE [personal consumption expenditures] decreased 1.1 percent in November, compared with a decrease of 0.5 percent in October. The PCE price index, excluding food and energy, was essentially unchanged in November and in October.In real terms, people are getting more spending power, but are choosing to save it, particularly since the declines are likely seen as temporary. (The Federal Reserve and BEA use different data to assess savings, see here.) So if you haven't bought anyone special that Christmas gift, may I suggest a savings bond? Seems like that's what they want.

Labels: economics

When life gives you lemons, make bonuses

This is utterly brilliant: �Credit Suisse makes chicken salad out of ...

Credit Suisse Group AG�s investment bank has found a new way to reduce the risk of losses from about $5 billion of its most illiquid loans and bonds: using them to pay employees� year-end bonuses.At least they laid the bad paper on the people who actually bought it. (As I told you a few years ago, there was a story in Armenia about workers at a piano factory receiving a piano in lieu of cash wages.)

The bank will use leveraged loans and commercial mortgage- backed debt, some of the securities blamed for generating the worst financial crisis since the Great Depression, to fund executive compensation packages, people familiar with the matter said. The new policy applies only to managing directors and directors, the two most senior ranks at the Zurich-based company, according to a memo sent to employees today.

�It�s monstrously clever,� said Dirk Hoffman-Becking, an analyst at Sanford C. Bernstein Ltd. in London who has a �market perform� rating on Credit Suisse stock. �From a shareholders� perspective it�s great because you�ve got rid of some of the assets and regulators will be pleased because you�ve organized a risk transfer.�It would have taken some foresight to have done this with bank execs in 2007, which is why they got a load of bonuses back then. I don't begrudge that money, and it was known when we supported bailouts, so the shock and outrage we hear now is misplaced. �If they pay them�now, we can rise up with the pitchforks. �But let's hope a few of those firms follow CS's example.

For employees, �there�s some upside in there and if the alternative is nothing, it�s a lot better than nothing,� Hoffman-Becking said.

Tuesday, December 23, 2008

The prices of corruption

Two things: 1. For those of you that heard me talk about my book on Ed's show earlier today, this type of table is exactly the kind of data we look for, which is to seek things at the micro level. While I appreciate the work of Transparency International, their data is not a substitute for what Kaufmann and his researchers tried to accomplish at the Bank. For most of the important research, the micro-level data appears to be better.

2. Kaufmann quotes the governor of the National Bank of Ukraine, who spoke at a gathering for Kaufmann's departure (which I believe I attended):

But I want to acknowledge the most important thing that you did is that you made sure that neither the World Bank nor the IMF, for the first two years, gave us a cent in loans, because we basically were not ready. The cadre that was in power would never have reformed, and this would have perpetuated non-reforms.The speaker of course is now-President Viktor Yushchenko. I wonder if the Bush Administration entertained this thought before agreeing to the auto bailout?

Labels: economics, Ukraine, World Bank

When you look at it that way

So we have a real schizophrenia today. People are going to the mall for holiday shopping, parking hundreds of yards away and waiting in long lines to check out. But then, these same people go to parties and argue about whether the Obama economic stimulus plan should be $500 billion or $1 trillion. It feels so bad that President Bush is justifying his economic intervention by saying that �I�ve abandoned free market principles to save the free market system.�Brian Wesbury and Robert Stein, First Trust, yesterday. I have found it funny that when I say unemployment might go to 8-9% I hear gasps from reporters. Most of them are in their 20s and 30s, though.

What�s important to recognize is that even at the bottom of the current recession, sometime in mid-2009, the living standards of the typical American will still be amazingly high. In fact, even an aggressive contraction in real GDP will leave per-capita real GDP above 2005 levels.

Now, we did not have 8% unemployment back in 2005, but that kind of jobless rate is not unusual for recessions. The unemployment rate peaked at only 6.3% in the recession early this decade but peaked at 7.8%, 10.8%, 7.8%, and 9.0% in each of the previous four recessions, respectively, dating all the way back to the 1973-75 recession.

P.S. That second graph is real 2000 dollars, by the way. Data from BEA, NIPA Table 7.1.

UPDATE: �Thanks for the link, John, and welcome to his readers.

Labels: economics

Media alert: Hot Air radio

Labels: Media

The purpose of quantitative easing

The Fed is lending on terms that private banks are not willing to offer. They are not searching for underpriced "bargains" on behalf of the public, nor is it their mission to do so. Their mission is to provide liquidity to the system by acting as lender-of-last-resort. We don't care about the quality of the assets the Fed acquires in doing this. We care about the quantity of its liabilities.Robert Lucas this morning on why the Fed is a better weapon against this recession than fiscal stimulus.

There are many ways to stimulate spending, and many of these methods are now under serious consideration. How could it be otherwise? But monetary policy as Mr. Bernanke implements it has been the most helpful counter-recession action taken to date, in my opinion, and it will continue to have many advantages in future months. It is fast and flexible. There is no other way that so much cash could have been put into the system as fast as this $600 billion was, and if necessary it can be taken out just as quickly. The cash comes in the form of loans. It entails no new government enterprises, no government equity positions in private enterprises, no price fixing or other controls on the operation of individual businesses, and no government role in the allocation of capital across different activities. These seem to me important virtues.

Labels: economics, Federal Reserve

Monday, December 22, 2008

The case against stimulus

The advantages that government officials enjoy in drawing their salaries are what is seen. The benefits that result for their suppliers are also what is seen. They are right under your nose.Bastiat, in What Is Seen and What is Not Seen, begins the case against stimulus. Money spent on things that are worth $100 (we'll skip the sous from now on) for which government extracts $100 are things that we can support. Things that are not worth $100 are not useful; the soil receives less than has evaporated through taxation.

But the disadvantage that the taxpayers try to free themselves from is what is not seen, and the distress that results from it for the merchants who supply them is something further that is not seen, although it should stand out plainly enough to be seen intellectually.

When a government official spends on his own behalf one hundred sous more, this implies that a taxpayer spends on his own behalf one hundred sous the less. But the spending of the government official is seen, because it is done; while that of the taxpayer is not seen, because�alas!�he is prevented from doing it.

You compare the nation to a parched piece of land and the tax to a life-giving rain. So be it. But you should also ask yourself where this rain comes from, and whether it is not precisely the tax that draws the moisture from the soil and dries it up.

You should ask yourself further whether the soil receives more of this precious water from the rain than it loses by the evaporation?

One hears arguments for stimulus largely on Keynesian grounds. The argument for fiscal expansion is that private spending is deficient, perhaps because households and private firms are going to save more money to make up for the financial losses incurred. The problem is that a permanent or sustained stimulus -- as opposed to the temporary stimulus packages Larry Summers originally supported -- is found in many cases to lead to a complete offset: Deficits now are seen as likely future tax increases. This was found in the early 1990s by Giavazzi and Pagano, and confirmed in many additional studies (the authors reprise their evidence here.) Small and temporary packages probably work in a more Keynesian sense than do large shocks of raising the full-employment deficit by 1.5% of GDP. (It's highly unlikely that a $750 billion over two year deal as the Obama transition team is proposing does not raise the full-employment deficit by that much.)

