Monday, November 30, 2009

Media alerts

Just as advanced notice, I will be also substitute hosting for Don Lyons on KNSI's Morning Show Wednesday through Friday this week.

Labels: Media

Friday, November 27, 2009

From a slouch to a dash

In March I thought we were slouching towards corporatism. It now seems like a full-out run.First, the Fed announced that it will evaluate bankers� pay on the basis of how well they manage risk. How better to be a good risk manger in a bureaucrat�s eyes than to take no risk? Purchasing Treasury obligations and federal agency paper is the sure way to avoid risk. The Fed has a second policy to make that strategy profitable: zero interest-rate borrowing to finance Treasury and agency debt yielding 3%.or more. The Fed continues to signal it will keep rates low, diminishing interest-rate risk.

These policies are choking off the supply of credit to the private sector, espcially small business. To add to the problem of small business, the Fed and the Treasury have a third policy of credit allocation to major banks like Citigroup, Bank of America and JP Morgan Chase; large industrial firms like GM and Chrysler; and such entities as money-market mutual funds.

The government crowds out the private sector overall, and Wall Street crowds out Main Street.

Melloan doesn�t state it, but there is a name for this economic policy: corporatism. Big government favors selected big business and rewards big labor as a junior partner. It�s not socialism, but the economic component of a fascist political program.

Cff. Steven Malanga from last April. I prefer corporatism to socialism as a description of Obama's policies, and when I said so on radio last July, boy did I catch heck! I wonder if it's because it blurs the distinction between our two major parties?

Not economist, just wrong

Surely a broader accounting of economic activity will enhance economic policy and decision-making. We commend the work of Professor Joseph Stiglitz and the Commission on the Measurement of Economic Performance and Social Progress for recognising that while facts and figures are important � indeed critical to thoughtful decision-making � we have placed too great an emphasis on outdated modes of distilling economic value. The longer we defer the proper accounting for externalities such as global warming pollution, the greater the strain we place on our already fragile economies.This concept of green GDP has been around for a long time. Minnesota had some group write a report on how to restate the state's economic growth with environmental factors. But it isn't just environmental -- if it was, you could have a reasonable discussion of a "net-of-resources domestic product" that would include some depletion charge for nonrenewables that would have a basis in real national accounting. But once you start this process you get a "genuine progress index" where "genuine" is determined by some elitists who decide whose income matters, which goods matter more, etc. Once one starts down the road you often don't like the result. The Chinese government tried green GDP in 2004, but killed the idea a few years later when the "deductions" decided to count against measurable growth of goods and services gave an answer decidedly against the political judgment.

GDP is a score, not a judgment. And it should be that way, so that we don't have to worry about whether we get the east German judge.

(P.S. the title of this post refers to the new film, Not Evil Just Wrong, which we need to show somewhere in St. Cloud soon.)

h/t: SCSU emeritus Professor Pat Mattson.

Labels: economics

Come nigh Dubai

My flashback was to August 1998, when I boarded a plane from Cairo back to the States, and as I took the International Herald Tribune from the flight attendant I saw the news of Russia's default on its bonds. That took a little time to sweep through markets; it was three weeks later that Russia floated the ruble. So while we may not want to believe the doom and gloom crowd, I think we should pay more attention to this than one might on a holiday weekend.

Gillian Tett puts it in some perspective, including the Greek story with it (I wrote about Greece earlier this week) as "a welcome wake-up call":

After all, [investors] have known for months that Dubai World was dangerously over-leveraged. They assumed that this would not be too dangerous, because they thought that foreign investors would always be protected."Seabee" at Dubai World expands:

For nearly a year the Dubai World companies have been going through a 'restructuring'. But it's always a nonsense for the management responsible for a company's troubles to be allowed to create and preside over a restructuring made necessary because of their own policies. A Chief Restructuring Officer, an outside expert with a proven track record, was needed from the beginning of the crisis to sort the mess out. But it wasn't treated with the urgency the situation demanded.Does this sound familiar to you?

They became bloated companies with unnecessarily huge numbers of people being paid huge amounts of money, huge duplication of job functions between the companies in the group, unnecessary competition to build the biggest, tallest.

That led to too many mega-projects all going ahead at the same time. Worse, many were pushing engineering into uncharted waters but second and third versions were being pushed ahead before the engineers had worked out how to make the first one.

...We're a year into the crisis before the real moves are made that needed to be made there and then.

Mohammed El-Erian of Pimco: "There will be contagion to many markets, especially in the emerging world where we are witnessing broad-based sell-offs among names with very different financial characteristics."

Labels: economics

Because it worked so well last time

The government admits in this article that more than half of the cars purchased in C4C was money expended on trade-ins that would have happened without the program. For $3 billion it got 330,000 cars purchased that would not otherwise have been, according the Obama Administration's Council of Economic Advisers. The other 360,000 vouchers cashed were either cars delayed from June, those that would have been bought in July and August, or those pulled forward a few months. This was just a transfer from all taxpayers to those lucky enough to have their car purchases happening around the time of the program. The same will be true for appliances. Many sales will be for homes purchased under the government's homebuyer tax credit: A major determinant of appliance sales is home sales. Those people already induced into buying an existing house with appliances they would have replaced are going to get another gift.On the heels of its ballyhooed "Cash for Clunkers" program for cars, the federal government is expected to finalize details in the coming weeks of another tax-supported shopping extravaganza, known as "Cash for Appliances."

Supported by $300 million from the economic stimulus, the program will offer rebates to consumers who buy energy-efficient refrigerators, dishwashers, air conditioners and other appliances to replace their older models.

And like the $3 billion cars program that gave consumers money for swapping their clunkers for more fuel-efficient rides, the appliance initiative seems destined to inspire shoppers, drive up sales for a while and profoundly divide economists over how much lasting good this chunk of government spending will do for the economy.

"The premise seems to be that for Americans to be richer, they need to throw out their old appliances faster -- I don't see it that way," said James D. Hamilton, an economics professor at the University of California at San Diego, who has blogged about the clunkers rebates. "I don't like the idea of just spending money for its own sake."

Details on the program are here. One more effect will be that those who planned to buy these items now are being incentivized to wait for the rebate program to kick in. That plus continued decline of consumer credit may make holiday season shopping a little less merry.

Labels: economics

Thursday, November 26, 2009

Media alert

Labels: Media

A grateful heart

Labels: thankfulness

Happy Thanksgiving

We have been blessed with a nation whose military fights to protect freedom. Our nation is rich in natural resources, has a system of government that is the best devised yet, provides incredible opportunities to those willing to take risks, and allows for a mindset that lets people dream and hopefully achieve those dreams.

Today, as you visit with family and friends, watch some great football, and have overall good times, please remember to be thankful for all we do have.

Labels: thankfulness

Wednesday, November 25, 2009

Quick followup on dispositions: Preaching to the choir

According to documents published by the college (see http://blog.lib.umn.edu/cehd/teri), it intends to mandate certain beliefs and values-"dispositions"-for future teachers. The college also intends to redesign its admissions process so that it screens out people with the "wrong" beliefs and values-those who either do not have sufficient "cultural competence" or those who the college judges will not be able to be converted to the "correct" beliefs and values even after remedial re-education.This should truly shock the conscience of any academic. You somehow can prejudge the ability to change the heart of a student? It is nothing short of cowardice. The school wishes to prescreen to be sure that it only credentials those who agree with them. No wonder they are willing to go to such lengths for remediation; they are trying to reclaim a congregant who left their church.

Missed last time, David French at PBC does a nice summary.

Labels: education, higher education

A veil of comradeship and colleagueship

It is the same with many lawyers and teachers, artists and actors, writers and journalists, architects and scientific research workers, engineers and chemists. They, too, feel frustrated be cause they are vexed by the ascendancy of their more successful colleagues, their former schoolfellows and cronies. Their resentment is deepened by precisely those codes of professional conduct and ethics that throw a veil of comradeship and colleagueship over the reality of competition.

Labels: economics

Media alerts

I will also be on the Ed Morrissey Show at 2pm CT to discuss the latest economic news, where the jobs are and are not, and whatever other silliness Ed and I get into. (Link goes to UStream page currently, will put in HotAir link when it goes live.)

Labels: economics, hot air, Media

Tuesday, November 24, 2009

Also sprach ZaKrugman

Why, people ask, would I want to compare us to Belgium and Italy? Both countries are a mess! ... If these countries can run up debts of more than 100 percent of GDP without being destroyed by bond vigilantes, so can we.Yoohoo! Mr. Nobel! Greece would like a word with you:

Greece is disturbingly close to a debt compound spiral. It is the first developed country on either side of the Atlantic to push unfunded welfare largesse to the limits of market tolerance.And that's the real point here. Unlike Greece, we can devalue and print money, but the cost is rampant inflation.

Euro membership blocks every plausible way out of the crisis, other than EU beggary. This is what happens when a facile political elite signs up to a currency union for reasons of prestige or to snatch windfall gains without understanding the terms of its Faustian contract.

When the European Central Bank's Jean-Claude Trichet said last week that certain sinners on the edges of the eurozone were "very close to losing their credibility", everybody knew he meant Greece.

The interest spread between 10-year Greek bonds and German bunds has jumped to 178 basis points. Greek debt has decoupled from Italian debt. Athens can no longer hide behind others in EMU's soft South.

"As far as the bond vigilantes are concerned, the Bat-Signal is up for Greece," said Francesco Garzarelli ...

Communist-led shipyard workers have already clashed violently with police. Some 200 anarchists were arrested in Athens last week after they torched streets of cars in a tear gas battle.

Mr Papandreou has mooted a pay freeze for state workers earning more than �2,000 a month. This has already set off an internal party revolt. "There is enormous denial," said Lars Christensen, emerging markets chief at Danske Bank. "They don't seem to understand that very serious austerity measures are needed. It is a striking contrast with Ireland," he said.

Brussels says Greece's public debt will rise from 99pc of GDP in 2008 to 135pc by 2011, without drastic cuts. Athens has been shortening debt maturities to trim costs, storing up a roll-over crisis next year. Some �18bn comes due in the second quarter of 2010 (IMF).

Modern economies have reached such debt levels before, and survived, but never in the circumstances facing Greece. "They can't devalue: they can't print money," said Mr Christensen.

For now things have gone well; today's bond auction was stellar for the United States. But with mountains of debt due for rollover in the next 12 months our luck had better hold. How will SEIU and AFSCME react when the government has to freeze government workers' wages while paying $700 billion in debt service in the 2019 budget?

Peter Boettke tells us of Tom Sargent's observation that before every inflation, there is debt.

Labels: economics

A U.S. Tobin tax?

Under a bill being drafted by Democratic Reps. Peter DeFazio (Ore.) and Ed Perlmutter (Colo.), the sale and purchase of financial instruments such as stocks, options, derivatives and futures would face a 0.25 percent tax.Treasury Secretary Timothy Geithner has said a �day-by-day� tax on speculation is �not something we�re prepared to support.� Paul Ormerod explained in 2001 why the tax doesn't help in terms of reducing market volatility. Ramkishen Rajan explains that one of two things happens: either it causes a sharp drop in market transactions, reducing economic efficiency and making revenues generated by the tax small, or it doesn't because the elasticity of demand for financial transactions is very low ... in which case the revenue it generates is quite large.

The bill, a copy of which was obtained by The Hill, is titled the �Let Wall Street Pay for the Restoration of Main Street Act of 2009.�

Half of the $150 billion in tax revenue would go toward reducing the deficit, while the other half would be deposited in a �Job Creation Reserve� to support new jobs.

The job fund would be available to offset the additional costs of the 2009 highway bill and other legislation that creates jobs.

The Obama administration and congressional Democrats are looking for ways to create jobs after the nation�s unemployment rate hit 10.2 percent in October and job losses are expected to rise.

You're just trying too hard

�Celebrations of Peace� weaves a diverse musical program featuring SCSU's finest instrumental and choral ensembles into a variety of readings from the pangea of mankind.Italics added. Pangea? Most commonly that word means a supercontinent; I suppose this avoids upsetting any religion, but who knows? More likely the writer is thinking of Pangea Day. (More on that day.)

So in order to eliminate reference to religion we need a theory of plate tectonics? I think you're just trying too hard.

Labels: higher education, SCSU

Monday, November 23, 2009

Deepening production vs ramping up production

If everyone scans the headlines and sees "Great Depression," that could very well cause a drop in consumption. And if everyone scans the headlines and sees "recovery," they might spend more.After a long comparison of information-based businesses versus manufacturing, he concludes:

We could also observe herd behavior among producers. I have been talking a lot about Garett Jones' remark that today's work force produces organizational capital rather than widgets. It is time to elaborate on this notion.

Thus, my experience fits very well with the notion that workers are needed in order to build organizational capital. In today's economy, the organizational capital often is embodied in a computer system of some kind. Those systems depreciate very rapidly, because of technological innovation and the evolution of business demands.The Quarterly Business Report we do at SCSU for central Minnesota includes a survey of local business leaders. We don't take a temperature of business confidence directly, but we can track their assessment of the national economy along with their own plans to expand payroll, wages to be paid and prices to be received, etc. I have long wanted to see if these data could be used somehow in a confidence index. There is some evidence that business confidence is a turning point indicator (McNabb and Taylor [2002], Holmes and Silverstone [2007] ). There's also at least anecdotal evidence that reporting on economic news influences that confidence. (This is why President Obama probably shouldn't say "double dip recession" in public.) Indeed, Google Trends still averages ten times more for recession than economic recovery.

Other forms of organizational capital are embodied in human capital. For example, an airline needs to have an effective program for training its employees and for ensuring the quality of their work. If your flight attendants are surly, some of your customers will switch to a different airline next time.

The macroeconomic significance of all this is that the choice of when to invest in organizational capital is discretionary. If you read a bunch of headlines that say "economic downturn," you can cut back your labor force to just the number of people needed to keep today's business operating. If you read a bunch of headlines that say "recovery," you may become inclined to invest in projects that make your business more complex or more competitive.

Labels: economics, forecasting, St. Cloud

Dispositions back in the news

We were last down this road in 2005 during the KC Johnson controversy at Brooklyn College. Yet it continues unabated. At SCSU students in educational administration or in child and family studies have a form to fill out if they see a disposition that doesn't meet the professional standards. In the former field, if you "express an inability or unwillingness to work with someThe initiative is premised, in part, on the conviction that Minnesota teachers' lack of "cultural competence" contributes to the poor academic performance of the state's minority students. Last spring, it charged the task group with coming up with recommendations to change this. In January, planners will review the recommendations and decide how to proceed.

The report advocates making race, class and gender politics the "overarching framework" for all teaching courses at the U. It calls for evaluating future teachers in both coursework and practice teaching based on their willingness to fall into ideological lockstep.

people" and "avoid collaboration", you have an area of need to work on. Teachers in graduate studies get courses in which their competencies are assessed to determine if they consider "multiple perspectives and willingness to challenge and analyze one�s own perspectives given alternatives" and "respond to items regarding lens of social justice and dispositions."

Johnson reports, by the way, that these Minnesota criteria are being highlighted at exactly the moment NCATE, the teachers' accrediting body, is turning away from them. So maybe this won't last for much longer around here.

Labels: education, higher education, Minnesota

I don't understand newspapers

Q: Gov. Tim Pawlenty said on MSNBC that moderates need to fall in line with the conservative base of the Republican Party. Do you agree?And they chastise as "pitching softballs" a newspaper that already declared "we've had enough" of Bachmann.

A: I think that he's accurate that ...

Q: AND HAVE YOU STOPPED BEATING YOUR CHILDREN? WHY DO YOU HATE CATHOLICS?!?!?

Labels: Media, Michele Bachmann, St. Cloud

Friday, November 20, 2009

Local responsibility for taxes reduces spending

Property taxes would increase an average of 3.5 percent across Minnesota next year if local governments adopt their proposed levies, the state Revenue Department announced Thursday.Source. The cap of property taxes was a bone of contention between DFL legislative leaders and Pawlenty, after Pawlenty cut intergovernmental aids. Giving local control of taxes seems to have reduced spending, rather than have the burden of some paid for by the taxes of others.

That would be less than the 5.6 percent increase in average property taxes this year and the average 6.9 percent increase over the past three years.

"City councils are very well aware of how poor the economy is and are doing everything they can to keep the levies down," said League of Minnesota Cities lobbyist Gary Carlson.

By law, cities and counties could have increased their property tax levies by the full amount that Gov. Tim Pawlenty cut their state aid. But counties appear to be levying for just 40 percent to 50 percent of their lost state funding, said Jim Mulder, executive director of the Association of Minnesota Counties.

The state cut aid to cities by $130 million over the past two years. Cities have levied $95 million in property taxes to replace those funds and absorbed $35 million in cuts, Carlson said.

Notable: Minneapolis property taxes are scheduled to rise almost 12%, highest in the state. Will any DFLer make this an issue in Mayor Rybak's run for governor?

Labels: Minneapolis, Minnesota, Pawlenty, taxes

Declare victory, supply-siders

In [2007] I argued that supply-side economics (SSE) should declare victory and then go out of existence. Everything that was true about it had by then been fully incorporated into mainstream economic thinking and all that was left was a caricature. Continuing to maintain a separate identity for SSE only created unnecessary conflict with mainstream economists, I argued.As someone who learned his graduate economics during the first Reagan Administration, I agreed with this back in the 1980s and still do. There were some taxes at that time, on particular types of equipment and structures, that approached and sometimes even exceeded 100%. Certainly those were on the wrong side of the Laffer curve hill. But others were almost certainly NOT. While I think the brush Bartlett uses to paint Bush is a little too broad, there was certainly some excessive statements about the gains we would find if only we used dynamic scoring.

...All economists today accept the importance of the money supply--perhaps too much; during the recent crisis many asserted that fiscal stimulus was unnecessary because an increase in the money supply was the only thing necessary to restore growth. (How this would have been accomplished when interest rates were close to zero was never explained.) All economists now accept the importance of marginal tax rates to economic decisionmaking, and organizations like the National Bureau of Economic Research publish vast numbers of papers on this topic.

During the George W. Bush years, however, I think SSE became distorted into something that is, frankly, nuts--the ideas that there is no economic problem that cannot be cured with more and bigger tax cuts, that all tax cuts are equally beneficial, and that all tax cuts raise revenue.

But the more important point Bartlett makes is the general acceptance of the disincentive effects of high tax rates. And the reach of that acceptance is even to places generally unreceptive to conservative thought. Witness today's StarTribune:

Yes, go check that link: This was in the StarTribune, in its editorial voice. More supply-side words have not been written.Organizers of last week's program at the TwinWest Chamber of Commerce may have been hoping for a tax policy fight. The lineup featured state Rep. Ann Lenczewski, DFL-Bloomington, head of the House Taxes Committee, and Mark Haveman, head of the business-oriented Minnesota Taxpayers Association.

But instead of an argument, chamber members heard considerable consensus around a key proposition: Minnesota's corporate income tax is too high, and it should be either reduced or scrapped. That would not be the universal view among DFLers at the Legislature. It might not be the first choice of Republicans or of most Minnesota businesses, since many small businesses don't pay corporate tax.

But it's an idea Minnesota policy leaders should seriously consider. State corporate income taxes generally top "worst tax" lists when economists and tax experts from around the country convene to dispense policy advice. State taxes on corporate profits are faulted for several reasons. They're highly volatile, rising and falling dramatically with the economic cycle. They're costly to collect, especially from big businesses that employ high-powered legal talent to dodge them. They're regressive -- invisibly so. They are paid by customers in the form of higher prices and by workers in the form of reduced wages and fewer jobs, all of which hits the poor disproportionately hard.

Minnesota's corporate income tax has one other defect -- its 9.8 percent rate. That's among the highest in the country. It's also deceiving because of adjustments that have been made through the years to the income base that's taxed. The effective rate most businesses pay is a good deal lower, particularly among those with foreign operations or those based in Minnesota with sales elsewhere. But the high rate creates a damaging impression among would-be out-of-state investors.

Rep. Lenczewski, who has also had her eye on tax expenditures, is in a strong position to make this argument from her position on the tax committee. While I fear her colleagues will not let her cut any tax when they face a tremendously high projected deficit in the next biennium, it would be wise for the long-run growth of this state for Republicans to focus their attention on that. And if it means killing a few tax expenditures that create corporate welfare, so be it. Along with it you could include eminent domain reform, which also strikes at corporate welfare.

Two good paragraphs

The individual insurance mandate, then, is a solution to a problem the bill itself would create. The authors invoke the Commerce Clause to protect interstate commerce from a threat they themselves pose to it. They could avert the threat simply by not imposing guaranteed-issue on insurers.From Sheldon Richman today. I know I've heard constitutional lawyers say this use of the Commerce Clause meets legal standards, but even CBO says it's unprecedented. How do they know? That CBO report also wondered whether the costs of complying with the mandate should be included in the budget documents. The current CBO report only reports an "unfunded" mandate but does not estimate the size.

---

I don�t want a single standard of health care, one standard of what�s �best.� Everyone is different and what is best for me may not be best for you. More importantly, what is best is unknowable to a committee of experts. Not hard to know. Not difficult to discover. Unknowable. What age should a women have a mammogram is not a question that has an answer. There are many answers. One reason is that women are different. A more important reason is that our knowledge evolves. What is thought to be �best� (wait until 40) may turn out to be different (wait till 50). But even more importantly, when power is centralized, the very idea of �best� no longer applies. The incentives aren�t there. When there is one standard set by the political process, the experts� incentives on whatever committee determines the universal standard are inevitably going to be politicized. So give me �inefficient� competition among standards. Let different standards vie for attention.Russ Roberts. BTW, I picked up and re-read The Price of Everything

Labels: economics, health care

Thursday, November 19, 2009

Random thought while playing a video in class

Can one compare countries in that timeline to the banks before and after TARP; where Lehman plays Thailand, I guess? It just seems that this video looks very different to me now than six years ago when it was first released.

Labels: economics

Gross jobs

From December 2008 to March 2009 the number of job losses from closing and contracting establishments remained essentially unchanged at 8.5 million. The number of job gains from opening and expanding private sector establishments fell from 6.7 million to 5.7 million, the lowest level since the series began in 1992, the U.S. Bureau of Labor Statistics reported today.From the Business Employment Dynamics report for Q1 2009 this morning. For Minnesota there were 110,150 jobs gains and 163,810 jobs lost in the first quarter of 2009. As one of the states with higher than average employment in manufacturing, it's worth noting that the manufacturing sector nationwide had 294,000 jobs gained and 990,000 jobs lost in Q1.

Gross job losses exceeded gross job gains in all but two industry sectors: utilities and education and health services.

The data for Q1 is of course old, but it does highlight something we've said for awhile -- the recession picked up great speed in late 2008 and early 2009, and job shedding was a big part of this.

In related news, the state reported unemployment of 7.6% in October, up from 7.4% in September and from 5.6% a year ago. September's number represented a sharp drop from levels in the summer, so I would have guessed a little bit of that to be a blip that got reversed. This week's initial claims for unemployment insurance hung above 500,000 this week, with an increase of 2,149 in initial claims in Minnesota.

Labels: economics

The limits of a CBO score

Let's first make sure we understand a CBO score, which only looks at the deficit (rather than private sector impact) and only for ten years. Director Elmendorf writes:

In the decade after 2019, the gross cost of the coverage expansion would probably exceed 1 percent of gross domestic product (GDP), but the added revenues and cost savings would probably be greater. Consequently, CBO expects that the bill, if enacted, would reduce federal budget deficits over the ensuing decade relative to those projected under current law�with a total effect during that decade that is in a broad range around one-quarter percent of GDP. The imprecision of that calculation reflects the even greater degree of uncertainty that attends to it, compared with CBO�s 10-year budget estimates. The expected reduction in deficits would represent a small share of the total deficits that would be likely to arise in that decade under current policies.That's a good score for Sen. Reid. Both the Reid and Pelosi plans have been written in ways that provide for deficit reduction beyond 2019. Of course, that means government can't pass things like doc fix in the future, as Elmendorf notes in his letter.

Reid's proposal ends up covering 94% of Americans who live in the U.S. legally, while Pelosi's is expected to cover 96%. Should this matter? If health care is a right, wouldn't you want the 96% bill rather than the 94% bill?

Down towards the bottom, however, you find discussion of unfunded mandates.

The total cost of mandates imposed on the private sector, as estimated by CBO and JCT, would greatly exceed the threshold established in UMRA for private entities ($139 million in 2009, adjusted annually for inflation). The most costly mandates would be the new requirements regarding health insurance coverage that apply to the private sector. The legislation would require individuals to obtain acceptable health insurance coverage, as defined in the legislation. The legislation also would penalize medium-sized and large employers that did not offer health insurance to their employees if any of their workers obtained subsidized coverage through the insurance exchanges. The legislation would impose a number of mandates, including requirements on issuers of health insurance, new standards governing health information, and nutrition labeling requirements.Similar costs are imposed on states and municipalities. One of those unfunded mandates is Medicare Advantage, which would be withdrawn under the Reid substitute in 2011. Democrat Sen. George Voinovich recently said that health care reform "should not come at the cost of limiting choice and access to physicians and health services for seniors." Medicare Advantage cuts provide $118 billion of the savings in the Reid proposal.

One other paragraph indicates the limitations of a CBO score:

Based on the extrapolation described above, CBO expects that Medicare spending under the bill would increase at an average annual rate of roughly 6 percent during the next two decades�well below the roughly 8 percent annual growth rate of the past two decades (excluding the effect of establishing the Medicare prescription drug benefit). Adjusting for inflation, Medicare spending per beneficiary under the bill would increase at an average annual rate of roughly 2 percent during the next two decades�much less than the roughly 4 percent annual growth rate of the past two decades. Whether such a reduction in the growth rate could be achieved through greater efficiencies in the delivery of health care or would reduce access to care or diminish the quality of care is unclear. [Emphasis mine]The goal has been to "bend the curve" and CBO indicates that it is bent a little. But it may be that this is all taken out of hide, particular out of the hide of seniors.

Overall, the CBO cannot tell us whether the share of GDP spent on health care will rise or fall or stay the same. If the goal really is to lower the share of spending we do in America on health care, shouldn't the Congress be able to answer this question?

I close with a hear! hear! for Hennessey's point on what Reid is proposing with the violation of the health insurance model implied by Reid's proposal:

...most people think their individual taxes paid are being used to finance their benefits, when in fact the funds are used to subsidize other people�s benefits. But the social insurance model and dedicated payroll taxes have been a core principle of Social Security and Medicare financing since they were created, and advocates (especially on the Left) of those programs have fiercely defended this principle.If the Reid bill lays bare the fiction that our Social Security and Medicare contributions sit in a box waiting for us to claim them in old age, I would almost find this debate worth the headaches it causes. Almost.

Leader Reid�s bill would use new Medicare payroll taxes to finance a new health entitlement outside of Medicare. His bill would turn Medicare payroll taxes into a general financing mechanism like the income tax. There is a slippery-slope argument against this that I would normally expect from the Left. If Republicans had proposed this, I would expect AARP to come unglued and raise fears among seniors that, if this proposal becomes law, future Congresses might take payroll tax revenues and use them for highways or defense or other non-social insurance spending. I am interested to see how AARP reacts. Will they support the Reid bill as they did the House bill? (Reporters: There�s a story for you. Ask AARP.)

UPDATE: Nice chart from the Tax Foundation:

Labels: economics, health care

Wednesday, November 18, 2009

I should have known better

One explanation was offered by journalist Michael Barone at an American Experiment forum in 1998, when he argued that �politics more often splits Americans on cultural than on economic lines.� As a prime example, he pointed to abortion. Moral issues of this sort, he went on to say, �engage and mobilize people and keep them fighting.� This, in turn, �has led to a politics in which people defend their niches fiercely against people whom they know little. . . . In the process, we get fierce attacks on politicians. People feel justified because they believe the moral stakes are high.�You folks write things to each other you could never say to one's face. I've met at least two of the vitriolic commenters, and they are not the people you think they are from the comments. Yet they persist in this behavior. Why? Is it just the impersonality of the web, or is it because we just have decided to have a meaner politics in this decade?

You may post only once in comments, and your only comment may be "I have been a turrible knucklehead." All other comments will be deleted.

Labels: blogging

Bloggiversary

Bang for your tuition buck

To determine whether institutions have a solid core curriculum, we defined success in each of the seven subject areas outlined as follows:Good list; I deleted the explanations of the seven courses, but you should read them. No school they surveyed had all seven, and of those that made their A-list requiring six of seven, only one -- West Point -- requires economics. The agony!

- Composition.

- Literature.

- Foreign Language.

- U.S. Government or History.

- Economics.

- Mathematics.

- Natural or Physical Science.

If you like that list and have a child close to deciding where to go to school, you'll see one school that surprises you: University of Arkansas. At $15,338 for out-of-state tuition, it appears to be a bargain compared to the others. If you're reading from UArk, send me some info -- Littlest is a sophomore.

SCSU would get a D as I read the criteria. Sounds terrible ... but Carleton gets a D too. The University of Minnesota does better than I thought it would.

Labels: economics, higher education

Waste, fraud and abuse

The federal government made $98 billion in improper payments in fiscal 2009, and President Obama will issue an executive order in coming days to combat the problem, his budget director announced Tuesday.Sheldon Richman says sarcastically "Yes, a well-worded executive order should do the trick." $24 billion of the improper payments came from Medicare according to this report; another report over the weekend suggested Medicare lost $47 billion. But the Feds are now saying they are going to count as improper incomplete or illegible documentation, which the Bush administration did not. This then permits them to "multiply by 10 the number of agents and prosecutors targeting fraud in Miami, Los Angeles and other strategic cities where tens of billions of dollars are believed to be lost each year." These will be claimed as savings ... which will be spent on expanded coverage.The 2009 total for improper payments -- from outright fraud to misdirected reimbursements due to factors such as an illegible doctor's signature -- was a 37.5 percent increase over the $72 billion in 2008, according to figures provided by Peter Orszag, director of the White House Office of Management and Budget.

Got that? Define a scribble as fraud, hire more government workers, get doctors to reduce scribbling, and claim savings of $9.7 billion. (The extra $1.3 billion is payroll for those new prosecutors and agents making our health care experience better.)

No word on how many agents and prosecutors will be used to find phantom districts receiving $6.4 billion in stimulus cash. Perhaps we should get another executive order wherein Obama calls for the elimination of phantom districts. Imagine the savings!

Labels: health care, it's the spending stupid, Obama

They assume they know you

While I was reading Eric's post, I came upon a title on that same site "Fear and Loathing in White Cloud." 'White Cloud' is a smear that people put on my fair city, and has been one I've heard pretty much since I moved here in 1984. At that time I was probably in the darkest 10% of the population here (unlike all you European descendants, my father's family is actually from the Caucasus.) Not to claim any minority status, but to say that I am aware of the whiteness of the place, particularly after moving here from Los Angeles.

While I was reading Eric's post, I came upon a title on that same site "Fear and Loathing in White Cloud." 'White Cloud' is a smear that people put on my fair city, and has been one I've heard pretty much since I moved here in 1984. At that time I was probably in the darkest 10% of the population here (unlike all you European descendants, my father's family is actually from the Caucasus.) Not to claim any minority status, but to say that I am aware of the whiteness of the place, particularly after moving here from Los Angeles.Even though the 6th District is among the least diverse in the country and Sherburne County is the whitest county in that district, the GOP still uses the fear of forced integration and public access for everyone as a reason to fear Democrats. To them, patriotic principles are at odds with protecting the weak. Many of us were taught that America is a �melting pot,� but here in Sherburne County you�re either one of us or one of them.Now for some reason we have to first assume that the only reason anyone burns a cross is because of racism. The fact that it's Halloween, or even Guy Fawkes Day, has nothing to do to change that inference in this writers world. (BTW, did you ever wonder where Jack O' Lanterns came from? I did too, now I know.) The SherCo list is a bit more problematic, but it was written in 2007 by someone unknown, and it took me some time to find it on their page (it's at the very bottom of their main page, in small font.) And let me again point out that very little of Sherburne County is in east St. Cloud.

...There is a stain on this part of the state. It�s ugly and real and always right under the surface of any political conversation. It�s played a big part in every election and yet it�s never come up in a debate or candidate interview.

Maybe it�s time it did.

Labels: Democrats, politics, St. Cloud

Tuesday, November 17, 2009

Understanding tenure

After the completion of such probationary period, without discharge, such teachers as are thereupon reemployed shall continue in service and hold their respective position during good behavior and efficient and competent service and must not be discharged or demoted except for cause after a hearing.The words "good behavior and efficiency and competent service" are of course subject to interpretation. And who gets to interpret that is often not the teacher but instead an arbitrator. Christine Ver Ploeg of the William Mitchell College of Law notes that almost all cases to terminate for cause are requested by Education Minnesota to go to an arbitrator. Why? Because the evidentiary standards change; the law calls for the board to provide a "preponderance of the evidence" to support the decision to terminate. Arbitrators can hand out back pay too. If instead a board's decision was appealed to a court, the teacher's termination could only be overturned if somehow the board did not follow the law. I'd encourage Eric to read Ver Ploeg's article, plus Minnesota Code 122A.40 (in addition to reading again the arbitration provisions in 122A.41) to see if he's misunderstood the nature of the process by which a tenured teacher can be removed.

Labels: education

For those of you scoring at home

On three votes that would massively expand the size of government -- the stimulus plan, cap and trade, and health care reform -- Blue Dogs mostly were AWOL. "Of the 52 House Blue Dogs, only four voted against all three," says Mr. Franc. Sixteen voted for two of the three, and 17 voted for all three.The four who voted against all three? Bobby Bright and Parker Griffith of Alabama, Walt Minnick of Idaho and Gene Taylor of Mississippi. Rep. Collin Peterson of MN voted for cap-and-trade but did vote against the stimulus and the health care bills.

These are the ones Heritage identifies who supported Obama on all three bills: Leonard Boswell of Iowa, Jim Cooper of Tennessee, Gabrielle Giffords of Arizona, Baron Hill of Indiana, Dennis Moore of Kansas, Patrick Murphy of Pennsylvania and Zack Space of Ohio. It's interesting that of this list of Democrats being supported by K Street that Gary pointed to last week, only Boswell is getting a thank-you note from AFSCME and health care reform advocates. (There are two other blue dogs on their list, but those did not vote 3-for-3.) Are the others all bark and no bite?

Labels: Democrats

Monday, November 16, 2009

Actuary: Pelosicare adds 23 million to Medicaid, 18 million to pay health care tax

Courtesy of Keith Hennessey. Memo from Chief Actuary of Medicare and Medicaid Rick Foster here. Hennessey notes that the 18 million who are "uninsured and paying the penalty tax" are "clearly worse off than they would be under current law" because they end up paying the lesser of 2.5% of their income or the average premium for health insurance. These are likely to be younger and healthier people. Why would someone who makes a high income not buy health insurance if the tax was equal to what she or he would pay in premiums?

Hennessey also notes that Medicaid is largely considered to be fiscally unsustainable now. How does adding 23 million to Medicaid help this?

Labels: economics, health care

Increase taxes or reduce spending 4%, lose GDP

Assuming no major changes in federal government tax and spending policies, the federal deficit and debt picture looks bleak. The picture is similar to that of the CBO (2009b) and Auerbach and Gale (2009), although in the present case all the macroeconomic endogeneity has been accounted for.From a new paper by Ray Fair, of FAIRMODEL fame. I use FAIRMODEL in some of my teaching in forecasting. His latest iteration is a little higher in terms of debt-to-GDP than in the paper but not appreciably so. The emphasis is mine. Both those runs of his model show negative GDP growth in Q4 of 2011, which would appear to suggest that fixing the debt problem means a W recession pattern. Fair assumes the tax increase or transfer payment reduction to fix the recession begins in the first quarter of 2011.

...Personal income tax increases and transfer payment decreases have similar effects on the economy. A tax increase or spending decrease of 4 percent of nominal GDP is enough to solve the debt problem. The real output cost is about $300 billion per year.

A national sales tax is more contractionary in the model than are personal tax increases and transfer decreases, due in large part to decreases in real wealth and real wages. A national sales tax thus does not look like a good idea, although there is more uncertainty here regarding the ability of the model to deal with this case.

Would the federal elected officials risk the W to get the debt issue off the 2012 agenda? It depends on whether they can impose the taxes fast enough and get the pain out of the way before the summer of 2012 when voter decisions for November are being made. Losing $300 billion a year means losing 1-2% of GDP per year, which will cost many jobs.

Labels: economics, politics, taxes

You can always call him stupid ex post

I disagreed by instinct. As I told a student after I got to campus who asked about the decision, I said you had to put your head in Belichick's place without regard to what eventually happened. You have to argue ex ante rather than ex post.

Your team has given up two fourth quarter touchdowns in possessions of 2:04 and 3:32. You are playing against arguably the greatest QB ever (arguably, acknowledging that the greatest QB ever could be your own QB.) You are on the road. You have a play that has worked quite well, and you ran it successfully earlier in the game. (Game log) And it's not the first time Belichick had done it this season, Michael Lombardi reminds us. He went 4th-and-1 from his 24 up 19-10 in the third quarter against Atlanta (successful, game log.) So this isn't gut instinct: Belichick has thought the math through.

I was going to write out the math of this in terms of expected values, but Brian Burke has already done this.

With 2:00 left and the Colts with only one timeout, a successful conversion wins the game for all practical purposes. A 4th and 2 conversion would be successful 60% of the time. Historically, in a situation with 2:00 left and needing a TD to either win or tie, teams get the TD 53% of the time from that field position. The total WP (win probability -- the likelihood you would win the game) for the 4th down conversion attempt would therefore be:Not to say that Belichick had those numbers firmly in his head and thought of it in terms of WP, but he's shown evidence that he's willing to go for fourth downs in his own territory, that the gain in punting would have been to reduce the likelihood of the average NFL team to score the winning TD to 30% from 53%. He certainly knew he would be skewered if his team failed to convert ... which he had to think was a 40% probability. He was confident enough to accept that fate in return for giving his team its best shot at winning the game. In terms of the rest of the season, would you rather have your team lose and the blame placed on your coach for a "bonehead move", or lose and have your defense questioned for its inability to hold a lead?

(0.60 * 1) + (0.40 * (1-0.53)) = 0.79 WP

A punt from the 28 typically nets 38 yards, starting the Colts at their own 34. Teams historically get the TD 30% of the time in that situation. So the punt gives the Pats about a 0.70 WP.

Statistically, the better decision would be to go for it, and by a good amount. However, these numbers are baselines for the league as a whole. You'd have to expect the Colts had a better than a 30% chance of scoring from their 34, and an accordingly higher chance to score from the Pats' 28. But any adjustment in their likelihood of scoring from either field position increases the advantage of going for it.

Labels: sports

Friday, November 13, 2009

Two questions

- I'm off radio this weekend to take a long-planned trip with my brother. His birthday is Sunday and he's a big Steelers fan, so I'm meeting up with him in Pittsburgh with tickets for Sunday's game versus the Bengals, with first place in the AFC North at stake. Eat your heart out, Morrissey! Questions are on transportation and food. We don't want to rent a car in case we imbibe a little more than usual at the game. ("in case??" -- ed.) How do we get there, what do we eat and where should we enjoy the evening's Patriots-Colts tilt?*

- Is it time to get off Blogger? I still have to use the Classic version, widget-less, because this blog is so damn old. I keep wanting to tweak the sidebar and start pushing content from the radio show there; I also want a feed of just economics posts that can go to the KYCR page. There's no money for this to buy a fancy solution, pretty much DIY. So what to do?

Labels: blogging, Northern Alliance Radio Network

D.C. index vanity

As a delightful insider's joke on the inbred Washington political establishment, the [Sarah Palin] book has no index. So they can't find mention of themselves while browsing in the store. Buy it or lump it.Academics do this all the time. Someone writes a paper in your research area? You immediately go to the bibliography to see if your paper was included in the review of previous literature on the topic. There's a very well-known economist who wrote me once a rather angry note (back before the internet was commonplace) complaining not that I had not cited his paper -- I had cited one -- but that he had a second paper I should have also included. I've heard others say "well, this paper is no good, she didn't cite me."

If only I could get people to read my papers first without looking at the bibliography. There was a time where we used footnotes with full citations and no bibliographies. But with the internet we now can just scan Google Scholar and other online indexes for who quoted us. Indeed, there's even a program for that. And it's free!

Labels: books, higher education, Sarah Palin

Letter from Chad the budding economist

I've been meaning to ask you for a while about the way that imports impact GDP. If Americans stop buying as much stuff at Wal-mart, imports go down which means GDP looks better. But few would take that as a positive sign.That question is a principles question. If I import a bottle of French wine to drink (say, some of that nice Beaujolais Nouveau coming in next week), it increases consumption, the largest part of GDP. Since GDP is gross domestic product, I have to deduct that consumption I do which is not from a domestic producer. So I subtract imports. So if people "stop buying as much stuff at Wal-Mart" and save the money, there's no effect at all on GDP. If I decide not to buy the beaujolais but celebrate the end of the harvest with Nebraska nouveau instead, then GDP expands.

Likewise in this article Chad sends me. If I buy a car with more American components in it, GDP is more greatly affected than not. But who cares? In 1992 we passed a law, the American Automobile Labeling Act, which required new cars to have stickers indicating how much of the car's components and assembly was off-shored. A government agency in 1998 interviewed 646 car purchasers to see what difference it made to them. Only 23% even knew of the stickers, 15% of them had seen one, and only 5% said it made any difference to them at all. (2% said it made a moderate or large difference.)

Chad closes by asking if we place too much stock in GDP as a measure of an economy's health. I certainly think there's an argument there, but most of the alternatives presented seem to be even more fraught with problems than GDP. Here's the U.S. government's 'celebration' of GDP. I'd encourage those interested to read Bryan Roberts' paper in our book for some of the critiques and counter-critiques.

Labels: economics

Supply curves slope upward

Kenneth Feinberg, the Obama administration�s special master for executive compensation, said he is �very concerned� about the possibility his pay cuts may drive talent away from companies bailed out by U.S. taxpayers.If you want to maximize profits, the flow from which you would repay the loans, you set the wage where you attract the best help. Private firms try to do this all the time. Perhaps Mr. Feinberg could enlist the help of a board of directors for these firms.

�I�m very cognizant of the concerns expressed by these companies,� Feinberg said today in Washington at an event held by Bloomberg Ventures, a unit of Bloomberg LP, parent of Bloomberg News. �The law makes it clear that the determinations I render are designed, first and foremost, to make sure those companies thrive and that the taxpayers get their money back.�

The U.S. will track possible executive defections by seeking from the seven companies data on comparative pay, by obtaining independent information and requesting �anecdotal evidence of vacancies and concerns about losing people,� he said.And what would he do if he found he had lost talent from his firms? Would he raise the pay? What do you suppose would happen then? Buses by the homes of those who left?

A thought on Clark

Thursday, November 12, 2009

You're missing the point

I know counterfactuals and math are hard to fit on a bumper sticker. But one would hope that in an 800-plus word essay on economics (even if in Politico), some economic content could be included.Thus Menzie Chinn concludes a defense of the "jobs saved or created" story complete with regression analysis (and not just ANY regression, mind you, but one with "error correcting mechanisms". Prof. Chinn is right that the proper measure is some ceteris paribus calculation. He quotes Greg Mankiw's analysis during the Bush Administration as some kind of shield. But Mankiw says "The job market is not what we would like it to be right now, but it would have been worse without the Administration's actions." Were those the words to come from Christina Romer's or Jared Bernstein's mouth, I'd have no debate. But I think it is more than semantics to go from "Simulations of a conventional macroeconomic model show that, without the tax cuts, the level of real GDP" would be x% lower and unemployment y% higher, than to say you've created or saved 640,329 jobs.

Official data here, where it helpfully adds "as reported by recipients", perhaps to shift the guilt.

The problem is the administration has oversold its control of the economy, and used statements of certainty with numbers -- six significant digits on that page, why? what is the basis of that level of precision if not hubris? -- where one reasonably should have reached for uncertainty. Bernstein, who originated the report that said with stimulus the unemployment rate would not be 8% with the stimulus bill, now says that without the stimulus the unemployment rate would be �at least 11 percent and going higher�. Hey, we all miss a forecast now and then, but if you miss one by 3% by your own admission, don't you have to be a little more modest about your predictions going forward?

Prof. Chinn's estimate includes a guess that Q4 output rises at the same rate as Q3. That's without cash-for-clunkers, and with data showing federal tax receipts 18% below year-ago levels. GDP growth of 3.5% for Q4 is not what the WSJ panel expects -- they forecast

Their average for payroll employment is a gain of about 565,000 jobs between now and November 2010. The low-end estimate of the original package estimated by the CBO and the Obama economic team was for a gain of 2.1 million jobs from 2009 to 2010. You can say all you wish that you've "created or saved" 1.2 million jobs next year, but you're missing the point.

Labels: economics

The most important graph you'll see today

The taxation story is not about the rich, folks. It's about the young earner. What this says is that, if you fully use the various transfer payments available to you as working poor (making $15,000) you can have goods priced at $40,000. If you earn $40,000 you can have goods and services worth ... a but less than $40,000. Maybe it's the same goods, maybe not. But the point of the graph is that when you combine the federal and state income taxes, payroll taxes and deduct the lost subsidies from various government programs from SCHIP to housing to food stamps, you lose sometimes more than a dollar of goods for each dollar you earn. Your incentive to improve your condition is de minimus.

The taxation story is not about the rich, folks. It's about the young earner. What this says is that, if you fully use the various transfer payments available to you as working poor (making $15,000) you can have goods priced at $40,000. If you earn $40,000 you can have goods and services worth ... a but less than $40,000. Maybe it's the same goods, maybe not. But the point of the graph is that when you combine the federal and state income taxes, payroll taxes and deduct the lost subsidies from various government programs from SCHIP to housing to food stamps, you lose sometimes more than a dollar of goods for each dollar you earn. Your incentive to improve your condition is de minimus. Graph from here with details. H/T: Greg Mankiw who asks that this be redone by someone with more authority, like the Congressional Budget Office. Health care reform as a transfer system will only make this worse.

Labels: economics, health care

Wednesday, November 11, 2009

Appreciation

St. Cloud State University Athletics will salute all members of the United State Armed Forces and veterans during Military Appreciation Night at the Husky men's and women's basketball games against Winona State on Friday, Dec. 4.I am happy to have Adam as a student and a major in our Economics program. He's a great young man, an excellent student, and on this Veteran's Day deserves our thanks for his service as do all the vets at SCSU.

As a special recognition on Dec. 4, all curent and retired members of the military and their families will be admitted free to the SCSU basketball games that night. The games begin with the SCSU-Winona State women's basketball game at 6 p.m., with the men's game beginning at 8 p.m.

One of those dedicated members of the military serving the United States is St. Cloud State University senior wrestler Adam Minette, a resident of New Prague and 2004 graduate of New Prague High School.

In addition to his spot on the SCSU wrestling roster, Minette serves with the Army National Guard. A redshirt senior at SCSU, Minette missed the 2007-08 season while serving on a tour of active combat duty in Iraq. He returned to the SCSU roster in 2008-09 and gained a 7-8 record with four pins at 149- and 157-pounds.

�It is a pleasure and an honor having Adam Minette as a member of our wrestling program," SCSU head coach Steve Costanzo said. "He has been dependable, loyal and committed in every aspect to our program. I am very grateful for what he has given to the citizens of the United States."

Best question I read today

If the Republicans were more willing to push this, they could show that the catastrophic plans in their proposal are the only ones that do not violate the concept of insurance. The Pelosi plan is, instead, an entitlement program that provides the illusion of help for the middle class while engaging in a transfer from young to old.

UPDATE: Should have known Milton Friedman said about the same thing, notes Mark Perry.

Labels: economics, health care

We also have a hiring problem

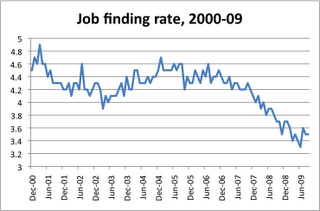

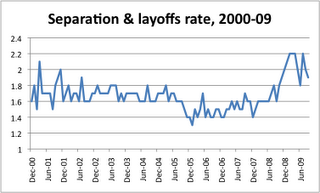

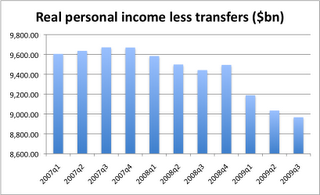

I simply want to display two graphs, both from the "JOLTS report" (Job Openings and Labor Turnover Survey.) These are the rates at which labor is currently being hired and separated (fired/laid off only) as a share of employment. The separation rate is now back below 2%, but has not seemed to be too different from a deep recession. The dataset only begins in December 2000, so I can't look back further.

Labels: economics

Tuesday, November 10, 2009

It's a spending problem

This is why I try to encourage elected officials to use the phrase �spending discipline� rather than �fiscal discipline.� Our long-term deficit problem is a spending problem.Welcome to Minnesota, where Governor Pawlenty has announced he wants a constitutional amendment to cap spending. The amendment reads: "Shall the Minnesota Constitution be amended to require that state government general fund expenditures be limited to the amount of actual general fund revenues received by the state in the previous two-year budget period?"

The reaction is predictable. You get DFL opponents saying things like "you can't cut your way to greatness." You get the Star

Hennessey argues that the following line of attack follows the Left's hold on government:

- Increase government spending, especially through rapidly growing entitlements. At the state level it�s Medicaid.

- Wait. While you�re waiting, define deficits as the problem, rather than spending.

- Try to label as radical and extreme those who argue for slowing spending growth and preventing tax increases. The goal is to discredit these solutions as legitimate.

- Once deficits get large enough, shrug and say we have no choice but to raise taxes. This is especially true for entitlement programs directed toward the elderly, who have less ability to adjust to changed government promises.

- Argue we must protect low and middle-income from higher taxes, so upper-income taxpayers must bear the entire burden increase.

- Raise taxes on upper-income taxpayers.

- Rinse and repeat.

Spending limits have a long history, as this National Conference of State Legislatures summary shows. Pawlenty's proposal is different from most in our history, which either set a limit tied to population growth or growth+inflation. (Cato argues that limits set by personal income growth have been ineffective.) Those that set a maximum percentage of personal income (share of a level, not a growth rate) would find us probably near the limit now. Unlike the Pawlenty logic, I actually do plan on spending more when I'm older if I think my income will rise over time. I would argue this plan would have had a more tested version than this. (How do I know in May when the Legislature adjourns what revenues were for June, the end of the biennium, for instance?) It's worth noting that Milton Friedman more preferred the pop-growth-plus-inflation formula.

I worry that this amendment will barely register a nod from the Twin Cities political establishment. But clearly Pawlenty has seen the light that Hennessey is shining. At my home when the checkbook looks empty, I don't usually say I have an income problem (and I sure don't ask my neighbor to cover it for me.) I say I have a spending problem, and I fix it by spending less.

Labels: DFL legislature, Minnesota, Pawlenty

Grandma and the necktie

Arguing that �economic incentives in health care� are perverse, David Leonhardt asserts that �As long as doctors and hospitals are paid for each extra test and treatment, they will err on the side of more care and not always better care. No doctor or no single hospital can change that. It requires action by the government� (�Making Health Care Better,� Nov. 4).From Don Boudreaux. He suggests the real problem is third-party payer. Certainly so. But does the difference in short-run demand elasticities between a necktie and an emergency bypass surgery on a beloved 75-year-old grandmother play any role here?

Hogwash. To see why, change just a few words in the above quotation: �As long as sales people and clothing stores are paid for each extra necktie and nightie that they sell, they will err on the side of more selling and not always better customer service. No salesperson or single clothing store can change that. It requires action by the government.�

Labels: economics, health care

Representative Bachmann Gets It Right

So, where does Congresswoman Bachmann fit? Michele understands in her core what is at stake with the current Democrat administration in Washington, DC. She also knows how to communicate the importance of the bills working their way through Congress.

Last night, Representative Bachmann, via representative, Julie Quist, gave Bachmann's statement supporting, thanking and praising CCHC for its nationally known efforts to stop government takeover of our lives.

Thank you, Representative, for continuing to support the people you represent. You get it right.

Labels: CCHC, Michele Bachmann

Monday, November 09, 2009

Part of the job

The purpose of a sabbatical leave is to enhance professional development, support department/unit goals, and/or meet the instructional, service, or research.I'm in my 26th year of service at SCSU, and so far have had one year (back when it was 2/3 pay for a year-long sabbatical rather than 80%.) My work that year and two more years, during which the university did not pay me but expected me to return to repay my sabbatical -- more on this below -- lead eventually to a third year away to work as an adviser at the National Bank of Ukraine and to my first book. I'd vehemently disagree with the idea that I 'took time off'. Indeed, the KSTP report cannot deny that these faculty members on sabbatical were in fact improving themselves. Sabbatical is not vacation. In 2007-08, throughout our system, here's what the sabbaticals were used for:Subd. 1. The President/designee may grant a sabbatical leave to an eligible faculty member who proposes to undertake a scholarly research project, additional study, or other endeavor related to the purpose described above.

- Professional development 26%

- Curriculum development 32%

- Education 18%

- Research 22%

...sabbatical leaves are an investment of the college/university in its academic future and reputation. Sabbatical leaves granted under the provisions of the collective bargaining agreements have permitted faculty to revitalize their teaching, improve their research skills, and maintain a vibrant, engaged, and up-to-date outlook on their profession.

One will recognize that sabbatical contains and derives from the word Sabbath, which holds two separate implications. One, it is intended to happen every seven years. As the report indicates, sometimes you cannot take sabbatical during the seventh year, or eighth, because your department would lose too many faculty and could not offer the courses needed to your students. So you wait. We are only guaranteed that we can go every ten years. Between seven and ten, your application gets scored, and you must have a minimum of 60% of the points scored or else you're out. Everyone knows the scoring rubric, and the applications typically are accepted. At the end of your sabbatical you complete a report on what you did.

But the other part of the sabbath that gets used in sabbatical is that it is a time of rest. Just as the Bible asks for land to recharge itself every seventh year (thanks to Jill Schneiderman for that observation) so too do faculty need to let the mind go wander once in a while. My own field changes from time to time. My next sabbatical -- I am one of those people who is asking to go away next year, seventeen years since my previous one -- will be my transition year to a post-chair life, one in which I start trying to teach economics more to people off this campus. But I need to figure out how to be effective in that teaching. I would like the inspiration to come during those thinking times in my day, but to actually build the course takes much longer. Should we have time to do that outside of the classroom?

So here's the real point, if you want to get to the dollars. If you tell me I have to do this job and never take a sabbatical, I would like to be compensated for giving up that right. Suppose my union and the state negotiate a 10% wage increase in return for the lost right. If I'm only guaranteed sabbatical every ten years, I only get one reassigned semester a decade. The state pays someone to replace me for that semester, and probably will not pay 50% of my salary, since that person is likely to be a lower-paid instructor (a young person just out of graduate school.) Are you better off or worse off, taxpayer-dollar-wise? And in the long-run, am I a better or worse instructor for having that time of rest, reflection and retraining?

Labels: higher education, SCSU

Ein Volk, Ein Plan, ...

Yes, them be Wobblies.

Labels: health care, socialism kills

254

It was later established that more that 254 people died there -- the number may have been more than a thousand. I recall a movie I've discussed before here: The Lives of Others. If you can rent it tonight, it would make a good tribute.August marks the anniversary of the building of the Berlin Wall that for 28 years thereafter, divided the city of Berlin and closed off the only remaining escape hatch for people in the communist East who wanted freedom in the West. It was a shocking surprise when it happened because no warning was given before East German soldiers and police first stretched barbed wire and then began planting the infamous wall, guard towers, dog runs, and landmines behind it.

By one estimate, a total of 254 people died at the wall during those 28 years�shot by police, ensnared by the barbed wire, mauled by dogs, or blown to bits by land mines as the �Workers� Paradise� sought to keep them imprisoned in a statist hell.

...We believers in freedom and free markets are often attacked by socialists as obsessed with self-interest. They like to remind us of every shortcoming or every problem that hasn�t yet been solved, no matter the degree to which freedom has already worked to solve it. But we don�t believe in shooting people because they don�t conform, and that is ultimately what socialism is all about. We don�t plan other people�s lives because we�re too busy at the full-time job of reforming and improving our own. We believe in persuasion, not coercion. We solve problems at penpoint, not gunpoint. Unlike the socialists of the old East, or homespun statists like Sen. Edward Kennedy, we�re never so smugly self-righteous in our beliefs that we�re ready at the drop of a hat to dragoon the rest of society into our schemes.

All this is why so many of us get a rush every time we think of Ronald Reagan standing in front of the Brandenburg Gate in 1987 and boldly declaring, �Mr. Gorbachev, TEAR DOWN THIS WALL!� This is why we were brought to tears in the heady days of fall 1989 when thousands of Berliners scaled the wall with their hammers, picks, and fists and pummeled into the dustbin of history that terrible wall and the Marxist vision that fostered it. That was a �Kodak moment� if ever there was one! For today�s young people who have no concept of what it was like for millions to live under socialism behind walls and barbed wire, or who have no appreciation for the blood, sweat, tears, and treasure spent by millions here and abroad to combat it, this anniversary is an opportunity to learn a little history.

Not A Sheep provides a list of the 254.

UPDATE: Anthony Daniels on the role of intellectuals in supporting this monstrosity: "They thought that if nothing great could be built without sacrifice, then so great a sacrifice must be building something great."

UPDATE 2: Pete Boettke -- in a very useful history of the Wall that deserves your reading -- reminds us of the story of Hans Ulrich Lenzlinger, who helped smuggle many out of East Germany:

There also emerged a smuggling business that ran ads in West German newspapers. One such company, Aramco, with headquarters in Zurich, Switzerland, gave out press releases referring to their �most modern technical methods.� The company�s prices were not that unreasonable: $10,000 to $12,000 per person, with �quantity discounts� for families, payable into a numbered account in a Swiss bank. If an escape attempt failed, the company refunded most of the money to the person financially sponsoring the breakout.They eventually got the Stasi assassin that killed Lenzlinger. (Mitch, that last link will be delicious for you.)

The East German government issued �wanted� posters on the East Berlin side of Checkpoint Charlie, offering 500,000 German marks for the director of Aramco, Hans Ulrich Lenzlinger. The �wanted� posters negatively referred to him as a �trader in people.� In February 1979, someone collected the bounty on Lenzlinger�s head, after he was shot repeatedly in the chest and killed at his home in Zurich.

LAST UPDATE: Courtesy Fausta, a story from a blogger in Cuba, where the wall is still intact:

We cried in each others arms in the middle of the sidewalk, thinking about Teo, for God�s sake how am I going to explain all these bruises. How am I going to tell him that we live in a country where this can happen, how will I look at him and tell him that his mother, for writing a blog and putting her opinions in kilobytes, has been beaten up on a public street. How to describe the despotic faces of those who forced us into that car, their enjoyment that I could see as they beat us, their lifting my skirt as they dragged me half naked to the car.Maybe 254 squared would be better for Cuba.

Labels: communism, socialism kills

Enough to make me want to move to Canada

No, the story that caught my eye over the weekend was Gordon Brown, the British PM, arguing for a tax on "day-to-day financial transactions" and getting it thrown back in his face by just about everyone there. Even Tim Geithner. But the very best reply came from Jim Flaherty, the Canadian finance minister:

We are not in the business of raising taxes, we are in the business of lowering taxes in Canada. It is not an idea we would look at.Mr. Flaherty notes that his country has not had the financial experience of London or New York. He has regulated banks much more. Now I would argue regulation is a form of taxation, but still, if Mr. Flaherty says his government is "in the business of lowering taxes", roll me in maple syrup and call me Canadian.

Alas, while the "Tobin tax" idea might be scotched by everyone but the British, they still want to tax banks for their own cowardice in letting one fail. Bernie Sanders has introduced a bill that says, if you're identifying all these banks as too whatever to fail, how about you just break them up? Forget the sand in the gears -- Mr. Sanders wants to throw a spanner.

Friday, November 06, 2009

Economists' best friends are at Treasury

I worry less than did some of the other bloggers about the Treasury awareness of major economic problems going forward. As governmental institutions go, Treasury has a real incentive to a) worry about the fiscal future, and b) worry about worst-case scenarios, including for financial institutions. Their daily interaction with the bond market gives them a longer time horizon and a more economics-friendly perspective than most of their bureaucratic counterparts. The problem is Congress.Tyler Cowen, commenting on the big pow-wow between Treasury and some financial economists. He provides a link to other commentary. When I have worked overseas, when it's been the US government who issued the contract the agency was USAID, part of State. In my first long-term post in Ukraine I found the most reasonable people were the ones assigned from Treasury followed by World Bank, IMF and last, State Dept. That pretty much worked everywhere else too, with some flipping of IMF/WB depending on personalities. Certainly Cowen's b) point fits all my experience (in those countries, too, the worst-case was really bad.) And I don't know colleagues who would disagree with this ranking.

That doesn't necessarily mean Treasury will generate good policy, though. I remember reading (cannot remember where right now) a description of central bank research staffs post-WW2, and one place that had a very good staff that generated professional research respected throughout its country was the Bank of Italy. Unfortunately its leadership never took the advice of that research.

Labels: economics

The value of college in a recession

| Education level | October 2008 | October 2009 |

| Less than H.S. | 10.4% | 15.5% |

| H.S., no college | 6.5% | 11.2% |

| H.S. some college | 5.3% | 9.0% |

| Bachelors & up | 3.1% | 4.7% |

I also note on Table A-8 many re-entrants into the labor force. How many of these are formerly stay-at-home spouses now trying to find work again?