Tuesday, March 31, 2009

Advanced notice -- citizen journalists academy

I am writing to let you know that the Society of Professional Journalists will be bringing one of its national training programs to Minneapolis in June. The Citizen Journalism academies are designed to help provide advice and information to journalists not affiliated with newsrooms or who have not had formal training about gathering and reporting news. The program provides primers on ethics, state open records laws, media law, writing for online audiences and a look at the latest technological trends that people are using to cover the news. The Minneapolis Academy is the fifth in a series that started in 2008. We have had successful stops in North Carolina, Los Angeles and Chicago. A program is planned for Denver in May.Word spread, Dave. The link says the Minneapolis session is June 13, at the StarTribune. Cost is $40 which includes lunch.

Minneapolis is an obvious place to conduct this event because of the great outpouring of citizen journalists in Minnesota.

I am hoping you will help me spread the word about this event to your friends and colleagues. I have provided a link that better explains the programs and describes some of the speakers we have lined up for Minneapolis. We will be completing the program lineup in the next few weeks.

http://www.spj.org/cja.asp

Labels: Media

The three influences on the money supply, or, why inflation lurks

The banking system can increase or decrease the money stock, but there is nothing unique about this power. Any holder of money balances can produce effects on the money stock similar to those produced by banks (though not through creation or extinction of deposits). When banks reduce their holdings of high-powered money by making loans and thereby reduce their reserve ratio, they increase the money stock; but the public also increases the money stock (eventually) when it reduces its holdings of high-powered money in relation to deposits (assuming banks maintain the same reserve ratio). Changes the currency-money and reserve-deposit ratios, therefore, have similar effects on the money stock, though they represent high-powered balances in relation to deposits of two different sectors, the banks and the public, which view deposits differently-banks, as a liability, and the public, as an asset. The two ratios are nevertheless separated in the analysis to follow, because they behave in different ways.From a very old essay by Philip Cagan. Many people want to wonder how it is that we can print as much money as we have and how it could not lead to inflation, and why we might have deflation. The answer comes in distinguishing monetary base from the money supply.

Monetary base or "high-powered money" (as we used to call it) is measured by the liabilities of the Federal Reserve. Jim Hamilton over the weekend had two posts highlighting how the Fed's activities in extending credit to all and sundry has exploded the balance sheet of the Fed. He asks at the end of the first post "Does the explosive growth of the monetary base ... imply uncontrollable inflationary pressures? My answer: not yet, but stay tuned." That takes us to the second post where he argues the Fed has hamstrung itself in creating these new lending facilities and tripling its liabilities.

Sure, but the fact remains that the relationship is between money supply and inflation or deflation, not monetary base. To get from one to the other you have to look at the other two routes that Cagan identifies. Both the public and the banks can demand monetary base and keep it, rather than have it create money. Indeed, the process of, for example, American citizens withdrawing deposits and sticking the resulting cash in the mattresses of their beds would destroy money created by deposit expansion. Since at least half of our currency is held overseas (largely by private citizens as a store of value), instability in those countries increases the demand for base money. Interestingly in this recession, so far we have not seen a run for currency -- the ratio of currency to deposits has remained relatively stable over the last two years.

Likewise, banks can decide to hold reserves against their deposits in greater proportion during times of turbulence. Particularly beginning in fall when the ability of banks to attract overnight loans was damaged in the credit crunch, banks relied on the old fashioned means of putting cash away in the vault or on deposit at the Fed (it's too soon to say whether the Fed's decision to pay interest on deposits has had any impact on this.)

We write about the wall of monetary base as if it is an excess supply of bank reserves; it's almost certainly not in the present environment. When it is, only then can it be inflationary. We can, of course, use government force to increase the demand for base money -- for instance, by reimposing reserve requirements on time deposits -- and limit inflation this way. We normally don't use reserve requirements for monetary policy only because it's a blunt, powerful tool. Yet it wouldn't be out of line to use it as part of a solution. (I doubt this would be news to the Bernanke Fed, btw.)

The public's demand for money has also increased, as shown by the decrease in the velocity of money (the inverse of which is the share of one's income one is holding as money.) I show here both M1 and M2 velocity, using personal income as a representation of GDP.

People in uncertain times want to hold on to money relative to other assets, and once again, inflation is the result of an excess supply of money. Our fears of inflation imply that the increased demand for reserves (by banks) and money (by the public) are temporary phenomena, bound to reverse in more normal times that are in the offing. I'm not sure why we believe this to be true. The disappearance of some asset classes, and the increased perception of risk in many others, would lead to a rise in the demand for money in almost any standard view of economics. Maybe that perception reverses quickly, but maybe not. High inflation isn't a problem until it does.

This does not deny Hamilton's last point in his second post, that the Fed has cost itself both maneuverability and credibility in its mission to fight inflation. But I would disagree with Hamilton that it's the Fed's primary mission. The Fed does not have the sole goal of price stability. We might wish it did -- I certainly have in years past -- but I do agree with Robert Gay's assessment in this Bloomberg podcast with Tom Keene last week that the Fed has two modes -- normal mode, in which price stability is its primary function, and crisis mode, where "inflation be damned, it's battle stations people!" Unless the Congress changes the rules and removes the lender-of-last-resort function from the Fed, it will always have those two modes.

Labels: economics, Federal Reserve

Monday, March 30, 2009

Slouching towards corporatism

FDR may have talked a good game about going after �economic royalists,� and he did love confiscatory personal income taxes. But he and his Brain Trust also loved cartels, big businesses, and other �big units� of society. The notion that big business and big government are at war with one another is one of the great enduring myths of the 20th century. The truth is that ever since Teddy Roosevelt abandoned his love of trust-busting, progressives have liked big businesses big, really big. The bigger the business, the more reliable the partner for big government.Douglas Carswell MP writes of his country's infatuation with independent commissions and watchdog groups instead of relying on party politics:

That�s why any huge corporation that plays ball on health care, or �green jobs,� or countless other initiatives, is hailed as a �forward-thinking� or �progressive� company. Companies such as GE, which stands to make billions from Obama�s energy proposals, are vital sidekicks in the new era of public-private partnerships. Why is Obama working tirelessly to save Detroit automakers? Because GM is a wonderful poster boy for peddling nationalized health care, and UAW is an indispensable cog in the Democratic Party.

For democrats like me, there's no point in explaining that the idea of disinterested technocrats is an illusion, and that no such person exists. Or that deference to supposed "experts" makes it much more difficult to recognise and correct failures. There's no point in saying that leaving it to "experts" was precisely what happened with child protection in Haringey. Or with the Bank of England setting interest rates too low for too long.

[U]nless we restore confidence to the Westminster system, people are going to end up preferring a technocracy that is technically inept to a democracy that excludes the people. We�re already half way there.

A CEO goes to a meeting in a government building in DC and is told that the only way his firm can get government assistance which, since the government helped destroy financial markets, is the only way a firm his size can get any kind of debtor-in-possession financing to get through bankruptcy -- the only way his firm can survive will require him to sacrifice himself. You might wish to argue that they shouldn't have taken the money they already got, but please tell me what the difference is between nationalization of a carmaker and a government firing the head of a carmaking firm? Yet it makes perfect sense in a corporatist world.

It is not, as John Hinderaker argued this evening, that Obama wants to run the car companies. Far from it: he's quite content to have technocrats in charge that call on government for protection from upstarts and who will pay obeisance in cash and ballots. What he wants instead is a unification of the people and of corporations towards a greater good. A "rationalized" system, as Goldberg points out, that compels a million small businesses to follow a national plan, incurring costs that choke the life out of the small business and leave the bigger sticks all alone. A bundle of sticks tied together for a common purpose.

Hmmm, "bundle of sticks." Seems I've heard that before.

Labels: economics

Thinking about media and bias

In the second half we turned to the idea of media bias; I am one who does not think there is groupthink in the media (Janet might disagree with me here, but read through to be sure), but that writers tend to reflect individual preferences and are reinforced in doing so when they think their audience will favor. Some of the economic research that convinces me of this is a paper by Mullainathan and Shleifer (2005 AER, ungated copy here, hereinafter MS.) It was their example of the two stories on the unemployment rate that I read to Dave. I think there's slanting of stories, which as MS point out can be a rational response to a biased readership. The market for the StarTribune contains the congressional district of Keith Ellison, so you write stories Ellison supporters would like. That's not bias, that's responding to incentives.

With that in mind, consider this opinion piece written by Randy Krebs in the Sunday St. Cloud paper. He illustrates his belief that he has intolerant readers by reporting on phone calls he receives after the paper reports on "Rep. Steve Gottwalt�s bill requiring people to remove headgear for their driver�s license photo." A few sentences later he writes, "A couple of different readers called separately to express support for Gottwalt�s initial idea." Mr. Krebs takes the rest of the column to call these two callers intolerant. Wouldn't a reader think that by extension Krebs thinks Gottwalt is, too?

Except that the paper reported weeks ago (in an article co-authored by Dave Aeikens, just to tie this together) that after meeting with Muslim groups, who felt the law was discriminatory against their religious practices, Gottwalt revised the bill to strike a better balance. This point appears nowhere in the Krebs opinion unless you ask why Krebs called it "Gottwalt's initial idea." It seems to me Krebs was aware of that change, but because it was inconvenient to his story he made his way quickly around that point to get back to attacking the droogs who dared ring his phone.

So is that bias? I don't think so; even if it is, Mr. Krebs is certainly entitled in an opinion piece to express it. I suspect though it's a bit more like slanting; there is nothing false about what Krebs has written, but he's in need of props to tell his story of religious intolerance and found these callers handy. It would muddy his story to remind people of Gottwalt's revision, so that doesn't make it into the op-ed.

Dave argues in the podcast that without newspapers bloggers have nothing to say. But newspapers in fact present us with something to do: to demonstrate slanting, and yes, re-slant for our readers. Since it appears more liberals self-select into careers in journalism (see for example here and here for evidence, for starters), those who want a different slant are served by both Fox and by center-right bloggers.

Labels: economics, Gottwalt, Media, St. Cloud

Media Alert: WJON, KLTF

- Up Front, with Rod Grams, KLTF in Little Falls, 9:40-10am.

- Jay Caldwell, WJON, around 10:15am.

Labels: Media

Friday, March 27, 2009

New Quarterly Business Report is out

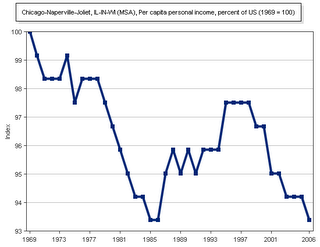

The news story in the Times is here. There's very little good news in it, alas. The continued decline of our local leading indicators series (above) gives a 99.3 reading for February, continuing a decline that began in earnest a year ago, making an end to the local recession before the end of summer quite unlikely. Our probability of recession index for February showed a 94% chance of recession 4-6 months ahead (again, for the June-August period.)

For Scholars readers, you may find a copy of the report here.

As supporting evidence, you may wish to see Minneapolis Fed President Gary Stern's address to the Minnesota Economics Club yesterday:

Once under way, the pace of the expansion is likely to be subdued for a time. There is historical precedent for this, since the recovery of the early 1990s was initially quite modest, as was the recovery earlier this decade. More importantly, in view of the state of the credit markets, it seems a fair bet that it will take time for momentum to build. But with the passage of time�as we get into the middle of 2010 and beyond�I would expect to see a resumption of healthy growth.I still see the possibility of a trough of the business cycle in late 2009, but if the recession and recovery is U-shaped, that trough may be barely perceptible this year.

Thursday, March 26, 2009

Is diversity a category of academic accomplishment

Labels: higher education

Economics as mental defect

Economics is a two-faced, one might almost say schizophrenic, discipline. It claims to be a science, describing the world, telling it like it is without preconception or value judgment. (Never mind that the hey-day of positivism that enshrines the separation between fact and value is long past; economists have always lived in a time warp.) The reality is that descriptive economics has been shaped by a framework of assumptions, a metaphysics more geared to its normative message than to its descriptive pretensions. This framework is essential to the normative side of an economics that trumpets the virtues of markets and is maintained even when it gets in the way of understanding how the economy really works.If this was a non-economist writing I'd probably blow him off as an ill-informed crank. Except he's not. I remember hearing him interviewed on Econtalk and while I disagreed with his critique I found him thoughtful.

The 19th century physicist, Lord Kelvin, famously proclaimed the virtue of knowledge imbued with the precision of number. Economics goes physics one better, from epistemology to ontology: anything we can�t measure�like community�simply doesn�t exist.

Couldn't remember when I heard this so I had to download and listen again. Russ Roberts does a good job of jotting some stream-of-consciousness notes to the page and there's a reference there that caught my eye:

Hayek was very aware, in The Fatal Conceit, championing the extended order of the market economy. Felt we had to be of two minds, interacting with our friends and loved ones differently. Dangerous to extend either realm into the other, though we may disagree where to draw that border.The extended order or, as I say in development economics, the extending order, is the process of widening the circle of potential traders that allows greater specialization and exchange. It is, in the view of the speakers of this conference, perfectly fine to extend the order but only to a certain degree. The quote above is of Roberts responding to Marglin who says this in the podcast (in Roberts' notes):

What is it that the market is actually doing so well? It's producing more and more goods. In large parts of the world that's still the prime necessity. In the U.S., though, we have plenty of goods, enough to lead a dignified life. Why is enough never enough? Dismal science, what does pursuit of more and more does to our relationships?Yet the production of those goods is not just an end in itself. Certainly in a 19th Century factory that division of labor, specialization and exchange may have lead to mind-numbing repetitive tasks, a suffocation of creativity and even spirit. But now? I find it difficult to hold that the act of creating a service or good doesn't contain some value to the worker. I take my income because my employer gives it to me, because I persuaded her or him to do so, but how many of us just do what provides a maximum income versus a job that provides some satisfaction from the work itself? The division of labor is not only about the maximization of production. It is about allowing a person to specialize in doing that which they do better than they do anything else. What other way to satisfaction do speakers at this conference see?

Note: no numbers were harmed in the production of this blog.

Labels: economics

Wednesday, March 25, 2009

Longrun slowdown

The rate of the 'primary deficit' that one can maintain is the function of three elements: the current debt-to-gdp ratio, the growth rate of real GDP in the long run, and real interest rates. If the government can maintain productivity to have real GDP grow faster than long run rates, it can run a small deficit and still have the debt-to-GDP ratio move towards zero to avoid the possibility will view US debt as a Ponzi scheme. But as the growth rate of GDP falls or the real interest rate rises, even small budget surpluses might not be enough to stabilize the ratio, leading to calls for even higher taxes (or lower spending) to get it onto a sustainable path.For the next few years, CBO projects faster growth than the Blue Chip, as the economy grows back toward CBO�s estimate of potential GDP (which corresponds to a high level of use of labor and capital resources). Still, the CBO forecast assumes that the gap between actual and potential output closes more slowly than in previous recoveries because of a persistent drag from financial markets, households� loss of wealth, the overhang of vacant houses, and weak economic growth overseas. Therefore, CBO projects that the economy does not return to its potential level until 2014.

In the 2015-2019 period, the projected rate of real GDP growth averages 2.4 percent. That rate is lower than during the period from 2010 to 2014, largely because there is no longer any gap to close between actual and potential GDP.

Projected growth from 2015 to 2019 is also below historical average growth rates, a difference that is more than accounted for by slower growth in the labor force because of the retirement of the baby boom generation. Over the postwar period, the labor force grew at an average annual rate of 1.6 percent; by contrast, we project it to grow only 0.4 percent per year in the period from 2015 through 2019. As a result, potential GDP grew 3.4 percent per year on average in the postwar period, but CBO expects that it will grow by only 2.4 percent annually...

Note, CBO is giving a better forecast than private forecasters, but worse than the Administration. I find Doug Elmendorf's explanation quite sound, though if there's a huge savings response to the loss of wealth (and future wealth via higher implied future taxes), you might not see as large an increase in interest rates on government debt as one might guess historically.

Reinhart and Rogoff:

Assuming the U.S. continues going down the tracks of past financial crises, perhaps the scariest prospect is the likely evolution of public debt, which tends to soar in the aftermath of a crisis. A base-line forecast, using the benchmark of recent past crises, suggests that U.S. national debt will rise by $8.5 trillion over the next three years. Debt rises for a variety of reasons, including bailout costs and fiscal stimulus. But the No. 1 factor is the collapse in tax revenues that inevitably accompanies a deep recession. Eight and a half trillion dollars may sound like a lot. It is more than 50 percent of U.S. national income. But if one looks at the Obama administration's stunning budget-deficit projections, with exceedingly optimistic projections on growth and bank-bailout costs, we think the U.S. is right on track.

Labels: economics

Love this metaphor

Regulation is a chess mid-game, not a math problem. With a math problem, once you solve the problem, it stays solved. In a chess mid-game, new opportunities and threats arise constantly. You try to plan ahead, but your plans inevitably degrade over time.From the ever-quotable Arnold Kling. Anything that combines two passions like that for me -- though I have lost my chess playing as Littlest has grown out of it -- is a winner. It's a nice way to describe the regulatory dialectic.

Labels: banking, chess, economics

Have a cough? Get a Kirby!

Today they posted a revision, removing the mandate on private policyholders, but retaining it for MA. It's on its way to the Finance Committee, having passed Health Care and Human Services. One can only shake his head, but hope his dandruff does not cause an allergic reaction.

Maybe it's time for another version of stupid bills.

Labels: DFL legislature, Minnesota

The Employee Free Dinner Act

Striking French workers for U.S. manufacturer 3M held their boss hostage amid labor talks Wednesday at a plant south of Paris, as anger over layoffs and cutbacks mounted around the country.While the situation at the 3M plant outside Pithiviers was calm, worker rage elsewhere boiled over into an angry march on the presidential palace in Paris and a bonfire of tires set alight by Continental AG employees whose auto parts factory was being shut down.

...A few dozen workers at Pithiviers took turns standing guard Wednesday outside factory offices where the director of 3M's French operations, Luc Rousselet, has been holed up since Tuesday. The workers did not threaten any violence and the atmosphere was calm.

A few police officers stood outside, while workers inside exchanged jokes and worries about their future amid heaps of empty plastic coffee cups and boxes of cookies.

...In France, it is not unheard-of for striking workers to hold company executives as a way of winning concessions from management. The hostages are almost never injured. A similar situation ended peacefully earlier this month at Sony's French facilities.

"We don't have any other ammunition" other than hostage-taking, said Laurent Joly, who has worked at the Pithiviers plant for 11 years and is angry that he is being transferred to another French site.

...When Rousselet came out of the guarded office to go to the bathroom Wednesday, workers booed him while reporters asked how he was holding up."Everything's fine," he said.

Workers planned to bring Rousselet mussels and french fries for dinner if he was still there Wednesday night.

Ming wonders if the workers are Belgian. Seems unlikely. Seems also unlikely that this tactic would work in the US; can you imagine Andy Stern serving mussels?

Labels: unions

Someone who won't be at the finance world's come-to-Jesus meeting Friday

A true Randian would have kept the money and gone to the Gulch. Yet Rand seems to echo Mr. Desantis:As most of us have done nothing wrong, guilt is not a motivation to surrender our earnings. We have worked 12 long months under these contracts and now deserve to be paid as promised. None of us should be cheated of our payments any more than a plumber should be cheated after he has fixed the pipes but a careless electrician causes a fire that burns down the house.

Many of the employees have, in the past six months, turned down job offers from more stable employers, based on A.I.G.�s assurances that the contracts would be honored. They are now angry about having been misled by A.I.G.�s promises and are not inclined to return the money as a favor to you.

The only real motivation that anyone at A.I.G.-F.P. now has is fear. Mr. Cuomo has threatened to �name and shame,� and his counterpart in Connecticut, Richard Blumenthal, has made similar threats � even though attorneys general are supposed to stand for due process, to conduct trials in courts and not the press.

So what am I to do? There�s no easy answer. I know that because of hard work I have benefited more than most during the economic boom and have saved enough that my family is unlikely to suffer devastating losses during the current bust. Some might argue that members of my profession have been overpaid, and I wouldn�t disagree.

That is why I have decided to donate 100 percent of the effective after-tax proceeds of my retention payment directly to organizations that are helping people who are suffering from the global downturn. This is not a tax-deduction gimmick; I simply believe that I at least deserve to dictate how my earnings are spent, and do not want to see them disappear back into the obscurity of A.I.G.�s or the federal government�s budget. Our earnings have caused such a distraction for so many from the more pressing issues our country faces, and I would like to see my share of it benefit those truly in need.

A society that robs an individual of the product of his effort, or enslaves him, or attempts to limit the freedom of his mind, or compels him to act against his own rational judgment-a society that sets up a conflict between its edicts and the requirements of man�s nature�is not, strictly speaking, a society, but a mob held together by institutionalized gang-rule. Such a society destroys all the values of human coexistence, has no possible justification and represents, not a source of benefits, but the deadliest threat to man�s survival.Perhaps some of the righteous anger will slow the advance of these predations, but it doesn't appear there is any governor on the engine that moves the gangs.

I wish you good luck, Mr. Desantis. You may now fully expect to be hounded by those folks who are about done with Joe Wurzelbacher.

(h/t: Division of Labor)

UPDATE: One of the forecasters who called the housing market correctly finds a gulch in Canada.

Labels: economics

Tuesday, March 24, 2009

Maiden lane

That $29 billion was an investment vehicle called Maiden Lane. A Scholarly A for those of you who can, without Google, tell me who was funded by Maiden Lane II and Maiden Lane III.``The Federal Reserve has judged it necessary to take actions that extend to the very edge of its lawful and implied powers, transcending in the process certain long-embedded central banking principles and practices,'' Volcker said in a speech to the Economic Club of New York.

Fed Chairman Ben S. Bernanke last month agreed to lend against Bear Stearns securities, paving the way for JPMorgan Chase & Co. to buy its Wall Street rival. Bernanke, who worked with Treasury Secretary Henry Paulson to broker the bailout, last week defended the move as necessary to prevent ``severe'' damage to financial markets.

Volcker, the Fed chairman from 1979 to 1987, had implicit criticism for U.S. regulators and market participants who allowed ``excesses of subprime mortgages'' to spread into ``the mother of all crises.'' The Fed's Bear Stearns loan was unusual, he said.

``What appears to be in substance a direct transfer of mortgage and mortgage-backed securities of questionable pedigree from an investment bank to the Federal Reserve seems to test the time-honored central bank mantra in time of crisis: lend freely at high rates against good collateral; test it to the point of no return,'' he said.

...``The extension of lending directly to non-banking financial institutions -- while under the authority of nominally `temporary' emergency powers -- will surely be interpreted as an implied promise of similar action in times of future turmoil,'

Give up? Hint: the answer requires three letters. It's in the paper a lot these days.

I'm reading through the history of the Banking Act of 1933. I landed on a Cato Journal article by William Shughart, explaining the Glass-Steagall provisions in something other than the omniscient regulator perspective. Seems to follow what I'm reading as well in Charles Ellis' The Partnership.

Too good not to share

Don't just look at the US

Prime Minister of Lithuania Andrius Kubilius confirmed preliminary forecasts of the Ministry of Finance stating that Lithuania's gross domestic product (GDP) would slump by 10% in 2009, the highest decrease since 1993.In fact, the Germans are wondering if it won't be worse than that. As a forecaster this tells me export growth, even if the dollar slides, will be worse than we thought. Menzie Chinn looks at this through an IMF report and worries about further downward surprises in world economic growth. But is this a case for fiscal policy expansion?

In past December, the Ministry of Finance forecasted that the Lithuanian economy would contract by 4.8% in 2009.

In an interview to the Lithuanian Radio on Tuesday, the prime minister said that it would only be possible to comment on these figures after their official announcement. "The updated forecasts are marked by consistent pattern that Lithuania's economy is falling at a faster pace than expected," stated Kubilius and recalled that the neighboring Latvia forecasted that its GDP would drop by 15%, Estonia � by 9% and Germany � over 6%...

Read more about eastern European economies here. I think this does a great deal of damage to the goal of EU expansion.

Labels: economics

Media alert: The Ed Morrissey Show

Labels: Media

Monday, March 23, 2009

Folk song propaganda

Sari Gelin is an old tale, which probably has Azerbaijani or Turkic roots, of intermarriage between a Turkish Muslim man and a Christian, blonde Armenian woman.* There are various versions of the story. (As a side note, it's also a folk song, performed here by an Armenian man on the duduk in the pre-Christian temple at Garni, if my eyes are right. There are Turkish performances as well.) It ends badly for the couple, in some versions the boy dies and in others the girl does. We can guess how it turns out here:Sari Gelin, or "Blonde Bride", was commissioned by the Turkish General Staff and distributed in recent months by the education ministry.

It is an attempt to counter what Turkey calls "baseless" claims that Ottoman Turks committed genocide against the Armenians in 1915.

The DVD was sent to all elementary schools with a note instructing teachers to show it to pupils and report back.

At the school of Mr Kaya's daughter, children as young as six had to watch.

"This film is not fit for adults, let alone children," he says."They're promoting discrimination, branding certain people as 'others' and teaching children to do the same. My daughter will not be part of this enmity."

Mr Kaya has applied to the courts to sue Education Minister Huseyin Celik, arguing the film incites ethnic hatred against Armenians.

There are around 50,000 Turkish-Armenians left in Turkey, mostly in Istanbul.

In a statement last month, the ministry said it had stopped distributing the film and claimed it was never intended for children.

But teachers are still receiving official reminders to screen it.

The subtitle of the movie is "Armenian issue" which is how most Turkish denial literature presents the question. The cover also says it's "the true story". Without getting into a debate over the historical record, I think it's fair to say this video represents an escalation of official Turkish efforts to dispute that record. (It's gone on less officially for a very long time.) And this happens at a time when Turkey's admission to the EU is under great scrutiny, and while it shows some signs of willingness to open trade and cultural links with Armenia."The word Armenian is used very many times and always negatively," says Ayse Gul Altinay, a board member of the Hrant Dink Foundation.

She has good reason for concern.

Two years ago, Hrant Dink - a prominent Turkish-Armenian writer - was shot and killed by a teenager, who saw him as an enemy of the state.

So, the foundation created in his memory has also applied to the courts to get Sari Gelin withdrawn from schools.

"Showing young people a film with graphic scenes of violence, that repeats over and again that the Armenians stabbed the Turks in the back, and killed innocent women and babies and civilians is very dangerous," Ms Altinay says.

"We worry it will create more hatred."

None of this would I expect to lead the Obama Administration to cancel its planned visit to Turkey. It's more likely to inflame than change if the Administration did so. But it would be welcomed if, during his visit to what is, after all, a forum on dialogue between the West and the Muslim world, President Obama called for an end to ethnic tensions among all the people in the Middle East and made mention of both the Kurds and Armenians.

*--While you'd struggle to find a blonde Armenian these days, that's because of the amount of intermarriage that occurred in the 1400 years or so up to the latter 19th C . Armenians were originally an Aryan tribe.

Not so smooth

One of the things we know in economics is that most people prefer to smooth their consumption over time. There are plungers; there are people who save too much and others who save too little, but on average people get it right. Because most people make less when they're young, they typically accumulate debt when they are young, only to retire it and accumulate wealth when you're old. For every individual, insolvency means you no longer can make a credible commitment to pay that debt down to zero in your lifetime.

The same applies to government. Governments cannot run Ponzi schemes, accumulating ever-higher amounts of debt. We need to demonstrate that, over time, the total national debt is on a path that leads eventually to its retirement. I've mentioned working on debt sustainability in Indonesia before; the goal there was to see if the government could repay a huge bank bailout that caused it to issue debt that was more than half of one year's GDP (to put that in our terms, that would be equivalent to a seven trillion dollar bank bailout here in the US.) In Indonesia's case, it was fine because it could always transfer oil royalties to the state budget to retire the debt.

Are we on a path headed to zero? The CBO's scoring last Friday of the Obama budget suggests that the proposal does not do so.

During the first hour of the Final Word on Saturday I put this graph up on Twitter for my listeners. The blue line represents the forecast of the ratio of federal government debt to GDP in the baseline scenario, which includes TARP and the stimulus bill. The purple line is that ratio as projected by CBO based on the proposed budget of President Obama. The report states:

The cumulative deficit from 2010 to 2019 under the President�s proposals would total $9.3 trillion, compared with a cumulative deficit of $4.4 trillion projected under the current-law assumptions embodied in CBO�s baseline. Debt held by the public would rise, from 41 percent of GDP in 2008 to 57 percent in 2009 and then to 82 percent of GDP by 2019 (compared with 56 percent of GDP in that year under baseline assumptions).I'm pretty confident a graph like this was one of the discussions that happened between CBO chief Doug Elmendorf and OMB director Peter Orszag last Wednesday. The White House is arguing that the Elmendorf forecast is more pessimistic, but they aren't saying too pessimistic. But the difference is $2.3 trillion in debt, and the WSJ reminds us this morning that this only includes the "down payment" on health care reform.

The way I look at this is to understand a concept called the "primary deficit". This is the deficit net of interest payments on the debt. Suppose you are paying on a credit card you've decided not to use any more. They are charging you high interest. You have to pay off at least all of the interest each month, plus some of the principal, for you to make any progress towards paying that debt off. Likewise, if the government wants to make any progress towards paying off its debt, it must collect enough in taxes, or cut spending enough, to not have to borrow all of what it needs to pay the interest on the debt. Now, it can hope to have an easier time paying back the debt because the economy grows, and it will if GDP growth should exceed the real interest rate it has to pay on the debt. But each year we add to the debt it gets a little harder. And doubling the debt-to-GDP ratio in ten years, with a forecast for real interest rates near 3% in their figures, that's quite hard to do.

The repercussions over the last three days have been astounding. Sen. Judd Gregg is sounding an alarm over the problem CBO raises. Nouriel Roubini says "A government that will issue trillions of dollars of new debt to pay for this severe recession and socialize private losses may risk becoming a Ponzi government if--in the medium term--it does not return to fiscal discipline and debt sustainability." In Canada Diane Francis thinks America may have reached its best-before date. And if the government is issuing into this environment $2.5 trillion in new debt that foreign governments no longer want to hold, this week starts to see the dollar slide and Treasury yields rise. Markets won't wait for Congress to figure this out; that market discipline that Robert Rubin once warned to Bill Clinton will come back in force. Maybe it's time for Mr. Rubin to make another visit to a young president.

While working on this article my friend Ed Morrissey at Hot Air forwarded a note from a concerned citizen who had seen Sen. Gregg's interview. What does this do, she wondered, for her as a mother, a business owner, someone in her late 30s? The conception in this post on consumption smoothing owes a great deal to the work of Lawrence Kotlikoff, who foresaw years ago the clash between young and old when it comes to this debt. His book, The Coming Generational Storm, detailed how the impending explosion of Social Security and Medicare benefits would devour the next generation that had to pay those benefits. He's set up a financial planning service that uses some of these theories. Six months ago he wrote:The decline in the dollar and our low national saving rate reflect an old policy of the government living beyond its means. If you look at all the extra consumption, it's occurring in large part among the elderly and, in large part, in the form of health care. This is not oldster bashing. We need to care for older Americans, but we need to do so in a way that doesn't constitute fiscal child abuse.

Some of this is changing -- some people are delaying retirement, others are saving more now -- but it's as if the current administration is turning its back on the very generation that brought it to office. If someone could get them the message...

UPDATE: Welcome Hot Air readers!

Labels: economics

Sunday, March 22, 2009

A Scientific Body Blow to Anthropogenic Global Warming

A new peer-reviewed paper has just delivered a major blow to the �greenhouse gas� assumptions that are central to the arguments of most climate alarmists. The paper, published in the International Journal of Modern Physics, is entitled Falsification of the Atmospheric CO2 Greenhouse Effects within the Frame of Physics. Both the abstract and a pdf of the full 115-page paper are available to the public.

Here are a few central points from this paper, done by two German physicists who understand that we have witnessed the erosion of the scientific method in order to support a political agenda. I have interspersed a few extra words of my own [set off in square brackets like this] for clarity.

There are no common physical laws between the warming phenomenon in glass houses [hothouses on farms and in indoor gardens] and the fictitious atmospheric green house effect... The terms "greenhouse effect" and "greenhouse gases" are deliberate misnomers...This paragraph from the abstract also provides food for thought:

The temperature rises in the climate model computations are made plausible by a perpetuum mobile [that is, the physically impossible "perpetual motion machine"] of a second kind. This is [accomplished] by setting the thermal conductivity in the atmospheric models to zero, an unphysical assumption [and an impossible action]...

The CO2 greenhouse effect ... is a "mirage." The horror visions of a risen sea level, melting pole caps and developing deserts in North America and in Europe are fictitious consequences of fictitious physical mechanism as they cannot be seen even in the climate model computations. The emergence of hurricanes and tornadoes cannot be predicted by climate models because all of these deviations are ruled out. The main strategy of modern CO2 greenhouse gas defenders seems to [be to] hide themselves behind more and more pseudo-explanations, which are not part of the academic education or even of the physics training...

If conclusions out of computer simulations are to be more than simple speculations, then in addition to the examination of the numerical stability and the estimation of the effects of the many vague input parameters, at least the simplifications of the physical original equations should be critically exposed. The point discussed here was to answer the question, whether the supposed atmospheric effect has a physical basis. This is not the case. In summary, there is no atmospheric greenhouse effect, in particular, [no] CO2 greenhouse effect, in theoretical physics and engineering thermodynamics. Thus, it is illegitimate to deduce predictions which provide a consulting solution for economics and intergovernmental policy.

The atmospheric greenhouse effect, an idea that may authors trace back to the traditional works of Fourier (1824), Tyndall (1861) and Arrhenius (1896), and which is still supported in global climatology, essentially describes a fictitious mechanism, in which a planetary atmosphere acts as a heat pump driven by an environment that is radiatively interacting with but radiatively equilibrated to the atmospheric system. According to the second law of thermodynamics, such a planetary machine can never exist. Nevertheless, in almost all texts of global climatology and in a widespread secondary literature, it [this belief that counters the 2nd law of thermodynamics] is taken for granted that such a mechanism is real and stands on firm scientific foundation.Perhaps we really need to consider the negative impact of government sponsorship and funding of research. We now have a graphic example of how vulnerable such a system is to being captured to support a political agenda. And perhaps, if our Democratic leaders are so interested in "helping" people they may consider Bjorn Lomborg's suggestion that the funds intended to delay the impact of the false belief of AGW, would be much better spent on projects with well-known high-value payoffs for people around the world.

UPDATE 3/23/2009 6:55 am: An alert commenter noted my error in the original title, which now has been corrected. However, his assertion that an article published in a well-respected journal is "bunkum" by "unknown scientists" is a classic illustration of my point about the politicization of science. The AGW alarmists repeatedly try to shut off debate by demonizing anyone who deviates from the politically correct party line.

Labels: global warming????

To buy or not to buy?

Labels: blogging

Friday, March 20, 2009

Even he noticed

the ruling AKP party in Turkey has made quite a few ominous moves on a wide variety of fronts. Prime Minister Recep Tayyip Erdogan delivered an anti-Israeli tirade and stormed out of a panel with Israeli president Shimon Peres at Davos. Polls indicate that that Turks like Obama more than they like Americans. New lawsuits against cartoonists and journalists have weakened freedom of the press in a country where it had generally thrived not long ago. The Turks' foreign policy has turned away from Europe and gotten closer to Russia and much warmer toward Hamas, Hezbollah, and Syria than it was a short while ago.He still sees the balance leaning against genocide recognition; I disagree for several reasons, but not least of which is the one he highlights: If you're going to trade a moral issue for realpolitik, shouldn't it be with a more reliable ally?

Losing independence

The Bernanke Fed has now dropped even the pretense of independence and has made itself an agent of the Treasury, which means of politicians. With its many new credit facilities -- the TALF and the others -- it is making credit allocation decisions across the economy. If a business borrower qualifies for one of these facilities, it gets cheaper money. If it doesn't, it's out of luck. Thus the scramble by so many nonbanks to become bank holding companies, so they can tap the Fed's well of cheap credit.The question is how the Fed will withdraw from all of this unchartered territory now that it has moved into it. How will it wean companies off easy credit, especially since some companies may need it to survive? What happens when Members of Congress lobby the Fed to keep credit loose for auto loans to help Detroit, or credit cards to help Amex? House Speaker Pelosi yesterday gave a taste, saying the AIG bailout was the Fed's idea "without any prior notification to us." Mr. Bernanke, meet your new partners.

From the Wall Street Journal this morning. Let me add a few thoughts:

The reason central banks were granted independence was that independence provided a bulwark against an inflationary bias that more dependent central banks have. (There's plenty of research on this, including my own here and here.) Dallas Fed President Richard Fisher puts this rather well:Why do we have independent central banks? To provide a barrier between government and the money supply. Why is this necessary? Because doing the right thing for the long-term interests of the people can be very hard to do. Monetary policymakers often have to make decisions that can cause economic pain for real people in the short term, or decide not to do things that could help people out of an immediate bad situation, in order to preserve the welfare of the people over the long run.But that's not the only reason we have the Fed. The Fed, unlike the European Central Bank or the Bank of Mexico (the subject of Fisher's speech), wasn't created in an inflationary world. Its purpose in 1913 was to act as a lender of last resort. It would lend to any and all on the basis of good collateral, following the precepts, I think, of Bagehot's Lombard Street. It does not have, like those other banks, the single goal of price stability. It is thus, in my view, a less independent bank than what 1990s "best practices of central banking" would have created.The incentives given to elected officials, even in the most praiseworthy democracies, increase the likelihood of harnessing monetary policy to their political needs. A congressman or a senator or a president who has all the best intentions and works earnestly for long-term prosperity is still subject to reelection and would quickly find himself voted out of a job if he tried to implement some of the stern policies that an independent central banker is often required to carry through.

Where the Fed is going now is a place we talked about last September when the most serious trouble brewed. Since Treasury seems unable or unwilling to act as a market maker of last resort, it is being left to the Fed to do so. In doing so we are shifting a large amount of risk onto the central bank, and because Congress sees this it is likely to meddle further in the Fed's actions. This is bad, as Fisher argues, for price stability. But it is worse than this. Anne Sibert wrote a short precis of what independent central banks do in liquidity crises, and the answer is quite clear:

The decision to bail out an individual bank is far too political an act for the unelected officials of an operationally independent central bank. It should be left to a separate regulatory agency, which has the expertise, and to the Treasury, which has the power to tax. All that is needed is that the regulators have a credit line with the central bank ... that is guaranteed by the Treasury.Interestingly, it is Senate Democrats such as Chris Dodd who are expressing this skepticism. While they are undertaking this overhaul, if Dodd and others are concerned about the size of the Fed's balance sheet and risk of inflation, they should consider amending the Federal Reserve Act to give the Fed more strength in the fight against inflation. Of course, that means tying its own hands, and so far this bunch doesn't seem up to that task.

Labels: economics, Federal Reserve

Thursday, March 19, 2009

Candidate versus president, Armenian edition

Presidential candidate Barack Obama shared with the Armenian National Committee of America (ANCA) a strongly worded statement today calling for Congressional passage of the Armenian Genocide Resolution (H.Res.106 & S.Res.106), and pledging that, as president, he will recognize the Armenian Genocide.From the Obama campaign site:

In his statement, the Presidential hopeful reaffirmed his support for a strong �U.S.-Armenian relationship that advances our common security and strengthens Armenian democracy.� He also pledged to �promote Armenian security by seeking an end to the Turkish and Azerbaijani blockades, and by working for a lasting and durable settlement of the Nagorno Karabagh conflict that is agreeable to all parties, and based upon America�s founding commitment to the principles of democracy and self determination.�

I will promote Armenian security by seeking an end to the Turkish and Azerbaijani blockades, and by working for a lasting and durable settlement of the Nagorno Karabagh conflict that is agreeable to all parties, and based upon America's founding commitment to the principles of democracy and self determination. And my Administration will help foster Armenia's growth and development through expanded trade and targeted aid, and by strengthening the commercial, political, military, developmental, and cultural relationships between the U.S. and Armenian governments.I also share with Armenian Americans � so many of whom are descended from genocide survivors - a principled commitment to commemorating and ending genocide. That starts with acknowledging the tragic instances of genocide in world history. As a U.S. Senator, I have stood with the Armenian American community in calling for Turkey's acknowledgement of the Armenian Genocide. Two years ago, I criticized the Secretary of State for the firing of U.S. Ambassador to Armenia, John Evans, after he properly used the term "genocide" to describe Turkey's slaughter of thousands of Armenians starting in 1915.

...America deserves a leader who speaks truthfully about the Armenian Genocide and responds forcefully to all genocides. I intend to be that President.

Now:

Seeking to avert tensions during President Barack Obama's visit to Turkey, both sides are playing down potential fallout from a renewed attempt by some U.S. lawmakers to declare the killing of Armenians by Ottoman Turks genocide.Ahmet Davutoglu, foreign policy advisor to Turkey's Prime Minister Tayyip Erdogan, told reporters on Thursday the issue, which caused U.S.-Turkish relations to plummet in 2007, would not "hijack" Obama's visit early next month.

"Nothing can shadow the success of this visit," Davutoglu told reporters after meeting Obama's national security advisor Jim Jones at the White House. ...

Asked whether Obama's views might have changed, Davutoglu was noncommittal.

"I did not say yes or no," he said. "Of course, I cannot speak on behalf of General Jones, but we went through all these issues in a very friendly and cooperative manner."

Recognizing how sensitive the issue could become in U.S.-Turkish relations, the State Department has avoided comment on the resolution or what the Obama administration's policy is on labeling what happened as genocide.

"I don't want to go any further on it until we have had a chance to take a closer look at it and discuss it within the government, and that's where I'm going to leave it," State Department spokesman Robert Wood told reporters on Wednesday.

He wasn't that unclear a year ago. Via YouTube:

I did not vote for or against candidates last year over the recognition of the genocide; he didn't disappoint me. As Jim Geraghty (no enemy of Turkey himself) often says, all promises from President Obama come with an expiration date. Other candidates have promised the Armenian diaspora recognition when they get into office, only to be disappointed when they get into office. What amazes me is two things: Why the Armenian diaspora continues to let itself be used this way; and the ease with which the State Department -- run by a former senator who sponsored a genocide recognition resolution not so long ago -- can pretend this is the FIRST time they thought about the question.

Public and private responses of culture to recession

As Rick Reilly points out, it does mean you have to watch the Timberwolves.

But at least the T'wolves understand a demand curve: If the demand for your product falls because, say, your best player blew out his knee, or the firing of Matt Millen leaves your GM the worst in professional sports, it's possible the profit-maximizing price for your product fell as well. They might not know Lebron from Love, but seems Wolves management understands dollars.

Not so the city of Chicago, who can't seem to figure out that recessions might be good for museums (h/t: WSJ BotW):

The city is mostly interested in negotiating for free dates from the museum. But the museum has already given away all its admission revenue from February after experiencing increased attendance last year. The Institute had or has a free admission day once a week. Like the T'Wolves, the Art Institute makes available high-priced tickets for those willing to pay, and has historically maintained free days (no doubt in part to its attractiveness to would-be contributors or funds and art exhibits.)Chicago would cut off the free water spigot and other public subsidies to museums that charge more than $10 for admission, under a measure proposed Wednesday in response to the Art Institute's 50 percent hike in its admission fee.

The increase approved last week by the Chicago Park District board would raise the Art Institute's admission fee from $12 a person to $18, a "remarkable jump," according to Ald. Edward M. Burke (14th), chairman of the City Council's Finance Committee.

Less than three years ago, the Art Institute was still one of the few big city museums with no mandatory admission fee. Museum patrons were asked to pay a "suggested" fee. But those who refused were not turned away.

"A family of four going to the museum would have to pay $72, plus parking, plus a Coke or a candy bar. It's becoming impossible for Chicago citizens to take advantage of these cultural institutions," Burke said.

Noting that the Art Institute received a $6.6 million Park District subsidy last year, Burke said, "I know their endowment has probably suffered with the downturn in the economy. But that's no excuse to stick it to the hard-working men and women of Chicago who are already paying taxes that subsidize these institutions who might like to take their kids to see these great treasures."

Those who do not have the money have options of other cultural activities which are free (such as the museum at Northwestern, or the Chicago Cultural Center.) Nobody makes someone go to the Art Institute, but someone makes it pay for water and maintains a monopoly on its provision. It is all pandering, of the same kind as is occurring with AIG, proven by the last line of the Alderman's outrage:

"It's one thing to charge $18 for somebody who's coming here from New Orleans or New York or San Francisco. It's something entirely different . . . to charge $18 to a taxpayer who lives in Chicago, who�s already paying taxes that subsidize these institutions.�And it's entirely another thing, Alderman, to coerce money from Chicagoans to give to a museum when they may lose their job -- they won't get their property taxes back -- all so that you can grandstand to the media about providing access to art.

Media alert: The Ed Morrissey Show

UPDATE: Different show link, and found out he wants to talk Fed. Google for Operation Twist to prepare...

Labels: economics, hot air, Media

Marty gets a pass, for one

My remaining concerns are simple. If there are new rules for "online" media, I haven't seen any. Perhaps we all fall under the umbrella of "Press", but then there remains the issue of updating the language to remove words like "television" and "radio", to be replaced with the more generic term "Press". If the process has not changed and the rules are what they've always been, then will every Journalist who applies for credentials have to wait two months and pester Legislators endlessly until they approve them?So we do not yet know if anything has been done for Dan Ochsner. As Sunshine Week conitnues, let's keep working for equal access to all journalists, regardless of their media. Let's hope that Marty getting a pass and Dan losing his is the result of a process that provides equal access and not because Marty and Dan are on different sides of most issues.

Labels: DFL legislature, Media, Minnesota

Wednesday, March 18, 2009

When you forecast, you will err

An old saw in forecasting: �Give 'em a number, or give 'em a date, but never give them both a number and a date. �If you do, you'll be wrong.

The Obama Administration, less than a week into its Spring Happy Offensive, got a bold fresh piece of reality from one of its allies in the Senate.

With new estimates due Friday from the Congressional Budget Office, the White House is being warned to expect a grim set of deficit projections, adding well over $1 trillion on top of the red ink already conceded in President Barack Obama�s 10-year spending plan.�

�The CBO re-score is going to be an eye-opening event for a lot of people who want to finesse this,� New Hampshire Sen. Judd Gregg told POLITICO. �You cannot finesse the coming fiscal calamity we are facing, the size of the debt in the out years and the size of the deficit in the out years.��

Gregg, the ranking Republican on the Senate Budget Committee, refused to discuss any of the CBO estimates. But behind the scenes, Senate Budget Committee Chairman Kent Conrad (D-N.D.) has begun to aggressively raise warnings with the administration and his colleagues about the data.�

CBO said Wednesday that it has yet to complete its formal scoring of the Obama budget. But some data, including a revised economic baseline, have been provided to Congress, and Conrad appears to be using these numbers to map out where he believes the figures will end up.�

In 2014, at which point the White House projects a deficit of $570 billion, it�s now expected that CBO will show a number in excess of $700 billion. Five years later, in 2019, Obama�s budget concedes that the deficit will have widened to $712 billion; Democrats expect CBO to put the number over $1 trillion....White House Budget Director Peter Orszag, who met with House Democratic leaders Wednesday evening, is himself a former CBO director and veteran of scoring former President George W. Bush�s budgets in the past. Orszag said he had yet to see any of his old colleague�s deficit numbers but said CBO�s economic growth numbers lagged behind Blue Chip forecasts and this would be a drag then on the Obama plan.�

Conrad is adamant that the numbers require budget adjustments: Senate Democrats could be put in the position of scaling back the administration�s domestic appropriations requests. �I�m expecting significant change,� Conrad said this week of the CBO numbers. �I think all of us have a very good sense that they will be more adverse.�

I italicized the key point. CBO is saying it sees the economy as being not as robust as the Blue Chip forecast, which is not as robust as that being offered by the White House (the forecast Orszag is charged with making.) There's nothing up at the CBO's site to tell us what those are. Some Senate Republicans are already slagging on the Obama budget for forecasting a 3.7% GDP growth rate between 2011 and 2015 as opposed to 3.1% for Blue Chip, -1.2% vs -2.6% for 2009 and 3.2% vs 1.9% for 2010. If CBO is even south of the Blue Chip estimates (courtesy U.S. News), it makes life for Orszag very hard and gives a lot of strength to Sen. Conrad, who is quickly becoming the center of the battle over the size of the deficit and the national debt. �Orszag is seen by most as an excellent former CBO head, and an honest broker. �It will do no good to his reputation if his forecast looks too rosy.

It's no small matter; the Senate Republican document claims that the Blue Chip forecast generates a national debt $2.2 trillion higher than that projected by the Obama Administration. �And they are pointing to nervous centrist Democrats who share their concerns. �And now maybe CBO projecting lower growth than even private economists? �For a first budget of a popular president being sent to a Congress of his own party, this cannot be what the White House expected.

Best sentence I read today

C'mon. If suicide were a proper penalty for piddling away taxpayer dollars, the National Mall would look just like Jonestown after refreshments.-- David Harsanyi (h/t: Russ Roberts)

UPDATE: This is almost as good:

I go back to Art Laffer�s four prosperity killers: inflation, higher tax rates, re-regulation, and trade protectionism. You can put a check mark next to each box.Yup.

Fat freedom

The current obesity �crisis� represents a significant triumph for private enterprise and freedom. For the first time in human history, people in most of the world are more worried about the risks of gaining weight than about the risks of starving. But this triumph is being discussed as a crisis which demands government to take action, and that action invariably involves more government restrictions over private enterprise and our freedoms. Unfortunately, the obesity �crisis� is but one of many examples of the successes of our economic system�a system based primarily on private property and voluntary exchange�being treated as failures. Such �failures� are then used to justify government actions that reduce both our prosperity and our freedom.That's Dwight Lee in the upcoming issue of Intercollegiate Review, which is available for a sneak peak. (If, by the way, you're itching to read some good economic principles and have not read Lee before, this search should bring up all the "Economic Notions" columns Dwight did for The Freeman about 7-10 years ago. (They ran for about four years.) Students in my lower-division classes frequently get one of these two-pagers; FEE should make a book of them.)

Lee is of course right: Julian Simon observed that Malthusian starvation is no longer a fact of this planet. It's worth noting that less than a year ago some Nobel prizewinners were whinging about high food prices and possibility of starvation again; most recent long-term and short-term estimates are for lower prices.

Ob: Medicare and obesity, see this from William Niskanen, and on whether they are actually a crisis, well, it looks like the numbers don't support this.

Labels: economics

More bang for your stimulus buck

Today, Sen. Chris Gerlach, R-Apple Valley, and Rep. Steve Gottwalt, R-St. Cloud, have joined with commercial builders to introduce legislation to call �time out� on prevailing wage mandates during budget strife. The bill would suspend prevailing wage for the calendar year following a November budget forecast of a 1-percent deficit or greater.Among other studies cited, Gerlach and Gottwalt offer a 2005 Minnesota Taxpayers Association study that shows that payment of "prevailing wages" as required by Davis-Bacon legislation (such as that proposed in the federal stimulus package) adds 7-10% to project costs. This enriches insiders that work on public projects, many of them unionized, at the expense of those who would work for less and permit those funds to hire more workers.

...Gottwalt said this means the state either pays more for a project, gets less construction for its money, or has fewer workers on the job. Being more efficient will create better outcomes for everyone, he said.

�We can�t cut other vital government services, lay off state employees, and raise taxes while deliberately overpaying to build or renovate buildings,� Gottwalt said. �With the state bonding bills averaging over a $1 billion per biennium, we could save a minimum of $70 million. That�s money that can build more projects and create more jobs.�

Paul Burke, owner of Mike�s Clean Sweep Services, agreed.

�We do the heavy cleaning to prepare the building for occupancy,� he said. �Our company pays good wages: nearly always more than my competitors. We need to do so to keep the best workers. But prevailing wage rates are 40 percent higher than my rates. I have to pass that on through the contract, and that means the project is more expensive, or they use less of my services and I have to hire fewer people.�

�At a time of budget cuts, it just doesn�t make any sense to have a super-minimum wage for state funded construction projects,� Gerlach said. �Our prevailing wage system is deliberately biased to ensure that high wages are paid. How can we deliberately overpay to construct buildings, while laying off the people that were supposed to work in them? The least we can do is suspend the program when we know we have to cut spending or raise taxes.�

It would make some sense if the wages that were required on public projects were those common to a region -- you wouldn't want people getting public money who were paying low wages when the purpose of the project is to stabilize family incomes. But as Investors Business Daily pointed out last week,

At the Department of Labor, two agencies gather information related to wages and labor: the Wage and Labor Division (WHD) as well as the Bureau of Labor Statistics (BLS). It is the WHD that has the job of calculating the prevailing wage under the Davis-Bacon Act.In Minnesota it's worse insofar as the sampling is for a modal wage (according to the MTA study), so one unionized large firm can force a high wage on many smaller firms (which may or may not be unionized.) The gap is probably not 22% in Minnesota, given the MTA estimate of 7-10%, but it is sufficiently high to cause one to wonder how these laws actually help all workers.

A 2008 study by Suffolk University and the Beacon Hill Institute found that WHD prevailing wage estimates were 22% higher than the BLS average reported wages paid in various cities. The reason is madness in the WHD's method.

According to the Suffolk study, the structure of the WHD methodology results in lower participation from small and midsize firms, provides an opportunity for unions to dominate the process of reporting wages, and lets as few as 12.5% of survey respondents set wages for the entire universe of workers.

In contrast, the BLS uses the Occupational Employment Survey, which collects wage data from more than 1.2 million establishments. Thus BLS wage estimates rely on a much larger sample that better represents wages that prevail in the labor market.

I hope Gerlach and Gottwalt go beyond this law and seek a law change that requires payment of median wages rather than the modal standard. It would reduce costs, allow more workers to be hired, and still assure that low wages are not paid on public projects. It's what most states do; time for Minnesota to catch up.

Tuesday, March 17, 2009

Quick note on media bias

- A discussion of Groseclose and Milyo on media bias (June 2004); updated copy of the paper here;

- Daniel Sutter, Cato Journal 2001;

- Does the town of a newspaper determine its bias?

Labels: Media

What happened last time we tried this

More pressure has ensued, and now we have congresspersons contemplating a 100% tax on the bonuses. I'm not even sure that Mr. Liddy in sackcloth and ashes will slake the thirst for vengeance over payment on these contracts.

It is worth recalling however, as a reader wrote me today, that we have been here before. The Clinton Administration in its 1993 tax law change wanted to cap the amount of executive pay that could be deducted against income taxes. My correspondent writes:

There was also a loophole, a provision that said that Bonus Compensation was taxed differently than standard compensation. Bonus compensation under those provisions is fully deductible. That was the year when people like Michael Eisner of Disney got large bonuses for performance. Over time, Executive Compensation was shifted from Salary to Bonuses, and such provisions were written into Executive Contracts and those of other high performing employees. Presumably �Bonus Compensation� was to be tied to performance or certainly used as an incentive to get a star performer to move into a failing area of the business to help �right the ship�. Another point that is sometimes missed is that compensating someone with a bonus is being more responsible to the shareholders because this allows the company to structure its tote sheet in a way to reduce the overall corporate tax burden.I think in fact they get it. One person reported to me that a client of his, who works for a large firm, was asked to move as a division president of a part of the firm that was struggling. The compensation agreement called for base salary and bonus, and that the bonus was to be as a minimum equal to base salary. That minimum was what the fellow received for two years; he got more in year three as the division turned around.

Now fast forward to the �Banking Crisis� and �Bailout Packages� and we have a sudden attack on �Bonus Payouts�. People who apparently don�t understand how business works or how to get top level performers to stick their careers out on the line are attacking people who get such rewards.

A couple years ago, as Democrats were taking office, Business Week discussed the distortion in the structure of compensation induced by the Clinton tax policy.

Bill Clinton had what he thought was a great idea to curb the soaring paychecks of the nation's executives. It was 1991, shortly after the launch of his Presidential campaign, and he had just read a best seller on corporate greed by compensation guru Graef Crystal.

Clinton's brainstorm: Use the tax code to curb excessive pay. Companies at the time were allowed to deduct all compensation to top executives. Clinton wanted to permit companies to write off amounts over $1 million only if executives hit specified performance goals. He called Crystal for his thoughts. "Utterly stupid," the consultant says he told the future President.

"We were trying to shame companies into changing their behavior," says former Clinton senior adviser Bruce Reed. "And companies have been shameless in ignoring what we did." Or perhaps just astute in exploiting the flimsiness of Section 162(m) of the IRS code, as the measure is formally known. Reed acknowledges that the Clinton team deliberately watered down the proposal to make it more palatable by, for example, not applying the performance requirement to the award of stock options.

This is part and parcel of a process we've referred to for years as "the regulatory dialectic." Often the dialectical process is technological in nature, and other times it's provided intentionally by the process, as it was in 1993. The underpayment of base salary was induced, in no small part, by previous fits of populist pique against executive compensation, and now that it produces an undesired outcome -- "bonuses" for executives at failing firms that aren't really bonuses at all. So now we'll respond with some new law hastily written and barely passable as not a bill of attainder, and what will happen? Probably something unexpected, and at some time in the future undesirable. Rinse and repeat.

Labels: banking, economics, politics

The Power of 0

Is there anything that can be done to change this ever increasing mindset of "we can always have our way, spend our way and never be held accountable"?

A simple but effective approach may be to include all the zeroes in these bills, current and future. Far too many people hear "million" and "billion" and "trillion" and simply don't understand the magnitude of these numbers.

Most politicians, under the guise of "caring" ignore the 600 pound gorillas in the room or just push the decision down the road to the next generation or more. So many baby boomers who were raised to disagree with the previous generation and taught they were special, raised another generation that thinks it's perfect. Terrific! Now these same boomers and their kids are putting in place programs that will eventually tax their kids and grandkids forever.

A wake-up call occurred with one of my former students who worked at the Federal Reserve Bank in Minneapolis. His paper draft wrote numbers as: $4.6 billion, $972 million, etc. I asked him to put in the zeroes: $4,600,000,000, $972,000,000 etc. He showed his paper to his boss, a minimum of a 10 year veteran of the Federal Reserve System. His boss was stunned.

If someone working with that much money gets stunned by looking at the zeroes, maybe, there is hope that if we include the zeroes in all these government programs, we'll wake up and take measures to protect our nation, its economy and, as Dems like to say, "the children." For now, our kids are on the hook for a long time for Irrational spending by their parents.

Labels: taxes

Monday, March 16, 2009

Call It What It Is

What's my point?

The press likes to cover up when Dems makes mistakes, get in trouble with the law, go back on their word. The press will use the name of the politician but not identify the party. However, if a Republican messes up, the party label is always included.

This practice is unfair to the population in general because it hides bad behavior and often implies that only Republicans make errors. Therefore, my recommendation to all who write about politics is to include the name of the party of the person being discussed, either side. Our writing is for all people, not just the "insiders." It's time everyone knew who was making the mistakes or reneging on their word.

Labels: politics

Happy Sunshine Week!

In an apparent effort to avoid being caught on candid camera, the House tried to limit audio and video recording and photography of public hearings in House Committee hearing rooms.Amen to that. Gary Gross provides additional coverage.Yes, that�s right. They sought to prevent reporting to the public events at public hearings.

On the Senate side, local conservative radio personality Dan �The Ox� Ochsner had the DFL-led Senate deny him annual media credentials this session despite having held them several other sessions.

Capitol folks have tried to justify these actions on themes such as �not enough room,� �we�re updating our rules� and �they don�t regularly cover the Capitol.�

Sorry, but they are missing the point. Legislators are conducting the public�s business, not the media�s business. The only rules needed are those that embrace openness � no matter who is asking for it.

Labels: DFL legislature, free speech, Minnesota

The return of Regulation Q?

A better idea, even Warren Buffet seems to agree, might be to halt the visible taxpayer handouts on the banks' asset side. Let the massive guarantees already in place on the banks' liability side do the work of bailing out the system via the fat spreads banks are now earning above their government-guaranteed cost of funds. The advantage: It's relatively invisible and/or can be claimed that it's being done for the good of depositors, not bankers.From Holman Jenkins in this morning's Political Diary (subscription required.) One hopes this does not mean a restriction on competition for deposits; our experience with Regulation Q and the savings and loan debacle should be instructive. I think it instead will mean the continued provision of cheap credit via the Fed; Bernanke said last night as much.

Mr. Bernanke's TV appearance obviously took place with approval from the White House...I don't know how Jenkins knows that, but if so it's distressing to see Chairman Bernanke toss away the Fed's independence quite so blatantly. Cooperating is one thing, seeking approval is quite another.

Labels: banking, economics, Federal Reserve

Summers, Bernanke, and the new Obama song list

Our single most important priority is bringing about economic recovery and ensuring that the next economic expansion, unlike it�s predecessors, is fundamentally sound and not driven by financial excess.

This is Larry Summers Friday at the Brookings Institute. Set aside the fact that he is dismissive of the Bush expansion that was "driven by financial excess". If you are going to say that, you'd have to include the late 1990s tech bubble when the Treasury secretary was the same Larry Summers. And set aside the errant apostrophe. (Grading papers this weekend, guess I'm hypersensitive.)