Friday, February 26, 2010

How out of touch are you old fogies?

Rowdy curling crowds; spontaneous street parties; public drunkeness. You don't have to look far for evidence that the crowds at Winter Games in Vancouver know how to have a good time.

And, as if anymore proof is needed that a wild Olympic atmosphere permeates B.C.'s largest city, now there's an apparent condom shortage.

That's right. As you read this, an emergency shipment of condoms is desperately making its way across Canada to the West Coast city.

Health officials in Vancouver have already provided 100,000 free condoms to the roughly 7,000 ahtletes and officials at the Games. That's about 14 condoms per person. But as of Wednesday, those supplies started running dangerously low.

So naturally, the Canadian Foundation for AIDS research decided to step and make sure there were no hitches in Olympic action.

"When we heard about the condom shortage in Vancouver, we felt it important to respond immediately," said Kerry Whiteside, CANFAR's Executive Director. The organization assembled three large boxes of about 8,500 condoms, much to the relief of libidos at the Olympic Village. They're expected to arrive on Thursday.

Labels: sports

Thursday, February 25, 2010

Notes from the road

Labels: travel

Wednesday, February 24, 2010

While I'm in the car

On an unrelated point, if you are in St. Cloud tonight, Benjamin refers us to a debate about the existence of God. Seems well worth your time, as both debaters appear interesting. Thought I would get that advertised before I leave.

Labels: economics

Tuesday, February 23, 2010

Mopping up

Treasury anticipates that the balance in the Treasury's Supplementary Financing Account will increase from its current level of $5 billion to $200 billion. This will restore the SFP back to the level maintained between February and September 2009.This action will be completed over the next two months in the form of eight $25 billion, 56-day SFP bills. Starting tomorrow, SFP auctions will be held each Wednesday...

The purpose of this will be to provide a temporary draining of excess reserves from banks, replacing them with these relatively short notes. The Treasury doesn't keep the cash; it hoards it in the Fed's balance sheet (see item 33 here) until it the paper matures, then it repays it. At last report the banks held $1,119 billion in excess reserves, so this is not that big an adjustment. But if interest rates don't move very much over the next two months from tighter credit, it will be a sign that banks are not seeing great lending opportunities outside of Treasuries. And it will give us some indicator of what happens when the Fed starts issuing its own paper instead of needing Treasury's help.

(h/t: Donald Marron, who reminds us that the Treasury can only do this while it has room under the debt limit.)

Labels: economics, Federal Reserve

Put Fannie and Freddie on budget

Today, U.S. Representative Michele Bachmann (MN-06) took part in a press conference as a cosponsor of the Accurate Accounting of Fannie and Freddie Mac Act. The bill is aimed at instituting a proper and complete accounting for the Government-Sponsored Enterprises Fannie Mae and Freddie Mac.The Obama Administration has been in the news this month with claims that Fannie and Freddie are not going to be that expensive. After projecting Treasury investments of $230 billion to prop up the two companies, the budget a few weeks ago said the investment would be $188 billion. Of that, about $97 billion is to be returned in dividends from the two firms by 2020. This does not count, alas, the $175 billion inserted into the firms by the Federal Reserve, nor the $1,250 billion of their debt -- mortgage-backed securities -- that the Fed has purchased. San Francisco Fed President Janet Yellen said yesterday that these purchases "were vital in preventing a complete financial breakdown," which might tell us Fan/Fred are still in some rough shape. I don't know that the legislation would count Fed contributions to Fan/Fred.

The Congressional Budget Office estimates that Fannie and Freddie added $291 billion to the federal deficit in 2009 and will cost an additional $389 billion to run over the next ten years. However, Fannie and Freddie are currently considered �off budget� meaning the actual cost to run these agencies is not considered by the Office of Management and Budget. By moving the activities of Fannie and Freddie Mac �on budget�, their financial obligations would then be included in the federal government�s budget and debt projections and provide a more accurate picture of our nation's precarious finances.

�The Accurate Accounting of Fannie Mae and Freddie Mac Act is a much needed remedy for a Washington that needs to come to terms with their spending addiction. One thing we know about Fannie and Freddie is that they cost the already overburdened and financially strapped taxpayer a pretty penny.

�Why should Fannie and Freddie be able to run up these numbers without the President having to reflect this risk in his budget? It just doesn�t make sense, and we owe it to the taxpayers to be transparent and forthcoming on the commitments we�re making with their credit card.�

Not to mention the fact that Fannie and Freddie are now paying off private debt holders of its MBS that are 120 days or more delinquent. It gets bad debt off the books of the two companies, but investors receiving this money are now getting money they cannot reinvest at the rates they used to get. Realizing the losses on those MBS will add to the cost of the bailout of these two firms -- it's worth remembering that the AIG bailout cost US taxpayers a relatively modest $9 billion.

Chief author of the legislation is Rep. Scott Garrett of New Jersey.

Labels: banking, economics, Michele Bachmann

Price discrimination story of the day

Mandalay Beach offers an 11-acre tropical lagoon which features a sandy beach, three exotic pools and a lazy river. Mandalay Beach's large 1.6 million gallon wave pool can reach waves as high as 6 feet. The lazy river called the Tropical River is perfect for relaxing the day away while floating on your inner tube. For those who like comforts of a classic pool, they have one of those as well."Are you going to Vegas soon, King?" Why yes I am, but I prefer the more old-fashioned hotels. Treat me nicely and I'll send pictures.Moorea Beach Club is separate and secluded area off of Mandalay Beach. Only 21 and older are allowed for entry as the club offers European sunbathing (topless). The Club has a separate pool, along with other perks such as chilled towel service and complementary selection of sun products.

Moorea Beach Club admission prices:

- Monday - Thursday Men $40.00, Women $10.00

- Friday - Sunday Men $50.00, Women $10.00

I'm still working on this "chilled towel service" idea. Is this a perk?

(h/t: Dave Switzer.)

P.S. I'm presenting a paper on sports gambling Thursday there. I have Two for the Money on my iPod -- haven't seen it before. Watched Casino last week. Any other good movie ideas?

Labels: economics

Wise words of the day

If we�re going to have a reasonable political discourse in this country we have to acknowledge that success is in the eye of the beholder. A successful America for Democrats is far different from that of Republicans and Libertarians. So it makes no sense to talk about success and failure independent of the definition held by the respective parties and factions.

Labels: politics

Monday, February 22, 2010

You got a license for that moonwalk, bub?

S.F. No. 1590, 1st Engrossment ... Posted on Feb 22, 2010 A bill for an act relating to consumer protection; protecting customers from injuries resulting from use of inflatable play equipment used for commercial purposes; requiring the presence of trained supervisors and liability insurance;proposing coding for new law in Minnesota Statutes, chapter 184B.And, of course, it'll cost you:

Subd. 6. Registration required. An owner of an inflatable that is subject to subdivision 2 must obtain and maintain a current registration with the commissioner of labor and industry. The registration information must include the name, address, telephone number, and e-mail address of the owner, the street address of each facility at which the owner regularly provides inflatables for commercial use in this state by others, and a current insurance certificate of coverage proving full compliance with subdivision 5. The commissioner shall issue and renew a certificate of registration only to owners who comply with this section. The commissioner shall charge a registration fee of $100 for a two-year registration designed to cover the cost of registration and enforcement. The registration certificate shall be issued and renewed for a two-year period.The insurance is for a $1 million policy ($2 million aggregate) and must be purchased from a Minnesota-approved insurance company. So all you carpetbagging bounce house operators, we're wise to you! We're happy to pay more for a better Minnesotan moonwalk amusement.

