Thursday, December 31, 2009

New QBR is up

Despite continued weakness in the regional labor market, St. Cloud-area firms are finally beginning to expect an improved future economic outlook. While it is still too early to declare that the local recession has ended, this improved outlook does suggest that 2010 will be a year of recovery and expansion for area firms.Full report available from here.

The area economy appears to be following the path of national economic activity. A large majority of economists agree that the national economy emerged from recession at some point in the second half of 2009. While national labor market conditions remain weak, U.S. production, income and sales data indicate a national recovery has begun. While the lags on the availability of data on local income, sales and output are long, the results of this quarter�s St. Cloud Area Business Outlook Survey provide some evidence that area firms will begin to enjoy this recovery by the middle of 2010. For example, the outlook for future business activity is the highest it has been in the fall survey since fall 2006.

Local labor market conditions remain weak. St. Cloud employment declined by 3.4 percent over the year ending October 2009 as only the leisure and hospitality

sector experienced employment growth over this period. The St. Cloud Index of Leading Economic Indicators continued to slide, though at a slower rate. The latest reading of the Probability of Recession Index predicts that it is 73 percent likely the local economy will be in recession in February to April 2010.

Thirty-four percent of surveyed firms report an increase in economic activity over the past three months, while 25 percent report a decrease. This is a large improvement over the survey from one year ago...

Labels: economics, Minnesota, St. Cloud

Gearin punts

Here's the full order. The part quoted by the newspapers is indeed one of the points of contention.

"The authority of the Governor to unallot is an authority intended to save the state in times of a previously unforeseen budget crisis," wrote Gearin. "It is not meant to be used as a weapon by the executive branch to break a stalemate in budget negotiations with the Legislature or to rewrite the appropriations bill."The sentence appears on page 6 of the order. The full paragraph is as follows:

In the beginning of June of 2009, Defendants took the steps to unilaterally balance the budget by unalloting specific programs enacted into law during the session. By exercising his unallotment authority to apply to reductions in revenues that were determined by a forecast made before the budget had even been enacted and by not excluding reductions that were already known when the budget was enacted, the Governor crossed the line between legitimate exercise of his authority to unallot and interference with the Legislative power to make laws, including statutes allocating resources and raising revenues. The authority of the Governor to unallot is an authority intended to save the state in times of a previously unforeseen budget crisis, it is not meant to be used as a weapon by the executive branch to break a stalemate in budget negotiations with the Legislature or to rewrite the appropriations bill.I believe the facts presented beforehand illuminate Judge Gearin's reasoning. It seems more a matter of timing to her. The biennium had not started. And yet the law doesn't require one to wait for a forecast. The trigger for the unallotment process is a letter from the Commissioner of Finance. The House Research Department reviews this:

Subd. 4. Reduction.(a) If the commissioner [of finance] determines that probable receipts for the general fund will be less than anticipated, and that the amount available for the remainder of the biennium will be less than needed, the commissioner shall, with the approval of the governor, and after consulting the legislative advisory commission, reduce the amount in the budget reserve account as needed to balance expenditures with revenue.Judge Gearin says the law has been determined constitutional, citing Rukavina v Pawlenty. I talked about this in June. (Note the link to the case in the June article has gone dead -- the one above worked this AM.)

(b) An additional deficit shall, with the approval of the governor, and after consulting the legislative advisory commission, be made up by reducing unexpended allotments of any prior appropriation or transfer. Notwithstanding any other law to the contrary, the commissioner is empowered to defer or suspend prior statutorily created obligations which would prevent effecting such reductions.

In the Rukavina case the Court of Appeals stated: "We conclude that MinnStat 16A.152 does not reflect an unconstitutional delegation of Legislative power, but only enables the Executive to protect the State from financial crisis in a manner designated by the Legislature." That remains the settled law in the State of Minnesota, and it would be improper for this Court to revisit the constitutionality of the unallotment statute itself. It is constitutional. It was the specific manner in which the Governor exercised his unallotment authority that trod upon the constitutional power of the Legislature, and the Legislature alone, to make laws that, in the Court's opinion, was unconstitutional. (p. 4)She then reviews the history of the 2009 session, noting the Governor Pawlenty signed the HHS appropriations bill, simultaneously noting that he would unallot to balance the budget if he did not get a balanced one. This came days after telling the Legislature that he would not accept a tax increase (see his letter of May 8 in re the tax bill.) After the announcement the Legislature and the Governor passed budget proposals back and forth. The Legislature then does three things: fails to override the tax bill veto; fails to override the GAMC line-item veto; passes a new tax bill unveiled a mere two hours before adjournment. The Legislature was given time to act to come to an agreement with the Governor. They did not agree.

Most of that history does not appear in Judge Gearin's order. She mentions the second revenue bill like it is well-formed, with no requirement upon them to bargain in good faith with Pawlenty. The burden of bargaining in good faith seems put too much on him.

Timing appears to be an issue for Judge Gearin, and on this point I think a valid concern is raised. The trigger letter from MMB Commissioner Tom Hanson is dated June 16. Note that there is in the law NO requirement of waiting for a forecast from Finance or the state economist, just this letter; nowhere does the law say the Commissioner must wait for a new forecast. On that point I think she's wrong. A statement begins two days later on how the unallotment will be effected -- the biennium has not yet been set. Given Judge Gearin's fascination with June, it appears she thought that the Governor was obligated to call the Legislature back into special session. Yet that is nowhere in 16A.152. There is a vagueness that I for one would have liked clarified.

My point, then, is that while Judge Gearin says she can't rule on the constitutionality of the unallotment law, she is trying to put limits on where it can be used. At no point does Rukavina tell you when the unallotment is constitutional, and it does not give the Legislature an upper hand in taxing authority.

Although appropriation of money is the responsibility of the legislature under Minn. Const. Art. XI � 1, it is an annual possibility that the revenue streams that fund those appropriations may be insufficient to actually realize each appropriation. For that purpose, the legislature, by statute authorized the executive branch to avoid, or reduce, a budget shortfall in any given biennium. Minn. Stat. � 16A.152 does not represent a legislative delegation of the legislature's ultimate authority to appropriate money, but merely enables the executive to deal with an anticipated budget shortfall before it occurs.It may be that you have to be in the biennium to enjoy this power. That is not for Judge Gearin to decide -- that will be up to the Court of Appeals and, I'll dare say, the state Supreme Court. The TRO she places on Pawlenty is in essence an invitation to the higher courts to clarify: Does he have to wait for the beginning of a biennium? If he knows there's a deficit, does he have to try again with a special session? Given that, in the present case, the Legislature never gave Pawlenty an overall budget target to which he could refer for the purpose of line-item vetoes, was Pawlenty entitled to treat the appropriations as things the Legislature would have to bargain over with him? It should be obvious from a reading of the history that they did not bargain. They passed a bill he disagreed with, that they knew he disagreed with, and for which they did not have the votes to override. Yet they continued to send spending bills. It's unfortunate that Judge Gearin chose not to include that history in her order.

At any rate, probably much ado about something that will be overturned quickly. Judge Gearin wants either the Governor and Legislature to agree to something, or for a higher court to review the constitutionality of the law as being perhaps overly broad. She'll get at least one of those, at which time her order will be a footnote. But she's doing us a favor, clarifying what has long been a rather vague statute.

Labels: DFL legislature, Minnesota, Pawlenty

Wednesday, December 30, 2009

Whatever it takes, Uncle Sugar provides

With Fannie and Freddie, it may be about the risks to the housing market, or it may be (as Nick Timiraos argues) a possible back-door to refinance mortgages with principal reductions. Ed Morrissey points me to this discussion with Ed Pinto with other explanations. Calculated Risk suggests this is much ado about nothing; if most of Treasury was taking the week between Christmas and New Years Day off, they simply waited to the last minute to do unilaterally what would have required Congressional action after January 1. I would rather have Congress vote on giving Fan/Fred carte blanche, but there you are."We said if you do not go raise capital from the private markets, if you are unable to, we will put capital into you because it is important to the stability of the system," he told a congressional oversight panel. "It was never going to be possible for GMAC. They are in a unique and difficult situation."

Geithner said the new investment in GMAC would likely be "a little lower than we anticipated."

With the new loan, taxpayers are now the majority shareholder.

Labels: economics

Buy the premise, buy the bit, part V

If you believe fiscal policy is ineffective, you have a model that finds it doesn't work, and so when you estimate the effects of fiscal stimulus, lo and behold, you show no effect and say it doesn't work.

Taylor says "the models have had their say. It is now time to look at the direct impacts using hard data and real life experiences." Yes. Robert Hall, for one (ungated copy? think so) suggests that while you could have a new Keynesian model which makes the purchases portion of the stimulus work, it was simply too small ($62.5 billion) to close the GDP gap ($1.2 trillion.) Paul Krugman would agree. But you have to assume a larger deficit would still have zero effect on real interest rates to argue for one big enough (in Hall's case, more than ten times the size for 2009.) I for one don't buy that premise.

Labels: economics

Tuesday, December 29, 2009

More on income and wealth

The importance of the study, John writes, is that by use of IRS records Auten and Gee can track the same individuals over time:

By tracking the same people over time it can answers questions like: how has income changed for people that were in a particular income quintile in 1996 by 2005 (adjusting for inflation)? This is a different question than comparing people in a particular income quintile in 1996 with the set of people in the same income quintile in 2005. Some of the same people will be in the same income quintile, but some will move up or down.John suggests you look at Table 4 (scrolling the table link), which is also the basis for most of the presentations slides. It is a little too hard for me to format, but this should do:

Percent Change in:

1996 Income Mean Median

Quintile Income Income

Lowest 186.8 77.2

Second 60.4 36.9

Middle 40.0 24.4

Fourth 31.7 17.9

Highest 25.8 8.6

Tap 10% 26.6 0.3

Top 5% 27.8 -10.6

Top 1% 10.1 -30.9

All Income Groups 37.1 22.7

Their main conclusions (quoting from the introduction):

- There was considerable income mobility of individuals in the U.S. economy over the 1996-2005 period. More than half of taxpayers (57.5 percent by one measure and 55 percent by another measure) moved to a different income quintile over this period. About half (56 percent by one measure and 42 percent by another) of those in the bottom income quintile in 1996 moved to a higher income group by 2005.

- Median incomes of taxpayers in the sample increased by 24 percent after adjusting for inflation. The real incomes of two-thirds of all taxpayers increased over this period. Furthermore, the median incomes of those initially in the lowest income groups increased more in percentage terms than the median incomes of those in the higher income groups. In contrast, the real median incomes of taxpayers who were in the highest income groups in 1996 declined by 2005.

- The composition of the very top income groups changed dramatically over time. Less than half (39 percent or 42 percent depending on the measure) of those in the top 1 percent in 1996 were still in the top 1 percent in 2005. Less than one-fourth of the individuals in the top 1/100th percent in 1996 remained in that group in 2005.

- The degree of relative income mobility among income groups over the 1996-2005 period was very similar to that over the prior decade (1987-1996). To the extent that increasing income inequality widened income gaps, this was offset by increased absolute income mobility so that relative income mobility neither increased nor decreased over the past 20 years.

- Upward and downward mobility is affected by many factors. Based on a regression analysis, we find that initial position in the income distribution and changes in marital status are among the more important factors associated with changing positions in the income distribution.

I found this fact quite interesting: For the top 1/100th of 1% of the income distribution -- the 11,700 wealthiest tax filers in 1996 -- their 1996 income was $11.6 million and their 2005 income was $4.1 million. Not suffering at all, but still a fall in median income of near 65%.

Look at all those mandates

Still, the underlying raw data was interesting, and so with that big caveat here are the rankings for upper Midwestern states.

| Rank | State | HSA deduct | GI/SE | CR/ SG | GI/ Ind | CR/ Ind | High Risk | Man- dates | Index |

| 2 | Nebr. | 0 | 0 | 0.33 | 0.00 | 0.00 | 0.00 | 1.60 | 1.93 |

| 4 | Iowa | 0 | 0 | 0.33 | 0.00 | 0.33 | 0.00 | 1.30 | 1.96 |

| 6 | SDak | 0 | 0 | 0.33 | 0.00 | 0.33 | 0.00 | 1.50 | 2.16 |

| 11 | NDak | 0 | 0 | 0.33 | 0.00 | 0.33 | 0.00 | 1.70 | 2.36 |

| 21 | Wisc | 1 | 0 | 0.33 | 0.00 | 0.00 | 0.00 | 1.70 | 3.03 |

| 37 | Minn | 0 | 0 | 0.33 | 0.00 | 0.33 | 0.00 | 3.40 | 4.06 |

Thanks to HTML Tables for formatting. Here's a brief guide to the labels, and see the study for details:

- rank -- from least to most costly

- HSA deduct -- are contributions to health savings accounts deductible from state income tax? (0 = yes, 1 = no)

- GI/SE -- are insurance companies required to issue health insurance coverage to self-employed persons without any other employees? (no=0, yes=1)

- CR/SG -- community rating for small groups (can't very price within a region for a small group plan)

- GI/Ind -- guaranteed issue for all in individual (non-group) market

- CR/Ind -- community rating in individual market

- High-risk -- presence of high-risk pools

- Mandates -- # of mandates divided by 20

- Index -- sum of the elements. It's this number on which the rankings are made.

There then is some use for this study: It focuses us on what the issue for health care costs in Minnesota is. It also suggests that reducing these will be hard. Alas, federal health legislation may reduce the differences in mandates between the Nebraskas and the Minnesotas before much longer.

Labels: economics, health care

My landlord, the state

My guess is that these agencies will become bloated agencies of rent-seekers throughout the US. It would take another Reagan-type sweep to de-politicize the mortgage insurance business.Tom Petruno is puzzled why investors are buying shares in this company because private shares will eventually be worth zero. I think it's an example of the greater fool theory. When the Treasury statement says they are "retaining flexibility" to not unwind their participation in the mortgage market, can there be any doubt that the Federal government is not being honest in saying it wants "the private market ... to provide a larger source of mortgage finance." The only credible commitment the administration has made is to not ask Congress for permission to expand its role in those markets.

Monday, December 28, 2009

The jawbone of an ass

While the Jets win today ended Indianapolis� streak and showed once again how difficult it is to go undefeated, I want to congratulate the Colts on a great run.Don Shula. Remind me how many teams with winning seasons were on the Dolphins' regular season schedule again? (Make a peace sign, you got it. Two 8-6 teams, that's it.)

Labels: sports

If by rich you mean the top 60%

For a quick tutorial on the specifics of how bad the decade was, check these two sources: a concise and authoritative McClatchy Newspapers article by Tony Pugh, published in September, and our good friends at the Minnesota Budget Project,... The McClatchy analysis echoes the overhwelming consensus that those in the top 1 percent or the top 10 percent benefitted enormously and disproportionately from whatever economic growth occurred, and now have a greater share of wealth and income than the top tier has enjoyed since 1929, just before the Great Depression.So is that really true? I went to the 2007 Survey of Current Finance (released early in 2009, and as a triennial survey is as close as we get to a systematic look at household finances) and pulled up a couple of datapoints on family net worth:

| Quintile | Median income 2007 | Median wealth, 2001 | Median wealth 2007 |

| Lowest | 12.3 | 9.2 | 8.1 |

| 2nd | 28.8 | 43.8 | 38.1 |

| 3rd | 47.3 | 74.5 | 88.1 |

| 4th | 76.7 | 168.8 | 205.8 |

| Highest10% | 397.7 | 975.0 | 1,119.0 |

All data are in thousands of 2007 dollars (i.e., inflation-adjusted) using weighted adjustments (i.e., the internal data the Fed uses in creating reports.) Feel free to whip, chop and puree that data as you like. The point is that the middle and upper middle quintiles of the distribution saw increases in real net worth, while the lower two tiers were worse off. So it's not the top 1% or 10% but the top 60% that are doing better.

A couple other facts from that dataset:

- As has often been pointed out for income, the premium for a college degree has grown. But real net worth rose for those with only a high school diploma; where it fell was for the family with a head of household who had some college but not a four-year degree.

- Regionally, the average Midwest family saw its net worth fall from $124,400 in 2001 to $107,500 in 2007. In the South, it rose from $86,300 to $97,100. Single parents rose from $22,900 to $25,100. I think that because the Midwest has a higher share of employment in manufacturing, this is could be a source of decline.

To the extent it's a tax cut decade, what of the extra 5% of families that no longer pay federal income tax in 2007 that did in 2001? The share of adjusted gross income paid in income taxes fell for both the poor and the rich. Again, what accounts for the differences in effect of these? I don't really know, but I don't think Dane does either.

Labels: economics

Friday, December 25, 2009

Blessings at Christmas

Thursday, December 24, 2009

Christmas Magic

We would awake Christmas morning (always early) and go downstairs to see a Christmas tree, lights, the cardboard-house village underneath the tree, the Manger creche and presents. Then it was a burst into our parents' room, "Wake up, wake up! Santa came last night." My poor dad had to drag himself out of bed, probably with less than 3-4 hours sleep.

My parents kept the magic alive for a number of years. After gaining a bit of maturity and realizing that Santa Claus hadn't decorated the tree on December 24/25, I finally asked them where they had kept the Christmas tree? See, neither my brother nor I had ever found it. It just appeared on Christmas Day.

What they had done was buy the tree, then they stuck it in the neighbor's back yard among other trees. After Dad came home from work on Christmas Eve, they rearranged the living room furniture, hauled in the tree and decorated it, during the night. My brother and I were never the wiser.

Today, and when I was a single parent, the tree is decorated before Christmas. We have a different ritual where we decorate the tree, have great finger food, and play Christmas carols. This year, as last, our son is deployed overseas but we kept the ritual alive. When he returns next Christmas, we'll do it again.

Rituals and magic are important. I was lucky as a kid to have parents who understood all the beauty of Christmas. Today, as we recall memories and celebrate Christmas in all its manifestations, let's remember the real reason for the holiday - a gift of life for all.

Merry Christmas to our readers.

Labels: Christmas

Not too fast

Business loans on the balance sheets of all federally insured U.S. banks fell $89.1 billion, or 6.5%, from July 1 to Sept. 30, according to the Federal Deposit Insurance Corp. That was part of a $210-billion drop in overall loans outstanding, the largest such decline since at least 1984.

"In some ways, the pendulum may have swung too far in the direction of not lending, after a decade in which it had gone way too far in the direction of getting money out the door, no matter the risk," Obama said. "If we can get that balance right . . . there are businesses and communities out there that are ready to grow again."

Prof. Charles Goodhart is seeing a similar story in Britain.

Prof. Charles Goodhart is seeing a similar story in Britain."What has happened to all the monetarists? Growth in money holdings and lending has plummeted. Thirty, or 40, years ago they would have been forewarning doom and destruction at this juncture, and casting anathemas at the authorities," he wrote in a consultant report for Morgan Stanley.

"There is a danger that markets and authorities become obsessed about the fiscal implications of the crisis at a time when the real worries should still focus on private sector access to credit and money."

Did anyone ask Bernanke about this in confirmation hearings earlier in the month? No, and the closest answer we got in written responses was that to Brad DeLong's 3% inflation target question, which Scott Sumner excoriated.

The risk is that we don't know where the Fed is heading next between this and the . Nariman Behravesh of Global Insight is nervous:

Would tightening credit in Q1 or Q2 be an example of "botched" monetary policy? (Thanks to Gary for the last link.)"Any number of risk could knock us back down into recession," ... These risks include botched monetary policy by the Fed, a major retrenchment of consumer spending in the face of rising unemployment, and another chapter to the financial crisis.

Behravesh isn't saying it's the most likely scenario; but at 20% the probability is "too high" for his liking.

Labels: economics, Federal Reserve

Another reason to not tax Minnesotans: A congressional seat

Minnesota would just barely miss keeping its eight Congressional seats, based on an analysis of new state population estimates from the U.S. Census Bureau.I hope we don't have to depend on California continuing its slow slide to oblivion in order for us to keep eight seats, but that might be what it comes down to.

The Congressional reapportionment forecast by State Demographer Tom Gillaspy projects Missouri would receive the last seat apportioned, with Minnesota just missing by about 1,100 people � a difference of less than one month�s population change for Minnesota. The difference between California, Texas, Missouri and Minnesota for the last three seats is about 2,200 people, which is well within the potential estimating error.

�Basically, this is a dead heat,� said Gillaspy. �Remember, these are just estimates by the Census Bureau, and our chances of retaining eight seats are improving every day. What will decide the issue is getting everyone in Minnesota counted in the 2010 Census.� Every household in the state will receive the 10-question Census form in mid-March 2010, which should then be returned to the Census Bureau by April 1.

North and South Dakota each grew faster than Minnesota. In 2008 there were almost the same number of moving vans coming here as leaving, according to United Van Lines. I've got some students needing senior projects this spring; maybe to help settle the old discussion Charlie Quimby and I have had on this issue we should get one to play with the data. (Or maybe with the IRS data. I've wanted to have someone do this for awhile. Off to check references on Google Scholar. So far I find [1], [2], [3]. [4] papers worth reading; not all appear to go in the same direction regarding the outcome. This note is a placeholder for that lucky student.)

Labels: DFL legislature, Minnesota, taxes

Wednesday, December 23, 2009

Media alerts

Holidays usually mean my substitute radio work goes up, and indeed I'll be filling in for Don Lyons on the Morning Show on KNSI next week, 6-8am Monday through Wednesday. (St. Cloud mayor Dave Kleis is taking both Christmas and New Year's Eves.) Wake up with me if you live nearby, or stream it.

Labels: Media

Game theory and ping-pong

There's been a lot of moralizing about the holdout strategies of Lieberman and Nelson, but under some game-theoretic accounts it is a blessing in disguise, a blessing for Obama at least. For instance Rahm Emanuel can now say to the House: "look, we just can't renegotiate this any more or the coalition will fall apart. You'd better get on board with the Senate version of the bill" A lot of these legislative games don't otherwise have a core, or it takes so long to find the core that the deal falls apart in the meantime.

The holdout behavior of one decisive Senator decreases the need to cut bargains with other members of Congress. The key words here are "credible precommitment to no further renegotiation." The more anxious or wavering Nelson and Lieberman were/are, the more credible this precommitment.

Tyler Cowen. No offense to my friends who are waging the battle against the bill by holding out for conference committee, but my best bet is that it never gets there. Keith Hennessey wrote last week: "When one legislative body credibly says 'We cannot pass anything but X,' and the other says 'We don�t want to pass anything but Y,' X wins." John Fund concurs:

When Democrats took over Congress in 2007, they increasingly did not send bills through the regular conference process. "We have to defer to the bigger picture," explained Rep. Henry Waxman of California. So the children's health insurance bill passed by the House that year was largely dumped in favor of the Senate's version. House Ways and Means Chairman Charles Rangel and other Democrats complained the House had been "cut off at the knees" but ultimately supported the bill. Legislation on lobbying reform and the 2007 energy bill were handled the same way -- without appointing an actual conference.So even if they can't get 218 on this version of the Senate bill, they may just circumvent conference and send something back to the Senate to which Reid and Pelosi have already agreed.

Rather than appoint members to a public conference committee, those measures were "ping-ponged" -- i.e. changes to reconcile the two versions were transmitted by messenger between the two houses as the final product was crafted behind closed doors solely by the leadership.

Labels: economics, health care

In my mailbox

Money is college sports is nothing new. But readers will be amazed at the alarming depth and breadth of influence, both financial and otherwise, that college sports has within our culture. Readers will learn how academic institutions capitalize on the success of their athletic programs, and what role sports-based revenues play across campus, from the training room to the science lab. Yost pays particular attention to the climate that big-money athletics has created over the past decade, as both the NCAA's March Madness and the Bowl Championship Series have become multi-billion dollar businesses. This analysis goes well beyond campus, showing how the corrupting influences that drive college athletics today have affected every aspect of youth sports, and have seeped into our communities in ways that we would not otherwise suspect. This book is not only for the players, policymakers, and other insiders who are affected by the changing economics of college athletics; it is a must-read for any sports fan who engages with the NCAA and deserves to see the business behind the game.

A bit of Davy Crockett

While in the legislature, there was a bill before it for the creation of a county. The author of if wished to run the boundary line, so as to support his popularity ; to this the colonel was opposed, because his interest was affected by it. They were hammering at it for some time ; whatever the author of the bill would affect by speaking, the colonel would undo by logrolling; until the matter was drawing to a close, when he rose and made the following speech:Any parallels between this story and the Senate health care bill are coincidental. Or not. Anyway, seemed worthy of its own post.

"Mr. Speaker, � Do you know what that man's bill reminds me of? Well, I 'spose you don't, so I'll tell you. Well, Mr. Speaker, when I first come to this country, a blacksmith was a rare thing; but there happened to be one in my neighbourhood : he had no striker, and whenever one of the neighbours wanted any work done, he had to go over and strike till his work was finished. These were hard times, Mr. Speaker, but we had to do the best we could. It happened that one of my neighbours wanted an axe, so he took along with him a piece of iron, and went over to the blacksmith's to strike till his axe was done. The iron was heated, and my neighbour fell to work, and was striking there nearly all day ; when the blacksmith concluded the iron wouldn't make any axe, but 'twould make a fine mattock ; so my neighbour wanting a mattock, concluded he would go over and strike till his mattock was done ; accordingly, he went over the next day, and worked faithfully ; but towards night the blacksmith concluded his iron wouldn't make a mattock, but 'twould make a fine ploughshare ; so my neighbour wanting a ploughshare, agreed that he would go over the next day and strike till that was done ; accordingly, he again went over, and fell hard to work ; but towards night the blacksmith concluded his iron wouldn't make a ploughshare, but 'twould make a fine show ; so my neighbour, tired working, cried, a show let it be � and the blacksmith holding up the red hot iron, threw it into a trough of water near him, and as it fell in, it sung out show. And this, Mr. Speaker, will be the way with that man's bill for a county ; he'll keep you all here doing nothing, and finally his bill will turn out a show, now mind if it don't."

Labels: health care, politics

I'm shocked, shocked there's vote-trading in Casablanca

I guess I had thought it was pretty well known that legislators trade votes and seek favors. Rentseeking has been around for centuries. Ever since James Madison wrote of factions in Federalist #10, we have known that we cannot remove the causes of special interests without removing liberty itself, so we have to control its effects.

Madison wrote, "When a majority is included in a faction, the form of popular government, on the other hand, enables it to sacrifice to its ruling passion or interest both the public good and the rights of other citizens." This is the situation in which we find ourselves today. The majority in the Senate prefers to gain control of the health industry, as it would any other if it found a pretense. This is the tyranny of the majority. So why did Madison think this would be nevertheless a good form of government? This is why he preferred a republic to a democracy, because a republic could better infuse the minority position into the legislative process:

In the next place, as each representative will be chosen by a greater number of citizens in the large than in the small republic, it will be more difficult for unworthy candidates to practice with success the vicious arts by which elections are too often carried; and the suffrages of the people being more free, will be more likely to centre in men who possess the most attractive merit and the most diffusive and established characters.It must be confessed that in this, as in most other cases, there is a mean, on both sides of which inconveniences will be found to lie. By enlarging too much the number of electors, you render the representatives too little acquainted with all their local circumstances and lesser interests; as by reducing it too much, you render him unduly attached to these, and too little fit to comprehend and pursue great and national objects. The federal Constitution forms a happy combination in this respect; the great and aggregate interests being referred to the national, the local and particular to the State legislatures.

That last bit, "State legislatures", of course refers to the fact that Senators at that time were to be appointed by the state legislatures and not by popular, direct election. It seems highly unlikely that, if they were so elected today, that Sen. Ben Nelson would have an opportunity to be vote #60. But that's not how we pick them today, even though I believe it means senators do not have enough "acquaintance with all their local circumstances." A couple of paragraphs later,

It will not be denied that the representation of the Union will be most likely to possess these requisite endowments. Does it consist in the greater security afforded by a greater variety of parties, against the event of any one party being able to outnumber and oppress the rest? In an equal degree does the increased variety of parties comprised within the Union, increase this security. Does it, in fine, consist in the greater obstacles opposed to the concert and accomplishment of the secret wishes of an unjust and interested majority? Here, again, the extent of the Union gives it the most palpable advantage.Madison clearly understood the ability of legislative leaders to vote-trade, as Harry Reid and Ben Nelson and the rest of the Democrats have now done. I don't think we should be surprised by it. Colbert King tells us to simply get over it: "My friends, dry your eyes, suck it up, and get on with it." And truly, Mr. King is right that the temptation to trade votes and to place pork in legislation is a temptation to which their has been bipartisan surrender and failure. This shock that Sen. Nelson has engaged in vote trading is a bit disingenuous. Challenge the constitutionality of the language of Nelson's bribe, or that of the binding of future Senates not to change the actions of the Independent Medicare Advisory Board. And sure you can point out who got which thirty pieces of silver. But let's not pretend this doesn't happen. It is the nature of government to logroll and always has been. (More on this in the preceding post.) James Joyner concurs:

This doesn�t mean we shouldn�t shine a light on these abuses. By all means, we should. But let�s not pretend that they�re a recent invention.But it would be a good outcome if his most brazen legislative language -- how often do we explicitly name the state who gets the goodies? how often do we get a Senate Majority Leader so unashamed that he accuses those who don't get pork as having failed? at least Dodd had enough shame to drag a stick behind his tracks as he snuck off with $100 million for U Con -- reminded our populace of how voting out one set of pork-consumers doesn't mean you get clean government. Sometimes you get hungrier pork-consumers.

Boettke and Rogers, in a wonderful (and wonderfully thin) volume The Beginners Guide to Liberty (whole thing at that link), remind us of a story:

There is an old tale that many economists use to set up the discussion of how well the market works in comparison to government policy. A Roman Emperor is asked to judge a contest between two singers. After hearing the first contestant sing, the Emperor awards the prize to the second singer under the assumption that surely the second cannot be worse than the first.The point of the story is that even when markets fail -- and the authors acknowledge that they do -- governments can fail too. When government failed in the second Bush Administration, people chose a different government. Perhaps next time they'll realize that when markets fail, the answer is to use markets to solve the failure.

Labels: health care, legislature, Obama, politics

Tuesday, December 22, 2009

Turn this plane around!

The federal government will impose stiff penalties starting this spring on airlines that keep passengers waiting too long on the tarmac without feeding them or letting them off the plane � a remedy that will relieve many travelers but mean longer delays for a few.The right granted for disembarkment to passenger 1 is to make the time until takeoff longer for passenger 2 who decides to stay on the plane. Turning the plane around involves not only going back to the gate (if such gate is still empty; there's the possibility of fewer flights in order to have disembarkment points) and then, in the winter in northern parts of the US, a second de-icing of the plane. Air traffic controllers can only waive the rule, the DOT's press release says, if "for safety or security or if air traffic control advises the pilot in command that returning to the terminal would disrupt airport operations." I have no idea how big a carve-out that is. The law also applies to international flights....Under the rule, airlines that do not provide food and water after two hours or a chance to disembark after three hours will face penalties of $27,500 a passenger, the secretary of transportation announced on Monday.

In recent years, relatively few flights have been held on the ground for more than three hours � about 1,500 a year, or roughly one out of 6,200 flights � but that has been enough to affect more than 100,000 passengers a year and to create substantial public resentment.

�This is President Obama�s Passenger Bill of Rights,� said the secretary, Ray LaHood, using the term favored by proponents of like-minded legislation that is before Congress. The administration�s action does not require Congressional approval.

The cost-benefit analysis of this is online; it says ExpressJet, the proposed new carrier to St. Cloud, would bear costs of $1.6 million per year for compliance. (It's the largest carrier of the smaller jet companies with planes in the 30-60 passenger class, the perpetrator of the Rochester overnight delay last August, and largest of the bunch.) Overall the cost of this program will be $100 million to the airlines

The government's delivery of these rights usurps a proper judicial function of torts. Most delays are the function of weather and air-traffic control, both beyond airline control. 7000 passengers were able to settle for $7.1 million over that Detroit fiasco that Northwest botched after snow clogged runways in 1999. That comes out to about $1000 per person. Will we have too much protection against unpredictable weather in the future to avoid penalties 27 times that much? Will it lead to cancellation of flights? The cost-benefit analysis guesses 2.5% of flights get canceled based on a single study that said if an airport gets closed for one hour for security reasons you get a 5.9% increase in cancellations. (See p. 104.) I find that figure for example a SWAG. There are many more.

Labels: cost-benefit analysis, economics

Sentence of the day

The radical uncertainty of how to please consumers is an argument FOR free markets.William Easterly. The graphic he copies over from the Wall Street Journal will be in my introductory economics course this spring, and a mark of success in teaching the course will be getting them to appreciate that sentence, even if they disagree with the argument.

Labels: economics

A larger than expected revision

The "third" estimate of the third-quarter increase in real GDP is 0.6 percentage point, or $17.3 billion, lower than the second estimate issued last month, primarily reflecting downward revisions to nonresidential fixed investment, to private inventory investment, and to personal consumption expenditures.The way many forecasters will read these results is that the inventory correction that is expected to crank up Q4 GDP will now be larger. That is, a smaller Q3 number will imply a higher Q4 number. Real final sales in Q3 were up 1.5%, but GDP excluding output of motor vehicles rose only 0.8% after declining 0.9% in Q2.

I am quite eagerly awaiting the November data on income and outlays, due out tomorrow morning. Personal savings is now tracking in a pattern of 4.5-5% of GDP, well above levels earlier in the decade, as families continue to rebuild their portfolios. GDP growth is likely to be slow in 2010 if this number gets and stays above 5%.

Best news in the report: inflation as measured by the deflator for personal consumption expenditures was revised downward.

The news in Minnesota is not much better. Private sector employment in the state is still down 3.4% in the 12 months to November, and the latest Federal Reserve Bank of Minneapolis forecast is for another 0.4% decrease in employment in 2010. They expect the unemployment rate in the state to remain stuck at about 8%. In one bit of good news, the Philadelphia Fed's state coincident indicators series shows Minnesota with a green color, with a bit of expansion off an August low. I wouldn't get carried away about this just yet, but it beats being red for as long as we have. Look for more in our latest Quarterly Business Report, which will be out on Monday next week.

Monday, December 21, 2009

Giving is social

My hypothesis is that everyone wants to be part of a success. Announcing that it already is and then completing the project allows others to purchase (via donation) the good feeling of being part of it. "Yes, wasn't that project great? I'm glad I gave to it." You can imagine the conversations over coffee in the church narthex. My friend wondered why the leadership didn't set a higher target, and if they should. I responded no, you should underpromise and overdeliver. I think you can overdo that, as biasing one's expectations downwards leads over time to people expecting overdelivery.

We know from economic experiments that social influence on charitable giving is an important factor. I also noted that his church collected donations by placing jars in front of the sanctuary and having people bring the money forward. Nobody wants to be seen not standing up, particularly when the pastor has just told you everyone else gave more than expected. The combination of the method of collection and signaling others' donations were good incentives to get others to also give.

These days

I know we�re all busy these days..

By the way, have you ever wondered what �these days� are? Were there ever any other �days� when people just sat around with nothing to do? Are we all busy �these days�? Sure, but no one in pioneer days had leisure time. Peasants in Czarist Russia didn�t twiddle their thumbs a lot. And for most of human history, every single human, from the second he woke up to the second he went to sleep in the cave, did nothing � NOTHING � but look for food. Every second of every day, look for food, look for food, look for food. Where�s Bob? Where do you think? Looking for food

--------------

This is the economic history of humanity in a nutshell: From 2 million or 200,000 or 20,000 or 2,000 years ago until the 18th Century there was slow growth in population, almost no increase in health or decrease in mortality, slow growth in the availability of natural resources (but not increased scarcity), increase in wealth for a few, and mixed effects on the environment. Since then there has been rapid growth in population due to spectacular decreases in the death rate, rapid growth in resources, widespread increases in wealth, and an unprecedently clean and beautiful living environment in many parts of the world along with a degraded environment in the poor and socialist parts of the world.

Labels: economics

Sunday, December 20, 2009

Children of Deployed Soldiers

1 - Too many of these kids have teachers who are against the war - their anti-war mantra has to affect these kids. Instead of putting down the USA, the military, and related groups, these teachers should be thanking these kids, their families and their military parents for the sacrifices, bravery and heroism displayed by the vast majority of our military, the real protectors of freedom.

2 - Perhaps if the mainstream media, Hollywood and so much of the rest of the "entertainment" industry covered and were supportive of the heroic efforts our soldiers show, these kids would have better scores.

Remember, there are over 200 of us, non-soldiers, enjoying our lattes, free education, shopping, freedom of choice because we have a couple of million people willing to serve our nation part time or full time. These people are the real heroes - and their kids deserve all the support we can give them.

Labels: Freedom, US Soldiers

Friday, December 18, 2009

By very small steps

Pick up the Senate health-care bill�yes, all 2,074 pages�and leaf through it. Almost half of it is devoted to programs that would test various ways to curb costs and increase quality. The bill is a hodgepodge. And it should be.Atul Gawande in the New Yorker this week. Hat tip to James Kwak, who adds the sentence of the day:

So the only political option is incremental reform through small programs that experiment with different ways to change the incentives of private-sector actors at the margin.Yes, a thousand times yes, and it will cost you much, much less than the Senate health-care bill. Why can't they just pass all the experimental programs and leave the crushing taxes behind?

Labels: economics, health care

Thursday, December 17, 2009

A graph that explains and needs explaining

Finally, it is of interest to note that a discussion of the prospects for US economic growth, and consumption behavior, cannot be realistically appraised using the standard Keynesian consumption function. Rather, some discussion of how consumption depends on both current disposable income and net household wealth is essential.Menzie Chinn this morning. I think I have done this in past lectures in my own graduate macro course, but perhaps not so much in intermediate undergraduate macro. Chinn is absolutely correct on how we will need to adjust macro textbooks regarding consumption, but it's the first opportunity to see a noticeable wealth effect. This ties well to a look at household balance sheets by James Kwak which I've used often in presentations. I'll be adding Chinn's graph to that mix, thank you sir!

(I can hear some of you asking "but did you ever use Keynesian consumption functions?" "Use" is too strong a word. But show and explain them, with critical appraisal of strengths and weaknesses? Certainly. They are still the language of many large-scale macroeconometric models. Hard to find a forecasting model for U.S. consumption that doesn't have some variant of disposable personal income in it.)

Labels: economics

What would Wellstone do?

Democratic Sen. Al Franken took the unusual step Thursday of shutting down Sen. Joe Lieberman on the Senate floor.One thing Wellstone would do is not rely on his spokeswoman to explain everything from how he votes to what he eats. But I think there's more:

Lieberman, a Connecticut independent, currently is the target of liberal wrath over his opposition to a government-run insurance plan in the health care bill.

Franken was presiding over the Senate Thursday afternoon as Lieberman spoke about amendments he planned to offer to the bill. Lieberman asked for an additional moment to finish � a routine request � but Franken refused to grant the time.

"In my capacity as the senator from Minnesota, I object," Franken said.

"Really?" said Lieberman. "OK."

Lieberman then said he'd submit the rest of his statement in writing. ...

Franken's spokeswoman, Jess McIntosh, said that the Minnesota senator wouldn't allow Lieberman to continue because time limits were being enforced by Senate leaders rushing to finish a defense spending bill and get to the health bill.

In a world that has become so divisive and so partisan, so angry, whether in this Chamber or in the House Chamber, Senator Wellstone reflected in the passion for his belief that politics was not a death sport, it was something which you could agree to disagree and still shake a hand and ask: How are you doing? And move on. -- Sen. Norm Coleman, 10/25/07If you were sworn in on the man's Bible, you may want to pay attention to things like that, Senator.

UPDATE:

None dare call it... statefare

That's right. TARP legislation said that the money was to be paid back:By a vote of 217 to 212, the House approved additional spending for "shovel-ready" construction projects and money to avoid layoffs of teachers, police and other public employees. No Republicans voted for the bill, and 38 Democrats voted against it.

The Senate is expected to consider the measure early next year.

Leftover money from the government's $700 billion bank-bailout fund would cover $75 billion of the bill's price tag.

TRANSFER TO TREASURY.�Revenues of, and proceeds from the sale of troubled assets purchased under this Act, or from the sale, exercise, or surrender of warrants or senior debt instruments acquired under section 113 shall be paid into the general fund. (Sec. 106(d))If you read Sec. 120, though, they gave the Secretary of the Treasury an out:

SEC. 120. TERMINATION OF AUTHORITY.And on the 9th of this month Secretary Geithner took advantage of this authority:

(a) TERMINATION.�The authorities provided under sections 101(a), excluding section 101(a)(3), and 102 shall terminate on December 31, 2009.

(b) EXTENSION UPON CERTIFICATION.�The Secretary, upon submission of a written certification to Congress, may extend the authority provided under this Act to expire not later than 2 years from the date of enactment of this Act. Such certification shall include a justification of why the extension is necessary to assist American families and stabilize financial markets, as well as the expected cost to the taxpayers for such an extension.

In order to accomplish these goals, pursuant to Section 120(b) of EESA, I certify that I am hereby extending the authority provided under the Act to October 3, 2010. This extension is necessary to assist American families and stabilize financial markets because it will, among other things, enable us to continue to implement programs that address housing markets and the needs of small businesses, and to maintain the capacity to respond to unforeseen threats, as described above.Now read that last part carefully. It says he's extending it for limited purposes of extending the mortgage modification program (which is a mess) and to encourage some more lending to small businesses, the ostensible reason President Obama invited fat-cat bankers to the White House on Monday. There is no provision for extending TARP for a jobs bill. It is quite simply fresh government spending, another stimulus package meant to cover up the fact that the money states took in last year was simply a one-year patch that was not followed by enough job growth to keep those people in jobs. From the Reuters report:

Italics added. Get that? We are using the TARP money for this spending, but we are not using it for the purposes that Geithner said he would keep TARP open, even when the Administration asks for it. Two months of the unemployment benefits are being attached to a must-pass defense bill in an act that stretches the word "germane" beyond any recognition.The bill would provide $48.3 billion for infrastructure projects that promise to get workers back on job sites by April. Highway construction projects would get $27.5 billion, while subway, bus and other transit systems would get $8.4 billion.

...The bill would also help cash-strapped state and local governments avoid layoffs of public employees.

States would get $23 billion to pay 250,000 teacher salaries and repair school buildings, and $1.2 billion to pay for 5,500 police officers.

States would also get $23.5 billion to help pay their share of federal healthcare programs for the poor.

The bill does not include two approaches backed by the White House: increased lending for small business, and funds to make buildings more energy-efficient, but Democrats say they plan to take up additional job-creating measures next year.

The bill also extends unemployment benefits and healthcare subsidies for the jobless for another six months, at a combined cost of $53.3 billion.

We need a new word for pork that goes mostly to state and school district budgets: statefare. Goodness knows they're desperate for the cash. Will there be any Republican governors this time who say no?

Wednesday, December 16, 2009

Apple Valley Job (aka tax) Summit

He told me about Medtronic's founder, Earl Bakken. His is a classic story, �What is the problem? Here is a solution." The first battery powered pacemaker was developed by Bakken as a huge improvement to the then existing devices that required a wire connection to an electrical source. Today there are over 1, 000,000 pacemakers implanted per year, and additional millions in use. This is the good news. The sad news is that today, it quite possible the device never would have been invented. Why? Government regulations. Now it can take up to five years to get approval to test a new medical device, and more to get a device to humans who can use them. Because of far too much bureaucratic intervention, many life-saving device ideas never see the light of day.

Connection with Apple Valley: The attitude that government can solve everything was alive and well with the legislators attending the AV summit who were DFLers and one lone Republican, Representative Tara Mack (who does not have a government can do all belief). Their talks were short but also worrisome. While MN does face problems including these:

1� Banks leery of lending money for two reasons: First, some government agency will come and second guess them; second, if you can get money at 0% from the federal government and earn a safe 2-3% in an investment, why take the risk on someone for a possible 6% return? Solution � the government needs to let the markets determine the interest rates, that is the value of money.

2 � Employers cutting back on hours worked in order to save jobs. Actually, this is commendable because it gives people an income versus letting them go.

3 � An erroneous attitude that in two years, the economy would rebound and all would be fine. In fact, that is one of the reasons the DFL wants to push through a $1,000,000,000 bonding bill this year. It looks nice but this is just more debt MN will have to retire. But oh, it goes for roads, zoos, etc.

Does the government have to intervene to solve everything including jobs?

As I listened to the politicians, I learned that MN has established a lot of government agencies trying to �help� business through programs, training, etc. While all this may sound good, it costs the taxpayers money to fund "middle man" government bureaucracy. I would think a business enterprise could provide the same service. What also was bothersome, some DFLers mentioned they wanted to "work with our partners at the federal level" to solve the job problem.

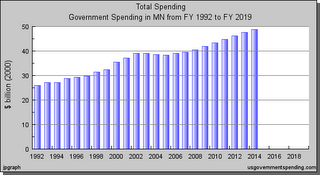

I distributed a chart with data that shows the 5+x rate of spending in MN versus population since 1960. Immediately, I was challenged on specific blips on the chart, etc. My response, �Even if the chart is off 100%, the approximate 45 degree trajectory is simply unsustainable. The easiest solution is to get government out of the way of business. Then the creativity, the risk takers, the Earl Bakkens, etc. can get moving on the job creation.�

My ultimate suggestion was this: �In the upcoming legislative session, make a commitment to cut business taxes and regulations by 20%. If you want jobs to come and stay in MN, this is the fastest way to get them. If government believes companies that left will come back, wake up, they won�t. They are gone. Now we need to protect the jobs still here.

Some regulation is necessary but the mindset to "protect everyone from everything" and

"government must interject itself to solve all problems" will not work. We need to remove the lousy middle man in job creation, the government.

Addition: Today's Star Tribune tells the story of a former Olympic swimmer who has a pacemaker. Would she even be alive without this invention? Who else will be denied a life-saving device because of "middle man" government's eagerness to "help" (aka get in the way)?

Labels: DFL legislature, Freedom, leftism, regulation

Can you get me a CD of Armenian death metal?

...go into a record shop and look at the dividers used to separate music into different categories. There used to be about a dozen: rock, jazz, ethnic, and so on. Now there are almost as many dividers as there are records, and they keep proliferating. The category I had a hand in starting�ambient music�has split into a host of subcategories called things like �black ambient,� �ambient dub,� �ambient industrial,� �organic ambient� and 20 others last time I looked. A similar bifurcation has been happening in every other living musical genre (except for �classical� which remains, so far, simply �classical�), and it�s going on in painting, sculpture, cinema and dance.Glad they still call them 'record shops', but honestly I don't go to them much any more (sad about this since I still like the people at Electric Fetus and miss their selections sometimes.) I did back then, and the joy of finding Here Come the Warm Jets filed right behind Emerson Lake and Palmer is now replaced by Genius lists on iTunes and a podcast of Irish rock I discovered after watching the movie Once. (If you've not used this movie for a night with your one true love, you have an opportunity knocking.)

...As people become increasingly comfortable with drawing their culture from a rich range of sources�cherry-picking whatever makes sense to them�it becomes more natural to do the same thing with their social, political and other cultural ideas.

When I asked Littlest who she's listening to the other night, she gives me a name I never heard of and calls it a "screamo band". What's screamo, I ask? Is it like emo? "Oh Dad, nothing like that." And the arguments over who gets the label are hilarious (I did a Google search for bands that are screamo, and the discussion is entertaining.) So we can expect more and more labels. #1 Son, when consulted, simply said "You've listened to Slayer -- she'd probably like that." He was wrong. My guess is, we'll simply divide the market further.

This goes further and further. Mrs. S asked this morning about personalized trains. Now I remember personal train cars from The Wild Wild West and the Atlas Shrugged, but a whole personal train? I said, this is why we have cars. Panera, not a coffee shop, still manages to have four flavors of coffee (light, dark, flavored, decaf), and we kvetch when the one we want isn't there. But what Eno is describing is that music that we missed out on because Rhino or the Fetus didn't have it -- and you thought they had everything! -- is now ubiquitous. I want to try out for a musical, I want to hear the soundtrack. But not just any soundtrack -- I want the one where so-and-so sang that part. Ten minutes later it's on my iPod, and in 15 I'm humming along and trying to learn the words. And it pretty much doesn't matter which musical I'm describing. I want some Armenian death metal? If I don't know any and there isn't a category, I start with someone nearby like System of a Down and seek similar bands via Pandora. Within an hour, I'd find something close. (note: I do not like metal. Just an example. But I did discover Visa the other night using SoaD, Gogol Bordello and some Armenian folk rock. I'm already addicted.)

Need to grade. I'll have some Bernanke thoughts this evening, please stand by.

Are they fluffing up the cap & trade jobs data?

President Barack Obama's clean-energy initiatives will help create more than 700,000 jobs and allow the U.S. to double its renewable-power generation in three years, according to a report by Vice President Joe Biden," Bloomberg reports. Wow, that's a lot of jobs.I checked; it's there. It's not 700,000 jobs, it's 700,000 job-years. Now the median job in America lasts about five years, according to the Employee Benefits Research Institute. So the number of actual jobs created may be inflated by a factor of five. 140,000 jobs would be about 0.1% of the workforce.Or is it? Take a look at footnote 3 on page 2 of the Biden memo:

All of the job estimates used in this document correspond to jobs that last for one year. Of course, some jobs could last longer--in this case the number of distinct jobs would be reduced proportionately. For example, a project that employs one person for two years would count as creating two jobs.

The jobs in here include some rather pie-in-the-sky stuff like three electric vehicle and advanced battery factories, as well as the more mundane (and useful) construction of nuclear power plants. There are plenty of projects in here that will make some areas (and their representatives) happy as it is. So why fluff the number of jobs? Following the funny accounting of Porkulus, this seems a pretty odd thing for the White House to do.

Labels: economics

Tuesday, December 15, 2009

Best sentence I read today

Instead, if you think in terms of "how can we optimally regulate so that banks have only incentives to do great things and no incentives to take excess risk," you are on the wrong track.From Arnold Kling, who argues that if you cannot imagine a world without deposit insurance -- and he doesn't -- then you have to have a world without big banks. Our experience with private deposit insurance so far has been miserable, as the fate of state deposit insurance funds in the S&L crisis made clear. Nobody has deep enough pockets. If banks can constantly game the system once they hit a certain size, perhaps you just can't let them be that size.

Simon Johnson seems to think you can just cut out all the bad things banks can do and make them just do the unrisky stuff. But didn't we try that with Glass-Steagall? How do we really think we can put the genie back in that bottle?

Wish I had time to think more about this, but grading continues for hopefully only another 24 hours. More when I can. In the meantime, please read back on "the regulatory dialectic".

P.S. I was going to give this to Alex Tabarrok's post on setting a carbon tax that varies by temperature when I started writing it this morning. Worth your time.

Are they inconsistent?

I don't really follow why wanting access to care necessarily leads to favoring individual mandates, but the rest of it is rather consistent with the view that people don't get economics well. H/T: Bryan Caplan, whose writings have helped me come to decide this should be a cause we support, and who calls normal voters both economically illiterate and childish. If I can fix the former, I think the latter cares to itself.My reading of the replies leads to the following conclusion: Despite all the media coverage (or maybe because of it), most of the public has a very limited understanding of the health care system and health policy. They think the insurance companies are the main problem. They think an employer mandate is a good idea because employers pay for care. They want to control cost, but oppose every policy that might do that except for thinking that drug company and insurance company profits are too high. They say they want everyone to have access to care but only one in four favors an individual mandate.

Why is the public�s understanding so limited?

Caplan also notes a poll question, "If the government makes these changes to health insurance [i.e., extending coverage], would that probably cause you to pay more, less, or the same amount for your own health care?"

- Pay a lot more - 29%

- Pay a little more - 20%

- Not change the amount - 32%

- Pay a little less - 7%

- Pay a lot less - 5%

Should voters care about other people's costs rather than their own? And how would improving people's understanding of health care policy improve public attitudes? Is it the job of economic education to soften these people up for a greater public role in health care?

Labels: economics, health care

Monday, December 14, 2009

Step aside, Greece and Dubai

Austria has nationalised the Carinthian lender Hypo Group after it ran into trouble on hidden losses in Eastern Europe, offering a stark reminder that Europe's banks are not yet out of the woods.This is a big deal. Hypo was owned by a Bavarian state bank, which now has to tighten its credit, harming Germany. And it shows that the ECB is much more heavily involved in regulation of individual banks at a time when it is reassessing how involved in supervision it wants to be.

Finance minister Josef Pr�ll said the government had been forced by fast-moving events to take a 100pc stake in the bank, Austria's sixth biggest lender with assets of �42bn (�38bn).

"The risk situation of this bank has created an enormous threat to Austria, to its future as a financial centre, and to the whole economic region in recent days and weeks," he said, speaking after a 14-hour emergency session overnight on Sunday.

Chancellor Werner Faymann sought to calm the fury of Austrian citizens and opposition leaders, saying there would have been "catastrophic consequences" if the bank had been allowed to fail.

Austria's press said that Mr Faymann was under intense pressure from Jean-Claude Trichet, the head of the European Central Bank, who feared a "domino-effect" that would undermine other banks and damage Austria's sovereign rating.

Probably the biggest concern of this, however, is that the problems of eastern Europe are not just coming from Greece. The Baltics are in dire straits, and tail risk is rising elsewhere. The ECB's actions perhaps support this Bloomberg report from last week that ECB fears the Baltics getting pulled in by another wave of credit tightening. Don't know -- that connection is a little vague even to me, but taken with Greece and Dubai suggests something bigger might be happening.

UPDATE: Ruh-roh. Mexico downgraded.

Labels: economics

Another oddity from Obama last night

President Obama, already at odds with bankers over big bonuses and new regulations, plans to urge executives at a White House meeting today to provide more loans to small-business owners.Remind me again how he voted on TARP? Oh yes. He was for it before he was, um, for it.

Top White House economic adviser Lawrence Summers said Sunday that Obama will remind the bankers of the taxpayer help they received during last year's financial crisis.

"We were there for them," Summers said on ABCsThis Week With George Stephanopoulos. "And the banks need to do everything they can to be sure they're there for customers across this country."

During a taped interview broadcast Sunday night on CBS' 60 Minutes, Obama blasted banking executives for opposing tighter regulations on Wall Street and for awarding themselves multimillion-dollar bonuses after they had repaid federal bailout money.

"I did not run for office to be helping out a bunch of, you know, fat-cat bankers on Wall Street," Obama said.

Anyway, the thesis of Mr. Summers' statement is that customers are there waiting to borrow money from banks and the banks are being stingy. The National Federation of Independent Businesses -- representing the people who would be standing in line in Mr. Summers' story -- say they're not:

�Twenty-four months of recession have sapped the financial strength of many small firms,� said [NFIB chief economist William] Dunkelberg. �Historically weak plans to make capital expenditures, to add to inventory and expand operations also make it clear that many potentially good borrowers are simply on the sidelines. They are waiting for a reason to make capital outlays and order inventory and to take out the usual loans used to support these activities.�That is, there's no demand for loans because small businesses are not adding capital or inventory. It may be harder to find a loan, but most business owners aren't asking for them anyway, and not because of anything fat cat bankers are doing.

Twenty-nine percent reported all their borrowing needs met (unchanged) compared to 10 percent who reported problems obtaining desired financing (up one point, not seasonally adjusted).

Commercial capital lenders are reporting stabilizing demand for loans, according to industry risk management firm PayNet. This is another sign that credit supply might not be the problem the administration wants you to believe it is.

Ed Morrissey writes that the bankers have every good reason to be cautious in lending.

Labels: economics

Administration views on recession dating

MR. GREGORY: When do you expect you will be able to say the recession is over?Prychitko thinks the administration will declare victory long before then. CBO projected in August the unemployment rate to by 9.1% in 2011 and to average 6.4% between 2012 and 2013. 5% is in the area of CBO's estimate of the natural rate of unemployment. What that would seem to mean is that she won't declare the recession over until we are near the peak of the expansion.

DR. ROMER: Well, I'm not going to say the recession is over until the unemployment rate is down to normal levels, until...

MR. GREGORY: Which would be?

DR. ROMER: You know, again--are you asking me, you know, timing?

MR. GREGORY: No, what's a normal level?

DR. ROMER: Well, the normal, you know, where we were before the recession is sort of in the--certainly in the 5 percent range. That is, you know, what Americans are, are used to.

MR. GREGORY: Can that be accomplished in a year's time?

DR. ROMER: Well, it--we'd have--I think we're going to--it's going to take--you know, this recession took a long time coming, it's going to take a long time coming out. We can make incredible progress. We can get that unemployment rate coming down.

President Obama on 60 Minutes last night had a lot more to say.

Here's what I know. That when I walked in to office, we had gone through a debilitating financial crisis. The banking system was close to meltdown. And in that first quarter, we lost over 3 million jobs. In December, we lost 681,000 jobs. That's before I was sworn in. January, 700,000 jobs. That was just about as I was being sworn in. The following month, before we had put any of our programs in place, we had lost another 681,000 jobs, and it just kept on going.I can forgive the addition error on 3 million jobs lost in the first quarter -- it's more like 2 million -- but he's still trying to parcel out blame to others. He does it a minute later:

Now, what we had to do was he had to make sure that there was some buoy, some stabilizer in the economy so that it didn't go into a Great Depression. And that's why we passed the Recovery Act. And for all the criticism that it received from the other side --and we got no help from any Republicans, other than a couple, in passing it -- what we now know and every economist who's looked at it will acknowledge this, is that it helped us [stem] the panic and get the economy growing again. And it probably saved somewhere between a million and a million and a half jobs.I really liked what Russ Roberts said about this last week:

In biology, a biologist doesn't pretend to know how many frogs there are at a particular point in time in the rain forest. He may have an estimate but if you ask him well "how many will there be in six months?", he can't give an honest answer about that. He can't even give you an honest answer and he won't pretend to give you an honest answer if you ask him well "what will happen in six months if something changes in the rain forest to the frog population?" That's what we expect of economists and that's wrong. We're not good at that.Not that we don't do it -- we do, and I have. But I also teach on the difference between extrapolating within sample and outside of sample, and the truth is we don't have any datapoints that look close enough for me to say whether it's one or one million jobs saved or created. Given an annual benchmark revision to employment data that is about +/- 275,000, I don't think we know.

The President continues:

All right, so financial market stabilized, economy growing again. The problem we now face is that in any recession, job growth is what's called a lagging indicator.Which, I believe, contradicts Dr. Romer.

Businesses don't start hiring again until they have some confidence out there that there's actually a market for additional goods and services. That's always true in any recession.At this point one would have hoped Steve Kroft would have asked two questions:

Usually, it's worse when you have a big financial crisis like this that prompts the recession. And this one's been exceptionally bad, partly because businesses were very spooked, and it was a global crisis. But partly because, frankly, businesses have figured out that maybe they can sustain themselves just with fewer employees producing the the same amount of goods and services.

- Mr. President, what policies have you taken that would give businesses some confidence that there's a market for their goods and services?

- Mr. President, why do you think firms keep redundant labor on hand?

Labels: economics

Blink, Dubai-style

[T]he Government of Abu Dhabi has agreed to fund $10 billion to the Dubai Financial Support Fund that will be used to satisfy a series of upcoming obligations on Dubai World.The rest is used to support Dubai creditors elsewhere. The announcement also includes a plan to create a workout for Dubai World if they cannot meet their obligations. It's a big acknowledgment by the UAE and Abu Dhabi that they are backers of Dubai's troubled credit, but James MacIntosh notes it seems to have enough vagueness that there should still be the lesson that a private company in Dubai is private.

As a first action for the new fund, the Government of Dubai has authorized $4.1 billion to be used to pay the sukuk obligations that are due today. The remaining funds would also provide for interest expenses and company working capital through April 30, 2010 � conditioned on the company being successful in negotiating a standstill as previously announced.

"Brinksmanship", says Seabee, who I think is unconvinced by that argument. We'll see.

Labels: economics

Sunday, December 13, 2009

US Constitution

As I've watched the chipping away and now gouging of our Constitution, I'm reminded of two key phrases: ..... PROVIDE for the common defense and PROMOTE the general welfare. Seems our current Democrat leaders have the words 'promote' and 'provide' backwards. It's time to take back our Constitution. You want to be inspired? Go watch this You Tube video of Lt. Col. Allen West, running for US Congress in FL's District 22. He nails it big time. And, if you can spare a few $$, send them his way. He gets it and says it very well.

Labels: Freedom

Saturday, December 12, 2009

Commenting shift

Labels: blogging

Friday, December 11, 2009

Financial reform bill passes anyway

One thing for higher education people to watch: an amendment that requires students to get financial aid counseling before receiving student loans from private lenders.

I'll have more on the bill and its provisions on the King Banaian Show tomorrow.

Your fever is a little less today

So it's better, but off a base that's so low that a little better isn't good enough. If you think of there being a separate phase of recovery before you get to expansion (off a business cycle trough) I might say recovery is beginning. But calling it expansion seems a little much.

I'm still waiting on employment and disposable personal income net of government transfers to make up my mind on the recession's end.

Labels: economics

Financial reform bill nears passage with lots of sausage

One provision many of my friends may like is at the beginning, where the act orders an audit of the Federal Reserve's actions during the financial crisis and its use of emergency powers. This has been the subject as well of work my friend Vern McKinley has been doing through a FOIA action. I need to get him back on the air to talk about this, but that will have to wait a week or two.