You will also hear that those types of estimates of crowding out apply to economies not as bad off as ours, that these are serious times. We need a new New Deal. Price Fishback notes, however,

Studies that examine [the success of Depression-era stimulus programs] suggest that an additional grant dollar per person distributed to a county for public works and relief during the period of 1933 to 1939 contributed to a rise in in-migration and an increase in income per person in the county of about 80 cents in 1939. We should remember, however, that this was during a period when there were huge numbers of unemployed workers available for work. Even during this period, some studies find evidence of crowding out of private employment. Today, with unemployment rates below 7 percent, it is likely that such public-works spending would crowd out a significant amount of private construction.That is, find out if a $100 of tax revenue taken -- now or later with interest -- generates $100 of benefits. Christina Romer, Obama's new head of the Council of Economic Advisers, wrote in 2003 as an entry in the Encylopedia Brittanica:

My own recommendation would be to evaluate the modern public-works programs more on the basis of the specific productivity of the programs rather than as stimuli to the economy. We know that we have an aging infrastructure of roads, bridges, and dams. The costs and benefits of the replacements would be my focus in evaluating whether to spend the money or not.

Fiscal policy played a relatively small role in stimulating recovery in the United States. ...Franklin Roosevelt�s New Deal, initiated in early 1933, did include aPerhaps Prof. Romer thinks the spending increases were too small -- damn those local and state governments for balancing their budgets! -- but she certainly believes that sustained deficit spending harms economic growth.

number of new federal programs aimed at generating recovery. For example, the Works Progress Administration (WPA) hired the unemployed to work on government building projects, and the Agricultural Adjustment Administration (AAA) gave large payments to farmers. However, the actual increases in government spending and the government budget deficit were small relative

to the size of the economy. This is especially apparent when state government budget deficits are included, because those deficits actually declined at the same time that the federal deficit rose. As a result, the new spending programs initiated by the New Deal had little direct expansionary effect on the economy. Whether they may nevertheless have had positive effects on consumer and business sentiment remains an open question.

What benefits do exist from larger deficit spending come more from tax cuts than spending. Ben Bernanke told us this six years ago, and a new paper from NBER supports it, though perhaps more weakly than the WSJ suggests. The authors note that whatever fiscal policy does, there is crowding out, just as Fishback found for the Great Depression. And it has to be a surprise to have that effect.

So the Obama stimulus plan, which appears to have no more than $100 billion in tax cuts while giving away money to state governments and making "investments" in " traditional infrastructure, school construction, energy efficiency, broadband access and health-information technology" should be evaluated as being too sustained, too tilted towards less-effective spending, and perhaps too large in the Giavazzi and Pagano sense.

What would I prefer? The experiment that has not been tried, but has been prepared for by the Fed, is continued monetary easing using quantitative tools rather than the interest rate (since we are now in ZIRP-land.) In their view, effective communication and asset purchases by the Fed are an alternative to fiscal policy. If deflation is the problem, let the Fed do its job of promoting price stability.

Labels: economics

The warm glow of Christmas and giving to charities

A woman sends a holiday card to a close female friend and includes in it a note. The note says that money is donated by the sender in the receiver's name to a charity in lieu of a gift for that holiday. The receiver does not particularly like this charity and is miffed. The two normally exchange gifts directly; there was no agreement beforehand on the use of this "indirect gifting". (I'm not sure that is the term of art here, but I'll use it throughout.)

Now there's the famous paper of the Deadweight Loss of Christmas, written fifteen years ago by Waldfogel. Tim Harford noted this weekend that the point of Waldfogel isn't to say gift-giving is wasteful or pointless but simply to identify sentimentality as a significant determinant in gift-giving. But sentimentality doesn't necessarily rise with expenditure, so "the wise gift-giver," Harford says, "will choose something inexpensive that expresses affection."

So how do we pick the charity that we contribute to on behalf of another? A friend or his spouse passes away, and the obituary announces where to send memorials rather than flowers. Very handy, but hardly useful here. Maybe our blogs, Facebook pages, etc., should all carry announcements telling our 'friends' "if you want to give to charity in lieu of sending me a gift, here are the ones I support." I guess that is unseemly or mercenary, so few will do it. But I don't think it's a terrible idea. After all, my friend wasn't upset that her friend sent to a charity: The charity her friend chose was the issue.

The point is that, much like with direct gifts, the point of an indirect gift should be that you demonstrate your knowledge of the receiver by the choice. This is why most men tremble in fear in buying gifts for their wives, and why I love Mrs S for her direction: She likes perfume, and it is always appreciated. (Yes, used to be perfume and jewelry last time I wrote about this, but she's off the latter.) My job is to walk to a counter and purchase something that I think will smell good on her and which is like what she wears. Something different but not too. (It's OK that she reads this, as this is what she expects of me.)

Now I can imagine a friend contributing to a charity the receiver doesn't know because the friend has some knowledge about a charity the receiver has not heard of. But giving to a charity without some knowledge that "my friend would give to this place, if she knew about it" is pretty dangerous stuff.

There's a tradeoff, of course. I have liberal friends who give to liberal charities. I am unlikely to join them in giving to them. If we don't share a value on charities to whom I could contribute on their behalf, I probably wouldn't do so. But then, why would be friends?

I guess I'm better off buying them a gift card somewhere. They can give the card to charity if they prefer.

Friday, December 19, 2008

My weekend to-do list

- Grade.

- Final Word, 3-5pm Saturday, AM1280.

- Fill out Boehner's form.

Labels: AM1280, economics, higher education

The power of incumbency?

A look back at Senate appointments made over the past 50 years shows a decidedly mixed electoral record. Of the 51 Senators who sought a full term in their own right, just 23 (45 percent) won their races. (Twenty one appointed Senators did not seek election to their appointed post.)Chris Cilizza (h/t: Ed). Of those that ran for their spot there's a 76.6% chance of re-election. But is that really that remarkable? Collier and Munger [1994] show that the longer a representative is in office the greater their re-election probabilities. With less time, and holding a statewide office that draws well-known and well-financed challengers, it probably doesn't make much difference that someone running for that office has had the position before by appointment or by prior election. States, unlike House districts, don't get gerrymandered. And because the senator only faces one challenger in six years as opposed to three, s/he's more likely to survive past six years than his or her House counterpart.

So one wonders instead why it is that so many appointed Senators do not seek election? Some of it is the placeholder hypothesis -- you put someone in the spot that is not going to run because someone else wants to run for it in two years. But how many Beau Bidens are there? I don't think we can expect that there will be too many of them. If incumbency has advantages, such as free press or the franking privilege, why wouldn't more appointed senators choose to run and win? Are appointees typically weaker political figures with little experience? In that case, wouldn't time in office for Caroline Kennedy be invaluable to prepare her for runs in '10 and '12? Wouldn't she more prefer to be appointed than, say, Andrew Cuomo?