My guess is this bill is really meant to go after people who rent them for their kid's birthday party. Here's a site that goes on and on and on and on about accidents from them. Nothing like a legislator who protects moms and dads from their own stupidity in putting an inflatable bounce house up in a 30 MPH wind.

(h/t: Sheldon Anderson.)

Labels: Minnesota

That trick never works

For many, price controls may seem like a tempting solution to holding down health care costs. However, past attempts at price controls teach us a very different lesson�this is one government policy guaranteed to do more harm than good. In fact, throughout history, price controls have been a notorious flop, bringing on economic stagnation and decline, rationing, hoarding, black marketing and organized crime, assaults on civil liberties, and even inflation, not to mention untold waste, graft, and human suffering.Thus wrote Simon Rottenberg and David Theroux in 1994 when we last debated price controls in health care. Some of the stories they tell come from overseas with regards to health care:

In fact, from Babylon�s King Hammurabi to presidents Richard Nixon and Jimmy Carter, the thirty-eight-century history of price controls is a recurring economics lesson for any modern Luddite seeking a quick fix to health care costs. For instance, after he and previous emperors had debased the currency, creating rampant inflation, the Roman emperor Diocletian set maximum prices on more than one thousand products and services. Goods disappeared in legal markets, and reluctantly consumers and producers turned toward black markets despite a penalty of death for participating in these markets. After much suffering and bloodletting of the unfortunate caught violating the law, the law was revoked and Diocletian abdicated.

- price controls on drugs in Germany in 1993 led to one in five firms cutting hours for their workers within a year, and 30-50% of firms experiencing sharp declines in drugs ordered. Families were upset about the unwillingness of doctors to prescribe medicines they requested;

- U.S. doctors were routinely advertising in Canadian newspapers, offering services that were cheaper in Canada ... but unavailable.

The Obama Administration's proposal leads to rationing of health insurance (or as Arnold Kling calls it, health insulation) that probably will not be on a queuing system. It creates a shortage, as any effective price control does. To provide the health insurance to others you will have government subsidies paid for by additional taxes. The growth-damaging effects of those additional taxes will not be recognized.

And as prices are reduced and people continue to be promised health care at near-zero marginal cost, insurance companies will slowly suffocate. Who will save us?

Labels: economics, health care, Obama

American Generosity, Part III of III - Threats to American Philanthropy

First point: Behemoth governments and agencies with their one-size-fits-all mindset too often create proposals that limit the diversity and independence of the charitable world. When the now jailed Eliot Spitzer was NY's Attorney General [2003], he proposed a prohibition on foundations with less than $20,000,000 in assets because there were too many of them for the government to monitor and police. In 2007, a top IRS official proposed that the IRS evaluate the effectiveness and governance of public charities and foundations. Late 2009, the Congressional Research Service published a report calling for a NEW oversight agency for charities and foundations. [Do we really need more federal employees?]

The second threat is the argument that foundation assets are"public money" and that decisions about grant-making are subject to political control. Democrat Congressman, Savier Becerra of CA, calls the tax-favored treatment of charitable giving a "$32 billion earmark" and wants Congress to ensure that philanthropic assets advance the public good. [Or does he want to tax these charities??????] Charities do have public purposes and state attorneys general do have some power to enforce adherence to respective charitable purposes. BUT, this does not mean charities must serve the same objectives as government or that the government can intrude on their decision making. [Can government agencies perform charitable acts as efficiently as private charities? Highly doubtful. And, how much money do charities save taxpayers? Billions - that's a number followed by a minimum of nine zeroes (000,000,000)].

There is a historic covenant that has governed foundations - they must use their assets for charitable, not personal purposes.

The final threat to the freedom of American philanthropy comes in the form of proposals that would define what kind of giving is charitable. A growing number of them would like to confine charitable deductions to direct help for racial minorities and low-income families and communities, only. The problem with this? Americans of all races, creeds and income levels can benefit from giving to or receiving from religious institutions, colleges and universities, hospitals and medical research, the arts, environment and other causes that fall outside of these proposed, limited restrictions. Government should NOT be picking winners and losers.

American charitable giving is a strong indicator of economic freedom. In turn, economic freedom is an indispensable means toward the achievement of political freedom. [Milton Friedman].

Again, article sourced is the January 2010 Imprimis published by Hillsdale College.

Labels: charity, education, ingenuity, US History

Credit cards -- cui bono? cui pendo?

Other rules will make it harder for others to get credit. Some of them just make sense: You need to be notified if your interest rate is going up with enough time to change cards if you don't like it. Your initial rate is frozen for a year. 21 days between getting your bill and having it due. This may reduce credit availability unless banks make their money elsewhere. And they are. James Kwak tells us this is all about shifting the burden of consumer credit from consumers -- who, you know, actually get the credit and decide when to pay off their debts -- to the retailers who sell stuff on credit.

...this is the credit card industry (partially) shifting its sights from consumers, who benefit from (modest) legislative and regulatory protections, to the retailers, who don�t. It�s also what you would expect when you have extremely high concentration among card issuers (and transaction networks) and low concentration among retailers. Perhaps consumers aren�t the only constituency that needs a little protection.Might be a good time to remind you it's America Saves Week. Except in Washington, St. Paul, or a state capitol near you.

(Been a long time since I tried some Latin in a subject. Probably a bit rusty on my translation.)

Labels: economics

Peer review isn't flawless

Scientists have been forced to withdraw a study on projected sea level rise due to global warming after finding mistakes that undermined the findings.Nature Geoscience says it

The study, published in 2009 in Nature Geoscience, one of the top journals in its field, confirmed the conclusions of the 2007 report from the Intergovernmental Panel on Climate Change (IPCC). It used data over the last 22,000 years to predict that sea level would rise by between 7cm and 82cm by the end of the century.

At the time, Mark Siddall, from the Earth Sciences Department at the University of Bristol, said the study "strengthens the confidence with which one may interpret the IPCC results". The IPCC said that sea level would probably rise by 18cm-59cm by 2100, though stressed this was based on incomplete information about ice sheet melting and that the true rise could be higher.

...is committed to publishing significant, high-quality research in the Earth Sciences through a fair, rapid and rigorous peer review process that is overseen by a team of full-time professional editors.One slipped past the goalie here. It would be easy to laugh and say this is proof global warming is a crock and the peer review process is flawed. But of course it is. What's important about this piece is to say that in this particular case the system actually worked. A piece of bad science got through the peer review process -- which is bound to happen -- and that when technical mistakes were found, they retracted the article. Does peer review fail more with articles that support AGW than oppose it? I don't know. That is a question worth researching, if anyone has the time.

(h/t: Eric Fruits)

Labels: global warming, higher education

Friday, February 19, 2010

I'll be back

Bait and kick down the road

School board members are expected to consider the budget recommendation Thursday. The 2010-2011 budget does not have to be approved until June 30, but staff needs to know how the board wants to deal with the expected shortfall before completing the budget.Mr. Jordahl is a young man, and perhaps he has not had experience with down budgets before. But how much of his budget comes from payroll? What his statement means is "we are declaring more than 75% of our budget off-limits to cuts." Rather than cut one dollar from anyone's pay, or cut one job, the district chooses to kick its unfunded retirement benefits problem down the road ... after having raised taxes explicitly to solve the problem.

Administrators considered layoffs, savings in health insurance and the elimination of a work day before settling on the use of the reserve and tax dollars, Superintendent Steve Jordahl said.

�We have said from the very beginning we would not cut staff. That is not an option for us. We said we wanted to protect, in this economy, our staff members,� Jordahl said.

Add to this the loss of $250,000 for failing to settle contracts by a state-mandated deadline -- which combined with the Superintendent's statement means the teachers have no incentive to settle -- and you have another governmental unit treating the incomes of their constituents like a cookie jar.

Thursday, February 18, 2010

Life at the top

To make the top 400, a taxpayer had to have income of more than $138.8 million. As a group, the top 400 reported $137.9 billion in income, and paid $22.9 billion in federal income taxes.The report details sources of deductions as well as of income. Over half of deductions came from charitable contributions, which totaled $11.1 billion. No wonder the Obama Administration wishes to limit that deduction! The group also paid $5.4 billion in state and local taxes and $1.6 billion in taxes to foreign countries.

About 81.3% of the income of the top 400 households came in the form of capital gains, dividends or interest, the IRS data show. Only 6.5% came in the form of salaries and wages.

Over the past 16 tax years 3,472 different taxpayers showed up in the top 400 at least once. Of these taxpayers, a little

more than 27% appear more than once. In any given year, about 40% percent of the top-400 returns were filed by taxpayers who weren�t in that exclusive club in any of the 15 years .

But the last paragraph is what interested me most. 73% of taxpayers who made the top 400 only made it for one year. 7 taxpayers made it all 16 years. The top 400 "mostly represent a changing group of taxpayers over time, rather than a fixed group of taxpayers." When people want to talk about "the uber-rich" they describe a fleeting thing.

Labels: economics

Encouraging profligacy

The $400/$800 Making Work Pay tax credit took effect in July 2009. Workers who have taxes withheld from their paychecks will see a decrease in the federal income taxes withheld from each paycheck by about $30 per paycheck every two weeks or $60 for couples.We are encouraging younger people to spend rather than save. And perhaps how this works is by giving the money back in $30 dribs and drabs that they don't notice. Wasn't this how we got into trouble in the first place? Why does government think it should encourage consuming new goods rather than paying off debt?

...The credit will phase out by two percent of any income over $150,000 for couples and $75,000 for others. Couples earning more than $190,000 and individuals earning more than $95,000 will not benefit from the credit.Unlike the 2008 economic stimulus tax rebate checks that were mailed to taxpayers in a lump sum, the government is hoping that offering the $400 Make Work Pay tax credit as a reduction in payroll deductions will encourage taxpayers to spend the credit rather than save the money or use it to pay down debt.

Karl noted a few weeks ago that the government is ending this credit as well, since it was expected to spend $116.2 billion over ten years, quite an expensive program. Perhaps one reason for cutting it was that voters like my son didn't even know they were getting it. When I told my son how he had gotten this credit already, all I got was the cryptic 'K'.

Labels: economics, Obama, taxes

Like you couldn't see this one coming

A key software system for the 2010 Census is behind schedule and full of defects, and it will have to be scaled back to ensure an accurate count of the U.S. population, according to a government watchdog report.At least it's not the software that does the actual counting. Again I wonder -- why can't you privatize the Census? There are many firms that will sell you software for scheduling and paying workers.

Even as Census takers have begun the decennial head count in Alaska and other remote areas, the system is still not ready to handle the paperwork and payroll data for what eventually will be a half-million Census takers.

The software to schedule, deploy and pay Census takers is at risk, according to the report released this week by the inspector general for the Commerce Department, which includes the Census Bureau. If changes are not made, the Census risks ballooning costs, delays and inaccuracies.

Labels: economics

American Generosity II of III - Reasons Why Americans are Generous

Regarding the religious aspect: Americans who attend church or synagogue or another form of worship once a week give three times as much to charity as a percentage of their income as do those who rarely attend religious services. Annually, about $100,000,000,000 goes to religious institutions of all faiths. These same donors also give more to secular charities than those who never or rarely attend religious services. The book, Who Really Cares, by Arthur C. Brooks, thoroughly documents amounts, percentages and types of giving (including blood donations and volunteer hours) to support this concept. A review of the book, here, summarizes many of the key findings.

The freedom angle: Historically, Americans did not wait for the government or the local nobleman to solve problems - we often solved them ourselves. A forthcoming movie, The Little Red Wagon, tells the story of a six-year-old boy in Tampa, named Zach, who wanted to help families who had been left homeless. He took his wagon door-to-door for four months and collected 27 truckloads of supplies. This is a great example but there are also 1000s of examples of Americans helping others in need via churches, community food drives, packages for soldiers, etc. - people just taking action on their own as part of their community. These events happen all the time in America.

American corporations give through their own programs. One local example is the 5% pretax operating profit give-back of Target Corporation. Other companies assist schools, support athletic teams and scout programs. Included also are volunteer fire departments (Bloomington, MN has one of the largest volunteer fire department in the US.) Historically, there is Andrew Carnegie who founded US Steel and took his wealth to establish public libraries all across America. Bill Gates of Microsoft is working to eradicate malaria. The list is endless. Why? Freedom. Americans simply give back, voluntarily, to the society that gave them the opportunity to succeed.

And, an interesting aspect: while many people in the upper quintile of earnings give more money to charity, those in the lowest quintile give the highest percentage to charity. Go here for a summary.

Update - I thought this had been posted; this will address some of the issues raised by commenters on I of III. Janet

Labels: charity, education, ingenuity, US History

Wednesday, February 17, 2010

What we don't know

Most of what we write about the effects of stimulus are just that, "an attempt to gain knowledge." A bureaucrat writes down some numbers. Reporters and bloggers find flaws. Econometric models estimate the effects, but those models were used to propose the policy put in place. It's not likely those models would go back and say the proposed plan didn't work: Econometric models aren't built to do that: If the model has as a premise that future government spending will create jobs, it isn't going to tell you that past government spending did not. Meanwhile, those in political opposition will look to find contradictions when none really exist. (GDP growth can lead employment growth.) And people get angrier and cynical.Most of what Thomas Friedman thinks we know is based on multiple regression analysis trying to hold other factors constant other than human carbon emissions and making a variety of assumptions about the interactions between those factors along with the factors we cannot measure. That is hard to explain to a sixth grader. It can be done But it�s not knowledge. It�s an attempt to gain knowledge.

It is very similar to writing a report for a sixth grader on how the stimulus turned out. We have fewer jobs than we had before. That�s what we know. But even I, a skeptic, wouldn�t call that knowledge about whether the �stimulus� package worked or not. But I wouldn�t use the CBO estimate either. The CBO estimate is a repeat of the forecast it made before the legislation passed. We don�t know how many jobs were created or destroyed by the legislation.

There is nothing wrong with saying we don't know. It might have worked; it might not have. What we know is there are between three and four million fewer jobs than a year ago, and the deficit is larger. We want to know more. We are trying to know more. And if the volume of studies since 2000 of the Great Depression are any indication, we'll still want to know more a century from now.

Labels: economics

SomewherE In yoUr alternative lifetime...

The mechanics call a local TV station, stand before a camera and say "We're drawing attention to this to tell these car owners like this gentleman that they need to intercede with the auto repair shops and tell them to settle this before it gets to a strike."

Do they appear on TV?

Why yes, yes they do.

No arrests were reported.

Labels: corruption, unions

The Georgian example

The aristocrats of the Caucasus recently adopted something called the Liberty Act, which limits their deficit to 3 per cent of GDP and their public debt to 60 per cent. The proportion of economic activity generated by the state is capped by law at 30 per cent, and the number of government licences and permits is likewise restricted. At the same time, control of public services, including healthcare and education, is shifted from state to citizen.Using the shortcut measure of economic freedom from the Heritage Foundation, Georgia does very well compared to its peers, though Heritage reports government spending as a share of GDP at 34% rather than 30. It ranks ahead of Vaclav Klaus' Czech Republic on that scale and 26th in the world.

Result? Georgia�s GDP is flourishing despite the Russian embargo and the recent war, and the country has continued to grow through the downturn.

Tuesday, February 16, 2010

An evening thought about prices

One element of stimulus that I think might not work as planned is infrastructure investment. Let�s look at the I-35 bridge that collapsed in Minneapolis and was rebuilt in 2007-8. According to Wikipedia, the original bridge cost $5.2 million to build in 1964-7, which is roughly $35 million in today�s dollars (admittedly not a bargain, given that it collapsed, but the collapse was due to a design flaw, not faulty construction or shoddy materials). The replacement cost $234 million. Public infrastructure, employing as it does an army of civil servants (and their pension obligations), union labor, and drawers full of lawyers, turns out to be one of the most expensive things in the world to buy. A sensible consumer, faced with an 7X increase in the real price of a good, would purchase less of that good rather than more.Philip Greenspun. Recall, of course, that we probably didn't go for the lowest cost on the replacement of that bridge -- we were in a hurry to get back a key artery of a major metropolitan area and speed was considered as a tradeoff to cost. And the 2008 bridge is not a replacement for the 1967 bridge -- you can't build that bridge any more, the design no longer is used by anyone (and considered unsafe.)

All that said, is it possibly true that the real price of government goods has risen? A bonding bill cannot pass without a provision that assures wages will be higher. A labor union claims the bill provides 21,000 jobs without asking "if that amount of money was spent by a private firm building its own infrastructure, how many jobs would that provide?" And for how long would those jobs last?

Government is not "a sensible consumer." In fact, thinking about a price of real government services, can we actually conceive of its demand curve?

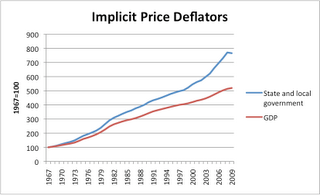

UPDATE: In comments Speed Gibson got me wondering about the implicit price deflators for state government spending, so I drafted a very quick graphic.

There are many ways to criticize a deflator, and many criticize them. But it's hard to find a better measure. I don't think they just take the deflator for all goods and add 1%, as SG suggests. It's late, someone else may find a better answer in the morning.

Labels: economics, it's the spending stupid

Worth your time

This is not a new story, at least not to me. I co-authored a paper published in 1994 with Hal McClure and Tom Willett in which we argued that the optimal inflation rate was probably zero for most economies if there was a tradeoff of even 1% of GDP growth for a 10% anticipated inflation rate. Developing countries are usually assumed to have a smaller tradeoff. There are non-linearities or threshold effects involved as well. (I don't know of a summary paper that covers the literature and none were obvious from looking on Google Scholar, at least not since Bruno and Easterly [1998]. If anyone knows one, please put in comments.)To be sure, there are plenty of studies suggesting modest increases in the rate of inflation from the levels currently targeted by many central banks would not be problematic�here, for example. But the point is that the evidence is not clear cut that an increase from an average rate of inflation in the neighborhood of 2 percent to the neighborhood of 4 percent would be innocuous. And there is always this element, noted by John Taylor in the aforementioned Wall Street Journal article:

"John Taylor, a Stanford University monetary-policy specialist who served in the Bush administration Treasury department, says that inflation could become hard to constrain if the target is raised. 'If you say it's 4%, why not 5% or 6%?' Mr. Taylor said. 'There's something that people understand about zero inflation.' "

Arguing for higher inflation targets at a time like this is a call for cheap credit, which seems like trying to do the same thing we did in 2004-05 while hoping for a different outcome.

Labels: economics

Which spending limitation amendment?

... we are offering a proposal in the current legislative session to let you vote on a constitutional amendment that would restrain state spending to the amount of money actually collected during the previous budget. Apply this concept to your own situation: If you make $40,000 this year, you don't set a larger budget for next year based on the possibility that you will make more money. You certainly can't storm into your boss's office during a recession and demand a 20 percent raise to meet your lofty spending visions. But that is exactly what government does. It sets a budget based on what it hopes to have, and comes calling for more of your money if that hope turns out to be wrong.Which sounds lovely as far as it goes, but what follows next is troublesome.

Our amendment would inject reality back into the budget process. But unlike attempts in other states, we would not be backing ourselves into a corner. On the occasion that government should take in more than it spends, the money would be used to build up rainy day funds, given back to taxpayers or spent on meeting a one-time need, like repairing a bridge or a building. That would be the case under the most recent budget forecast, which shows future revenue exceeding current spending by nearly $2 billion. The key is the Legislature would maintain the flexibility to use the surplus for one-time expenditures as it sees fit. The last time the budget had a surplus, in 2007, the money went primarily to support on-going spending that we can no longer afford. Had it been spent on one-time construction or maintenance costs, our spending problem would be less severe and our infrastructure much improved.The government currently budgets for repairs and maintenance. It takes nothing to shift spending so that all of those maintenance expenditures show up in extra monies in one year and then put into continuing expenditures in subsequent years. I can also imagine DFLers complaining that maintenance of our bridges and roads depends on the state of the economy.

Giving any legislative body flexibility is unwise, as the history of government spending has chosen. As I wrote last time, this formula assures higher spending when times are good, and a reason to hold huge reserves to prevent any cut in government's role in the economy when recessions force a re-evaluation. When I asked gubernatorial candidate Marty Seifert about this amendment he indicated he thought it would encourage more spending in boom times than wise. A $5 billion deficit for a future biennium focuses the mind of the Legislature and the next Governor to think about what is sustainable. Why not keep the legislature constantly focused on that sustainable level?

On Rod Grams' radio show this morning we talked about this very issue. I suggested there that the only way to hold the government to a spending limit is to give them a real limit, established beyond their control and without wiggle room. There are models around us right now: Kansas has a proposal before its legislature to restrict growth of spending to inflation only. Other variations are out there. A population-and-inflation limit provides a slow steady increase while holding the real cost of government per capita constant. If government can make itself more efficient it can generate new public goods. Any funds obtained in excess of that limit can be placed in the rainy day fund or returned to taxpayers only. There's ample lesson from California's Prop. 4 to tell us what happens when you let the legislature and governor game that system for spending on designated areas. So don't.

Monday, February 15, 2010

Similar to 1981?

I like this passage. But what I found in MM's description was this:

When Ronald Reagan took office on January 20, 1981, our nation was facing a terrible economic crisis, similar to what we are experiencing today. This video contains excerpts of Reagan's first inaugural address. His prescription to solve the economic crisis was vastly different than the policies being pursued by the Obama administration.Emphasis mine. But the speech describes a far different world than the one Obama is in. Reagan said:

These United States are confronted with an economic affliction of great proportions. We suffer from the longest and one of the worst sustained inflations in our national history. It distorts our economic decisions, penalizes thrift, and crushes the struggling young and the fixed-income elderly alike. It threatens to shatter the lives of millions of our people. Idle industries have cast workers into unemployment, human misery and personal indignity.Who among us would think that story is similar to today? Inflation has not been an issue this past decade -- if anything, we faced deflationary pressures in the recession and may yet face more. Tax rates in 1980, particularly on high-income earners, were much higher than they are now -- in fact, twice as high at the top end. Productivity growth was substantially higher in the late 1980s and 1990s than in the 1970s, and so far has accelerated through this recession.

Those who do work are denied a fair return for their labor by a tax system which penalizes successful achievement and keeps us from maintaining full productivity. But great as our tax burden is, it has not kept pace with public spending. For decades we have piled deficit upon deficit, mortgaging our future and our children�s future for the temporary convenience of the present. To continue this long trend is to guarantee tremendous social, cultural, political, and economic upheavals.

You and I, as individuals, can, by borrowing, live beyond our means, but for only a limited period of time. Why then should we think that collectively, as a nation, we are not bound by that same limitation?

I certainly have said enough to readers to understand that I think Obama fiscal policy has made several missteps. But a simple hearkening to the days of the Gipper is a poor substitute to thinking through new policies.

This isn't new. We have people constantly holding up conservatives against the Reagan yardstick and finding out nobody measures up. The recent kicking of Paul Ryan is but one example. But none of them would know what Reagan would have said about this current situation or how he would have voted. Rep. Ryan has explained his votes; you can draw your own conclusions, but suffice to say purity is a rare thing.

As are parallels between 1981 and 2008-09.

Labels: economics, Reagan, Republicans

History may repeat

In this paper we provide some evidence on when central banks have shifted from expansionary to contractionary monetary policy after a recession has ended--the exit strategy. We examine the relationship between the timing of changes in several instruments of monetary policy and the timing of changes of selected real macro aggregates and price level (inflation) variables across U.S. business cycles from 1920-2007. We find, based on historical narratives, descriptive evidence and econometric analysis, that in the 1920s and the 1950s the Fed would generally tighten when the price level turned up. By contrast, since 1960 the Fed has generally tightened when unemployment peaked and this tightening often occurred after inflation began to rise. The Fed is often too late to prevent inflation.Michael Bordo and John Landon-Lane, in a new NBER working paper (ungated copy here.) Since September 23rd's FOMC statement the Fed has been emphasizing "resource utilization" and "resource slack", code for unemployment. Will prices turn north again before the Fed starts this new policy?

Labels: economics, Federal Reserve, money

What do we mean by sustainable debt?

From 2005 to 2007, before the recession and financial crisis, the federal government ran budget deficits, but they averaged less than 2 percent of gross domestic product. Because this borrowing was moderate in magnitude and the economy was growing at about its normal rate, the federal debt held by the public fell from 36.8 percent of gross domestic product at the end of the 2004 fiscal year to 36.2 percent three years later.And that's using the more favorable growth and spending assumptions in the Administration's budget. If you use CBO, the story gets worse. This is why the figures Menzie Chinn shows only take us so far: One can easily imagine a case where cyclical adjustment in a recession causes a temporary rise in the debt-to-GDP ratio without a concern about sustainability, if in the long run we stabilize and eventually reduce that ratio.

That is, despite substantial wartime spending during this period, budget deficits were small enough to keep the debt-to-G.D.P. ratio under control.

The troubling feature of Mr. Obama�s budget is that it fails to return the federal government to manageable budget deficits, even as the wars wind down and the economy recovers from the recession. According to the administration�s own numbers, the budget deficit under the president�s proposed policies will never fall below 3.6 percent of G.D.P. By 2020, the end of the planning horizon, it will be 4.2 percent and rising.

As a result, the government�s debts will grow faster than the economy. The administration projects that the debt-to-G.D.P. ratio will rise in each of the next 10 years. By 2020, the government�s debts will equal 77.2 percent of G.D.P.

Debt market participants are forward looking. What they concern themselves with is that the debt they are buying are not part of a Ponzi scheme. To make a long story short (the long, mathematical story is here if you're curious), your country must be expected to run budget surpluses some time in the future to pay off the current debt. There's discounting involved of course, but most important is the difference between your country's real interest rate and the rate of growth of real GDP. (One of the remarkable lessons of the theory is that you can't inflate your way out of the problem, as long as we assume nominal interest rates fully adjust to higher money growth rates being used to pay off the debt. Read around the math of that last link for more.)

What matters most then are either policies that bring down the primary deficit, those that maintain our credit such that real interest rates are reduced, and those that increase the growth rate of GDP. At present the primary deficit -- the deficit less interest payments on the debt -- doesn't stabilize. It's not necessarily the bomb that Ed is talking about; this debt is a very slow rotting of the nation's economic health, taking a couple of decades to become apparent. It's worth remembering in this story that while the government may show you the debt "held by the public", the bonds in the trust funds are being held in trust for the public. Interest on those bonds in the trust funds are meant to pay for future benefits for Social Security, Medicare, railroad pensions, etc. At present all we have is the past good credit of the US and a promise by the Obama Administration to get serious ... by forming a committee to tell us how to get serious.

Labels: economics

Friday, February 12, 2010

American Generosity - Part I of III

The basis of this information is a speech given in Washington, D.C. on January 8, 2010 by Adam Meyerson, President of The Philanthropy Roundtable. My source is Imprimis, a publication of Hillsdale College. (A free publication - go here to register to get your monthly articles.)

In 1859, a professor and preacher named Ransom Dunn started a horseback journey to raise funds for a young institution of higher learning, Hillsdale College, in southern Michigan. 6000 miles later, Dunn had raised $22,000, the equivalent of about $500,000 today. The sources of his success: rural families of the upper Midwest. The largest donation was $200. What does this even show?

Charitable giving in America has never been exclusively limited to the wealthy. Throughout America's history, Americans from all walks of life have given generously. When giving is calculated as a proportion of income, the highest percentage of givers is the working poor. Secondly, Professor Dunn, did not play on guilt, too often the ploy of today's charity solicitors. Dunn appealed to people's ideals, aspirations and religious principles.

This charitable aspect of Americans is central to our free society. Hillsdale was the second American college to grant a four-year liberal arts degree to women. Hillsdale was the first American college to prohibit any discrimination on the basis of race, religion or sex. These unique components would have been difficult, if not impossible to implement if Hillsdale had had to rely on public moneys.

The 19th century was a great age in America for the creation of colleges. Every town in the decentralized America of that time wanted its own college to promote economic opportunity and encourage citizen leadership. (In 1880, Ohio [with 3,000,000 inhabitants] had 37 colleges; England [with 23,000,000 people] had four degree-granting institutions.)

Today Americans give over $30,000,000,000 a year to support higher education. Even state universities depend upon private contributions. In addition, private charity sustains museums, orchestras, hospitals, clinics, churches, synagogues, animal refuges and habitats, youth programs, grass-roots problem solvers, etc. Private charity makes possible great think tanks, left, right or center.

Our awareness of charity is usually low, until there is a disaster. During Hurricane Katrina, Americans gave $6,000,000,000 and in 2009, Americans gave $300,000,000,000 to charities. This final amount is about twice what we spend on electronics equipment, three times what is spent on gambling and 10x as much as spent on professional sports.

Labels: charity, education, ingenuity, US History

Don't feed the bears

Recreational wildlife feeding would be banned in Minnesota for four months each year under legislation being proposed by the Minnesota Department of Natural Resources.You have a budget to balance, fellas. What is the burning desire to deny corn to Bambi?

Exceptions would be made for farmers, bird feeders, bear hunters and trappers, but the legislation would prohibit placing grains, vegetables or other feed for wildlife from Sept. 1 to Dec. 31.

The goal is to stop people from feeding deer, an activity that leads to car collisions and encourages illegal deer baiting during hunting seasons, DNR officials said.

"Wildlife and deer don't need supplemental food at that time of the year," said Maj. Rodmen Smith, manager of operations for the DNR's Division of Enforcement. "This will solve a lot problems with people attracting deer to their property, and it will clear up loopholes in the baiting law."

I don't doubt the issues Maj. Smith names are real issues. What I doubt is that this is a good use of a DNR officer's time. "Did you put this food here, son?"

Government now thinks it can control which animals get to eat, and when. Whatever did they do when the Minnesota Legislature didn't exist?

Labels: it's the spending stupid, Minnesota

Stenting competition

Actually, it's already happening. Announced earlier in the week, the company is cutting 1,300 jobs, with many likely to come from the Twin Cities.

