Monday, March 08, 2010

The cost of Northstar

Metro Transit has set a goal of 897,000 riders in 2010. Monthly ridership goals begin at 45,000 in January, climbing to 71,600 in June and ramping up to 102,000 in November. In the first three full months of operation, ridership has averaged around 45,000.While I won't quibble the data -- I haven't checked every one of their figures -- let's take it as correct. Let's also assume that some of those 45,000 people are substituting Northstar for their cars. Certainly for some it's greater value than for others, and their benefits should be accounted. And the benefit of less congested roads and less maintenance needed therein should be counted. Do we think this will account for the entire amount? As I often say about cost-benefit analysis: We usually can measure the costs pretty well but we measure the benefits pretty poorly. It will be little more than a SWAG to get the benefits. I do know this press release doesn't get all the benefits written down yet.

Officials estimate passenger fares will only cover an estimated 21% of Northstar�s $16.8 million 2010 operating budget, requiring taxpayers to subsidize the difference. For every $14 round trip ticket purchased between Big Lake and Minneapolis, taxpayers kick in an operating subsidy of $29.66 per ticket to keep the trains running. Total operating cost per round trip: $43.66, based on Metro Transit�s operating $16.8 million operating budget and projection of 897,000 riders.

Yet the taxpayers� ticket to ride on Northstar is far higher when you take into account the amortized $317 million capital costs - a combination of federal, state, and local funds � that it took to build the line. Using a standard federal government formula, Northstar�s capital costs come to $25.3 million annually.

Thus, the true taxpayer cost of operating Northstar is about $42 million annually: $16.8 million in operating costs and $25.3 million in capital costs.

I still would argue that if the elasticity of demand for Northstar riding is sufficiently high, we should lower the price of the ticket. Would FFM agree? I'll have to get them on the air some day to find out.

Wednesday, March 03, 2010

Budget fun starts soon; questions abound

OK, that's all the politics I'll do. Here's two more detailed parts of it if you want to get your hands dirty.

There's the ongoing GAMC fight, and the full forecast tries to add some instruction on this issue. If you read the full report, much of the benefit to the budget was foreseeable from a federal program that eases Minnesota's cost of Medicare and Medicaid. You will not get that money next time around, so it will make the 2012-13 deficit look a bit worse. As we knew would be true, unallotment doesn't help you at all with the out-year estimates.

The $2.5 billion in spending reductions made through unallotment do notMMB's report says the entire amount of MinnCare needed to take care of those moved from GAMC is reflected in the budget at p. 53-54. Wonkier types should read that page very carefully. I am not positive this is right, but it makes some statements, like that of Rep. Larry Haws, look like it's working with incomplete information :

become permanent reductions that continue in FY 2012-13. The planning estimates include complete repayment of K-12 school aids deferred in FY 2010-11 ($1.163 billion) and no repayment of the K-12 property tax recognition shift ($564 million). The projections do not include reinstatement of funding for the General Assistance Medical Care (GAMC) program that was line-item vetoed in FY 2011. If continuation of the program at current levels were assumed, an additional $928 million would be required in the 2012-13 biennium.

The Legislative GAMC solution is more cost-effective and efficient than the Governor�s auto-enrollment plan that will drain the Health Care Access Fund to the point of bankruptcy and exacerbate the state�s budget deficit. Minnesotans can�t afford the Governor�s plan or his veto pen. The clock is ticking and the poorest of the poor and sickest of the sick need us to breathe parliamentary live back into the GAMC solution. I will encourage House leadership to bring people back to the table.Here's the problem, based on discussion with sources and on documents we can see. One reason this was vetoed was that the Legislature's solution, according to Gov. Pawlenty's veto letter, used $170 million of money that he had already designated to close off the deficit in the current biennium. It also cuts provider reimbursements (at least until the hospital lobby gets around to pressuring for that money in later legislation.) Then there's this $928 million in the budget document. I'm still working on other leads to see if someone can get this explained to me better, but that appears to be an extra billion in deficits over the next three years plus change. The transition to MinnCare appears to add $766 million between current and next biennium, so that's a savings. It looks like two gross figures to me, and the MinnCare one looks smaller. I'm open to being persuaded differently about that, but I think I'm right.

Revenues are a little down from November forecast because, while GDP growth has been adjusted up to 3% from 2.2% for 2010, they've cut just a bit the wage projection. Take a look at this passage from page 38:

Global Insight expects growth in U.S. wages and payroll employment in 2010 to be stronger than they factored into their November baseline forecast, while MMB�s outlook for Minnesota employment and wage growth in 2010 has weakened modestly.Lower wages drive a lower income tax forecast which makes the deficit larger. Tom Stinson is up here tomorrow for Winter Institute, and I intend to ask him about this sentence to get it clarified. Why would Minnesota's wage growth lag the nation's? I have some ideas why it might be true, but it's not my sentence and I'm not sure I would write something that strong. And they wrote this before data revisions from BLS and DEED came out yesterday. They note that the revisions might change their view. If the answer is at all interesting, I'll tell you Friday.

Monday, February 22, 2010

You got a license for that moonwalk, bub?

S.F. No. 1590, 1st Engrossment ... Posted on Feb 22, 2010 A bill for an act relating to consumer protection; protecting customers from injuries resulting from use of inflatable play equipment used for commercial purposes; requiring the presence of trained supervisors and liability insurance;proposing coding for new law in Minnesota Statutes, chapter 184B.And, of course, it'll cost you:

Subd. 6. Registration required. An owner of an inflatable that is subject to subdivision 2 must obtain and maintain a current registration with the commissioner of labor and industry. The registration information must include the name, address, telephone number, and e-mail address of the owner, the street address of each facility at which the owner regularly provides inflatables for commercial use in this state by others, and a current insurance certificate of coverage proving full compliance with subdivision 5. The commissioner shall issue and renew a certificate of registration only to owners who comply with this section. The commissioner shall charge a registration fee of $100 for a two-year registration designed to cover the cost of registration and enforcement. The registration certificate shall be issued and renewed for a two-year period.The insurance is for a $1 million policy ($2 million aggregate) and must be purchased from a Minnesota-approved insurance company. So all you carpetbagging bounce house operators, we're wise to you! We're happy to pay more for a better Minnesotan moonwalk amusement.

My guess is this bill is really meant to go after people who rent them for their kid's birthday party. Here's a site that goes on and on and on and on about accidents from them. Nothing like a legislator who protects moms and dads from their own stupidity in putting an inflatable bounce house up in a 30 MPH wind.

(h/t: Sheldon Anderson.)

Labels: Minnesota

Tuesday, February 16, 2010

Which spending limitation amendment?

... we are offering a proposal in the current legislative session to let you vote on a constitutional amendment that would restrain state spending to the amount of money actually collected during the previous budget. Apply this concept to your own situation: If you make $40,000 this year, you don't set a larger budget for next year based on the possibility that you will make more money. You certainly can't storm into your boss's office during a recession and demand a 20 percent raise to meet your lofty spending visions. But that is exactly what government does. It sets a budget based on what it hopes to have, and comes calling for more of your money if that hope turns out to be wrong.Which sounds lovely as far as it goes, but what follows next is troublesome.

Our amendment would inject reality back into the budget process. But unlike attempts in other states, we would not be backing ourselves into a corner. On the occasion that government should take in more than it spends, the money would be used to build up rainy day funds, given back to taxpayers or spent on meeting a one-time need, like repairing a bridge or a building. That would be the case under the most recent budget forecast, which shows future revenue exceeding current spending by nearly $2 billion. The key is the Legislature would maintain the flexibility to use the surplus for one-time expenditures as it sees fit. The last time the budget had a surplus, in 2007, the money went primarily to support on-going spending that we can no longer afford. Had it been spent on one-time construction or maintenance costs, our spending problem would be less severe and our infrastructure much improved.The government currently budgets for repairs and maintenance. It takes nothing to shift spending so that all of those maintenance expenditures show up in extra monies in one year and then put into continuing expenditures in subsequent years. I can also imagine DFLers complaining that maintenance of our bridges and roads depends on the state of the economy.

Giving any legislative body flexibility is unwise, as the history of government spending has chosen. As I wrote last time, this formula assures higher spending when times are good, and a reason to hold huge reserves to prevent any cut in government's role in the economy when recessions force a re-evaluation. When I asked gubernatorial candidate Marty Seifert about this amendment he indicated he thought it would encourage more spending in boom times than wise. A $5 billion deficit for a future biennium focuses the mind of the Legislature and the next Governor to think about what is sustainable. Why not keep the legislature constantly focused on that sustainable level?

On Rod Grams' radio show this morning we talked about this very issue. I suggested there that the only way to hold the government to a spending limit is to give them a real limit, established beyond their control and without wiggle room. There are models around us right now: Kansas has a proposal before its legislature to restrict growth of spending to inflation only. Other variations are out there. A population-and-inflation limit provides a slow steady increase while holding the real cost of government per capita constant. If government can make itself more efficient it can generate new public goods. Any funds obtained in excess of that limit can be placed in the rainy day fund or returned to taxpayers only. There's ample lesson from California's Prop. 4 to tell us what happens when you let the legislature and governor game that system for spending on designated areas. So don't.

Friday, February 12, 2010

Don't feed the bears

Recreational wildlife feeding would be banned in Minnesota for four months each year under legislation being proposed by the Minnesota Department of Natural Resources.You have a budget to balance, fellas. What is the burning desire to deny corn to Bambi?

Exceptions would be made for farmers, bird feeders, bear hunters and trappers, but the legislation would prohibit placing grains, vegetables or other feed for wildlife from Sept. 1 to Dec. 31.

The goal is to stop people from feeding deer, an activity that leads to car collisions and encourages illegal deer baiting during hunting seasons, DNR officials said.

"Wildlife and deer don't need supplemental food at that time of the year," said Maj. Rodmen Smith, manager of operations for the DNR's Division of Enforcement. "This will solve a lot problems with people attracting deer to their property, and it will clear up loopholes in the baiting law."

I don't doubt the issues Maj. Smith names are real issues. What I doubt is that this is a good use of a DNR officer's time. "Did you put this food here, son?"

Government now thinks it can control which animals get to eat, and when. Whatever did they do when the Minnesota Legislature didn't exist?

Labels: it's the spending stupid, Minnesota

Thursday, February 11, 2010

Tax migration and context

But meanwhile, in a new study released yesterday by the Freedom Foundation of Minnesota, two researchers looked at the IRS' data on income tax filings and returned a strong conclusion:

From 2002-2009 Minnesota lost an estimated 54,113 residents to other states, according to the new report, Minnesota�s Out-Migration Compounds State Budget Woes. These out-migrants also take their incomes with them. Between 1995 and 2007, the total amount of income leaving the state was at least $3,698,692,000 on which state and local governments would have collected an estimated $423,317,000 in additional taxes.For example, in 2007 -- the last year of their study, a net 4,428 taxpaying units left the state, and took $378,757,000 in AGI with them. By aggregating up the thirteen years of study they find that a total of $2.548 billion in additional taxes would have been collected. That's of course over 13 years, a period in which we would spend maybe 80 times that? I would have liked that number put in context, just as the income data should be put in context of state personal income ($216,436,888,000 in 2007, to put it in the same context the FFM study does.)

What caught my eye as well was their ability to identify where the taxpayers moved to. The top five destinations of out-migrants were Arizona, Florida, Colorado, California and Texas. Four of those places are very warm. We talk about the low taxes of South Dakota, though on net 1,322 taxpaying units moved TO Minnesota. But on net more AGI left than came. What was missing here was an attempt to tease out the effects of other factors they identified like weather or cost of housing. The study shows these factors as important, but doesn't get relative importance of these additional factors. That requires a regression analysis, which that study chose not to do.

But this is a very interesting and worthy study. It uses actual tax return data rather than a survey or the loose proxy of moving vans. It can measure income flows separately from people flows. And it fits the theory that people are sensitive to the cost of government.

Labels: economics, Minnesota, taxes

Wednesday, February 10, 2010

I'm persuaded by your argument

"So, son, did you build a road today?" That's a question Ward Cleaver never asked the Beav.He's right of course: Government is NOTHING like a family budget. They're not even alike in how they take money. The editor says the family "takes money", by which he means the family needs an income. It's not just a matter of balancing a budget. Unlike the state of Minnesota, the family can conceivably borrow past the end of a biennium. But in the long run it must balance. And how does it get its income? By persuading someone to hire one of the family's resources -- the labor of one of its members, or its land and buildings, or its savings and perhaps machinery. The person it persuades believes it receives something of greater value for something of less value. So does the family.

But it's a question politicians are beginning to ask as an election year begins.

It seems that many politicians love the analogy of government's revenue and spending plans being like a family budget.

And my response is: Government is nothing like a family budget.

Excuse me. I should say, there is a similarity: They both take money.

The government's budget is nothing like that. It can force others to lend to it, as the current state budget forces school districts and its universities to do so. It can impose taxes, which involve coercion rather than persuasion. Its coercion may take something of greater value and convert it to something of less value; in fact, more often than not, it does. And it can claim some moral high ground while it coerces, claiming to do it for "those less fortunate" or "the children." My family could persuade a few dollars from people through begging. The government does not stand on street corners.

So good job, Winona Daily News.

Labels: it's the spending stupid, Minnesota, taxes

Tuesday, February 09, 2010

Lipstick on industrial policy

I say "get religion" because this is not the Ann Lenczewski I kind of admired last year, when she had this to say in an interview with Steve Perry:

PIM: You�re talking about loopholes and exemptions that principally benefit upper-bracket people. Could you give me a couple of examples?Emphasis added. She is now willing to sponsor legislation that spurs "angel investment" ... but the angels only visit those "in high tech, manufacturing, or green businesses with fewer than 100 employees and less than $2 million in gross receipts." She's now putting "certified historic projects" for rehabilitation ... certified by whom? Who will "government playing king" take money from when she says she will "conform" REIT income to federal taxation? And what kinds of jobs are being created by using state monies for Mall of America? I'm saddened by this because I thought she had seen the light given the Perry interview. I am sure she prefers a higher tax rate than I do, but we both prefer (or preferred) a flatter tax base.

Lenczewski: There are like 25 things that I�m repealing, and they do different things. Some of them aren�t just helping wealthy folks. Some of them aren�t working at all, no matter who they�re intended to help�for example, the long-term health care credit. That�s intended to get people to buy long-term health care, and what it�s really doing is costing the state a ton of money. It�s a net loser, it�s completely not working. I heard a Harvard study at the National Tax Association showing that states doing this are just nuts, because they�re net losers.

So I�m repealing some things that don�t work, and then I�m repealing some things that are discretionary ways of saying, we�ll give you tax credits for certain activities but not for others. It�s sort of government playing king. .And then there�s a whole bunch of things for people who are high income-earners. We�re not getting rid of them entirely; we�re still going to keep them for people of limited means, but we�re going to turn them into a credit.

Gary Gross (whose link to Lenczewski's release inspired this post) properly chastises this effort:

David Strom was right when he told KSTP�s Tom Hauser that tax credits was a new way for government to pick winners and losers. I�ve said before that government�s record at identifying the next Microsoft, the next Fedex or the next Dell has been terrible. Still, the DFL insists that it knows best.Link added. Don Boudreaux also points out the folly of this new wave of industrial policy at the national level, arguing that the government's choice of winners depends on how many jobs it creates or saves rather than how much output is made.

Perhaps that is because a widget doesn't vote, but a worker does.

And worse, when you have a government picking winners and able to solicit donations from the contestants, you have a powerful incentive for corruption. Or at least, a little humor.

Labels: economics, Minnesota, taxes

Wednesday, February 03, 2010

Great news for the Minnesota economy

South Dakota is contemplating economic suicide.

After a number of years of finishing second to Wyoming, South Dakota had the best business tax climate in the nation. Perhaps owing to their humble nature, South Dakota seems to have its minds made up to not repeating their performance. HJB 1002 if passed would impose a 6% corporate tax.Here's one of their gubernatorial candidates pitching the idea.

Tuesday, February 02, 2010

Caucusing, and thanking those who give them

We New Englanders know a thing or two about participatory politics. Most of our towns have Grange Halls where a town meeting happens annually. Most of the town's major political decisions happen there. But it's not the same as a caucus. You talk about resolutions, things that matter greatly to you. You talk about candidates and maybe meet a neighbor who's decided to take the plunge and run for a legislative office. One of them may be sitting next to you tonight. We live in a republic, I tell my students, but there are places where democracy happens, and caucus night is one of them. Maybe the biggest.

But they don't happen spontaneously. There are people working hard to make that caucus happen. This year, for the first time, and as result of Mrs. S becoming part of the local party leadership, I've been able to see up close the work it takes to put on a caucus. And it's much more than I thought. Training conveners -- I'll do that for the first time tonight -- hiring the hall, getting maps so people find their precincts ... it's more than I had imagined. I spent a few hours making copies, running convention calls to other precincts, stuffing envelopes, etc., with several people I now can call a friend who I didn't know before. I have found it rewarding as well as tiring. And I know some of those friends worked many more hours than I did.

When you go to your caucus tonight -- and you should, no matter your party -- thank the people who work the registration table and the people who bring the caucus together. They worked hard to give you the chance to exercise the most democratic part of our political process.

Monday, February 01, 2010

Your role in transparency

The Minnesota Legislature hopes that the process for making state administrative rules will be open and transparent. In fact, Minnesota�s Administrative Procedure Act is structured so as to increase the public�s access to government information, improve public participation in the formulation of administrative rules and boost the accountability of government agencies.The judge writes, "Mindful of your own work in educating the public on economics -- and particularly "public choice" -- I thought that this news would be of interest you and your NARN audience." I quite agree. $20 to register from the link above, including a meal, seems money well spent.

The MSBA Administrative Law Section will host a training session on citizen involvement in the rulemaking process. This course will explore how citizens can improve the effectiveness of their comments on proposed rules and a set of best practices for government officials when reviewing this important feedback.

Friday, January 29, 2010

Saved or created: one consultant

Plans to bring high-speed rail to Illinois, Minnesota and Wisconsin got a major boost Thursday from President Barack Obama administration�s commitment of $823 million to get projects rolling.Hot damn! Choo-Choo Jim must have come through for us. And $823 million sounds like a lot of money. Except that ... it's not for us, exactly.

The money comes from $8 billion set aside from the economic stimulus package passed last year to develop the nation�s first intercity high-speed rail service, a top priority for Obama.Obama announced the funding during an appearance with Vice President Joe Biden in Tampa, Fla. A high-speed rail project linking Tampa and Orlando was awarded $1.25 billion.

In all, 13 rail corridors involving 31 states will receive funding.

Of the funding announced Thursday, $810 million is planned to go toward building rail service between Madison and Milwaukee, and $12 million is designated for the Milwaukee-Chicago corridor.$1 million for the home state? Really? This has transportation advocates fuming, it seems. Noted progressive activist Dave Mindeman is steamed:

An additional $1 million is planned to go toward developing the Madison-Twin Cities line.

$1 milllion for a study? That's like saying..."thanks for trying, we'll put you on our mailing list."You don't even build anything with that $1 million. It's for a study, which would do what? Let's ask Assistant Choo-Choo guy Tim Walz:

"I have always advocated for a data driven process to determine the route for high-speed rail that's in Minnesota's long term best interests," Congressman Tim Walz, vice chair of the House Transportation Committees Subcommittee on Pipelines, Railroads and Hazardous Materials said in a press release. "This funding will be used to study possible routes that Minnesota outlined in its recent Statewide Rail Plan - including the River Route and the Rochester Route and put Minnesota in the running for future rail construction funding that will create jobs across our state."The rest of Bob Collins' reporting describes the back story -- infighting between the Rochester/Mayo coalition that wants the train to go through Rochester that requires more track to be laid down. There is an existing line through Winona that takes you up the river directly to the Twin Cities; going by Rochester compels you to continue on to Owatonna before you can pick up a line to St. Paul unless you lay all new track. (I base that on this map of Minnesota rail lines.) The million dollars basically buys a consultant to write a report while the two sides in this battle continue their argument.

I wonder what the conversations between Oberstar and Walz are like?

UPDATE: How could I have forgotten? Stephen Karlson has a view from the other terminus.

Labels: economics, Minnesota, trains

Thursday, January 28, 2010

From TARP to SEED

It's not completely horrible, though. I did some reading on the research regarding wage subsidies, and at least one recent study seems to find some positive effects of it. Maybe they're not very large. It appears the best results come from Germany. What we don't know is whether the money could be better spent elsewhere, says Paul Walker. Nor do we know why the Congress seems to continue to think TARP repayments are a windfall.On the Senate floor, Franken proposed using $5 billion from the Troubled Asset Relief Program to subsidize job creation in the private sector.

"The SEED Act will incentivize rapid job creation by offering small and medium-sized companies, and non-profit companies, a direct wage subsidy to hire new workers and expand their operations," Franken said.

The job creation subsidy would be available for 50 percent of wages, up to a $12 per hour subsidy. The employer eligibility period would last 12 months.

Franken also proposes re-allocating another $5 billion in TARP funds to provide states, local governments, and tribes with grants for green job creation.

One wonders -- if reducing the net cost of labor to business is a good idea, why is increasing the minimum wage a good idea?

Labels: economics, Franken, Minnesota

Tuesday, January 26, 2010

The resource curse, there and here

Our finding that oil windfalls translate into little improvement in the provision of public goods or the population�s living standards raises a key question � where are the oil revenues going? As a way of addressing this question, we put together a few pieces of tentative evidence:

- First, oil revenues increase the size of municipal workers� houses (but not the size of other residents� houses).

- Second, Brazil�s news agency is more likely to carry news items mentioning corruption and the mayor in municipalities with very high levels of oil output (on an absolute, though not per capita, basis).

- Third, federal police operations are more likely to occur in municipalities with very high levels of oil output (again in absolute terms).

- And finally, we document anecdotal evidence of scandals involving mayors in several of the largest oil-producing municipalities, some of which involve large sums of money.

More locally, consider a place that has a large power plant, say, Becker or Monticello.) Those plants generate a good deal of revenue to the municipality and in good times the property tax revenues permit cities to add lots of services, and hold down property taxes for residents. But they also become very dependent on that money and when times get bad it creates a lot of stress. (The city administrator in Becker blogs and here's what he's written about taxes from the coal plant there, called Sherco.)

More locally, consider a place that has a large power plant, say, Becker or Monticello.) Those plants generate a good deal of revenue to the municipality and in good times the property tax revenues permit cities to add lots of services, and hold down property taxes for residents. But they also become very dependent on that money and when times get bad it creates a lot of stress. (The city administrator in Becker blogs and here's what he's written about taxes from the coal plant there, called Sherco.)But the taxes are the result of intense lobbying between the power or oil companies and the state. The state forces different property tax rules on the localities here in Minnesota and then the cities have to lobby back (from the rest of us) to get the money taken away (to make energy firms richer.) This story replays not just in Minnesota but in resource-rich states like Alaska, where dependence on oil firms colors the politics that gave us Ted Stevens and Sarah Palin.

I'm very happy to join my friends in talking about nuclear power, but explain to me why that conversation between state and corporation should produce a deal any better for the taxpayer than having the government talk to Zygi Wilf?

What is needed, as always, is competition. The resource curse happens in a world where the resources are monopolized by the government (I struggle to think of a place where this isn't so. Can anyone name one for me?)

Labels: economics, Energy, Minnesota, rentseeking, sports

Thursday, January 21, 2010

Minnesota job loss 3% for 2009

�December�s results are consistent with the ebb and flow of a recovering economy. We expected the pace of recovery would be slow, although generally the Minnesota economy is on the mend and should continue to improve in the coming months,� DEED Commissioner Dan McElroy said.The decline in St. Cloud for the 12 months to Novmeber 2009 was 3.6%, so the rate of decline is slowing, but at a job loss of 3,100 it is still the largest yearly decline in St. Cloud since we started tracking the data in 1988.

...In the state Metropolitan Statistical Areas, over-the-year job losses occurred in the Duluth-Superior MSA (down 3.4 percent), St. Cloud MSA (down 3.1 percent), Minneapolis-St. Paul MSA (down 2.7 percent) and Rochester MSA (down 0.5 percent).

Labels: economics, Minnesota, St. Cloud

Monday, January 18, 2010

Taxapalooza

- Increase the individual income tax to 9 percent (House) and 9.25 percent (Senate) on the top tier of earners

- Increase the current income tax rates for all income taxpayers (Senate)

- Eliminate the tax deduction for mortgage interest for many homeowners; replace the deduction with a targeted credit

- Eliminate the tax deduction for real estate taxes

- Eliminate the tax deduction for charitable donations; replace with targeted credit

- Eliminate the tax credit for education expenses

- Double the gross-receipts tax and increase the excise on alcohol and beer, and more than double the excise tax on cigarettes

- Impose a surcharge on lenders charging interest greater than 15 percent

- Increase commercial and industrial property taxes by a projected $300 million in the 2010-11 biennium

- Allow counties to exercise the option to impose a � cent sales tax to compensate for loss in county aid

- Eliminate the tax exemption for interest on municipal and 501(c)(3) bonds

- Eliminate the foreign royalty subtraction and foreign operating company provision in corporate income tax

- Eliminate the credit for organ transplants

- Tax as income a portion of most tax increment financing and tax abatement subsidies

- Tax sales of remote sellers by expanding the definition of a company's nexus

- Impose a sales tax on digital downloads

- Eliminate some of the incentives for JOBZ, or eliminate the program entirely

- Allow the creation of "street improvement districts" by cities to assess fees at uncapped levels for transportation improvements

About that Vikings stadium article

Your child is threatening to leave if you don't let him go out with his friends tonight. Your decision whether to cave in to this kid or not depends in part on whether you think he'll carry out his threat. If you think the threat is real, you may be more willing to relent. (Of course not me. I'm a hard dad.)

Likewise, we've been through this with the Twins. They at one time told us they were leaving, taking their marbles and going to Charlotte. While some fans panicked, many others and the state of Minnesota called Carl Pohlad's bluff, which ended up failing. It took another 8 years before the papers got signed for a new Twins stadium. Interestingly, at that time there was no threat of leaving.

This matters greatly to the reaction of people to a survey asking "how much would you be willing to pay to build a new stadium for the Vikings?" When such a survey was done for the Jacksonville Jaguars, they got a very low number (about $36 million, well below what Jacksonville subsidizes for the Jags.) The authors of the Viking study point out that at the time the Jag survey was done the threat of Jacksonville leaving had disappeared. So you had to ask Viking fans at the time of a threat. The use of 2002 in that Viking study is not an accident. It's the time Red McCoombs was threatening to sell the team to an out-of-state party because his in-state offers were too low.

The answer that the paper gives of $515 per household overstates the case the authors made, since building the new stadium costs them a perceived amount of future income as well. The authors measure this as well, and the net-of-stadium benefit to Minnesotans is $292. They might be willing to pay this if you have a credible threat of leaving ... which is why sports leagues go to such lengths and torture fans. It's a pretty ugly thing to do to people, but when the payoff is that large, it's hard to pass up that temptation.

There are many people skeptical of this paper's methodology, but it continues to be used in cost-benefit analysis to measure the benefits of public goods, and if anything I think the authors over-sampled non-metro population to be sure they were a little conservative on their value. If you compare that number to today -- when while Viking fans are giddy, they do not think the Vikings will leave next year -- you will find it an obvious exaggeration. That's not what the paper measured though. It is more the answer to the question "how much would each Cleveland resident have paid if they saw Modell closing the door on the van?" Doesn't sound as far-fetched then, does it?

Tuesday, January 12, 2010

Wages fell more than employment

Data now available from the U.S. Department of Labor�s Quarterly Census of Employment and Wages (QCEW) shows how the Great Recession�s impact has been distributed across the state. The QCEW data show that between the second quarter of 2008 and the second quarter of 2009 employment in Minnesota fell by 3.6 percent and total wages paid by the employers fell by 5.0 percent.From the new Minnesota budget update. The data for QCEW for Minnesota is here. (National data is due later this week.) The budget update showed income taxes were almost equal to forecast for November and December, but the latter was set to show very low growth in Q4 anyway. We're still way down on sales tax receipts, which indicates still to me a slow first half of 2010, inventory adjustment or not.

Job losses exceeded the state-wide average in central Minnesota, northeast Minnesota, and the Twin Cities region. Job losses in southwest, southeast and northwestern Minnesota were less than the statewide average, but still exceeded three percent.

Total wages paid by Minnesota employers fell by five percent over that same period. The declines in wages were largest in the twin cities and northeast Minnesota. Total wages grew slightly in southeast and southwest Minnesota even though the numbers of jobs declined.

Thursday, December 31, 2009

New QBR is up

Despite continued weakness in the regional labor market, St. Cloud-area firms are finally beginning to expect an improved future economic outlook. While it is still too early to declare that the local recession has ended, this improved outlook does suggest that 2010 will be a year of recovery and expansion for area firms.Full report available from here.

The area economy appears to be following the path of national economic activity. A large majority of economists agree that the national economy emerged from recession at some point in the second half of 2009. While national labor market conditions remain weak, U.S. production, income and sales data indicate a national recovery has begun. While the lags on the availability of data on local income, sales and output are long, the results of this quarter�s St. Cloud Area Business Outlook Survey provide some evidence that area firms will begin to enjoy this recovery by the middle of 2010. For example, the outlook for future business activity is the highest it has been in the fall survey since fall 2006.

Local labor market conditions remain weak. St. Cloud employment declined by 3.4 percent over the year ending October 2009 as only the leisure and hospitality

sector experienced employment growth over this period. The St. Cloud Index of Leading Economic Indicators continued to slide, though at a slower rate. The latest reading of the Probability of Recession Index predicts that it is 73 percent likely the local economy will be in recession in February to April 2010.

Thirty-four percent of surveyed firms report an increase in economic activity over the past three months, while 25 percent report a decrease. This is a large improvement over the survey from one year ago...

Labels: economics, Minnesota, St. Cloud

Gearin punts

Here's the full order. The part quoted by the newspapers is indeed one of the points of contention.

"The authority of the Governor to unallot is an authority intended to save the state in times of a previously unforeseen budget crisis," wrote Gearin. "It is not meant to be used as a weapon by the executive branch to break a stalemate in budget negotiations with the Legislature or to rewrite the appropriations bill."The sentence appears on page 6 of the order. The full paragraph is as follows:

In the beginning of June of 2009, Defendants took the steps to unilaterally balance the budget by unalloting specific programs enacted into law during the session. By exercising his unallotment authority to apply to reductions in revenues that were determined by a forecast made before the budget had even been enacted and by not excluding reductions that were already known when the budget was enacted, the Governor crossed the line between legitimate exercise of his authority to unallot and interference with the Legislative power to make laws, including statutes allocating resources and raising revenues. The authority of the Governor to unallot is an authority intended to save the state in times of a previously unforeseen budget crisis, it is not meant to be used as a weapon by the executive branch to break a stalemate in budget negotiations with the Legislature or to rewrite the appropriations bill.I believe the facts presented beforehand illuminate Judge Gearin's reasoning. It seems more a matter of timing to her. The biennium had not started. And yet the law doesn't require one to wait for a forecast. The trigger for the unallotment process is a letter from the Commissioner of Finance. The House Research Department reviews this:

Subd. 4. Reduction.(a) If the commissioner [of finance] determines that probable receipts for the general fund will be less than anticipated, and that the amount available for the remainder of the biennium will be less than needed, the commissioner shall, with the approval of the governor, and after consulting the legislative advisory commission, reduce the amount in the budget reserve account as needed to balance expenditures with revenue.Judge Gearin says the law has been determined constitutional, citing Rukavina v Pawlenty. I talked about this in June. (Note the link to the case in the June article has gone dead -- the one above worked this AM.)

(b) An additional deficit shall, with the approval of the governor, and after consulting the legislative advisory commission, be made up by reducing unexpended allotments of any prior appropriation or transfer. Notwithstanding any other law to the contrary, the commissioner is empowered to defer or suspend prior statutorily created obligations which would prevent effecting such reductions.

In the Rukavina case the Court of Appeals stated: "We conclude that MinnStat 16A.152 does not reflect an unconstitutional delegation of Legislative power, but only enables the Executive to protect the State from financial crisis in a manner designated by the Legislature." That remains the settled law in the State of Minnesota, and it would be improper for this Court to revisit the constitutionality of the unallotment statute itself. It is constitutional. It was the specific manner in which the Governor exercised his unallotment authority that trod upon the constitutional power of the Legislature, and the Legislature alone, to make laws that, in the Court's opinion, was unconstitutional. (p. 4)She then reviews the history of the 2009 session, noting the Governor Pawlenty signed the HHS appropriations bill, simultaneously noting that he would unallot to balance the budget if he did not get a balanced one. This came days after telling the Legislature that he would not accept a tax increase (see his letter of May 8 in re the tax bill.) After the announcement the Legislature and the Governor passed budget proposals back and forth. The Legislature then does three things: fails to override the tax bill veto; fails to override the GAMC line-item veto; passes a new tax bill unveiled a mere two hours before adjournment. The Legislature was given time to act to come to an agreement with the Governor. They did not agree.

Most of that history does not appear in Judge Gearin's order. She mentions the second revenue bill like it is well-formed, with no requirement upon them to bargain in good faith with Pawlenty. The burden of bargaining in good faith seems put too much on him.

Timing appears to be an issue for Judge Gearin, and on this point I think a valid concern is raised. The trigger letter from MMB Commissioner Tom Hanson is dated June 16. Note that there is in the law NO requirement of waiting for a forecast from Finance or the state economist, just this letter; nowhere does the law say the Commissioner must wait for a new forecast. On that point I think she's wrong. A statement begins two days later on how the unallotment will be effected -- the biennium has not yet been set. Given Judge Gearin's fascination with June, it appears she thought that the Governor was obligated to call the Legislature back into special session. Yet that is nowhere in 16A.152. There is a vagueness that I for one would have liked clarified.

My point, then, is that while Judge Gearin says she can't rule on the constitutionality of the unallotment law, she is trying to put limits on where it can be used. At no point does Rukavina tell you when the unallotment is constitutional, and it does not give the Legislature an upper hand in taxing authority.

Although appropriation of money is the responsibility of the legislature under Minn. Const. Art. XI � 1, it is an annual possibility that the revenue streams that fund those appropriations may be insufficient to actually realize each appropriation. For that purpose, the legislature, by statute authorized the executive branch to avoid, or reduce, a budget shortfall in any given biennium. Minn. Stat. � 16A.152 does not represent a legislative delegation of the legislature's ultimate authority to appropriate money, but merely enables the executive to deal with an anticipated budget shortfall before it occurs.It may be that you have to be in the biennium to enjoy this power. That is not for Judge Gearin to decide -- that will be up to the Court of Appeals and, I'll dare say, the state Supreme Court. The TRO she places on Pawlenty is in essence an invitation to the higher courts to clarify: Does he have to wait for the beginning of a biennium? If he knows there's a deficit, does he have to try again with a special session? Given that, in the present case, the Legislature never gave Pawlenty an overall budget target to which he could refer for the purpose of line-item vetoes, was Pawlenty entitled to treat the appropriations as things the Legislature would have to bargain over with him? It should be obvious from a reading of the history that they did not bargain. They passed a bill he disagreed with, that they knew he disagreed with, and for which they did not have the votes to override. Yet they continued to send spending bills. It's unfortunate that Judge Gearin chose not to include that history in her order.

At any rate, probably much ado about something that will be overturned quickly. Judge Gearin wants either the Governor and Legislature to agree to something, or for a higher court to review the constitutionality of the law as being perhaps overly broad. She'll get at least one of those, at which time her order will be a footnote. But she's doing us a favor, clarifying what has long been a rather vague statute.

Labels: DFL legislature, Minnesota, Pawlenty

Thursday, December 24, 2009

Another reason to not tax Minnesotans: A congressional seat

Minnesota would just barely miss keeping its eight Congressional seats, based on an analysis of new state population estimates from the U.S. Census Bureau.I hope we don't have to depend on California continuing its slow slide to oblivion in order for us to keep eight seats, but that might be what it comes down to.

The Congressional reapportionment forecast by State Demographer Tom Gillaspy projects Missouri would receive the last seat apportioned, with Minnesota just missing by about 1,100 people � a difference of less than one month�s population change for Minnesota. The difference between California, Texas, Missouri and Minnesota for the last three seats is about 2,200 people, which is well within the potential estimating error.

�Basically, this is a dead heat,� said Gillaspy. �Remember, these are just estimates by the Census Bureau, and our chances of retaining eight seats are improving every day. What will decide the issue is getting everyone in Minnesota counted in the 2010 Census.� Every household in the state will receive the 10-question Census form in mid-March 2010, which should then be returned to the Census Bureau by April 1.

North and South Dakota each grew faster than Minnesota. In 2008 there were almost the same number of moving vans coming here as leaving, according to United Van Lines. I've got some students needing senior projects this spring; maybe to help settle the old discussion Charlie Quimby and I have had on this issue we should get one to play with the data. (Or maybe with the IRS data. I've wanted to have someone do this for awhile. Off to check references on Google Scholar. So far I find [1], [2], [3]. [4] papers worth reading; not all appear to go in the same direction regarding the outcome. This note is a placeholder for that lucky student.)

Labels: DFL legislature, Minnesota, taxes

Tuesday, December 22, 2009

A larger than expected revision

The "third" estimate of the third-quarter increase in real GDP is 0.6 percentage point, or $17.3 billion, lower than the second estimate issued last month, primarily reflecting downward revisions to nonresidential fixed investment, to private inventory investment, and to personal consumption expenditures.The way many forecasters will read these results is that the inventory correction that is expected to crank up Q4 GDP will now be larger. That is, a smaller Q3 number will imply a higher Q4 number. Real final sales in Q3 were up 1.5%, but GDP excluding output of motor vehicles rose only 0.8% after declining 0.9% in Q2.

I am quite eagerly awaiting the November data on income and outlays, due out tomorrow morning. Personal savings is now tracking in a pattern of 4.5-5% of GDP, well above levels earlier in the decade, as families continue to rebuild their portfolios. GDP growth is likely to be slow in 2010 if this number gets and stays above 5%.

Best news in the report: inflation as measured by the deflator for personal consumption expenditures was revised downward.

The news in Minnesota is not much better. Private sector employment in the state is still down 3.4% in the 12 months to November, and the latest Federal Reserve Bank of Minneapolis forecast is for another 0.4% decrease in employment in 2010. They expect the unemployment rate in the state to remain stuck at about 8%. In one bit of good news, the Philadelphia Fed's state coincident indicators series shows Minnesota with a green color, with a bit of expansion off an August low. I wouldn't get carried away about this just yet, but it beats being red for as long as we have. Look for more in our latest Quarterly Business Report, which will be out on Monday next week.

Thursday, December 17, 2009

What would Wellstone do?

Democratic Sen. Al Franken took the unusual step Thursday of shutting down Sen. Joe Lieberman on the Senate floor.One thing Wellstone would do is not rely on his spokeswoman to explain everything from how he votes to what he eats. But I think there's more:

Lieberman, a Connecticut independent, currently is the target of liberal wrath over his opposition to a government-run insurance plan in the health care bill.

Franken was presiding over the Senate Thursday afternoon as Lieberman spoke about amendments he planned to offer to the bill. Lieberman asked for an additional moment to finish � a routine request � but Franken refused to grant the time.

"In my capacity as the senator from Minnesota, I object," Franken said.

"Really?" said Lieberman. "OK."

Lieberman then said he'd submit the rest of his statement in writing. ...

Franken's spokeswoman, Jess McIntosh, said that the Minnesota senator wouldn't allow Lieberman to continue because time limits were being enforced by Senate leaders rushing to finish a defense spending bill and get to the health bill.

In a world that has become so divisive and so partisan, so angry, whether in this Chamber or in the House Chamber, Senator Wellstone reflected in the passion for his belief that politics was not a death sport, it was something which you could agree to disagree and still shake a hand and ask: How are you doing? And move on. -- Sen. Norm Coleman, 10/25/07If you were sworn in on the man's Bible, you may want to pay attention to things like that, Senator.

UPDATE:

Tuesday, December 08, 2009

A parable

Suppose a man has a drinking problem. He decides to repent of his evil ways and, to make the commitment more binding, tells all his friends to come to his home at some appointed time. At that time he announces "I will not drink any more at all, and to prove it I will now have Dr. Smith implant this device in my arm. If I should take a drink, this implant will assure that I get very sick for 24 hours, with no lasting effects."

The man's friends divide in two groups. One thinks it laudable that the man is using a commitment device to assume he doesn't drink any more. The other group says "this is an extreme and inflexible tool that takes decision-making power out of your hands."

You say, "but that's the point. I need the power taken out of my hands because I'm helpless to prevent myself of drinking without some enforcement mechanism."

Your friend says "but you had the ability to do this before and you didn't."

"I know. That's why I'm starting now, before the bar opens again."

---------

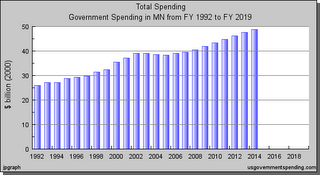

For more, see Barry Weingast's 1990 review of Margaret Levi's Of Rule and Revenue. Countries that did constrain the state's revenue collection abilities fared better than those that did not, he argues. Note that the graph at top is in real 2000 dollars.

Wednesday, December 02, 2009

You don't say!

The University of Minnesota-Twin Cities has come under pressure to reject a faculty panel's proposal to require students in its education school to doubt the United States is a meritocracy and to demonstrate an understanding of concepts such as "white privilege."

...Jean K. Quam, dean of the university's College of Education and Human Development, said today in an interview that the proposal was just one of several being offered up by various faculty panels as the college moves to overhaul its teacher-education program to better prepare students to deal with today's classrooms. She characterized the proposal as "a brainstorm of ideas" that the education school had yet to act upon as it develops a sweeping plan to change teacher preparation in the coming academic year."We would never impose requirements of how people are required to think or act as part of their teacher education," Ms. Quam said. "We are trying to broaden the way that they think or act and not narrow that view."

From the Chronicle of Higher Education this afternoon. Yet according to that task force's own final report:

...let there be no doubt that we consider cultural competence to be an indispensable characteristic of all beginning teachers and, hence, an obligatory goal of teacher education. In fact, we believe that the following outcomes that we present should serve as an overarching framework from which beginning teachers frame the rest of teacher education courses and practice.Emphasis added in both cases. Did the Chronicle author read the report?

...Future teachers will understand themselves as beings who position themselves and are positioned by others in relation to dimensions of differences (racial, social class, gender), and other hierarchies in school and society.

Labels: higher education, Minnesota

Now the real budget fun begins

General fund revenues are now forecast to fall $1.156 billion (3.7 percent) below earlier estimates for the 2010-11 biennium. After adjusting for actions taken by the Governor following the legislative session, general fund expenditures are $44 million lower. When combined with a $91 million reduction in the ending balance from FY 2008-09, a budget deficit of $1.203 billion is now projected for FY 2010-11. About 70 percent of the projected deficit is due to a reduction in expected income tax receipts.The loss in revenues is pinned on mostly a fall in wages (income from interest and capital gains "changed little".) The previous forecast was drawn in up February, was little changed from the November 2008 forecast except for the calculation of the effects of the Obama stimulus. Nine months between forecasts in this environment is an eternity, and there was no way anyone expected even this summer that the number wouldn't revise down by a billion or so. So I don't think this report is a shock or a sign that the economy is any more terrible than what I thought it was yesterday.

On the other hand, a new hand is dealt to the Legislature and Governor Pawlenty. They will be having press conferences in a while and we can expect DFL legislators to start their call for asking the rich to pay their fair share. Public employee union leader Eliot Seide was on the radio this morning (I listened during the Morning Show) saying the rich only pay 2/3 of their fair share and that getting the right amount from the rich would add $3.8 billion to revenues. For the life of me I can't figure out where either number comes from; what's this "fair share" he keeps talking about? Meanwhile, the governor is offering to talk to legislative leaders saying he doesn't want to use unallotment again. But having demonstrated he is willing to do it and not running for re-election, he undoubtedly feels he bargains from a position of strength. If you thought end of session in May was fun, pop some corn and settle in. This could be a hoot.

A couple of other quick notes while talking state budget. I did read this profile of state economist Tom Stinson and its effort to make him a pain in Governor Pawlenty's side. The article creates controversy where one doesn't exist, and the reporter was calling for weeks trying to dig up dirt on this topic according to people I spoke with. Tom's doing his job; everyone knows he tends to "go low" with the revenue figure, since the cost of underpredicting revenue is a lot lower than the cost of overpredicting (as we will now see; but the overprediction is certainly not an error made by the Minnesota Finance staff. Very few of us had 10% unemployment forecasts back in February.) The only shock in that article that I saw was Tom's age. I thought he was younger.

The other thing is this decision to list a separate estimate of inflation in the out-biennium forecast. I don't like it, I never have, and I wish they would stop it. You cannot assume a cost that doesn't yet exist. The decision to spend a public dollar takes a vote; it is not implied by previous decisions as taxes are.

Labels: DFL legislature, Minnesota, Pawlenty, taxes

Monday, November 23, 2009

Dispositions back in the news

We were last down this road in 2005 during the KC Johnson controversy at Brooklyn College. Yet it continues unabated. At SCSU students in educational administration or in child and family studies have a form to fill out if they see a disposition that doesn't meet the professional standards. In the former field, if you "express an inability or unwillingness to work with someThe initiative is premised, in part, on the conviction that Minnesota teachers' lack of "cultural competence" contributes to the poor academic performance of the state's minority students. Last spring, it charged the task group with coming up with recommendations to change this. In January, planners will review the recommendations and decide how to proceed.

The report advocates making race, class and gender politics the "overarching framework" for all teaching courses at the U. It calls for evaluating future teachers in both coursework and practice teaching based on their willingness to fall into ideological lockstep.

people" and "avoid collaboration", you have an area of need to work on. Teachers in graduate studies get courses in which their competencies are assessed to determine if they consider "multiple perspectives and willingness to challenge and analyze one�s own perspectives given alternatives" and "respond to items regarding lens of social justice and dispositions."

Johnson reports, by the way, that these Minnesota criteria are being highlighted at exactly the moment NCATE, the teachers' accrediting body, is turning away from them. So maybe this won't last for much longer around here.

Labels: education, higher education, Minnesota

Friday, November 20, 2009

Local responsibility for taxes reduces spending

Property taxes would increase an average of 3.5 percent across Minnesota next year if local governments adopt their proposed levies, the state Revenue Department announced Thursday.Source. The cap of property taxes was a bone of contention between DFL legislative leaders and Pawlenty, after Pawlenty cut intergovernmental aids. Giving local control of taxes seems to have reduced spending, rather than have the burden of some paid for by the taxes of others.

That would be less than the 5.6 percent increase in average property taxes this year and the average 6.9 percent increase over the past three years.

"City councils are very well aware of how poor the economy is and are doing everything they can to keep the levies down," said League of Minnesota Cities lobbyist Gary Carlson.

By law, cities and counties could have increased their property tax levies by the full amount that Gov. Tim Pawlenty cut their state aid. But counties appear to be levying for just 40 percent to 50 percent of their lost state funding, said Jim Mulder, executive director of the Association of Minnesota Counties.

The state cut aid to cities by $130 million over the past two years. Cities have levied $95 million in property taxes to replace those funds and absorbed $35 million in cuts, Carlson said.

Notable: Minneapolis property taxes are scheduled to rise almost 12%, highest in the state. Will any DFLer make this an issue in Mayor Rybak's run for governor?

Labels: Minneapolis, Minnesota, Pawlenty, taxes

Tuesday, November 10, 2009

It's a spending problem

This is why I try to encourage elected officials to use the phrase �spending discipline� rather than �fiscal discipline.� Our long-term deficit problem is a spending problem.Welcome to Minnesota, where Governor Pawlenty has announced he wants a constitutional amendment to cap spending. The amendment reads: "Shall the Minnesota Constitution be amended to require that state government general fund expenditures be limited to the amount of actual general fund revenues received by the state in the previous two-year budget period?"

The reaction is predictable. You get DFL opponents saying things like "you can't cut your way to greatness." You get the Star

Hennessey argues that the following line of attack follows the Left's hold on government:

- Increase government spending, especially through rapidly growing entitlements. At the state level it�s Medicaid.

- Wait. While you�re waiting, define deficits as the problem, rather than spending.

- Try to label as radical and extreme those who argue for slowing spending growth and preventing tax increases. The goal is to discredit these solutions as legitimate.

- Once deficits get large enough, shrug and say we have no choice but to raise taxes. This is especially true for entitlement programs directed toward the elderly, who have less ability to adjust to changed government promises.

- Argue we must protect low and middle-income from higher taxes, so upper-income taxpayers must bear the entire burden increase.

- Raise taxes on upper-income taxpayers.

- Rinse and repeat.

Spending limits have a long history, as this National Conference of State Legislatures summary shows. Pawlenty's proposal is different from most in our history, which either set a limit tied to population growth or growth+inflation. (Cato argues that limits set by personal income growth have been ineffective.) Those that set a maximum percentage of personal income (share of a level, not a growth rate) would find us probably near the limit now. Unlike the Pawlenty logic, I actually do plan on spending more when I'm older if I think my income will rise over time. I would argue this plan would have had a more tested version than this. (How do I know in May when the Legislature adjourns what revenues were for June, the end of the biennium, for instance?) It's worth noting that Milton Friedman more preferred the pop-growth-plus-inflation formula.

I worry that this amendment will barely register a nod from the Twin Cities political establishment. But clearly Pawlenty has seen the light that Hennessey is shining. At my home when the checkbook looks empty, I don't usually say I have an income problem (and I sure don't ask my neighbor to cover it for me.) I say I have a spending problem, and I fix it by spending less.

Labels: DFL legislature, Minnesota, Pawlenty

Wednesday, November 04, 2009

Another "short" note to G&J

Wow. Thanks for your explanation of your position on why you think Minnesota has tried the less government approach. I had no idea my short note would generate such leverage of your lengthy response! I was not aware of your support for reducing revenue cyclicality, and I thank you and Charlie for point that out. Good to hear we're on the same side there.

I hope you will continue your good humor while I point out two other things. You wrote:

Points given, but you are in essence begging my question. We can split this in two parts: First, what would have been the revenue generated by the old tax rates (whose, by the way? Ventura's? Carlson's? Perpich's?) if we assume no change in the tax base in response to those rates? That's pretty simple, you can throw that up on a spreadsheet and see who salutes. I don't have the resources (mainly time) to do that right now, but it would be useful. Second, let's relax the assumption and ask what would happen to the tax base if we had higher individual and corporate income taxes? What would happen if we did that and used some part for property tax relief? That's not a number crunch: It's a question of modeling family and business behavior (location, spousal participation and effort, to name three) in response to different tax rates.Revenues as a percentage of income are largely a function of tax rates. The shrinkage came from major and permanent income tax rate cuts, then a refusal to significantly raise state tax rates or impose new state taxes during the immediately ensuing shortfalls. Contrary to your argument, tax policies did make a major difference and Gov. Pawlenty himself takes credit for his policies shrinking government when he preaches to his conservative base.

But we would also acknowledge that we would have had shortfalls even if we hadn't cut taxes, because the spending base would have been larger, and downturns always create shortages. That's a point you could have raised, but didn't. So give us points for fairness and good faith.

There is, unsurprisingly, a great deal of research in that area, some suggesting that it's not a big change, others saying it does make a good deal of difference. Austan Goolsbee, now an Obama adviser, acknowledges that a higher corporate tax rate (holding individual income rates constant) shifts the form of business organization away from incorporation. But he doesn't find it affects overall economic activity. That might be a point in your favor or mine, I don't know. But it would be worthy of another of those hands across the water things you and I like to do.

On your other point, the growth of Minnesota is in fact still impressive, but we can get diminishing returns. We know from economics that growing countries or states tend to converge: Those with lower per capita GDP will tend to grow faster and catch up to those with higher per capita GDP. We also know that it's conditional, but for the several states of our country those conditions should be met. As states begin to receive information created elsewhere they grow faster for awhile, but then slow down. Minnesota and California have converged dramatically, partly because of good policies here and bad policies there, and partly because convergence just happens. It just seems very unlikely that we can grow faster than the rest of the country forever, and efforts to keep us growing faster may be counterproductive. Even investments in human capital hit diminishing returns, as Alwyn Young found for developing Asia in the 1990s.

Always a pleasure to chat, Dane. And thanks for your compliment on the name. 'King' is actually a family name on my mom's side; coolness was never part of the process.

Monday, November 02, 2009

Anyone seen Atomizer?

Did he collect them all in one email, or did he call a hotline one thousand times? This was the end of the article, and I cannot tell you how disappointed I was to see it end. Who is this guy? What motivated the 1000 calls? Where does he live relative to the flight path?The runway project especially affected such St. Paul neighborhoods as Highland Park, Mac-Groveland and Summit Hill, which are in the flight path of a secondary runway that's typically not heavily used.

A year ago, St. Paul residents filed 10 aircraft noise complaints in September. This September, there were 2,474 complaints from St. Paul, including more than 1,000 from one person.

I want an accounting from Fraters tout suite.

Labels: Delta Airline sucks even more, Minnesota, Northwest Airline sucks

Tuesday, October 27, 2009

A short note to Growth and Justice

Just read your note on less government not helping Minnesota. You use a ratio of government spending to personal income. Two things: One, we know state tax receipts are highly cyclical. That's what those tax commissions were telling you last year, if you had paid attention to it. Here's the Legislative panel:

While short-term cyclical volatility in Minnesota�s general fund tax base appears to increase during periods of economic downturn and typically parallels a significant disturbance or shock, long-term trend volatility in the tax base is roughly 30 percent greater today than it was during the 1970s. Most of this increase has noticeably occurred since the late 1990s.So when the national economy turns downward, that ratio is going to fall. You can't blame that on policy. Where has G&J been in the debate to reduce cyclicality of tax receipts? I doubt you would support putting a sales tax on food; I know I wouldn't, even if it did reduce cyclicality.

There have not been chronic budget crises. There have been two shortfalls due to our reliance heavily on tax bases that are volatile.

Second, what was the growth of personal income in Minnesota 2006-08? 9.2% How about for the U.S.? 8.6%. Wisconsin? 7.0%. South Dakota? 16.6%. Where is this underperformance you were speaking of? Which state would you like me to emulate?

Monday, October 26, 2009

Ya sure we got an airline

Did anyone notice how the story changes? They initially said they were in a heated discussion over airline policy, but now it appears they have recanted that story. 78 minutes of radio silence? This story will have enough legs to get to next Saturday's potluck.

Labels: Delta Airline sucks even more, Minnesota, Northwest Airline sucks

Wednesday, October 21, 2009

A temporary shock, a permanent bias

State Economist Tom Stinson told the Subcommittee on a Balanced Budget � part of the Legislative Commission on Planning and Fiscal Policy � that tax collections for the first quarter of Fiscal Year 2010 (the state�s fiscal year begins July 1) came in below the original forecast by $52 million, or approximately 1.7 percent. ...The latest edition of the Tom and Tom presentation is here. It has been a staple on the St. Paul fiscal policy circuit for about three years now. But the recession has changed how they present this, and I'd like to suggest it's lead them to one positive statement or forecast that is contentious and one normative statement that I think we should question.Stinson said Minnesota will likely begin the 2012-13 biennium with a budget deficit of at least $4.4 billion; however, House Chief Fiscal Analyst Bill Marx said the true number could be as high as $7.2 billion, once inflation and the impacts of Gov. Tim Pawlenty�s 2009 unallotments and vetoes are factored in.

Beyond 2013, Stinson said long-term demographic trends will reduce the state�s tax revenue base. In particular, he said the state�s aging population will create a situation where revenue growth will decrease just as demand for government services is going up.

�The demographics are going to make tax increases more difficult,� Stinson added, explaining that Baby Boomers trying to save money for retirement will likely resist proposals to raise taxes.

State Demographer Tom Gillaspy said the Baby Boomers will also require more state health care spending as they get older, making it more difficult to fund education and other government services. He suggested the key to getting out of this �fiscal trap� would be to increase the productivity of the state�s workforce. Stinson noted that this in turn requires new public investments, like infrastructure and education, creating what he called a �fiscal Catch-22.�

To see the positive, let's look at a graph in the presentation (at page 9.)

This is a representation of the Global Insights forecast for nominal GDP at two different points in time. Nominal GDP is a driver of the revenue model Department of Finance uses to project tax receipts. If you forecast nominal GDP to be lower, your tax revenues will go down, and your budget deficit looks higher, all other things equal. Dept. of Finance uses Global Insights' forecast.

They project a permanent decline from the recession. A textbook description of recessions, however, would not normally show a permanent shock to GDP from its trend values. This would normally be the result of a negative productivity shock. But has that happened? Multifactor productivity in the US rose 1.2% in 2008. Why would we not get a period of above-average growth? Real earnings are up. Casey Mulligan has sounded this theme for awhile, and it's plausible -- not that it's beyond debate, just that it's a real possibility that there has been no permanent shock, and that nominal GDP can return to its previous path. That would imply that the Minnesota budget deficit for 2012-13 is possibly not nearly as bad as predicted by Tom & Tom.

Their final slide includes this statement, emphasis added:

If we don�t make the necessary public investments in human capital, research and infrastructure, then we won�t have the productivity gains needed to provide the resources to make those investments.I would hope that's a misprint, or a hasty slide. (Given it's the last one, quite possible.) Human capital formation does not require public investment. I buy my child a private education. A private university raises funds to permit faculty time to create new basic research. Infrastructure has both private and public components -- and more of it could be private if we made that choice. There is nothing necessary about "public investments" other than a lack of imagination of what the private market could do if permitted.

The decision to invest "other people's money on other people" is a normative decision with disastrous consequences.

Nobody spends somebody else's money as carefully as he spends his own. Nobody has the same dedication to achieving somebody else's objectives that he displays when he pursues his own."a feeling of childlike dependence" -- from your trash service to your college to your health care.Beyond this, the programs have a insidious effect on the moral fiber of both the people who administer the programs and the people who are supposedly benefiting from it. For the people who administer it, it instills in them a feeling of almost Godlike power. For the people who are supposedly benefiting it instills a feeling of childlike dependence. Their capacity for personal decision making atrophies. The result is that the programs involved are misuse of money, they do not achieve the objectives which it was their intention to achieve. But far more important than this, they tend to rot away the very fabric that holds a decent society together.

Labels: economics, Minnesota, taxes