Most hilarious thing I read today

What about that guy who set up the phony investment company? Can the Treasury make a new one of those, only bigger? He took money away from people and gave it to charities and the needy and the arts and higher education. That sounds like stimulus so why are we sending him to jail? Wasn't he ahead of the curve?Bigger than $50B? From "Tyrone", with perhaps as good an argument against stimulus as I have found.

Labels: economics

Unallotment, for the rest of us

Gov. Tim Pawlenty plans to cut money for cities and counties and for human services to make up for a $426 million short-term deficit.The Taxpayers League's Phil Krinkie is applauding this decision. The key was to get it out there before the LGA money was to be distributed. You can only unallot monies that haven't been spent, and if you sent out the LGA money on the 26th you would either have to make deeper cuts to human services and higher ed, or impose a quicky tax increase. Besides bad timing, the latter option probably is impractical in such a short period given the lag between passage of a bill and implementation. I will be waiting to see DFL reaction to this, but my expectation is that any commentary will be muted -- their turn comes to deal with the $4.8 billion deficit to be closed for the upcoming biennium, so they'd be better off letting Pawlenty accept the responsibility for this without any cover or criticism.Pawlenty presented his plan Friday afternoon. It includes $110 million in cuts for cities and counties. It will be deducted from the money they were set to get Dec. 26.

...Pawlenty's plan also includes cutting spending for human services by $73 million and taking back $40 million allocated to the University of Minnesota and the Minnesota State Colleges and Universities system.

We're already looking around the university for money not to spend, cutting travel and looking for low-enrollment classes we might be able to cut. I don't know the local effect because I haven't yet heard what the split on that money would be between the U and MnSCU (and whether the latter puts more pain on larger institutions, which has been their wont in the past.) The university has been trying to keep us up-to-date with information. If I learn more that I can share, I'll update this.

UPDATE: Here's the governor's announcement. MnSCU takes a $20 million hit, and the U of M system takes $20 million.

For the remainder of FY09, the reductions represent approximately five percent of the unexpended general fund appropriation for each.Most departments excepting police and corrections and military & veterans affairs are going to take a 10% hit. Meanwhile, the legislative leaders have volunteered to chip in $2.2 million of their funds; it expects to spend $80 million according to budget documents.�These reductions present a challenge, but the availability of reserves and unspent state appropriations at these institutions should allow them to respond without dramatic impact on students,� Governor Pawlenty said. The MnSCU system has approximately $70.8 million in reserves across all campuses and about $7 million in central reserves. The University of Minnesota has $15 million in central reserves and $50 million of unspent state appropriations not needed to cover binding obligations.

Labels: legislature, Minnesota, Pawlenty, taxes

Thursday, December 18, 2008

Why I'm not watching the recount

So stop watching the recount, Leo! That's what they pay the lawyers for. I know some of the rulings are odd -- John Lott has used some pictures to show us how the count is going, though the results on the STrib website seem to get changed regularly -- but until we know how the withdrawn challenges are being added back into the totals, we have no bloody idea where the count is. Forgive my flippant-ness here; real-time data just tends to be real messy and there's a tendency to be fooled by randomness.There are hundreds, if not thousands, of challenged ballots that have been withdrawn from both campaigns. We're not certain if those ballots will be dedicated to Coleman, to Franken or to the Other pile. The Secretary of State's Office is working to process the withdrawn ballots and redeclare the vote to the call made by the local election official during the recount.

What makes things tougher is that the campaigns are now restoring some challenges that they withdrew earlier. They're doing this because they know that the board is acceptable to certain challenges. They are also withdrawing challenges that they know have no chance of being upheld.

Labels: Coleman, elections, Franken

What is a disorderly bankruptcy?

The White House is apparently still trying to figure out its strategy here, but for the moment it appears to have landed on a good one. The key to this deal, as an Investors Business Daily editorial stated last week, would be to get government out of the way. Dan Ikenson last month reminded us that these two firms failing would not doom the U.S. auto industry, since they employ roughly a third of all autoworkers.President Bush�s spokeswoman, Dana Perino, confirmed growing speculation within legal circles that the president and Treasury Secretary Henry M. Paulson Jr. were considering the step as part of an overall rescue package for the automobile industry.

The action would be unusual, and would require concessions by the United Automobile Workers union, suppliers, investment banks, the federal pension board, bondholders and other stakeholders in the two auto companies.

Under one possibility that has been discussed, the government would give G.M. and Chrysler enough financing to operate for several months. Then a government-selected overseer would bring together company executives and other representatives to map out steps that would be taken once the two companies file for Chapter 11 protection.

They employ American workers, pay U.S. taxes, support other U.S. businesses, contribute to local charities, have genuine stakes in their local communities and face the same contracting demand for automobiles as does the Big Three. The difference is that these companies have a better track record of making products Americans want to consume and are not seeking federal assistance.

...If one or two of the Big Three went into bankruptcy and liquidated, people would lose their jobs. But the sky would not fall. In fact, that outcome would ultimately improve prospects for the firms and workers that remain in the industry. That is precisely what happened with the U.S. steel industry, which responded to waning fortunes and dozens of bankruptcies earlier in the decade by finally allowing unproductive, inefficient mills to shut down.

That graph isn't a reason to bail them out either, however. In 2001 Russ Roberts wrote this about the bankruptcy of Bethlehem Steel:

The underlying explanation for the drop in employment in the steel industry over the last half-century is an increase in productivity�the industry gets more done with fewer people. America is not the only nation with less employment in the steel industry. World steel employment is roughly a third of what it was 25 years ago. Virtually all of the steel producing nations, even the ones who allegedly dump their steel on U.S. markets, have fewer people making steel than they did 25 years ago. But world output of steel is up.The Bethlehem bankruptcy was also blamed on "complacency and high labor contracts" that left it less competitive. Its bankruptcy did not kill the U.S. steel industry: US Steel is still in the Fortune 500, just not a top 20 company any more. In 2008 American steel producers will make about 76 million metric tons of crude steel according to Stratfor. That's half of what we produced in 1970, as imports have replaced the use of steel, and as we have found substitutes for the product. (Those CAFE standards could be one reason for that.) Maybe we don't do steel as well as we did in 1970; maybe we don't do cars as well as we did then either. But we do many other things better now than we did then, some things we didn't even see.

The same thing has been going on in many manufacturing industries. Overall, manufacturing employment is close to the same as it was 25 years ago, while output is up dramatically. The cause: higher productivity. The phenomenon holds in good times and bad. It's not an indication of an economic crisis�it's the result of innovation. Competitive pressure drives manufacturers to find ways to do more with less.This is good for America overall. It means we get more output from fewer workers while employment expands in health care, entertainment and the other sectors of the economy where the American skills and creativity produce the best products in the world. It allows new industries to be created and others to expand. It means we remain competitive with the rest of the world, using the best techniques available for steel production. It lets us use our highly skilled labor force to focus on what we do best and on the dynamic future rather than a static past.

But make no mistake: Bethlehem Steel's bankruptcy was only 'orderly' in the sense that it didn't cause riots in the streets of Pittsburgh. A great wailing and gnashing of teeth in the papers happened then. For those in the steel industry, it was very disorderly. Lives were turned upside down. As they will be in the auto industry.

For he who occasionally espouses free markets: Markets are volatile; disorderly only means volatility in the absence of news. There's plenty of news, so lots of volatility. Wear a helmet.

Labels: economics

Coleman Recount

The MN voting system actually is good. When overseas ballots and machine unreadable absentee ballots are received, a duplicate ballot is made, under very specific guidelines. The number of ballots marked as "duplicate" is supposed to be equal to the number of original ballots. Sometimes, the originals are lost (as in Lakeville P-10) but in the vast majority of cases, the number of originals and duplicates matched.

For most precincts the recount does find an equal number of duplicates and originals. But what do you do when the numbers do not match? In Dakota County, where I observed the entire process, Secretary Ritchie changed the rules multiple times. First, the recount was to count ballots that went through the machine, the duplicates; then originals; then the two party representatives were to agree on which set was to be counted. In addition to the changing rules, it appeared the Franken people knew in advance what was going to happen. Now, this last point could have been because they had better communication or maybe some other reason????

As the Dems argue, A is harmed if his vote is improperly rejected; but voter B is equally harmed if A's vote is counted twice. Therefore, you cannot count originals and duplicates. Heck, if this request is granted, any other close race in the state should have the same rules applied.

Wednesday, December 17, 2008

Obamanomics not to include free trade

So it has to come as no surprise that the pick for U.S. Trade Representative got passed over by Obama's first choice.

Rep. Xavier Becerra has decided not to accept Barack Obama's offer to be United States Trade Representative, according to an interview the California Democrat gave to the editorial board of La Opinion, a Spanish-language newspaper in Los Angeles.Maybe it will take another Perot to push Obama into the arms of free trade. Barring that, the Columbia Free Trade Agreement is probably dead. And Canada can't be too happy with incoming Ag Secretary Tom Vilsack.

...Becerra said, "My concern was how much weight this position [U.S. Trade Representative] would have and I came to the conclusion that it would not be priority No. 1, and perhaps, not even priority No. 2 or 3."

On the other hand, Becerra now regrets his vote in favor of NAFTA. So while the Obama team may not advance the cause of free trade, they might be distracted enough to not do it too much damage.

Labels: economics, Free Markets, trade

Media alert

The dark side of contango

Remember when we bragged about First Fuel Bank and its novel approach to handling gas price risk? They're experiencing some changes.

The St. Cloud fuel bank plans to announce today a new way of selling gas. Consumers in the program can buy gas for 10 cents off the daily pump price, or as company President Jim Feneis guarantees, the cheapest legal price.I've thought about that decision for a few days, and read the company's newsletter. (I have an account with them.) One thing I learned there that I didn't see elsewhere is that if I deposit in this new kind of account -- the firm calls it a "prepaid rolling account" -- you always have the option of moving that money into your fixed price account when that price is acceptable. You can either lock-in at $2.379 or have a rolling account which today prices at $1.599.

It is illegal to sell fuel below a minimum price set by the state.

The program is called a prepaid rolling account. Here�s how it works: A customer opens a First Fuel Banks account, which works much like a gift card, depositing a specific amount of money for fuel purchases.

Some speculate that the company might have been caught in a bad position with the decline in price. Under the old rules, the firm sold future gas at a date uncertain and should turn around and buy a contract to take delivery of gas at some future, certain date at a price that is a little lower. The margin is their profit. They could also trade future options, hedging the prices as specified here. At present futures prices increase rapidly over the time horizon, so the question for the firm is where to buy those contracts, which in turn sets the price he charges.

The difference has to be more than just the price premium for futures gas (currently running about $.25 to $.30). It also has to cover the uncertainty of the timing of withdrawal. If he buys a futures contract to deliver in June but then demand of people with the lock-in price accounts is low, he is caught with gas perhaps at a lower price than the contract he bought. Rather than accept delivery he closes the position at a loss. He could just accept delivery, but storage is not cheap. He can sell the delivered gas now at the current price and buy a future contract for those who didn't use their locked-in accounts, but the slope of that maturity curve may still be positive, meaning he is still taking a loss.

The slope of that forward curve (called 'contango' when it slopes upward and 'backwardation' when it slopes downward) is what's bugging the firm. It's the opposite of the condition of traders who don't have oil yet.

This firm already has it. The rolling account is a way to deal with it.Phil Flynn, vice president at Chicago-based trading firm Alaron, said the oil contango has created a frenzy for storage space.

�You pay as much as $2 a barrel to store it but you can lock in the profit instantly today and make out like a bandit,� he said.

The scramble for oil storage, combined with reduced demand in the recession, has lifted U.S. inventory numbers to 321 million stockpiled barrels�an 8 percent increase over this time last year, according to the latest report from the Energy Information Administration.

Some companies reportedly are even storing crude in tankers, leaving them at sea instead of delivering their cargo.

We've only been doing this six years

Labels: higher education

To prove we don't know anything about this either

Labels: Final Word, humor, sports

Drug theater of the absurd

Grandmaster Vassily Ivanchuk refused to submit a urine sample for a drug test at the Chess Olympiad in Dresden and is now considered guilty of doping. The world of chess is outraged that he could face a two-year ban.Chess. CHESS. Unfreakingbelievable. This caught my eye because 1) I used to play a lot of chess (and still teach kids when I find the time) and 2) after writing this, I was curious if the drug of choice was Red Bull. Am I to look out for my kids who drink more Dew than my radio board ops?

It makes sense that anabolic steroids, the bulk-producing drug of choice for weightlifters, and EPO, the wonder drug of the cycling world, would not improve a chess player's performance. But when a chess player nears the end of a match and comes under mounting pressure, he can hyperventilate, and his pulse can shoot up to 160 and his arterial blood pressure to 200. In that situation, beta-blockers could help a player keep his head clear.Breathing exercises and a paper bag would help that too. I am a bit incredulous that it's beta-blockers they are looking for. Sure enough, you can't time the dosage of a beta-blocker to help when you need the help in a chess match. There's too much variability in length of time. So,

It would certainly make sense for a chess player to take Ritalin or Modafinil. Both substances increase the ability to concentrate. Students take the drugs during exams, and doping inspectors test chess players for both substances.So I was right? FIDE, the organization that oversees chess championships, is trying to keep the sport clean of drugs that help you focus? I am still trying to figure out why. Wait, next paragraph:

The only reason there are doping tests in chess in the first place is that the World Chess Federation (FIDE) has been trying, since the late 1990s, to make chess an Olympic discipline. And anyone wishing to be part of the Olympics must submit to the rules of the International Olympic Committee (IOC).I don't know what strikes me as more absurd: �chess in the Olympics? �or the IOC testing chess players for Ritalin? �Powerboating is in the IOC's list of recognized sports (though not in the Games themselves, yet). �NASCAR apparently lets their drivers advertise those energy drinks (I'm pretty sure I saw Rusty Wallace in an ad.) �What are they testing powerboaters for? �

h/t: Kouba.