Boston Scientific has been facing a lot of headwinds lately. They recently had to make a $1.7 billion payment to their competitor Johnson and Johnson over patent disputes and sales of key products are down. They include drug-coated stents, mesh tubes that prop open clogged arteries, and cardiac rhythm devices, which treat irregularly beating hearts.It's not a great example for Malkin's narrow point about the company and stents, but in the broader sense it makes a very good point. These companies that produce valuable, life-extending medical devices -- just ask President Clinton, or my dad who has a few of those in him -- live in a profit-and-loss system, one that is quite competitive. The company does not run on a very large profit margin with competition from places like JNJ and Medtronics and St. Jude Medical, etc. To the extent that government regulation damages these firms we could see a loss of competition and higher prices for devices, leading to government price controls and non-price rationing. Not that ex-Presidents will ever go wanting for a stent, but for you and me that's not a pleasant prospect.

CEO Ray Eliot joined the company last summer and said during a conference call Thursday that investors should be patient with his efforts to improve the company's results.

"This is a big ship," Eliot said. "I don't care how smart you are, you don't turn this around in a quarter or two, and it...has had some underlying issues that I think we've addressed well. "

By their royal powers

Another part of the discussion pertains to faculty who assign outside activities with mandatory attendance, part of that "voluntyrrany" I mentioned the other day. Faculty who assign these activities are bucky over other faculty not cutting their mutual students any slack from a stated policy about attendance or make-up exams. I wonder if the subtext is that, because the goal of the outside activity is noble, the other faculty member should make exceptions for the activity. Everyone thinks their own class is the most important class a student takes; I watch the piano instructor practically terrorize a student over her taking part in sports, or the Scoutmaster unhappy that a scout will attend a Bible camp instead of camping with his troop. Happens in lots of places. The biggest problem, to me, is that the professor who expects students to attend outside activities does not notify students of the intention until after students have started taking the class. Advanced notice would help.

But then I get the faculty who have to declare those of us who hold fast to rules antipathetic. Our students have lives, they have real problems, and we should try to balance our hidebound regulations on a case by case basis. If so, then why print any rule other than this?

Making up exams and deductions for missing class will be determined by your ability to provide me a way to feel better about myself through my magnanimity. I will appear on Atwood Mall promptly at noon each Wednesday, on a litter carried by four GAs dressed as Egyptian slaves. Students wanting dispensation of the rules will come to me at this time with their cases. Offerings such as burnt incense will not be needed, only your persuasive powers. My decisions are final, unless you can find the litter of the Grade Appeal Committee chair, to whom you can plead your case.Discretion is the denial of rules. It is a use of a professor's powers to build up the ego, to allow cheap expressions of one's goodness. I do not validate a student or professor's judgment of my humanity based on whether a student can get a set of notes from me after missing my class, and I don't understand those who do.

Labels: higher education

Media alert

Thursday, February 11, 2010

Bye-bye Fed funds target

The text is here. In it Bernanke also suggests a new instrument for removing excess reserves from the system, a term deposit banks could make to the Fed that would compete with Treasuries as a store of liquidity for them.�Although at present the U.S. economy continues to require the support of highly accommodative monetary policies, at some point the Federal Reserve will need to tighten financial conditions by raising short-term interest rates and reducing the quantity of bank reserves outstanding,� he wrote.

�We have spent considerable effort in developing the tools we will need to remove policy accommodation, and we are fully confident that at the appropriate time we will be able to do so effectively.�

Mr. Bernanke, however, did provide new details of a major concern: how, as the recovery proceeds, to gradually shrink the balance sheet, which along with a vast array of assets also includes $1.1 trillion that banks are holding with the Fed.

Mr. Bernanke suggested that a new policy tool � the interest rate on excess reserves, which the Fed began paying in October 2008 � would be a vital part of the Fed�s strategy.

Increasing that interest rate, he said, will have the effect of pushing up other short-term interest rates, including the benchmark fed funds rate � the rate at which banks lend to each other overnight.

The Federal Reserve would likely auction large blocks of such deposits, thus converting a portion of depository institutions' reserve balances into deposits that could not be used to meet their very short-term liquidity needs and could not be counted as reserves. A proposal describing a term deposit facility was recently published in the Federal Register, and we are currently analyzing the public comments that have been received. ... we expect to be able to conduct test transactions this spring and to have the facility available if necessary shortly thereafter. Reverse repos and the deposit facility would together allow the Federal Reserve to drain hundreds of billions of dollars of reserves from the banking system quite quickly, should it choose to do so.Both new instruments provide a means by which the Fed can increase its balance sheet without impacting the money supply, by inducing banks not to use their excess reserves for deposit expansion. I was familiar with both these instruments in Macedonia, where excess reserves were close to 30% of the money supply. The problem there was that it created flabby banks unwilling to lend, since easy government revenue was close at hand. The Fed does not directly spend taxpayer dollars, but its remission of excess earnings from its portfolio to the Treasury would be shifted to banks, and that indirectly expands the government's need for additional debt to cover its spending. That's not likely to go over well.

The biggest signal was not a date but a statement that the Federal funds rate would no longer be a policy instrument for the Fed, at least for awhile:

As a result of the very large volume of reserves in the banking system, the level of activity and liquidity in the federal funds market has declined considerably, raising the possibility that the federal funds rate could for a time become a less reliable indicator than usual of conditions in short-term money markets. Accordingly, the Federal Reserve is considering the utility, during the transition to a more normal policy configuration, of communicating the stance of policy in terms of another operating target, such as an alternative short-term interest rate. In particular, it is possible that the Federal Reserve could for a time use the interest rate paid on reserves, in combination with targets for reserve quantities, as a guide to its policy stance, while simultaneously monitoring a range of market rates. No decision has been made on this issue; we will be guided in part by the evolution of the federal funds market as policy accommodation is withdrawn. The Federal Reserve anticipates that it will eventually return to an operating framework with much lower reserve balances than at present and with the federal funds rate as the operating target for policy.The last time the Fed abandoned the Fed funds target was October 1979, when then-Chair Paul Volcker thought it more prudent to stop inflation by using a target on reserves. That lasted perhaps three years, maybe less (see Alton Gilbert for more.) That period led to rather high volatility in interest rates may have contributed to the double-dip recessions in 1980-82.

It would be fair criticism of the above to say we really haven't used the Fed funds target for awhile and that this is just recognition of reality. But the FOMC statement still focused on it, and the Fed had not enunciated until yesterday what we might look at for an alternative target. Now we have. This will make reading the next FOMC statement on March 16 very interesting indeed.

UPDATE: John Taylor doesn't like the term deposits from the Fed to the banks.

In my view, Fed borrowing instruments should be avoided as much as possible because they delay essential adjustments in reserves and create precedents which make it easier to deviate from the monetary framework in the future. Similarly, the instrument of paying interest on reserves to achieve the short term interest rate target should be used only during a well defined transition period.He argues instead for a rule that ties Fed fund rate increases to a decrease in reserves. It would make Fed policy more predictable.

[P]olicy makers could treat this exit rule as an exit guideline rather than a mechanical formula to be followed literally, much as a policy rule for the interest rate is treated as a guideline rather than mechanical formula. They would vote on how much to reduce reserves at each meeting along with the interest rate vote. Note that the exit rule would we working in tandem with a policy rule for the interest rate, such as the Taylor rule.With all that's going on in Europe, this might be sliding under the radar. It shouldn't.

Labels: economics, Federal Reserve, money

Rose bowls at the margin

...there are two costs that seem especially relevant: (1) The costs of getting big donations are more than just seats on a plane to the Rose Bowl. Tremendous amounts of time, energy, and resources go into "asks," and these costs should be factored into the whole calculation about whether a firm/university is "making it." (2) Universities like UW-Madison receive a tremendous amount of support from taxpayers. Thanks to taxpayer subsidies, prices for tuition are kept artificially low. Furthermore, many student scholarships are funded by tax dollars. (Here, in Georgia, for example, lottery revenues cover tuition costs for all students with a B or better average in high school.) Again, these are just two of the relevant costs that must now be considered once we take the "look at the overall picture" approach.This is no doubt true, but one would want to think then about the rate of substitution between the salary of another fundraiser in the alumni office and the recruiting costs of a star quarterback. Given that the athlete is barred from receiving a wage, it may be that the relative prices of athletes and fundraisers tilts towards a better athletic program and fewer glad-handers.

There are also questions to be raised about whether your basketball team getting to the Final Four of the big dance gets you more applications for admissions, from people with parents with deep pockets perhaps. It's advertising for your school, which is much cheaper in basketball than football due to team size (and why so many schools want D-I basketball programs.) Prof. Beaulier is right, you can add more costs on if you want ... and more revenues. This is why economists like that ceteris paribus assumption.

So maybe we take Prof. Beaulier's Austrian advice and say "we just don't know," which is true if you insist on moral certitude as your standard of knowing. Or we could think marginally, arguing that for the last person you put on the plane to the Rose Bowl, the price of the ticket was lowered to induce an additional contribution to the alumni fund, given the fixed costs of the alumni office's payroll. I wouldn't call that a moral certitude, but I can predict a great deal of human behavior thinking marginally.

Tax migration and context

But meanwhile, in a new study released yesterday by the Freedom Foundation of Minnesota, two researchers looked at the IRS' data on income tax filings and returned a strong conclusion:

From 2002-2009 Minnesota lost an estimated 54,113 residents to other states, according to the new report, Minnesota�s Out-Migration Compounds State Budget Woes. These out-migrants also take their incomes with them. Between 1995 and 2007, the total amount of income leaving the state was at least $3,698,692,000 on which state and local governments would have collected an estimated $423,317,000 in additional taxes.For example, in 2007 -- the last year of their study, a net 4,428 taxpaying units left the state, and took $378,757,000 in AGI with them. By aggregating up the thirteen years of study they find that a total of $2.548 billion in additional taxes would have been collected. That's of course over 13 years, a period in which we would spend maybe 80 times that? I would have liked that number put in context, just as the income data should be put in context of state personal income ($216,436,888,000 in 2007, to put it in the same context the FFM study does.)

What caught my eye as well was their ability to identify where the taxpayers moved to. The top five destinations of out-migrants were Arizona, Florida, Colorado, California and Texas. Four of those places are very warm. We talk about the low taxes of South Dakota, though on net 1,322 taxpaying units moved TO Minnesota. But on net more AGI left than came. What was missing here was an attempt to tease out the effects of other factors they identified like weather or cost of housing. The study shows these factors as important, but doesn't get relative importance of these additional factors. That requires a regression analysis, which that study chose not to do.

But this is a very interesting and worthy study. It uses actual tax return data rather than a survey or the loose proxy of moving vans. It can measure income flows separately from people flows. And it fits the theory that people are sensitive to the cost of government.

Labels: economics, Minnesota, taxes

Eurohandcuffs

Germany and France will on Thursday promise their support for debt-laden Greece in a vow of eurozone solidarity but they are unlikely to come up with a detailed rescue plan.At the time this is posted, we have only word that they have an agreement to take "co-ordinated measures""if needed to safeguard stability of the euro zone as a whole", but no details.

President Nicolas Sarkozy and Chancellor Angela Merkel are expected to give a show of political support to Athens at a summit of EU leaders in Brussels, one of the most momentous in the bloc�s recent history, in the hope that it will calm debt market turmoil.

But officials in Paris said there was �reticence� in Berlin about signing up to a bail-out package with further �assurances that the Greek government would undertake the measures necessary� to cut its budget deficit by 4 percentage points a year by 2012.

If this was a developing country, there'd be no doubt what would happen -- Greece would be given IMF assistance in return for a plan from the Greek government to restrain government spending -- but this is the Eurozone, and you cannot really do that. And finding a lender of last resort is much harder. Germany, towards whom everyone is looking, seems more constrained these days. STRATFOR reports:

Most investors assumed that all eurozone economies had the blessing � and if need be, the pocketbook � of the Bundesrepublik. It isn�t difficult to see why. Germany had written large checks for Europe repeatedly in recent memory, including directly intervening in currency markets to prop up its neighbors� currencies before the euro�s adoption ended the need to coordinate exchange rates. Moreover, an economic union without Germany at its core would have been a pointless exercise.And that really is the issue: The French and German governments now face the constraints of Maastricht and the ECB charter, which were written to prevent one of those PIIGS from profligacy but never were meant to handle a systemic shock hitting all five at once. A guarantee or pledge of unity for Greece will mean a pledge to all. And the problem then is whether speculators will test the pledge. If they use actual funds they will cause a constitutional crisis in the EU; if they do not, they risk having these countries make an exit from the Eurozone, something nobody is prepared for (even the biggest skeptics.)

...The 2008-2009 global recession tightened credit and made investors much more sensitive to national macroeconomic indicators, first in emerging markets of Europe and then in the eurozone. Some investors decided actually to read the EU treaty, where they learned that there is in fact no German bailout at the end of the rainbow, and that Article 104 of the Maastricht Treaty (and Article 21 of the Statute establishing the European Central Bank) actually forbids one explicitly. They further discovered that Greece now boasts a budget deficit and national debt that compares unfavorably with other defaulted states of the past such as Argentina.

...As the EU�s largest economy and main architect of the European Central Bank, Germany is where the proverbial buck stops. Germany has a choice to make.

The first option, letting the chips fall where they may, must be tempting to Berlin. After being treated as Europe�s slush fund for 60 years, the Germans must be itching simply to let Greece and others fail. Should the markets truly believe that Germany is not going to ride to the rescue, the spread on Greek debt would expand massively. Remember that despite all the problems in recent weeks, Greek debt currently trades at a spread that is only one-eighth the gap of what it was pre-Maastricht � meaning there is a lot of room for things to get worse. With Greece now facing a budget deficit of at least 9.1 percent in 2010 � and given Greek proclivity to fudge statistics the real figure is probably much worse � any sharp increase in debt servicing costs could push Athens over the brink.

From the perspective of German finances, letting Greece fail would be the financially prudent thing to do. The shock of a Greek default undoubtedly would motivate other European states to get their acts together, budget for steeper borrowing costs and ultimately take their futures into their own hands. But Greece would not be the only default. The rest of Club Med is not all that far behind Greece, and budget deficits have exploded across the European Union.

Megan McArdle says it's a design flaw, and she's right to say "none of the choices are good." The markets have so far seemed to put considerable weight on the likelihood of a bailout -- the scene to the left from Athens indicates that a government austerity plan, if enacted, would be very unpopular. Large cash infusions may be the only way to get the public to swallow the bitter medicine. But markets do not seem aware of the constitutional restrictions placed on a bailout package from EU member states or from the IMF.

Megan McArdle says it's a design flaw, and she's right to say "none of the choices are good." The markets have so far seemed to put considerable weight on the likelihood of a bailout -- the scene to the left from Athens indicates that a government austerity plan, if enacted, would be very unpopular. Large cash infusions may be the only way to get the public to swallow the bitter medicine. But markets do not seem aware of the constitutional restrictions placed on a bailout package from EU member states or from the IMF.Thus it is unsurprising that there will be little more than a statement today from the EU members, with details to be worked out later. But time is of the essence, for as we learned in 2008, when the end comes it can be swift and a less-than-united front could cause far greater harm in Europe than what happened here.

UPDATE: Welcome HotAir and Atlanticist readers. Just as a coda to this story, the markets didn't buy the band-aid the EU tried to apply to the gash in the Greek budget:

An attempt by Europe�s richest countries to end the crisis engulfing the euro failed to impress financial markets today as the single currency fell despite promises that the battered Greek economy would not be allowed to implode.The euro is down to about $1.36 as I type this (1:30 pm CT.)

As the EU�s main paymaster, Angela Merkel refused to tie Germany down to a bailout of Athens at a one-day European summit, with EU leaders instead making a general pledge to take �determined and co-ordinated action if needed� to prop up the euro.

The statement of political intent followed a failure by the 16 nations in the eurozone to agree the precise details of a rescue plan for Greece, leaving the euro to lose most of the gains it had made in the run-up to the Brussels meeting of the 27 EU leaders.

I detoured today to talk about U.S. monetary policy but will get back to Greece this PM. Thanks for stopping by.

Labels: economics

Wednesday, February 10, 2010

I'm persuaded by your argument

"So, son, did you build a road today?" That's a question Ward Cleaver never asked the Beav.He's right of course: Government is NOTHING like a family budget. They're not even alike in how they take money. The editor says the family "takes money", by which he means the family needs an income. It's not just a matter of balancing a budget. Unlike the state of Minnesota, the family can conceivably borrow past the end of a biennium. But in the long run it must balance. And how does it get its income? By persuading someone to hire one of the family's resources -- the labor of one of its members, or its land and buildings, or its savings and perhaps machinery. The person it persuades believes it receives something of greater value for something of less value. So does the family.

But it's a question politicians are beginning to ask as an election year begins.

It seems that many politicians love the analogy of government's revenue and spending plans being like a family budget.

And my response is: Government is nothing like a family budget.

Excuse me. I should say, there is a similarity: They both take money.

The government's budget is nothing like that. It can force others to lend to it, as the current state budget forces school districts and its universities to do so. It can impose taxes, which involve coercion rather than persuasion. Its coercion may take something of greater value and convert it to something of less value; in fact, more often than not, it does. And it can claim some moral high ground while it coerces, claiming to do it for "those less fortunate" or "the children." My family could persuade a few dollars from people through begging. The government does not stand on street corners.

So good job, Winona Daily News.

Labels: it's the spending stupid, Minnesota, taxes

Move away from the nuisance

- FGCU seems to be atoning for its original sin of being built on land claimed after draining a swamp. It must lead a very conflicted life.

- Ashley has invented a great word: voluntyrrany. That's a keeper.

Students take field trips to places such as the Corkscrew Swamp Sanctuary, and they must participate in ten hours of mandatory service projects. Upon completion of the Colloquium, students take an assessment to measure how well they learned �an ecological perspective� and �community awareness and involvement� for the university�s student learning outcomes (SLO) records.Which to me is the point. The students there knew what they were getting into. I appreciate the effort of students who want to make this course optional rather than mandatory, but I would suggest instead simply getting away from a school that thinks that is 2/9 of its student learning objectives.

FGCU thus teaches the highly contested idea of anthropogenic global warming; engages in voluntyranny; mandates student action on behalf of the �imperative for ecological sustainability�; and buys in to the self-justifying mediocrity of the outcomes movement. The University is forthright in its efforts to provide across-the-board sustainability education; students who choose to attend FGCU doubtless know what they�re signing up for.

Before choosing your university, read something to help pick places where intellectual freedom is respected. ISI's College Guide or Thomas Sowell's Choosing a College (older, but still helpful.)

Labels: higher education

"Stop stimulating us!"

Washington still does not get it. It pays lip service to the fact that small business generates half of private sector GDP and creates over two-thirds of private sector net new jobs, but when it comes time to provide help, small business gets $30 billion IF banks decide to accept the TARP funds to support loans and IF the owners can subsequently get a loan from a bank. But for most firms, this dinky amount is of little help. More so, this new aid misses the main problem since only five percent of small business owners cite �financing� as their top business problem but 31 percent cite �poor sales.�This from the National Federation of Independent Businesses. Add to it the overhanging burden of health care reform and a minimum wage increase and small business owners are quite nervous ... about getting more stimulus.

The National Bureau of Economic Research is expected to declare a recession bottom in the second half of 2009. Manufacturing turned in the third quarter, employment managed a positive month in the fourth, both determinants of the turning point. The NFIB indicators do not appear to agree however. At the end of the 1982 recession (Q4, 1982), the Index value was 98, the percent of owners viewing that period as a good time to expand was nine percent and the net percent expecting better business conditions was 47 percent. The January Index value is 89.3, the percent of owners viewing the current period as a good time to expand is five percent and only a net one percent expect better business conditions in the first half, not really strong signs of a turn in the economy. The decline in the unemployment rate reflects a reduced number of individuals looking for a job and is more consistent with the NFIB forecast which did not anticipate a continued rise in the unemployment rate above 10 percent. The loss of a lock on 60 Senate votes for the Democrats may be encouraging to some owners, but the President and Congressional leaders still sound like they plan to press on with their agenda, not good news for small business owners.Bruce Yandle does it shorter:

Imagine yourself as owner of a small business with 20 employees. You are trying to decide if you should build up inventories again, hire one or two people, and lease another pickup truck. Would you make your decision on the basis of the fourth quarter GDP numbers? Would you base your plans on the explosion of existing home sales that followed the first-home-buyer stimulus? Most likely not. I�ll bet you would wait so that you could get a better fix on the real economy.When I teach cost-benefit analysis one of the factors we discuss is the value of the option of waiting. Waiting for more information, waiting for a reduction in finance uncertainty, waiting for a reduction in policy uncertainty. Yet we have financial reform hanging up in the Senate -- bipartisanship or ram it through? Policy makers occasionally say they are moving forward with health care, then they want a summit. If you ran a business and I was your silent partner, my silence would be tough to maintain if you started an expansion right now. And there's no sign of a pickup in the hiring rate...

Perhaps we need six months of political silence.

Labels: economics

Tuesday, February 09, 2010

Lipstick on industrial policy

I say "get religion" because this is not the Ann Lenczewski I kind of admired last year, when she had this to say in an interview with Steve Perry:

PIM: You�re talking about loopholes and exemptions that principally benefit upper-bracket people. Could you give me a couple of examples?Emphasis added. She is now willing to sponsor legislation that spurs "angel investment" ... but the angels only visit those "in high tech, manufacturing, or green businesses with fewer than 100 employees and less than $2 million in gross receipts." She's now putting "certified historic projects" for rehabilitation ... certified by whom? Who will "government playing king" take money from when she says she will "conform" REIT income to federal taxation? And what kinds of jobs are being created by using state monies for Mall of America? I'm saddened by this because I thought she had seen the light given the Perry interview. I am sure she prefers a higher tax rate than I do, but we both prefer (or preferred) a flatter tax base.

Lenczewski: There are like 25 things that I�m repealing, and they do different things. Some of them aren�t just helping wealthy folks. Some of them aren�t working at all, no matter who they�re intended to help�for example, the long-term health care credit. That�s intended to get people to buy long-term health care, and what it�s really doing is costing the state a ton of money. It�s a net loser, it�s completely not working. I heard a Harvard study at the National Tax Association showing that states doing this are just nuts, because they�re net losers.

So I�m repealing some things that don�t work, and then I�m repealing some things that are discretionary ways of saying, we�ll give you tax credits for certain activities but not for others. It�s sort of government playing king. .And then there�s a whole bunch of things for people who are high income-earners. We�re not getting rid of them entirely; we�re still going to keep them for people of limited means, but we�re going to turn them into a credit.

Gary Gross (whose link to Lenczewski's release inspired this post) properly chastises this effort: