Tuesday, January 26, 2010

The resource curse, there and here

Our finding that oil windfalls translate into little improvement in the provision of public goods or the population�s living standards raises a key question � where are the oil revenues going? As a way of addressing this question, we put together a few pieces of tentative evidence:

- First, oil revenues increase the size of municipal workers� houses (but not the size of other residents� houses).

- Second, Brazil�s news agency is more likely to carry news items mentioning corruption and the mayor in municipalities with very high levels of oil output (on an absolute, though not per capita, basis).

- Third, federal police operations are more likely to occur in municipalities with very high levels of oil output (again in absolute terms).

- And finally, we document anecdotal evidence of scandals involving mayors in several of the largest oil-producing municipalities, some of which involve large sums of money.

More locally, consider a place that has a large power plant, say, Becker or Monticello.) Those plants generate a good deal of revenue to the municipality and in good times the property tax revenues permit cities to add lots of services, and hold down property taxes for residents. But they also become very dependent on that money and when times get bad it creates a lot of stress. (The city administrator in Becker blogs and here's what he's written about taxes from the coal plant there, called Sherco.)

More locally, consider a place that has a large power plant, say, Becker or Monticello.) Those plants generate a good deal of revenue to the municipality and in good times the property tax revenues permit cities to add lots of services, and hold down property taxes for residents. But they also become very dependent on that money and when times get bad it creates a lot of stress. (The city administrator in Becker blogs and here's what he's written about taxes from the coal plant there, called Sherco.)But the taxes are the result of intense lobbying between the power or oil companies and the state. The state forces different property tax rules on the localities here in Minnesota and then the cities have to lobby back (from the rest of us) to get the money taken away (to make energy firms richer.) This story replays not just in Minnesota but in resource-rich states like Alaska, where dependence on oil firms colors the politics that gave us Ted Stevens and Sarah Palin.

I'm very happy to join my friends in talking about nuclear power, but explain to me why that conversation between state and corporation should produce a deal any better for the taxpayer than having the government talk to Zygi Wilf?

What is needed, as always, is competition. The resource curse happens in a world where the resources are monopolized by the government (I struggle to think of a place where this isn't so. Can anyone name one for me?)

Labels: economics, Energy, Minnesota, rentseeking, sports

Friday, October 02, 2009

Too clever by half

To counter the argument that the energy economy would grind to a halt if the president were to sign a climate bill, Steffen points to an economic principle called Harberger�s Triangle, named after an economist of the same name. In terms that the noneconomists among us can understand, Harberger accounts for the economic growth that is surrendered when the government imposes limits that weren�t there before, like in the case of carbon legislation. But this surrendered growth is not a loss. Instead, it�s actually a transfer of economic activity from the emitters to those who monitor the system and grant the permits to emit. The only real loss is what Harberger�s theory calls dead weight, which accounts for the inefficiencies in the system. And if we�re really in pursuit of economic efficiency, the inefficiencies should be abandoned anyway.This measurement is also cited by Paul Krugman, who links to this CBO report. The report states that measurement a little more clearly:

Yes, it�s a convoluted and immensely theoretical argument. But here�s what you need to know: the loss that many critics suspect would come from such a bill appears objectively minimal. The nonpartisan Congressional Budget Office characterized the economic loss of the House climate bill as being between 0.2 and 0.7 percent of GDP in 2020.

Reducing the risk of climate change would come at some cost to the economy. For example, the Congressional Budget Office (CBO) concludes that the cap-and tradeLet me make the following points about this line of "reasoning":

provisions of H.R. 2454, the American Clean Energy and Security Act of 2009 (ACESA), if implemented, would reduce gross domestic product (GDP) below what it would otherwise have been�by roughly � percent to � percent in 2020 and by between 1 percent and 3� percent in 2050. By way of comparison, CBO projects that real (inflation-adjusted) GDP will be roughly two and a half times as large in 2050 as it is today, so those changes would be comparatively modest. In the models that CBO reviewed, the long-run cost to households would be smaller than the changes in GDP. Projected GDP impacts include declines in investment, which only gradually translate into reduced household consumption. Also, the effect on households� well-being of the reduction in output as measured by GDP (which reflects the market value of goods and services) would be offset in part by the effect of more time spent in nonmarket activities, such as childrearing, caring for the home, and leisure. Moreover, these measures of potential costs imposed by the policy do not include any benefits of averting climate change.

- The emphasis on deadweight cost (i.e., ignoring the transfer of resources from emitters to monitors, to use the first link's language) ignores the lobbying and other rent-seeking activity around manipulation of climate-change legislation to favor certain types of emissions over others. Safety valves in cap-and-trade legislation just invite this kind of lobbying; money spent on lobbyists doesn't get spent on consumption or investment goods and services. Thus using the Harberger Triangle understates the true loss of cap-and-trade.

- It is important to compare apples to apples. Citing the cost of climate change as "0.2% of GDP in 2020" makes it sound like the total cost of the legislation is 0.2% of that year's GDP (which would come up to $50 billion.) That would the the cost for that year. The total cost rises over time and would lead to a permanent loss of jobs due to lower investment in capital goods.

- The laugher part of the CBO paragraph is "the effect on households� well-being of the reduction in output as measured by GDP ... would be offset in part by the effect of more time spent in nonmarket activities, such as childrearing, caring for the home, and leisure." This is also known as "what you do when you're unemployed." If that was supposed to be factored in, we would say fewer bad things about unemployment.

UPDATE: Kimberly Strassel uses the rent-seeking line too.

Tuesday, August 18, 2009

Heavy burden

It's sensible, though higher than I thought. Using Ironman's tool, it appears that if you think the deadweight cost is 100%, you can even use the Obama Administration's assumption of a multiplier and still show that stimulus doesn't stimulate.

Meanwhile, another tax the Administration is thinking about, cap and trade, turns out to be really bad for poor people. Corbett Grainger and Charles Kolstad in a new paper from the National Bureau for Economic Research (abstract here for free; this appears to be an ungated version):

For a tax of $15 per ton CO2, an average household in the lowest income quintile would pay around $325 per year, while an average household in the wealthiest quintile would pay $1,140 annually. Although wealthier households would pay more in absolute terms, as a percentage of annual income, lower income groups bear a disproportionate share of the burden. The poorest quintile�s burden (as a share of annual income) is 3.2 times that of the wealthiest quintile�s. The burden as a share of annual income for the lowest income group ($7,500-9,999) is almost four times higher than the burden-to-income ratio for the highest income group in the data ($200,000-250,000).You can use a tax instead of cap-and-trade specifically in the analysis, as the effect should be identical in either case. You could compensate lower income families for cap-and-trade with, say, a reduction in payroll taxes (which as just as regressive), but when you decide to give away most of the permits, you don't have any money to transfer.

Labels: economics, Energy, other people's money, taxes

Monday, August 10, 2009

Another blow to the biofuel crowd

The price of raw sugar has increased to its highest level since 1981, as supply concerns grow.The price was under thirteen cents in April. Note that both a change in supply and in demand happened here (see the italicized paragraph) which means we have much higher prices without anyone really getting more fuel or sugary products.

Raw sugar futures added 3% on Monday, to finish the day at 22 cents a pound.

"The main problem is a deficit in sugar supplies," said Nick Penney, a trader with Sucden Financial, a firm that focuses on sugar trading.

Growing demand in Brazil for sugar to be turned into ethanol, coupled with a sharp fall in Indian production, have both prompted worries, he explained.

Sugar production in India for 2008-09 fell 45% year-on-year, according to a report by Sucden.

And a "drastic fall" is expected for the coming Indian crop, it said.

India had less rain in the monsoon season and it was also uneven, damaging a number of agricultural crops.

Labels: economics, Energy, gas

Wednesday, August 05, 2009

Clips of the day

Calculations by The Associated Press, using Department of Transportation figures, show that replacing those fuel hogs will reduce carbon dioxide emissions by just under 700,000 tons a year. While that may sound impressive, it's nothing compared to what the U.S. spewed last year: nearly 6.4 billion tons (and that was down from previous years).

That means on average, every hour, America emits 728,000 tons of carbon dioxide. The total savings per year from cash for clunkers translates to about 57 minutes of America's output of the chief greenhouse gas.

------------

To begin with, building a new car consumes energy. It is estimated that 6.7 tons of carbon are emitted in process. So a driver who participates in the "cash for clunkers" program would need to make up for that wickedness.(h/t for second clip: Chad.) Note that 6.7 tons times 250,000 cars produced is greater than 728,000 tons.

Monday, July 27, 2009

Alternative energy in the UK and Midwest

I am often amused by the blog of James Delingpole, who I first heard on a Dennis Miller podcast some months ago and who wrote the most wonderful depiction of Robert Gibbs and the American media in its reporting on President Obama's trip to England a few months ago. He's piqued me with this story now on building wind farms in national parks, proposed by a group whose mission is to preserve nature. You've seen wind farms, haven't you?

So the best way of conserving natural England, a body calling itself Natural England has decided, is to destroy it. Can anyone come up with a more ludicrous example of the warped, supposedly �progressive� but in fact utterly poisonous, wrong and self-defeating thinking so prevalent in these dark times?Last week we find out that our neighbor colleges, St. Benedict's and St. John's, have decided to get into the solar farming business.

St. John's soon could become home to the largest solar farm in Minnesota and possibly in the Upper Midwest, providing as much as 20 percent of the campus's electricity on a cloudless day.Well yes, yes, quite noble.

St. John's and the Order of St. Benedict are partnering with Westwood Renewables, an Eden Prairie-based company that received a $2 million grant from Xcel Energy for a renewable energy project.

They hope to install about 1,800 solar photovoltaic panels just northwest of the St. John's campus in Avon Township. The panels would produce up to 400 kilowatts an hour or about 575,000 kilowatt hours annually, roughly the same amount of energy that 65 homes consume in a year.

The project is part of St. John's goal to end its contribution to global warming. In 2007, it joined more than 300 colleges and universities nationwide signing a pledge to become "carbon neutral."

"It's a nice step forward," said Brother Benedict Leuthner, treasurer for OSB, which is spearheading the project. "It's surely not going to solve all our energy needs."Now I'm not a real statistician, just an economist, but I think that means 96% of their electricity needs would still be met with fossil fuels? So this is a small "part of St. John's goal to end its contribution to global warming". As Radar O'Reilly would say on M*A*S*H, "wait for it..."

When nights and cloudy days are factored in, the solar farm would supply about 4 percent of St. John's electricity needs annually, Leuthner said.

The project's backers hope it will raise awareness ...

...of Minnesota's potential to produce electricity from the sun, one of the cleanest sources of renewable energy. The St. John's site would serve as a research and education tool for students and visitors who want to learn more about solar power.

Solar hasn't caught on widely in Minnesota largely because it costs more to produce than other types of renewable energy such as wind.Professor Larson, have you thought about where California gets the money to offer incentives for solar panels? Mr. Shoemaker, where do those federal tax credits come from? They are paid for by taxing other things in lieu. It isn't as if the government reduces its spending dollar-for-dollar with those tax credits and rebates.

Electricity in Minnesota comes mainly from coal-fired power plants and is inexpensive compared with other parts of the country, [SJU professor of environmental studies Derek] Larson said. In California, customers pay a higher rate for any electricity they consume above a base level. The state also offers incentives for homeowners who install solar panels.

"It becomes really economically smart," Larson said.

New federal tax credits and rebates from the state and utility companies should make solar energy more appealing for Minnesota homeowners, [Doug] Shoemaker [a renewable energy spokesman] said.

But more to the point. if it costs more to produce a kilowatt by coal-fired power plants, and it's inexpensive here versus other parts of the country, why not use the coal? "Oh, but it harms our planet!" you say. Instead, the brothers at St. John's and sisters at St. Ben's decide this is better:

This is a 16 acre solar farm at Florida Gulf Coast University. For four hundred acres, multiply that picture by 25.

This is a 16 acre solar farm at Florida Gulf Coast University. For four hundred acres, multiply that picture by 25. India will continue to use coal to meet its energy demands, says Rajendra Pachauri, chair of the UN Intergovernmental Panel on Climate Change (IPCC).He must be some conservative nut, right? No, actually, Mr. Pachauri shares a Nobel Peace Prize ... with Al Gore. So at least raising consciousness comes after lighting one's home. There's still a place called Hope.

�Can you imagine 400 million people who do not have a light bulb in their homes,� Pachauri told reporters here Monday.

�You cannot, in a democracy, ignore some of these realities and as it happens with the resources of coal that India has we really don�t have any choice but to use coal in the immediate short term,� he said.

"We have to get out of the preconceived notion, which is based on western media, and invest our scientific research and other capacities to study Himalayan atmosphere," he said. "Science has its limitation. You cannot substitute the knowledge that has been gained by the people living in cold deserts through everyday experience."Nurture that common sense, dear Indians. We'll want to import some when we get leaders here who can use it.

Labels: economics, Energy, global warming????, higher education

Monday, June 29, 2009

The government that can give you everything you want...

The list goes on and on, but the point is this: this legislation will finally make clean energy the profitable kind of energy.Note the definite article "the". It makes one type of energy at the expense of another. And how does it propose to do this? He's already told us once.

So, if somebody wants to build a coal plant, they can � it�s just that it will bankrupt them, because they are going to be charged a huge sum for all that greenhouse gas that�s being emitted.That was January 2008. As of last week energy experts were determining the likelihood that cap-and-trade will favor natural gas over coal. This government is engaged in picking winners, an industrial policy that more and more represents the second Carter Administration. That didn't turn out so well, as I recall.

But 25 senators (soon 26) represent states that produce more than average amount of energy from coal sources. If we can't rely on the sensible economic advice that Obama supposedly is receiving -- perhaps not listening -- maybe we can appeal to those who have used government to give their states something in the past to oppose having it taken away now.

Thanks to President Ford for the title to this post.

Labels: economics, Energy, Obama

Friday, June 26, 2009

How big a tax?

| Congressperson | Lost personal income % 2012 | Lost jobs 2012 |

| Walz | 2.35% | 3871 |

| Kline | 1.09% | 3835 |

| Paulsen | 1.41% | 4496 |

| McCollum | 2.31% | 3984 |

| Ellison | 1.60% | 3819 |

| Bachmann | 1.24% | 4127 |

| Peterson | 2.41% | 4174 |

| Oberstar | 1.46% | 3340 |

This is a tax therefore that varies but bears down hard on Collin Peterson's district. It will cost CD-3 more jobs, but the impact there is less as a share of income.

Labels: Energy, global warming, politics

Thursday, April 09, 2009

Quick thoughts on the Bachmann cap-and-trade presentation

- Let me lead by complimenting our students. Those who disagreed with Rep. Bachmann, or with the presenter, Mr. Horner, at the St. Cloud event used their free speech rights with due respect for the speakers, were not disruptive, and made me rather proud of my university today. Don't agree with them, not sure they understood the points Mr. Horner was making (more on that in a second) but when he asked for his turn to speak they relented with the shouting of questions and gave Horner his due. I'd rather they didn't shout, but given Horner answered them when they shouted, he agreed to that format. I agree with Andy that they were restless, but largely because they were in a minority in the crowd.

- Horner is entertaining. If I could suggest one thing, it'd be to s-l-o-w d-o-w-n. The points were excellent but rattled off quickly because he had lots he wanted to do. So I agree with Muse on that one, though he did have a handout that I got that helped comprehension. (I hate handouts. I use PowerPoint often, and let me say to Mr. Horner -- watch Prof. Tufte for some tips.)

- But he did change at least one person's thinking. A couple rows ahead of where I eventually sat (finally finding Mrs. S in the crowd) was a fellow professor of another social science. An excellent professor, I am inclined to think he holds views that favor the MMGW theory. After the talk I asked him what he thought and he said that he thinks we should not do cap-and-trade. That surprised me; why? I asked. It doesn't seem to do what we want, he said, and it's not clear how it would work and not clear people can actually understand it. This has long been my point on cap-and-trade. Any estimate of "what does this cost the average citizen?" comes up against the fact that it is a hidden tax. It's so well hidden, so complex in its changing of relative costs, so shifted forward and back between producer, labor supplier, capital, and consumer, that any attempt to measure the cost has to be theoretical and contentious. Horner says this, but then throws out a number anyway. DON'T DO THAT! Your best point is that you cannot know the cost of this thing. The only solid number you can generate is what you intend to sell the initial pollution rights for. All the rest is dross. If you buy MMGW theory, you should buy it with an explicit tax, openly adopted in Congress and signed by the President. Cap and trade is bad policy because it hides costs and benefits.

The word you want is "disputed", Larry. The point I made above is that every number can be disputed. And yes, I do work as an editor from time to time, at the right price. Call my office if you would like my services.

Labels: economics, Energy, Michele Bachmann

Wednesday, December 17, 2008

The dark side of contango

Remember when we bragged about First Fuel Bank and its novel approach to handling gas price risk? They're experiencing some changes.

The St. Cloud fuel bank plans to announce today a new way of selling gas. Consumers in the program can buy gas for 10 cents off the daily pump price, or as company President Jim Feneis guarantees, the cheapest legal price.I've thought about that decision for a few days, and read the company's newsletter. (I have an account with them.) One thing I learned there that I didn't see elsewhere is that if I deposit in this new kind of account -- the firm calls it a "prepaid rolling account" -- you always have the option of moving that money into your fixed price account when that price is acceptable. You can either lock-in at $2.379 or have a rolling account which today prices at $1.599.

It is illegal to sell fuel below a minimum price set by the state.

The program is called a prepaid rolling account. Here�s how it works: A customer opens a First Fuel Banks account, which works much like a gift card, depositing a specific amount of money for fuel purchases.

Some speculate that the company might have been caught in a bad position with the decline in price. Under the old rules, the firm sold future gas at a date uncertain and should turn around and buy a contract to take delivery of gas at some future, certain date at a price that is a little lower. The margin is their profit. They could also trade future options, hedging the prices as specified here. At present futures prices increase rapidly over the time horizon, so the question for the firm is where to buy those contracts, which in turn sets the price he charges.

The difference has to be more than just the price premium for futures gas (currently running about $.25 to $.30). It also has to cover the uncertainty of the timing of withdrawal. If he buys a futures contract to deliver in June but then demand of people with the lock-in price accounts is low, he is caught with gas perhaps at a lower price than the contract he bought. Rather than accept delivery he closes the position at a loss. He could just accept delivery, but storage is not cheap. He can sell the delivered gas now at the current price and buy a future contract for those who didn't use their locked-in accounts, but the slope of that maturity curve may still be positive, meaning he is still taking a loss.

The slope of that forward curve (called 'contango' when it slopes upward and 'backwardation' when it slopes downward) is what's bugging the firm. It's the opposite of the condition of traders who don't have oil yet.

This firm already has it. The rolling account is a way to deal with it.Phil Flynn, vice president at Chicago-based trading firm Alaron, said the oil contango has created a frenzy for storage space.

�You pay as much as $2 a barrel to store it but you can lock in the profit instantly today and make out like a bandit,� he said.

The scramble for oil storage, combined with reduced demand in the recession, has lifted U.S. inventory numbers to 321 million stockpiled barrels�an 8 percent increase over this time last year, according to the latest report from the Energy Information Administration.

Some companies reportedly are even storing crude in tankers, leaving them at sea instead of delivering their cargo.

Monday, September 29, 2008

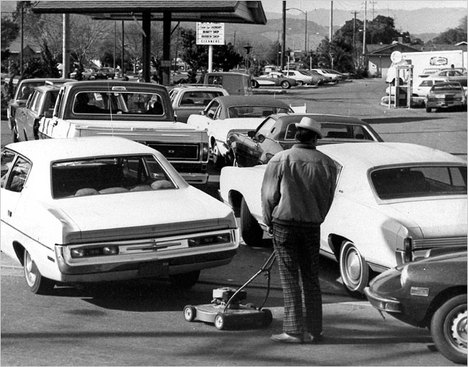

In case you forgot the gas problem

There's still a shortage going on, and might for awhile longer, in the southeast.

There's still a shortage going on, and might for awhile longer, in the southeast.Atlanta�s chaotic gasoline shortage should be back to normal by Columbus Day, Oct. 13, at the latest, said Randy Bly of AAA South. That means about two more weeks of uncertainty, desperate searches for stations with gasoline and long lines at stations that do.More thoughts on inventories at The Oil Drum. I agree with their comment, "why haven't gas prices risen more?"

Bly said Nashville had fuel shortages similar to those in metro Atlanta, but now 70 to 80 percent of the city is being supplied.

...The chaos began when Hurricanes Gustav and Ike temporarily shut down Gulf Coast refineries. As shortages began to become evident, panicked motorists began topping off and filling up gas canisters. That has delayed a recovery, but the flow through major pipelines from the Gulf remains reduced. As of Friday, only three of the Gulf's 56 refineries were still off line, but several open refineries were at reduced production levels.

Next time you hear a liberal yearn for Jimmy Carter (they do!) you can also remember these lines from 1974. Cui bono?

Thursday, September 25, 2008

Not so fast

Despite much hope that the Congress would at least get the energy question right, it appears that the Democrat leadership is up to its old tricks. �Offshore will be OK for now, but not shale, says Sen. Jim DeMint.

We've just been alerted that despite House Democrats relenting on extending bans on offshore drilling and oil shale in the continuing resolution (CR) appropriations bill, Democrat Senate Leader Harry Reid has decided to sneak an extension of the oil shale ban through as Congress fights over the financial bailout. Oil shale in America's West is estimated to hold be between 800 billion and 2 trillion barrels of oil -- that is more than three times the proven oil reserves in Saudi Arabia alone.

Gary is correct: The final victory on energy is still far, far away.

Follow the DeMint link for the exact language.

Friday, September 12, 2008

Energy Independence and Democrats

"Speaker Pelosi (Democratic leader of the US House of Representatives), give the American people an up or down vote on energy." Americans are still waiting for the Congress, controlled by Democrats, to provide a vote on an "all of the above," comprehensive energy plan for Americans.

Beginning in August after Speaker Pelosi shut down Congress for a summer recess, Republicans took the energy issue to the floor of the House of Representatives. Congress resumed this week. Pelosi still refuses to address our energy problems, our gas prices and the related increased costs in home heating fuel, food, and all goods produced.

Yesterday, Democrat Pelosi again refused to address energy. Republicans are continuing the fight for energy independence and jobs for Americans. There is no need for us to send $500,000,000,000-$700,000,000,000 to people who want all of us dead.

We Americans deserve a vote from our representatives or it's time to replace irresponsible energy and job Democrats with responsible energy and job Republicans.

Labels: Energy, John Kline

Sunday, August 17, 2008

Congressman Kline, Energy, Independence, Security

Earmarks

Washington is simply stuck. Sometimes this may be good, other times bad but when important issues that affect Americans and business are ignored, all lose. The earmark system is an example of a system gone amok. My understanding is that local governments can request that their DC representative request money for X project. In the past, the project was raised in Congress, the merits were debated and a decision to allocate or not allocate the funds was made.

Unfortunately, the system has lost its transparency. Today earmarks are slipped into bills without debate, without voting, without transparency to the taxpayer. What Congressman Kline did in 2007 was say, "No more. We've got to fix the system (ie, make it transparent)." There were 12 Congressmen who agreed with him; in 2008, there are approximately 50 who have signed on board. We, the taxpayers, foot the bills for such stupid earmarks as the researching the fruit fly in Paris, France. Excuse me, the French can do their own research.

Energy

In 2007, the USA imported 4,915,957,000 barrels of crude oil and petroleum products from all countries. The price per barrel was significantly lower than in 2008 when prices have ranged from $84/barrel in January to $125 in June, and reached $140 in July/August. Bottom line: through May of 2008, Americans spent over $193,000,000,000 for oil imports.

The Republicans have proposed the American Energy Act, an all-encompassing energy plan to free the US from the potential shackles of foreign oil producers. Counter to what much of the press is reporting, the Republican energy bill is thorough. It supports: Increased conservation; increased alternative energy sources; increased nuclear; increased oil refineries; opening the Outer Continental Shelf and North slope of AK for oil and gas drilling. However, the Democrats won't allow the bill to come to the floor of the House for a vot. Their maneuvers, described below, show that they really don't care about Americans.

The US House of Representatives has a procedure whereby any member who is on the floor is allowed to speak for 5 minutes. On August 4, 2008 when Republicans were lined up to speak on energy, as is their right by House rules, Democrat Speaker Nancy Pelosi (San Fran Nan) and her buddies forced adjournment for the next five weeks, turned off the lights and microphones. This procedure denied Republican representatives their right to speak.

Hm, what to do? Another rule says if a House member is speaking, visitors can be seated on the House floor. Republicans rounded up visitors inside the Capitol, invited them to the House floor because Republicans believe Americans should be represented- their representatives should have a vote on energy bills. These actions have been continued for the past two weeks.

Why won't the House Democrat leadership allow a vote? The bill would pass because many Democrats are in favor of it. But, there are problems. The Democrat leadership is beholden to the environmentalist lobby (as well as trial lawyers and the teachers' unions). We have been fed a bill of goods on the damage to the environment. This is ludicrous - no nation drills, processes and transports fuels as cleanly as Americans. (An aside, a Norwegian acquaintance of mine who is working in the Gulf of Mexico says the Mexican drilling sites are no where near as clean as the American platform sites and ours are 30+ years old.)

The numbers are all over the map but sending $500,000,000,000 or more a year to overseas oil suppliers, many of whom would like to see us disappear is just dumb.

The briefest summary of the root cause of our energy problem is the actions taken by environmentalists and Democrats over the past 30+ years that have literally prevented the US from building nuclear plants and refineries, drilling for its own oil, mining clean coal, etc. Already we have made significant investments in alternative energy sources and will continue to do so. However none has proven financially viable for a large marketplace, yet. In time, yes but not now.

The House did pass an excuse for an energy bill, HR 6 which will be the topic of a separate post.

Labels: Energy, Feminists, Security

Tuesday, August 12, 2008

Congressman Kline's Energy Blogger Call

Democrat Speaker of the US Congress gaveled the House to summer adjournment for five weeks and left unaddressed, the pressing need of the USA to face its energy crisis. Of course, this behavior pattern has been repeated over the last 20 or so years by either a Democrat president (President Clinton vetoed the key energy bill in 1996) or Democrat members of Congress. While they claim they're for the little guy, their behavior indicates otherwise. Then there is the national security angle, but why should Democrats be concerned about national security?

The Speaker, Democrat Nancy Pelosi, promised that when the Democrats took over Congress they would grant the minority party the right to offer alternatives to proposed bills. She and her Democrat party leaders have reneged on this promise. Not only have the Democrats refused to even address Republican suggestions, they have also ignored Speaker Pelosi's statement upon the Democrat wins in 2006 that they, the Democrats had a comprehensive energy plan. She even has blocked her own party members from addressing this issue.

We Americans can continue to elect Democrat representatives who are so out of touch with what we, the little guys of America, want and need or we can toss out the Democrat members of this Congress, one of the most lame congresses in US history. There is a reason this Congress' approval rating is in single digits - it's the Democrats ignoring real needs of Americans coupled with their inability to get anything done.

(For those of you who were short-changed on being taught American government, it's not the president who makes laws, it's Congress and this Congress has done zip.)

Labels: Energy, Feminists, John Kline

Friday, August 08, 2008

Dontgocomeback

Harry Reid thinks a month recess "will allow everyone to cool down," while the Gang of Ten continue to meet and try to get past the election with what seems to be a bad compromise. Intriguingly, two of the ten -- Bob Corker and John Thune -- appear in this ad. Are then in or out of the Gang?

Labels: Energy, Feminists, politics

Tuesday, August 05, 2008

Oil later reduces prices now

That story looked kind of familiar to me; it has the flavor of the Hotelling extraction story but told in a simple way. My recognition was of the story of the trees in Alchian and Allen's Exchange and Production. Let me type out a little bit of this for you. Imagine a tree that can yield only one service, producing lumber, which it can provide at only one date in the future. (Oil wells can provide service over many years, we'll get to that in a minute.) At the moment of planting the present value of the tree as lumber at some future date will be greater than the cost of planting the tree.Imagine that you are sitting on a huge oil deposit, which has (let us suppose) one billion barrels that can be brought to the surface for $20 each, so long as you don't pump more than one million barrels per day. (If you want to pump at a higher rate, you have to spend more money per barrel, and you might reduce the total number of barrels you can extract from the deposit.) So the question is, how fast should you pump?

You might at first think that you should pump at the maximum extraction rate, without raising your marginal costs � i.e., that you should pump at one million bbls/day. But this clearly is wrong, if you expect oil prices to keep rising. Why sell 365 million barrels in 2008 at an average of $150 each, when you could postpone production for a year and then sell those same million barrels for, say, $200 each?

In light of this consideration, maybe you think you should just hold your barrels off the market forever. By letting them sit in the ground, the market value of your asset rises over time, as the market price of oil rises.

But that isn't necessarily the right thing to do, either. What if oil prices rise an average of only 10 percent per year over the next two decades? Do you really want to put all your eggs (oil) in one basket, by leaving them sitting underground? Especially if your deposit is located in the Middle East, you might feel more comfortable selling off some of the oil now, and then using the revenue to buy stocks and bonds, not to mention a few surface-to-air missile silos. (And of course, you could be wrong in your forecasts; maybe oil prices will tank in two years.)

As time passes and we apprach that future date, the present capital value rises towards that anticipated future value, and rises at the market rate of interest. Consequently, the date at which you might invest in that resource has no effect on your realized rate of return. If you invest in the first year, or any year, you will get the same annual percentage rate of growth, as long as beliefs about the future value of the lumber don't change. (p. 122)The return on the tree, or an oil field, is equalized at the market rate of interest whether you buy a new or old tree, a new oil lease or an established field.

What ensures that equilibrium? People don't give away opportunities to get more than the rate of interest -- that is, profitable opportunities. If a young tree were priced so low that people expected to get a higher return over its life than [the market rate] per year, everyone would want to buy it; if it were priced to high, the return would be smaller, so no one would want to buy it: The price would adjust. Every durable good whether new or old will be priced on the expectation of the same interest rate of return. (ibid.)The risk of holding that asset is that there would be additional supplies that reduce the rate at which the price of your asset increases. This intertemporal analysis would make an increase in future supply of trees -- reducing future prices -- encourage the cutting of trees now. Likewise, an increase in future production of oil would reduce the rate of return to the Saudis of their reserves, and encourage them to produce more oil now. Such a point is made explicitly by Coats* and Pecquet [2008], but the same can be found in Lee [1978 J Pol Econ; JSTOR link here if you have access.] Coats and Pecquet demonstrate that the effect of a reduction in scarcity rents -- the marginal cost of using oil now rather than later -- has an identical effect to a reduction in extraction costs. This applies to a good that grows until harvest or a durable asset that generates revenue over time. And this applies both to the monopolist or cartel as it does to a competitive oil industry.

This difference between comparative static and dynamic analysis is at the base of the argument between the drill and don't drill debaters. The don't drill side has an argument that future oil production can only affect future oil prices; good economic analysis would tell you otherwise.

*updated to get Morris Coats' last name in that post. He blogs, by the way, and wrote a nice letter. The paper was presented at the Southern Economics Association. Professor Coats reports that he was inspired on this by Dwight Lee's work.

Monday, August 04, 2008

Congresswoman Bachmann Nails It - Energy Wise

When Larry King returned to Bachmann for her comments in response to Governor Richardson, it was over. She nailed the problem clearly and succinctly. She and Barbour showed how the Democrats have been obstructionists for decades on energy. After the commercial, the topic was changed. Score one more for the Republicans.

A few minor points: the Phd. was big on blaming the US for not investing in solar (and wind power) for the past 10 years. I know for a fact that there were windmills and solar experiments in CA for at least the past 25 years. Perhaps the Phd. never traveled to southern CA to observe them. What he conveniently omits is that if solar and windmills were financially sound, we'd have more than 1% of our energy from them. It's not for lack of investment, it's because it's not economically sound.

Democrat Hypocrisy on Oil Drilling

The above is the lead sentence in an article in The American magazine. At the World Petroleum Conference in Madrid, Spain, the leaders of OPEC in essence told American reporters, (paraphrased) "Quit telling us to produce more oil - get your own from your own shores." The big three talkers included the Algerian head of OPEC, Chakib Khelil, who told the press that there are bidding wars in Algeria (not in the US, home of the free market concept) and Americans should open the OCS.

The Petrobras (Brazilian oil company) CEO, Sergio Gabrielli, told the press to drill in the Gulf of Mexico. The Saudi Arabian oil minister Ali Al Naimi said, "The limits to future petroleum supplies have more to do with politics (in the US, it's the Democrats) than with geology and resource availability. ...The most promising acreage remaining in the U.S. is located offshore, most of which is off limits to the industry."

The obstructionist attitude of Democrat politicians is just phony rhetoric. These Democrats denounce the Saudis and OPEC; they complain about the price of gasoline and claim that $10 a gallon is OK; they rant about the evils of Big Oil while The Ego-bama talks about taxing only Big Oil but no other industries (like high-tech, Democrat Warren Buffet's funds, George Soros funds, etc.). Until the US opens its offshore waters to oil drilling, the world will continue to hate us - not for protecting them or removing thugs but hate us because we will be seen as the world's worst energy hypocrite.

A final point - for all the whining by the leftist Dems, their obtuse concept to "protect the planet" in reality hurts the little guy and their union base. This vague "save the world" mindset stifles innovation, ignores the safest oil drilling system on the planet. The Democrat impediments to increasing domestic oil production along with nuclear plants and mining of clean coal ship jobs overseas, jobs that could be in the U.S. Their behavior increases the federal deficit thereby penalizes our kids and grandkids. I hope Americans wake up in time to make the change in November that will provide more energy, better food, safer drilling, warmer homes, and jobs for all of us.

Who were these speakers? Only the leaders of the world 's oil producing nation.

Tuesday, July 29, 2008

The markets for gas and oil can differ

Most of the letters you read these days involve the EIA's estimate of the effect of opening drilling in ANWR. As I wrote about this last week, the report assumes that the price of a barrel of oil in 2020 would be less than $60. If $140 a barrel produces a price of $4 for gasoline, what does a price of $60 a barrel for oil produce? Those of you who answered "$2" can stop now; you've just agreed with Rep. Bachmann. (Though that's 2020 versus Bachmann's forecast date of 2012; if you'd like to argue a price that stays at $140 through 2012 -- or higher -- and then falls to $60 by 2020 so that EIA is right and Bachmann is wrong, I invite you to tell that story and wish you good luck.)

So let's suppose EIA is wrong about that forecast. This kind of cuts the legs out from Gaertner's substantive claims, but let's answer her question for her anyway. What might additional drilling produce for a price change? The key lies in understanding it's about more than just additional oil production.

James Hamilton posts this evening that demand for gasoline in the US appears to be more responsive to prices now that we're at $4 than it was when we were at $3 a gallon. I have talked about this in terms of the "second law of demand": consumer responsiveness to price changes is time dependent and expectations dependent. If the price rise is temporary, you smooth your consumption of gasoline through a combination of less spending on other goods and by saving less. If on the other hand you believe it is permanent, you make bigger changes, like dumping your SUV, riding a bike or buying a more fuel-efficient car. As that shift occurs, you move from a very inelastic demand curve to a more elastic one, and that produces a snap-back of prices towards where you were before. Jim's graphs would indicate that since the beginning of 2008 we are seeing some of that. That should give one some hope that the price decline we're experiencing right now could be the beginning of a longer period of lower gas prices.

But it's also expectations-dependent for suppliers, particularly at the refinery level. There's a very interesting post on VoxEU from Lutz Kilian of U. Michigan regarding the sources of increase in gasoline prices. Most importantly, his model distinguishes the market for gasoline and the market for oil. Domestic demand for gasoline and speculation over oil futures play almost no role in the price of gas; foreign demand and supply uncertainties explain most of the change in Kilian's model. That result makes sense to most observers (it fits, for example, that CFTC report on speculators.) The price spikes following Hurricanes Katrina and Rita reflected very tight refining capacities that were upset. Those shocks went to gas prices, with negligible impact on world oil prices.

Part of the plan pushed by Rep. Bachmann is to pass HR 6139 to cut the bureaucratic hurdles that impede the construction of new refineries. Sure, they take years to produce, but the prospect of additional capacity would reduce uncertainty about gasoline supplies and reduce inventories (which, unlike crude, have been going up versus a year ago.)

Inventory uncertainty, then, can play a substantial role in gasoline prices. Easing the regulatory chokehold on gasoline production could take much more off the price of gasoline today than anyone's projection of the impact on crude oil.

Cross-posted at Outside the Beltway.

(Afterthought: Just after posting this I realize some might think I'm predicting $2 gas myself. That's not the point; the point is the plan laid out has the capacity to create a $2 price all other things equal. To actually make that forecast would require a whole lot more analysis than offered here. I don't wish to denigrate the efforts of EIA with its annual energy outlook -- just that using it to talk about prices 12 years hence is bound to be fraught with the very difficulties I used here to dismiss Gaertner's use of it. Error bands expand the further into the future you forecast.)

Labels: economics, Energy, Michele Bachmann

Thursday, July 24, 2008

What is "the subtle difference between a want and a need"?

Regarding "Bachmann, back from Alaska, urges more domestic drilling" (July 23): U.S. Rep. Michele Bachmann doesn't seem to understand the subtle difference between need and want (describing the untapped Alaskan energy resources as a locked pantry filled with food while children go hungry). Perhaps a better analogy would be a locked medicine cabinet filled with morphine in a room full of addicts.

Let's tend to the real needs of our children and provide a livable planet for their future that doesn't involve destroying our environment.

The difference between want and need is a source of great confusion in economics. Needs are necessary; wants are optional. In The Economic Way of Thinking, Paul Heyne, Peter Boettke and David Prychitko suggest for statements of "needs":

- The average person needs eight glasses of water per day in order to maintain optimal health.

- All citizens should be able to obtain the medical care they need regardless of their ability to pay.

- A diabetic needs insulin.

- You need to read your economics textbook.

The authors point out that all decisions are made at the margin, that all the values that matter are those at the margin. When I'm watching a baseball game at home and Mrs. S says "Who do you love more, me or baseball?" I answer "At the margin, baseball. And you're blocking the TV."

Is a picture of an arctic scene equal to Area 10-02? Certainly not. But suppose I said you could have Area 10-02, another area of ANWR that has a very similar picture and no oil, or another area in ANWR and x billion barrels of oil. Is there no value for x that gets you to make that trade? I doubt it. I highly doubt it. If there are alternatives to oil, there are also alternatives to undeveloped land.

Scarcity is not optional; we do not live in a world where one can "tend to the real needs of our children" without sacrificing other goods for other people. People can provide for the "real needs" of pristine lands in a variety of ways, both public and private.

We call it the law of demand for a reason.

h/t: KAR, whose post is entertaining as well as educational.

Tuesday, July 22, 2008

Stein's law, ANWR, and oil prices

Stein's Law, "If something cannot go on forever, it will stop," came to mind to me today while reading a post on Angry Bear about ANWR. To get at the thought, consider this graph above, which is from a report that pgl and most of the ANWR-ain't-diddly-squat crowd quote. You know, the one from EIA that says ANWR will make barely $.02 a gallon difference for gas. See if you can find the heroic assumption in the actual passage:

With respect to the world oil price impact, projected ANWR oil production constitutes between 0.4 and 1.2 percent of total world oil consumption in 2030, based on the low and high resource cases, respectively. Consequently, ANWR oil production is not projected to have a large impact on world oil prices. Relative to the AEO2008 reference case, ANWR oil production is projected to have its largest oil price reduction impacts as follows: a reduction in low-sulfur, light (LSL) crude oil prices of $0.41 per barrel (2006 dollars) in 2026 in the low oil resource case, $0.75 per barrel in 2025 in the mean oil resource case, and $1.44 per barrel in 2027 in the high oil resource case. Assuming that world oil markets continue to work as they do today, the Organization of Petroleum Exporting Countries (OPEC) could neutralize any potential price impact of ANWR oil production by reducing its oil exports by an equal amount.Did you catch that? It assumes OPEC's behavior in ten to twenty years will be to offset (potentially) any change in prices that occurs. It has complete control of the price. Were that true, why would people caterwaul about speculators? Can't OPEC control their behavior too?

These very same people are the ones who contend peak oil will drive the price of oil ever higher, which increases the temptation to cheat within the cartel. They never cheat, do they?

Now read that graph again. The part unshaded below the green area is production of oil in the lower 48; the green part is the current production in the leased parts of Alaska. You know, the part Pelosi says the oil companies don't use enough currently. Those other areas are the three possible projections for output from ANWR. Without additional drilling, US production in their model peaks in about ten years. (Just put your finger over all the colored areas except the green.) Drilling more of what we current lease is more a change in timing, borrowing against future oil production, unless you think the oil companies are sitting on proven reserves after a one-year 75% rise in prices.

Last point: the projections assume that in 2020 the price of a barrel of oil (without ANWR) is $59.70 and $70.45 in 2030. Were these accurate, you can see that there isn't nearly the need to increase production; prices will fall reasonably soon on their own. And they might. But people making models estimating the impact on the price of oil 20+ years from now are dealing the most imprecise of estimates. It assumes that world oil consumption is 117.6 million barrels per day. That's about thirty million more than now; if China continued to grow its consumption at its 1995-2005 rate, it would consume 21 of the 30 additional alone. And let's not forget India, perhaps for another four million. (It assumes the US would by 2020 only consumer 800,000 bpd more than it did in 2006.) Are all those assumptions realistic to you?

One of those things has to change, via Stein's Law. If prices are going to be where EIA is putting them, some economy is using a lot less energy than current trends project. Something that adds 10-20% more to our own production and reduces imports of oil by 6% (both figures for 2025, again if you beleive EIA), certainly seems a reasonable first step, lest that economy be ours.

UPDATE (7/23): pgl responds, arguing that the price in 2020 is irrelevant to the comparative statics. That's only true if you think the elasticity of demand at $60/bbl and $140/bbl are the same. I doubt this is true and would like him to write out the demand equation that does that. Given that the EIA included the price in its spreadsheet, I'm going to argue it was part of the calculations.

Monday, July 21, 2008

The Bush tax cut of 2008?

I use First Fuel (bought a big load at $2.649 about fifteen months ago), so I usually go around to Highway 15 to get to the Pantown station near the St. Cloud Times' offices. There's a station owned by some immigrant family on Third St. N., and it's sign was $3.799. I smile: I was right about those stations near St. Augusta.

Later on the phone Gary tells me that stations on the east side were selling at $3.699. The Sunday morning paper reported it; this morning prices are two cents less than that according to GasPriceWatch.

What does a forty cent decline in gas prices mean for you and me? In 2005-2006 the average vehicle consumed about 700 gallons of gas according to the Bureau of Transportation Statistics. The average household has 2.28 vehicles. So a forty cent drop in gas prices is the equivalent of a $638.40 tax cut for the average household if the price remains at this lower level for a year. As it is, for a week it would get you about $12.27 in savings.

I am hard pressed to find alternative explanations for the reduction to the president's signature of a rescission of the ban on offshore drilling. You are welcome to add other possible explanations in comments; the previous statement has a very post hoc ergo propter hoc feel. I like the graph Paul Krugman draws -- I've discussed this before as the second law of demand -- but the precipitous nature of the drop makes me skeptical that a fall in demand is the proximate cause.

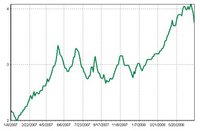

FFB, by the way, pushed its price down to $3.749 to put gas away for the next time we get over $4. To the right is a chart of their prices to put fuel into your account since Jan 2007. Time to buy again?

Wednesday, July 16, 2008

Return to MEOW

I could have lived without the reference to CAFE standards, but Bush's tying of consumer sovereignty in energy goods to tax cuts was worth the wait.

(Your title hint here.)

Life's value

It's not just the American dollar that's losing value. A government agency has decided that an American life isn't worth what it used to be.Now where do you get that $6.9 million from? There are two ways traditionally used in cost-benefit analysis. One is to take my estimated income over my lifetime, discount it to present value and come up with the sum. That number is likely to be relatively low, almost certainly less than $6.9 million. (If yours is not, congratulations -- you're a pretty rich fellow!)The "value of a statistical life" (VSL) is $6.9 million in today's dollars, the Environmental Protection Agency reckoned in May � a drop of nearly $1 million from just five years ago.

The Associated Press discovered the change after a review of cost-benefit analyses over more than a dozen years.

The other way to find that out is to look at different jobs with different levels of safety or risk. Figure out the probability of a job fatality for the different occupations, and then compute how much additional pay the average worker receives in the riskier job. For example, one of the job opportunities I might have is to work as an adviser to, say, the central bank of Afghanistan. How much more would you have to pay me to go there versus, for sake of comparison, the central bank in Mongolia? Afghanistan is riskier, and if we can figure out how much riskier it is and compare it to the wage differential required to hire economists into both positions we have some measure of the value of a life. Indeed, this is what EPA is using:

...economists calculate the value based on what people are willing to pay to avoid certain risks, and on how much extra employers pay their workers to take on additional risks. Most of the data is drawn from payroll statistics; some comes from opinion surveys. According to the EPA, people shouldn't think of the number as a price tag on a life.There's no good reason for them to use different numbers, so that there has been convergence between DoT and EPA should be considered a good thing, caterwauling by liberal blogs notwithstanding. Here's a white paper from 2004 that EPA has posted that describes their study of VSL. Part of the problem is that people sort themselves into jobs in part depending on the attitudes towards risk. The report takes, for example, the observation that night clerks at convenience stores tend to be older and male. Older individuals tend to make more because of experience; males have been noted to earn more than females. Should all of the difference between the pay the night clerk and the morning clerk receive be attributed to the greater chance of armed robbery at night?

The EPA made the changes in two steps. First, in 2004, the agency cut the estimated value of a life by 8 percent. Then, in a rule governing train and boat air pollution this May, the agency took away the normal adjustment for one year's inflation. Between the two changes, the value of a life fell 11 percent, based on today's dollar.

EPA officials say the adjustment was not significant and was based on better economic studies. The reduction reflects consumer preferences, said Al McGartland, director of EPA's office of policy, economics and innovation.

"It's our best estimate of what consumers are willing to pay to reduce similar risks to their own lives," McGartland said.

But the EPA's cut "doesn't make sense," said Vanderbilt University economist Kip Viscusi. The EPA partly based its reduction on his work. "As people become more affluent, the value of statistical lives go up as well. It has to." Viscusi also said no study has shown that Americans are less willing to pay to reduce risks.

At the same time that the EPA was trimming the value of life, the Department of Transportation twice raised its life value figure. But its number is still lower than the EPA's.

Interestingly, that paper includes a study done by Viscusi, which puts VSL at $6.9 million in one estimate. You would need to adjust that for inflation from 2003.

The implications of this for the drilling debate should be obvious. We have on one side a desire to reduce the price of gasoline and other energy products, which clearly increases the welfare of our citizens. Against that we have to weight the cost to the environment, which might include the loss of wildlife. What is the demand for wildlife? If you look at it in market terms, the location of ANWR matters as it provides less value to tourism than a similar-sized area on the California coast. We can compute the value of ANWR or any other place by looking at how much people will pay to travel there, and how many people do so. Take for example this 2001 piece that says 2500 people travel there and pay $4000 each to go. That's $10 million a year; discounted at 5% in perpetuity says the value of tourism in ANWR is $200 million. Now that number is almost assuredly too low -- there must be other tours. But as well, tourism would not fall to zero if rigs were put there. If we assume the tourists are there to see caribou, and if caribou will remain after the rigs are put in, some fraction of the 2500 will still go. A survey might tell you how many.

The benefits are likely to be large; sure, it might take years to get production (though Larry Kudlow (h/t: Dave) points out that in California, one estimate says you get drilling within one year), but that is an easy correction to the spreadsheet on which you do the cost benefit analysis.

Democrats have ignored tradeoffs on energy for years, and a few Republicans have joined them at least until now. A format exists to make sound calcuations about the tradeoffs. It is good to see liberals considering the meaning of VSL. Now to get consistent application of the method...

Labels: cost-benefit analysis, economics, Energy

Thursday, July 10, 2008

Joseph was a foreign speculator

Lovely. Foreign speculators. It takes a special kind of chutzpah for someone to practice xenophobia while selling you a plane ticket to Asia. (Now with an extra $100 processing fee for using your frequent flyer miles, too!) Foreign speculation has been done for a long time, even going back to Biblical times. Does it matter? Do we think the price would be less if speculation was restricted to Wall Street firms? (Such firms, by the way, often use foreign futures markets for their trading, just a small quibble.)Every time you buy products such as food or gas, you are impacted by unregulated, secretive and often foreign commodities futures markets. Speculators in these markets are increasingly buying and selling commodities such as oil to sell again, rather than to use. As largely unregulated speculators pocket billions of dollars at your expense, the price of commodities has increased out of proportion to marketplace demands.

As speculators continue to dominate the market, the volume of oil traded �on paper� has been as high as 22 times greater than the volume of oil consumed. As prices rise, institutional investors have become active traders, turning commodities into just another asset class. This has caused severe market imbalance and upset the natural relationship between supply and demand. As a result, legitimate customers such as trucking companies, airlines, and consumers have been forced to purchase oil at unnecessarily higher prices. This has dramatically raised costs, resulting in needlessly high prices for American consumers and businesses.

The site provides a definition for a speculator:

In commodity futures, an individual who does not hedge, but who trades with the objective of achieving profits through the successful anticipation of price movements.That begs the question, what do they mean by hedge?

Hedging: Taking a position in a futures market opposite to a position held in the cash market to minimize the risk of financial loss from an adverse price change; or a purchase or sale of futures as a temporary substitute for a cash transaction that will occur later. One can hedge either a long cash market position (e.g., one owns the cash commodity) or a short cash market position (e.g., one plans on buying the cash commodity in the future).So someone who is minimizing risk is hedging. But risk doesn't disappear when a futures contract is purchased or sold. It can only be transferred from the seller of the contract to the buyer. The speculator, in buying futures contracts, is accepting the risk that the price will be lower in the future; he loses money if the spot price for oil in the future is below the contracted price in the futures contract. The airlines are of course trying to reduce their exposure to oil price fluctuations, so they pay speculators to transfer that risk. Who did they think they were doing business with before, just oil companies?

Northwest and others are seeking relief from Congress, to which Chad writes:

One obvious question is how the UNITED STATES CONGRESS plans to "act" to do something about these "foreign" commodities futures markets. The arrogance and ignorance that leads these bozos to believe that global oil markets will bow to the whims of Congress is rather astounding.

Labels: economics, Energy, Northwest Airline sucks

Tuesday, July 08, 2008

Who's fishy?

Offshore drilling is extremely expensive and jeopardizes important sources of seafood.This despite there being not one drop of oil spilled from Katrina or Rita off of the Louisiana Coast. And Humberto Fontova points out, the fish and coral life seem to like being around oil rigs. He's written a book on a group of people who go fishing off of abandoned oil rigs, most of which are off the Louisiana coast. The group has a video that shows spearfishing off those waters.

The high prices of gas and oil are exactly the thing that induces offshore drilling. Yes it's expensive, but firms in Florida who got a few leases squeezed out of Congress in 2006 are willing to risk $100 million or more to see if they can find new reserves. When Congress passed the Deep Ocean Energy Resources Act of 2006 , Democrats like Florida Senator Bill Nelson threatened a filibuster. DOER never passed the Senate. It kept drilling (in a rider on another bill) to 125 miles offshore the FL panhandle, an area of 8.3 million acres. That's when gas was $3 and oil $60. Now we're north of $4 and $140, and they're drilling and wanting more leases. Any chance we could get Congress to agree?

Let's say that again: in 2006, the Republican House passed DOER Act; the Democrats in the Senate threatened a filibuster and gutted it. Anyone wanting to blame Republicans for not drilling OCS when they were in charge is ignorant of DOER's history.

Saturday, June 28, 2008

The anti-captalistic mentality

(2) eliminate excessive speculation, price distortion, sudden or unreasonable fluctuations or unwarranted changes in prices, or other unlawful activity that is causing major market disturbances that prevent the market from accurately reflecting the forces of supply and demand for energy commodities.The bill, introduced by Minnesota Congressman Collin Peterson, passed overwhelmingly, with only 19 nays. I've already written this week about speculation, but some further comments seem justified.

Congress has heard lots of testimony from 'experts' contending that the price of gas would fall to $2 if we could just get those nasty speculators out of the market. The testimony most have focused on is that at the top of the article, by Michael Masters. Here that is. The focus is on index speculators, who are now buying futures contracts almost equal to the entire increase in demand for oil from China. This however does not reduce the supply of oil unless someone takes delivery of the contract. Krugman hints at this very same point; see also Craig Jones. Most futures contracts are going to be closed out by writing the opposite contract as one reaches expiration. (Futures basics.) You might keep your long position by buying another future, but that does not remove oil from supply.

Now that doesn't mean that the price isn't influenced by what is going on in futures markets. Prices have been rising in part by expectations of the future, but it was ever thus since the beginning of asset trading. The key question is, at what point does speculation become excessive? And the reaction of politicians and everyday people, in my view, is emotional rather than economic. Excessive speculation occurs, in the mind of the non-economist or Congressperson, when the price of X is driven beyond the point where he or she can afford to own it. To take just one example: A St. Cloud resident is a Green Bay Packers fan. He owns season tickets to Packer home games. He does not use these often, instead selling them for above face value. Is he a speculator? When I ask him why he still gets the tickets, he hopes some day to return to the Land of the Cheese and attend all the games when he retires. He thinks the price will be higher for him to go to games when he returns than it is now, so he is hoarding his spot in the season ticket queue.

He is preventing others from holding that ticket, and therefore is helping drive up prices now. Unlike the index speculators, he actually HAS THE TICKET. But is his speculation excessive, or is it rational? You don't know, I don't know, and the government regulators don't know.

This does not prevent, unfortunately, government from acting as if they did. Sometimes arrogance is a disguise for ignorance, and as a good example this week consider Tim Walz' antipathy to markets, as Andy Aplikowski documents. He quotes a Rochester Post-Bulletin article in which Walz denies the market.

This idea � this red herring � that all of a sudden you�re going to drill and everything is going to be better, as if the market fundamentals are at work here � that�s not happening... These are the same people that are (getting) $40 billion in profit."As if" Walz believes profits do NOT motivate drilling. What do you think they do it for, to drop the rocks they drill in the ocean to watch the ripples? There is, in the Walz mentality, a suspicion that people who earned a profit got this from someone, that it's undeserved. For many years we've understood profits as the return to risk born by the residual claimant, the entrepreneur. But instead we get people who believe corporations are reprobates less worthy of our trust than a government that has a monopoly on force.

But that's not the point either. There's no need to believe the government is more immoral than corporations. There's little argument from either side of this debate that corporations are quite willing to co-opt or corrupt government to do their bidding, or that it's easier for them to do so than the hordes of consumers. It is that Walz and the others in Congress do not comprehend how the wealth we live in today came from. In the book with the title that I made this post, Ludwig von Mises stated this well:

And thus there is no check on the ability of people to vilify speculators, because of course the oil can be brought to market in any number of ways! It occurs to me that people do not know what the world was like before the Industrial Revolution (or perhaps they want to go back to those halcyon days?) and how recent our gains against disease and starvation and the Malthusian world. Anthony de Jasay writes about how the modern progressive glorifies envy by its ignorance of these gains on the subsistence level:Economics is so different from the natural sciences and technology on the one hand, and history and jurisprudence on the other hand, that it seems strange and repulsive to the beginner. Its heuristic singularity is viewed with suspicion by those whose research work is performed in laboratories or in archives and libraries. Its epistemological singularity appears nonsensical to the narrow-minded fanatics of posi�tivism. People would like to find in an economics book knowledge that perfectly fits into their preconceived image of what economics ought to be, viz., a discipline shaped according to the logical structure of physics or of biology. They are bewildered and desist from seriously grappling with problems the analysis of which requires an unwonted mental exertion.

The result of this ignorance is that people ascribe all improvements in economic conditions to the progress of the natural sciences and technology. As they see it, there prevails in the course of human history a self-acting tendency toward progressing advancement of the experimental natural sciences and their application to the solution of technological problems. This tendency is irresistible, it is inherent in the destiny of mankind, and its operation takes effect whatever the political and economic organization of society may be. As they see it, the unprecedented technological improvements of the last two hundred years were not caused or furthered by the economic policies of the age. They were not an achievement of classical liberalism, free trade, laissez faire and capitalism. They will therefore go on under any other system of society�s economic organization.

Most of us react to the decency or otherwise of large incomes and quickly made fortunes by moral reflexes that evolved under the capitalism of a generation or two ago. They have not yet been adjusted to the changes capitalism has since undergone. One such change is the flood tide of pension funds in the Anglo-American type of capitalism which, after all, sets the mode of operation the rest of the world is beginning to imitate. The needs of pension funds and the competition between their managers sets the maximisation of asset values as the primary goal, and the more classic goal of profit maximisation by corporate enterprise tends to become a mere instrument of the primary goal. Socialists whose rejection of the "system" is visceral rather than intellectual, call this "Casino capitalism," run by and for "speculators".It is that same visceral reaction that lead 402 Congresspersons yesterday to cast aside the gains that result from finding more ways to spread risk in the world to those willing to bear them, gains that allow pensions, homeownership, life insurance, and the development of new technologies -- the very ones the modern progressive says we should trust instead to give us energy rather than tapping the oil deposits we already know exist. Ignorance of that history is a peril to us all.

Labels: economics, Energy, libertarianism, socialism