Labels: sports

Tuesday, December 16, 2008

Who said this?

History has shown that the greater threat to economic prosperity is not too little government involvement in the market, but too much. Our aim should not be more government, it should be smarter government.Second,

Yup, same guy, a month apart. h/t: Leo, who asks,I've abandoned free-market principles to save the free-market system ... to make sure the economy doesn't collapse.

A disorganized bankruptcy could create enormous economic difficulties, further economic difficulties. I feel a sense of obligation to my successor to make sure there is a not a huge economic crisis. Look, we're in a crisis now. We're in a huge recession, but I don't want to make it even worse.

Correct me if I'm wrong, King, but isn't the only way to save the free market to enact and to engage in behavior consistent with those very principles that make it viable? Can one "save" the free market by enacting policies that are antithetical to same, and which by their very nature and in every other known circumstance act to thwart the growth of a free-market economy and benefits thereof? If so, then when is the correct time to right the ship back on that course of economic freedom and the prosperity (and risk) that goes along with it? Can one merely parcel a free market and expect it to then flourish?Many of us have been quoting Hayek at this moment: The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design.One doesn't need free markets just when Bush or Obama or anyone else thinks we need free markets. We either need them all of the time or none of the time. �All the rest is planned chaos.

Labels: economics

Kathy Kersten, the Strib and a Free Press

Kathy's view, is another issue. Her columns provide much needed fresh air and common sense. They covered issues too much of the mainstream media is either afraid to write about or is incapable of comprehending. If you wish to make your sentiments known, please contact the paper's editor, Nancy Barnes at: nbarnes@startribune.com. While I doubt Ms. Barnes will even consider hiring a conservative replacement, letting her know why releasing Ms. Kersten is a horrible mistake has a slight chance of making an impact.

When papers and media present only one side of an issue or ignore an issue in its entirety, they are cheating themselves and their audience. A press that engages in such self-censorship is no longer free - it has voluntarily given up its freedom - without a fight.

Labels: free speech, Media, StarTribune

Recognizing reality

The central bank on Tuesday said it had reduced the federal funds rate, the interest that banks charge each other, to a range of zero to 0.25 percent. That is down from the 1 percent target rate in effect since the last meeting in October. Many analysts had expected the Fed to make a smaller cut to 0.5 percent.

...The Fed's action and statement made clear that economic conditions have worsened since its last meeting in October.

Federal Reserve Chairman Ben Bernanke and his colleagues said they will use unconventional methods to try to contain a financial crisis that is the worst since the 1930s and a recession that is already the longest in a quarter-century. For example, the Fed last month said it planned to purchase up to $600 billion in direct debt and mortgage-backed securities issued by big financial players including Fannie Mae and Freddie Mac in an effort to boost the availability of mortgage loans.

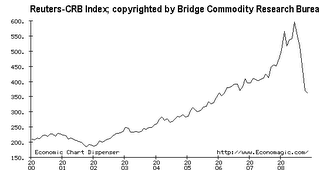

Krugman says we're in the soup now. ZIRP soup, they'll call it, for Zero Interest Rate Policy. It is now obvious that the Fed's concern is deflation, not inflation. You see to your right a chart of commodity prices by one measure; the size of this decline is unprecedented certainly since WW2; I'd have to research some other records to see what happened before WW1, and it's finals week here so I don't have the time. Justin Fox observes that this is a change of attitude: All of the previous activities have swapped out T-bills for lower-grade securities. Now they appear prepared to just buy them outright, for new currency.

Krugman says we're in the soup now. ZIRP soup, they'll call it, for Zero Interest Rate Policy. It is now obvious that the Fed's concern is deflation, not inflation. You see to your right a chart of commodity prices by one measure; the size of this decline is unprecedented certainly since WW2; I'd have to research some other records to see what happened before WW1, and it's finals week here so I don't have the time. Justin Fox observes that this is a change of attitude: All of the previous activities have swapped out T-bills for lower-grade securities. Now they appear prepared to just buy them outright, for new currency.My colleague Rich MacDonald reminds me of when Ben Bernanke spoke about this in 2002:

Once the nominal interest rate is at zero, no further downward adjustment in the rate can occur, since lenders generally will not accept a negative nominal interest rate when it is possible instead to hold cash. At this point, the nominal interest rate is said to have hit the "zero bound."Sudeep Reddy, reading that same speech, observes that Bernanke argued for the central bank to target a longer-term interest rate. The two-year bond currently yields 0.65% (one reason why the effective Fed funds rate had to go to zero -- shorter term maturities were about there already). The Fed could decide even to purchase foreign government debt, though it would have to be seen as not bailing out a foreign government (according to Bernanke's speech.) Whatever they do, James Picerno says, it's a gray area.

Deflation great enough to bring the nominal interest rate close to zero poses special problems for the economy and for policy. First, when the nominal interest rate has been reduced to zero, the real interest rate paid by borrowers equals the expected rate of deflation, however large that may be. To take what might seem like an extreme example (though in fact it occurred in the United States in the early 1930s), suppose that deflation is proceeding at a clip of 10 percent per year. Then someone who borrows for a year at a nominal interest rate of zero actually faces a 10 percent real cost of funds, as the loan must be repaid in dollars whose purchasing power is 10 percent greater than that of the dollars borrowed originally. In a period of sufficiently severe deflation, the real cost of borrowing becomes prohibitive. Capital investment, purchases of new homes, and other types of spending decline accordingly, worsening the economic downturn.

Although deflation and the zero bound on nominal interest rates create a significant problem for those seeking to borrow, they impose an even greater burden on households and firms that had accumulated substantial debt before the onset of the deflation. This burden arises because, even if debtors are able to refinance their existing obligations at low nominal interest rates, with prices falling they must still repay the principal in dollars of increasing (perhaps rapidly increasing) real value. When William Jennings Bryan made his famous "cross of gold" speech in his 1896 presidential campaign, he was speaking on behalf of heavily mortgaged farmers whose debt burdens were growing ever larger in real terms, the result of a sustained deflation that followed America's post-Civil-War return to the gold standard.

It's worth noting that Bernanke argued that a tax cut financed by monetized deficits would be "essentially equivalent to Milton Friedman's famous "helicopter drop" of money." He adds:

Of course, in lieu of tax cuts or increases in transfers the government could increase spending on current goods and services or even acquire existing real or financial assets. If the Treasury issued debt to purchase private assets and the Fed then purchased an equal amount of Treasury debt with newly created money, the whole operation would be the economic equivalent of direct open-market operations in private assets.What do you want to bet someone in the Obama transition team has already cut out that quote for delivery to its new economic policymakers?

Labels: economics, Federal Reserve

Transformational food

There's a course on campus called "Sociology and The Global Politics of Food". �It's not taught in the political science program but in the sociology department. �That in and of itself isn't the interesting part. �Social sciences often try to blur the lines between disciplines -- economics departments are as imperial as any of them (public choice in politics, experimental economics in psychology, etc.) �Nor do I really concern myself with the politics or the sociology. �Here's what they did this year for class projects.

Outside the faculty office of the instructor (one of those offices festooned with leftist propaganda) was something that looks like a bookmark (a strip on thick paper.) �On one side were "resources" with names of a number of local areas that appear to be related to food (not all are obviously connected, but I'll assume they are.) �On the other side are "Action Steps". �This is the list:

- Visit websites of hunger-relief organizations to learn what they do and how you can best help them.

- Host a "virtual lunch". �Decide how much it would cost to host a lunch with friends and then donate that money to a food shelf or food bank.

- Host a money drive in your school, work or faith community and see if your company will match the funds.

- Donate 10% of your grocery expenditures to your local hunger relief organization.

- Donate a grocery gift card to your local food shelf so they are able to purchase the items they need the most.

- Donate a gas card to a program that delivers meals to people in the community.

- Encourage your book club to focus one of their book choices on the issues of hunger and poverty. �Take it one step further and have your book club members organize a money drive or volunteer at a hunger relief organization.

I like that list. These are good things and I hope people do them. Here's my question: Does this constitute something we do in a public university? �What is the purpose of higher education -- to organize a food drive? �To say "if you liked what you learned in my class, you will give more to charity"? �I cannot imagine teaching a course where, among the items I give students or make available to students -- perhaps this professor distributed this in class, perhaps not -- I cannot imagine giving a student an "action step". �

Robert George writes:

Of course, what goes on ... in far too many classrooms is radically different from the classical understanding of the goal of liberal arts education, which is not to liberate us to act on our desires, but precisely to liberate us from slavery to them. Personal authenticity, under the traditional account, consists in self-mastery�in placing reason in control of desire. �This appears to support telling people to donate to food shelves, but the purpose of education is to give students the opportunity to "place reason ahead of desire" by their own lights. �Telling them what "action steps" they can take is not something that belongs in a university where we are developing reason and intellect of young adults attempting to transform themselves. � Telling them what to do is something we do in kindergarten. �By the time they're 21, we hope they don't need someone to give them action steps.

How can it be liberating to enter into the great conversation with Plato and his interlocutors? According to the classic liberal-arts ideal, doing so enables us to grasp more fully the humanizing truths by which we can direct our desires and our wills to what is truly good, beautiful, worthy of human beings as possessed of profound and inherent dignity. The liberal-arts ideal is rooted in the conviction that there are human goods, and a common good, in light of which we have reasons to limit and even alter our desires, thus becoming masters of ourselves.

Now if you accept this ideal, you are seeking answers to the question: What qualities make for an upright life?

Labels: higher education, SCSU

The six marks of coffee

I was checking a student's coffee cup this morning while watching final exams. �There's a Caribou on campus and kids use it all the time. �This one is busy and run by a third party franchisee (Sodexho). �To keep track of the cups and orders, rather than using a screen with cups on it -- like you see at most coffee shops and fast-food restaurants -- the person taking the order simply put letters on the cup of appropriate size. �The barista looks at the cup, interprets the letters and makes the proper drink and calls it out for the student or staff member to pick up.

As I tweeted (how odd that verb!) this morning, the student had�five�marks on it. �Six, if you count the cup's size as a signal, since its size tells the barista how much espresso to brew and milk to heat and froth. �I'm sure one says the type of drink, another maybe the type of milk, but at some point I was stumped to what they meant. �And stumped by how much we want our drinks customized. �

Now of course part of this is Caribou's way of extracting revenues by price discrimination. �(I have followed Tim Harford's advice and ordered the short cappuccino, because that's the strength I like. �A small macchiato is actually preferred, but it costs more.) But to think how we decide to specialize our drinks this way! �And that the market provides that to you. �What people forget is that price discrimination is beneficial to some consumers. �Some will get the product at the low price rather than not at all; others will get a product that it would not have paid to produce and instead get a cheaper product. �

Would my student get the six-marked-coffee if he had walked into a Dunkin Donuts in 1976 (when I was hitting the place every morning on my way to school for "cahffee regulah no sugah and a honey dip"*?) �No, and he might be willing to buy something from DD, but it would not be as good as what he has now, because if it was he could still get it -- or could have, when KK was here (STC has never had a DD, alas.) �

*translation from New Englandese: �coffee with milk and a glazed, raised donut

Monday, December 15, 2008

"Don't think, just throw"

So how do quarterbacks do it? How do they make a decision? It's like asking a baseball player why he decided to swing the bat: the velocity of the game makes thought impossible. What recent research in neuroscience suggests is that quarterbacks choose where to throw the ball by relying on their unconscious brain. Just as a baseball player will decide to swing at a pitch for reasons he can't explain (he' is acting on subliminal cues from the hand of the pitcher), an experienced quarterback picks up defensive details he's not even aware of. Although he doesn't consciously perceive the lurking cornerback, or the blitzing linebacker, the quarterback's unconscious is still able to monitor the movement of these players. And then, when he glances at his receivers, his brain automatically converts these details into a set of fast emotional signals, so that a receiver in tight coverage gets associated with a twinge of fear, while an open man triggers a burst of positive feeling.Lehrer argues that, while it's unconscious, you can still learn how to do it by being put in realistic situational practice runs. I imagine it's like how you train a fighter pilot (or a good videogamer.) You obviously cannot put them in a lethal plane fight, so you put them in simulators. Lehrer argues convincingly that what we measure to predict performance of a quarterback, say by an intelligence test, completely misses the point.

We've assumed that passing decisions are rational decisions when, in fact, there's nothing rational about them. Obviously, it's a bit more difficult to measure the unconscious, but that doesn't mean it can't be done.Lehrer also argues about our decisions on what to buy, that it's not just rational. This is discussed in a Newsweek column by Sharon Begley (h/t: my colleague Phil Grossman.)

The brain has distinct circuits for registering that you want something and for recoiling at the price. When a price seems too high, as more and more bargain-crazed consumers are concluding about more and more products, the region that anticipates loss and registers disgust�the insula again�turns on, telling you to move away from the overpriced laptop. With consumers demanding bargains, that activity overwhelms the brain's pleasure-anticipating center, called the nuclear accumbens, which turns on when you see something desirable. The relative power of the insula and the nuclear accumbens determines whether you buy or not. That, in turn, reflects people's temperaments and habits�self-indulgence, compulsive shopping, self-denial and the like�as well as the messages they get from the environment.I contemplate in thinking about this how we might train our children, our co-workers, or our students to make better economic or financial decisions. If the training-the-quarterback analogy carries to shopping, might we as well use simulations of market processes to teach how to buy the goods or assets that will best use our scarce resources? With kids we play games like Lemonade Tycoon or Minyanland to learn how to use money. More elaborate simulations are created by programs like Junior Achievement. But there are adults who make lousy decisions. Are there games we can use to give them the training they need to "don't think, just buy" smartly?

What should you expect in the MN economy?

The DFL leadership has decide unsurprisingly to blame Republicans for "a significant lack of jobs problem".

When state finance officials released their latest economic forecast last week, they predicted Minnesota will lose another 58,000 jobs by the end of the current recession.�

"We have a significant lack of jobs problem going on in this state," said DFL House Speaker Margaret Anderson Kelliher.

Kelliher has taken note of the numbers and, along with other Democrats, is now stressing a job-creation theme when discussing the state budget deficit.�

During a recent MPR interview, Kelliher said it's time to reexamine the state's economic development efforts.�

"The loss of jobs over the last few years would tell us we're not doing as well as we could," Kelliher said.�

DFL Senate Majority Leader Larry Pogemiller also wants another look at jobs programs. But Pogemiller has already made up his mind about the need for big changes.�

"I think it's pretty clear that our economic development strategy that we're on has been a failure, and I think we need a total revamping of that," Pogemiller said. "And frankly, I think we need some new leadership there."Pogemiller is specifically targeting the Department of Employment and Economic Development and its commissioner, Dan McElroy, a former Republican state representative from Burnsville. McElroy also served as state finance commissioner and chief of staff to Gov. Tim Pawlenty.

Many states are already approaching the incoming Obama administration for a big stimulus check, which is just shifting the deficit spending from the states to the federal government. �Chris Edwards points out that nationally 7.6% in 2007 and 7.0% in 2008; such money is supposed to be spent on infrastructure for the states, but we've already had taxes imposed by the DFL for more of this, and nationally that level of infrastructure spending is 2.4% of GDP. �About of third of this is coming from state governments, as shown in the last graph in this CBO presentation last May.

As to job creation, Kelliher and Pogemiller seem to be unaware of the difficult national environment in which the Minnesota economy exists. �The state economy has 16.5% of its employment in the goods-producing areas (largely construction and manufacturing, plus some forestry), all of which has taken a beating in recent years. �This is 1.5% more than the national level (as of 2008). �Indeed, in 2008 the decline in goods production in MN has been better than for the country as a whole; the decline in area construction accounts for most of the decline in 2006-07, which does not have roots in the policies of DEED, Governor Pawlenty or anywhere else. �It certainly is not the case that causality runs from Minnesota to the national figures. �It's that the state economy is being dragged along by the national. �

Most of my presentations to local economic groups in the last year have emphasized this particular point: �Forget about the housing issue; track manufacturing. �If it does well nationally, Minnesota will be OK. �If we can get some forestry employment back that's better, but that's likely to come later, when the housing surplus nationally comes off the market.

If you wanted to use state policies to try to move the economy forward in Minnesota, providing for productivity increases in the goods sector -- by allowing capital development to face light taxes, for example -- would be much more productive than scapegoating.

Foolish bubbles

Bubbles disappear when people learn, which is why bubbles seem to be more prevalent in assets for which there's little history for the buyer or seller to gauge fundamentals from.Experimental bubbles are particularly surprising because in laboratory markets that mimic the production of goods and services, prices rise and fall as economic theory predicts, reaching a neat equilibrium where supply meets demand. But like real-world purchasers of haircuts or refrigerators, buyers in those markets need to know only how much they themselves value the good. If the price is less than the value to you, you buy. If not, you don�t, and vice versa for sellers.

Financial assets, whether in the lab or the real world, are trickier to judge: Can I flip this security to a buyer who will pay more than I think it�s worth? In an experimental market, where the value of the security is clearly specified, �worth� shouldn�t vary with taste, cash needs, or risk calculations. Based on future dividends, you know for sure that the security�s current value is, say, $3.12. But�here�s the wrinkle�you don�t know that I�m as savvy as you are. Maybe I�m confused. Even if I�m not, you don�t know whether I know that you know it�s worth $3.12. Besides, as long as a clueless greater fool who might pay $3.50 is out there, we smart people may decide to pay $3.25 in the hope of making a profit. It doesn�t matter that we know the security is worth $3.12. For the price to track the fundamental value, says Noussair, �everybody has to know that everybody knows that everybody is rational.� That�s rarely the case. Rather, �if you put people in asset markets, the first thing they do is not try to figure out the fundamental value. They try to buy low and sell high.� That speculation creates a bubble.

In fact, the people who make the most money in these experiments aren�t the ones who stick to fundamentals. They�re the speculators who buy a lot at the beginning and sell midway through, taking advantage of �momentum traders� who jump in when the market is going up, don�t sell until it�s going down, and wind up with the least money at the end. (�I have a lot of relatives and friends who are momentum traders,� comments Noussair.) Bubbles start to pop when the momentum traders run out of money and can no longer push prices up.

Labels: economics

Sunday, December 14, 2008

Democrats, the $$$$$$ Party

I asked one of the Dems, "Who's feeding you guys?" I thought maybe every Democrat volunteer was �pitching in� for the food. His response: �I think the Franken campaign is paying for it.� This is the Franken campaign partially financed by funds raised or provided by George Soros who not only now has his man in the White House, but wants them in the Senate and US House. Directly or indirectly the $$$ Dems were footing this food bill, a minimum of $400- $500 a day, seven days, for how many county counts? Literally $1000s a day.

Who�s the party of the rich? The Democrats, the party of the party of billionaires and multi-millionaires.

Labels: Democrats

When Democrats Lose, Well, Sort Of........

We�re seeing the same thing here. Mr. Ritchie now wants all those rejected absentee ballots revalued. Seems that all those city and county clerks and judges trained by the Secretary of State�s office couldn�t do their job right the first time. Is this "do-over" because Mr. Ritchie�s candidate is losing? If so, he undermines the very workers he trained for the election.

Sure he says he wants to be fair. Face it, if he did want to be fair, he wouldn�t undermine the election system by demanding that the very people he trained redo their jobs. Just how sloppy does he think they were? Ask this question � if the Republican candidate were behind, would these absurd gyrations be occurring? Would the majority of "found" votes have gone in Norm's favor, against all statistical probabilities? I doubt it.

Update Dec. 10 - appears some county legal groups refused to recount these already considered ballots; others are showing a meager 50+ in the "5th" pile. Point remains - most judges and clerks know what they are doing.

Update Dec. 13 - Is Franken getting what he wants from the canvassing board. If 133 missing ballots can be counted for Franken, the 9 votes for Senator Coleman from Lakeville's Precinct 10 should be counted. At least Lakeville HAD the ballots. The Lakeville discrepency was between originals and the duplicates run through the machines on Election Day. The duplicates were all there; one envelope of originals was missing. Franken got his way here, too - only the originals were counted. At one point in this process, only the ballots that went through the machine were to be counted. This changed during the recount. I know, I was there.

Labels: Coleman, Democrats, Franken

Saturday, December 13, 2008

Radio atwittering

For those of you following the Final Word today, you can use Twitter to follow the conversation. �I'll monitor the hashtag #finalword to track what you're saying about the show. �Streaming starts for NARN 2 in a minute, and Final Word begins at 3, all at am1280thepatriot.com

Michael is away today, so I am joined instead by our show friend Pat Shortridge. �A man who lists The Cocktail Hour as a hobby is a perfect fit for FW!

Labels: AM1280, Final Word, NARN

Friday, December 12, 2008

Happy day, sad day

Got back to the office 90 minutes ago, and just delivered is my copy of the book. Indeed, a few copies. I'm going to celebrate it by getting out of the suit, putting on a sweatshirt, and watching basketball here on campus. Many toasts will come when I get to a conference in January with my co-editor and a few of the authors. I wish I had gotten the book two weeks ago, it would have been a bigger party. But I'm tossing the champagne in the garage -- in winter, your garage is your auxiliary refrigerator (sometimes your freezer!) -- and hoisting two tonight: One for a job well done, and the other for a life well done.

Labels: life

What passes for economic policy analysis

You wouldn't lump the current state Republican administration into the progressive camp, so they're talking more about the likes of former Govs. Al Quie and Arne Carlson, as well as retiring Congressman Jim Ramstad.Al Quie, progressive? I listened to the talks at the Center for the American Experiment surrounding Mitch Pearlstein's new biography of Governor Quie, and I wouldn't have put him in the category of progressive. I guess if you ever supported a tax hike -- even one in a period where the budget deficit dwarfs the news -- you're a 'progressive'.

The show, called �Minnesota�s Progressive Republicans,� was co-produced by Growth & Justice -- the economic policy group headed by former Strib and Pioneer Press reporter Dane Smith ...

Not that this is necessary. Mitch mentions a proposal from Senator Geoff Michel and Rep. Laura Brod to privatize the airport. That's hardly progressive; its mother is Margaret Thatcher. The British took in $40 billion from privatizing state industries and council houses; the Japanese, $100 billion for just two state industries (airline and telephone monopolies were sold off.) Michigan, long suffering from overspending in its state budget, has 97 state parks, leading one group to suggest selling a few off. Now who's more progressive? Governor Pawlenty, who has fought for a new state park at Lake Vermillion? (Think he might like to have that $20 million back?)

But G&J seems to equate progressive with tax-raising. I wonder if this is because, when looking at their staff, economists are few and far-between at this "economic policy group".

Card check and the bailout

DeMint emphasizes that EFCA contains not only card check but a noxious provision that has a government agency write labor contracts when the new union and the company cannot agree. Mirengoff calls this "well down the road to Socialism."

Indeed, DeMint tied the Employee Free Choice Act to various bailout programs, especially the one for the auto industry, which will also enhance the government's control over the economy while protecting the UAW. Through legislation like the auto industry package and the Employee Free Choice Act, the Democrats see, simultaneously to bail out unions, a key political ally, and increase government control over the economy.One place it would potentially give control is for unions negotiating with foreign firms. In this morning's Political Diary from the Wall Street Journal (subscriber's link), Holman Jenkins makes this case as well.

[UAW head Ron] Gettelfinger didn�t quite say so, but card check is also part of Big Labor�s increasingly hopeless strategy to preserve its Big Three pay levels. The idea is to drive up wage and benefit costs at Toyota, Nissan and other transplants. Card check is key. The UAW has racked up a goose egg in 20 years of trying to organize the foreign-owned plants, and Detroit's recent troubles are not exactly a big advertisement to workers in Tennessee or Alabama to welcome the UAW. Whether even card check would help is doubtful in any case. But certainly a process that continues to rely on a secret ballot free from intimidation is unlikely to advance the UAW�s cause.Specter was one of ten GOP senators to vote yes on the auto bailout bill. Three others were lame ducks (Dole, Domenici and Warner.) If the bailout bill was a test vote for the card check debate, the future isn't too bright. If used this way, foreign investment into the US would fall.

Thursday, December 11, 2008

But it got better after Berg and Lileks moved

Its largest city is legendary for machine-style politics and its elected leaders have been under investigation for years, but by one measure, Illinois is not even close to the nation's most-corrupt state.North Dakota, it turns out, may hold that distinction instead.

They have a map for this, too! It calculates the ratio of corruption convictions to population. Which is a crazy way to do this: You can lower your corruption index by not prosecuting crooks. That's not what they do in NoDak, they say:

Don Morrison, executive director of the non-partisan North Dakota Center for the Public Good, said it may be that North Dakotans are better at rooting out corruption when it occurs.

"Being a sparsely populated state, people know each other," he said. "We know our elected officials and so certainly to do what the governor of Illinois did is much more difficult here."

Morrison said the state has encouraged bad government practices in some cases by weakening disclosure laws. North Dakota does not require legislative or statewide candidates to disclose their campaign expenses.

The analysis does not include corruption cases handled by state law enforcement and it considers only convictions. Corruption may run more rampant in some states but go undetected.

There are international measures, most commonly used being the Transparency International rankings of bribe payers and corruption perceptions. The large issue found in the paper in our book, by Omer Gokcekus and Justin Myrie, studies the relationship between officials' pay and their level of corruption. Micro-level studies seemed to be more persuasive. I would argue that corruption is higher in places where the top pay of the private sector is greatest, which is not inconsiderable in Chicago. What do you suppose it takes to be in the top 1% of the income distribution in North Dakota?

Labels: corruption, economics, lileks, Mitch Berg, North Dakota

Because the real tragedy is when government is out of money

One of the most obvious ways to avoid this situation in the future is by building up a strong budget reserve fund which could make similar situations in the future much less painful to deal with. There are a number of steps I would propose to build a strong reserve fund.The cash flow fund and the budget reserve fund are set at $350 million and $653 million by law. If the government has more money than that it can either send back rebates or pass a law to spend the extra. Send the money back? Liberals think this is a terrible idea.

So their answer is, while the budget is in bad shape, to increase the cap so that when the Minnesota economy turns around you don't get any more Jesse checks?

I would propose increasing the cap to 15 percent of projected FY revenues, for the 2010-11 year that would be $5,141,896. If we had that kind of reserve fund built up we simply would not have to make dramatic changes in services depending on the economic conditions which is not something that is healthy for our state.That is, the next $4 billion or so -- I don't know if the writer is counting the cash flow account in her calculation of the cap -- won't go back to you, and won't be spent on anything that might give you some benefit (like, God forbid, an extra lane on I-94 past Rogers!) It would just sit there in an account waiting so that when the next revenue shortfall hits AF$CME and Education Minne$ota don't quake in its boots worried about their salary steps. And just in case that's not enough, this 'progressive' will make sure the beatings continue to at least 2.5% of revenues: