Tuesday, February 02, 2010

FHA faces the music

The roots of this crisis go back a long way, perhaps to its beginnings in 1951. In testimony before the House last October, mortgage specialist Ed Pinto gave testimony that showed it already had a default rate of 2.36% in 1998 before heading to current levels approaching 5%. The agency has jacked up the fees borrowers pay for FHA loans to more than double previous year revenues -- which of course reduces the amount of borrowing and depresses the housing market. But that may not be enough money still. And worse, as Pinto points out, increasingly those willing to pay the fee are exactly those you'd least like to loan the money to.The share of borrowers who are falling seriously behind on loans backed by the Federal Housing Administration jumped by more than a third in the past year, foreshadowing a crush of foreclosures that could further buffet an agency vital to the housing market's recovery.

About 9.1 percent of FHA borrowers had missed at least three payments as of December, up from 6.5 percent a year ago, the agency's figures show.

Although the FHA's default rate has been climbing for months and eating into the agency's cash, the latest figures show that the FHA's woes are getting worse even as the housing market shows signs of improvement. The problems are rooted in FHA mortgages made in 2007 and 2008. Those loans are now maturing into their worst years because failures most often occur two to three years after a mortgage is made.

If the trend continues and the FHA's cash reserves are exhausted, the federal government would automatically use taxpayer money to cover the losses -- a first for the agency, which has always used the fees it charges borrowers to pay for its losses.

The loan portfolio FHA holds has clearly deteriorated, as shown by the rise in the share of mortgages with three missed payments. (This number was closer to 3% in the middle of the last decade.) And the capital level has now fallen to around 0.5% of assets, far below the statutory minimum of 2%. (I had reported on this in November.) Fees will perhaps cure this in the short run, but more likely continued foreclosures will chew up most of that money. Pinto thinks the FHA needs $40 billion in cash from the government, and there is nothing in the Obama budget to prepare for this possibility.

Peter Wallison put the blame squarely where it belonged last November:

Emphasis added; you can't blame greedy lenders for FHA, because they were government officials. The Congress and the Administration are flat-footed on this one. They still can't figure out what to do with Fannie and Freddie, and they are soon to add another agency to the list of those waiting for Godot.The role of the FHA is particularly difficult to fit into the narrative that the left has been selling. While it might be argued that Fannie and Freddie and insured banks were profit-seekers because they were shareholder-owned, what can explain the fact that the FHA�a government agency�was guaranteeing the same bad mortgages that the unregulated mortgage brokers were supposedly creating through predatory lending?

The answer, of course, is that it was government policy for these poor quality loans to be made. Since the early 1990s, the government has been attempting to expand home ownership in full disregard of the prudent lending principles that had previously governed the U.S. mortgage market. Now the motives of the GSEs fall into place. Fannie and Freddie were subject to "affordable housing" regulations, issued by the Department of Housing and Urban Development (HUD), which required them to buy mortgages made to home buyers who were at or below the median income. This quota began at 30% of all purchases in the early 1990s, and was gradually ratcheted up until it called for 55% of all mortgage purchases to be "affordable" in 2007, including 25% that had to be made to low-income home buyers.

It was not easy to find candidates for traditional mortgages�loans to people with good credit records or the resources for a substantial downpayment�among home buyers who qualified under HUD's guidelines. To meet their affordable housing requirements, therefore, Fannie and Freddie reduced their lending standards and reached into the FHA's turf. The FHA, although it lost market share, continued to guarantee what it could, adding to the demand that the unregulated mortgage brokers filled. If they were engaged in predatory lending, it was ultimately driven by the government's own requirements. The mortgages that resulted are now problem loans for the GSEs, the FHA and the big banks that were required to make them in order to burnish their CRA credentials.

The significance of the FHA's troubles is that this agency had no profit motive. Yet it dipped into the same pool of subprime and other nontraditional mortgages that the GSEs and Wall Street were fishing in. The left cannot have it both ways, blaming the private sector for subprime lending while absolving the government policies that created the demand for subprime loans. If the financial crisis was caused by subprime mortgages and predatory lending, the government's own policies made it happen.

Tuesday, December 29, 2009

My landlord, the state

My guess is that these agencies will become bloated agencies of rent-seekers throughout the US. It would take another Reagan-type sweep to de-politicize the mortgage insurance business.Tom Petruno is puzzled why investors are buying shares in this company because private shares will eventually be worth zero. I think it's an example of the greater fool theory. When the Treasury statement says they are "retaining flexibility" to not unwind their participation in the mortgage market, can there be any doubt that the Federal government is not being honest in saying it wants "the private market ... to provide a larger source of mortgage finance." The only credible commitment the administration has made is to not ask Congress for permission to expand its role in those markets.

Thursday, November 05, 2009

Congress played health care fiddle while housing burned

A much-anticipated audit of the Federal Housing Administration was abruptly postponed just before it was supposed to be made public, after questions arose about its accuracy.Sure a bad time for this, particularly given Barney Frank's continuing headache with Fannie Mae.

The auditor, Integrated Financial Engineering, said it notified the F.H.A. late Tuesday that its computer models were creating unexplained inconsistencies. A news conference scheduled for Wednesday morning was canceled.

The delay came amid broad public concern about the financial condition of the F.H.A., and appeared likely to add to questions about whether the agency is running excessive risks with taxpayers� money.

Fannie Mae reported a net loss of $18.9 billion in the third quarter of 2009, compared with a loss of $14.8 billion in the second quarter of 2009. ... Third-quarter results were largely due to $22.0 billion of credit related expenses, reflecting the continued build of the company�s combined loss reserves and fair value losses associated with the increasing number of loans that were acquired from mortgage backed securities trusts in order to pursue loan modifications.Yup, another $15 billion going into Fannie to bail out the housing industry. Congress' answer? Keep more first-time homebuyer credits flowing. Damn the pusher man.

...

As a result, on November 4, 2009, the Acting Director of the Federal Housing Finance Agency (FHFA) submitted a request for $15.0 billion from Treasury on the company�s behalf.

Labels: banking, economics, housing

Friday, July 17, 2009

It's better to burn out than it is to modify

Re-default is a huge problem, because it means those homes should have just undergone foreclosure instead of modifying their underlying mortgages. After all, if those borrowers default again, the modification merely delayed the inevitable. This might indicate that the modification efforts are more focused on getting all troubled homeowners to modify, without really determining who can successfully manage those modification terms.And yet,

As complaints mount about President Obama's foreclosure prevention program, the administration is ratcheting up the pressure on mortgage servicers.You could have seen this coming from far off. Does this administration not understand incentives?

Financial executives will meet with Treasury Department and administration housing officials on July 28 to discuss how the loan modification and refinancing plan has been implemented. The administration plans to grill servicers that have done few modifications or have had many complaints.

Officials also want financial institutions to hire more people and train them better, expand their call centers, and send more mailings to eligible borrowers, according to a letter sent to servicers last week. The government also said servicers need to establish a way for borrowers to contest their treatment or denial.

Wednesday, June 17, 2009

First look at bank reform -- not impressed

Above (please click to enlarge) is Table 5 from Chapter 2 of Frederic Mishkin's The Economics of Money, Banking and Financial Markets, 8th edition.* It maps for you the variety of regulators currently in the U.S. banking system. There's an interesting passage in the book much later on regarding multiple regulatory agencies:

Above (please click to enlarge) is Table 5 from Chapter 2 of Frederic Mishkin's The Economics of Money, Banking and Financial Markets, 8th edition.* It maps for you the variety of regulators currently in the U.S. banking system. There's an interesting passage in the book much later on regarding multiple regulatory agencies:Commercial bank regulation in the United States has developed into a crazy quilt of multiple regulatory agencies with overlapping jurisdictions. The Office of the Comptroller of the Currency has the primary supervisory responsibility for the 1,850 national banks which own more than half of the assets in the commercial banking system. The Federal Reserve and the state banking authorities have join primary responsibility for the 900 state banks that are members of the Federal Reserve System. The Fed also has regulatory responsibility over companies that own one or more banks (called "bank holding companies") and secondary responsibility for the national banks. The FDIC and the state banking authorities jointly supervise the 4,800 state banks that have FDIC insurance but are not members of the Federal Reserve System. The state banking authorities have sole jurisdiction over the fewer than 500 state banks without FDIC insurance. (Such banks hold less than 0.2% of the deposits in the commercial banking system.)That last bit is amusing (Mishkin has a new edition out next month, and I can't wait to see what he does with that second paragraph now!) So as we look at the new draft from the White House, what do we see? In their words (p. 2)

If you find the U.S. bank regulatory system confusing, imagine how confusing it is for the banks, which have to deal with multiple regulatory agencies. Several proposals have been raised by the U.S. Treasury to rectify this situation by centralizing the regulation of all depository institutions under one independent agency. However, none of these proposal has been successful in Congress, and whether there will be regulatory consolidation in the future is highly uncertain. (pp. 249-50)

- A new Financial Services Oversight Council of prudential regulators to identify emerging systemic risks and improve interagency cooperation.

- New authority for the Federal Reserve to supervise all firms that could pose a threat to financial stability, even those that do not own banks.

- Stronger capital and other prudential standards for all financial firms, and even higher standards for large, interconnected firms.

- A new National Bank Supervisor to supervise all federally chartered banks.

- Elimination of the federal thrift charter and other loopholes that allowed some depository institutions to avoid bank holding company regulation by the Federal Reserve.

- The registration of advisers of all hedge funds and other private pools of capital with the SEC.

It will take days to read and digest what's in there. For example, I'm quite concerned about the reduction in Federal Reserve independence that is reflected in the proposal (on p. 14) to force the Fed to get a signature from the Secretary of the Treasury before it could invoke its emergency powers (under Section 13(3) of the Federal Reserve Act) to prevent a financial crisis. I'm sure there are other little noxious nuggets among the 85 pages in this thing.

Let me make two points though. First, I showed the structure above and the quote from Mishkin to point out that most of us have thought the regulatory system was, if anything, too unwieldy. We were hoping for simplification. At first reading this proposal drops one regulator (the Office of Thrift Supervision, within FDIC) but puts two in its place, one for consumer finance protection and one for insurance firms. That just feels like it's going in the wrong direction, based on what we've taught in money and banking for the 25+ years I've done it.

Second, I fully agree with Arnold Kling that the Fed does see systemic fragility of the financial system as within its purview. I wrote several weeks ago that the Fed has basically two modes of conduct: in normal mode it fights inflation (with some eye on "high employment" as its goals insist -- the degree to which it looks at that varies by Fed chairman); in emergency mode it will act as a lender of last resort without regard to inflation in the short run. I am not yet sure there's any discussion in this draft of the connection between regulation and lending of last resort, or the connection between each of those and deposit insurance. (See Kahn and Santos [2005] for more.)

Kling also notes the Treasury brief is mute on housing policy. Can't imagine why.

*See also this from the Federal Reserve.

Labels: banking, economics, Federal Reserve, housing

Tuesday, April 28, 2009

Ann of a thousand yachts

I am probably the most sympathetic conservative to the idea of removing tax preferences in legislation, but I think Rep. Ann Lenczewski has missed the main message of tax reform. The lesson from 1986 was that you could only trade their removal for lower tax rates. The 2005 tax reform proposal at the Federal level was an example of this as well. But removing tax preferences makes substantial changes in the tax price of certain economic activities. Removing the tax preference for home ownership raises the cost of it, at a time when the market needs to stabilize. The plan Lenczewski proposes reminds me of nothing so much as the famous yacht tax. The home construction industry is probably in worse shape in 2009 than the boat-building industry was in 1990. Million-dollar mortgages support million-dollar homes which support many electricians and carpenters. A phase-in during a period of robust home construction would make much more sense than the present bill.

I could go on, but time is short. I outsource my own thoughts on tax reform to Alvin Rabushka.

Labels: DFL legislature, housing, Minnesota, taxes

Friday, February 06, 2009

Mrs. Scholar writes

Wednesday, December 03, 2008

Prices and mortgage rates

Lower mortgage rates can help people buy housing, but only if they feel secure enough in their jobs, and confident enough in their financial future to take the plunge. Given that consumers are drowning in debt -- especially housing debt -- fearful of layoffs, and waiting for housing prices to hit bottom, it's unlikely that they'll react to this initiative with a spending spree.But that's in fact what both FDIC Chair Sheila Bair and now Treasury Secretary Hank Paulson are doing. The graph shows that affordability has only turned around for us over the last few months, and as the quote above by June Fletcher notes correctly, that is only part of what we're waiting for. If you have $25,000 on your credit card bill and have a $20,000/year job, cutting your card interest rate from 15% to 10% or even 5% isn't going to get you out of debt. Prices have to fall enough to get buyers into the market, and for long enough that sellers recognize that they are better off getting out of that house and facing whatever consequences the loss of investment puts on them.

Friday, October 10, 2008

I got a brick

Matthew Parris with the Economic Crisis in Three Minutes":

The stage is empty against the backdrop of a blue sky and scudding clouds. ENTER: Joe Citizen carrying a small brick, and Jack and Jill Jones carrying a large one...&c. A bubble begins, and then crashes. RTW clever T.

Joe Citizen (to the Joneses): That�s a nice big brick you own.

The Joneses: It�s for sale. The kids have flown the nest and we�re downsizing. We�d take �10 for our brick. What are you asking for your smaller one?�

Joe Citizen (to himself): �10? Pricey for a brick, but I guess mine must be worth more than I realised too. The market�s obviously on the up. (To the Joneses) I�d sell mine for �8.

The Joneses (conferring): Brick prices must be rising faster than we thought. If his is worth �8, ours must be worth more than �10. (To Joe) We�ve raised our asking price to �20.

Wednesday, October 08, 2008

How much hope do homeowners need?

America�s families are bearing a heavy burden from falling housing prices, mortgage delinquencies, foreclosures, and a weak economy. It is important that those families who have worked hard enough to finance homeownership not have that dream crushed under the weight of the wrong mortgage. The existing debts are too large compared to the value of housing. For those that cannot make payments, mortgages must be re-structured to put losses on the books and put homeowners in manageable mortgages. Lenders in these cases must recognize the loss that they�ve already suffered.There has been since December a plan that asks lenders and borrowers to get together and renegotiate mortgages. A newer plan (described Monday in the LA Times) already has such a provision in place.

A new federal loan workout program called Hope for Homeowners (HfH) begins this month, targeting those unable to pay their mortgages. It is for homeowners who bought their homes before 2008 and now have monthly payments exceeding 31% of their income.This was passed last week in the bailout bill (see page 69, Sec. 124). And I understand that Section to have been introduced by Sen. Dodd. He pitched it in March. I think this is what Ed Morrissey (whose boss is one of the people slamming McCain) was referring to initially in his post (I now see he has updated and included the HfH plan.) And the McCain page refers to the bill as part of the powers it would have to create the Resurgence Plan. Ed also mentions a post by Marc Ambinder in which the McCain campaign says this money comes out of the $700 billion in the plan. It would be a redirection of the money, not a new cost. That was certainly not clear last night (not that much of this plan really was before I sat and read the email that had the plan I'm quoting here.)

Under the program, banks would in many cases write down mortgages to 90% of a home's current value. Such a provision would be important in California, where many recent home buyers have mortgages that now greatly exceed their property values.

The new 30-year fixed-rate loan would be insured by the Federal Housing Administration and could not exceed $550,440.

Also worth noting are the conditionalities on the plan:

The McCain Resurgence Plan would purchase mortgages directly from homeowners and mortgage servicers, and replace them with manageable, fixed-rate mortgages that will keep families in their homes. By purchasing the existing, failing mortgages the McCain resurgence plan will eliminate uncertainty over defaults, support the value of mortgage-backed derivatives and alleviate risks that are freezing financial markets.Note that there is no mention of the 31% payment-to-income ratio from HfH, so to me it doesn't look really like the same plan. So buyers of homes with stated-income loans would be out (like this fellow) or people flipping properties.

The McCain resurgence plan would be available to mortgage holders that:

- Live in the home (primary residence only)

- Can prove their creditworthiness at the time of the original loan (no falsifications and provided a down payment).

There's a glut of homes on the market. A glut is reduced either by decreasing supply or increasing demand. Lee Ohanian tries to sell an increased in skilled immigrants as a way to increase demand. The McCain Resurgence Plan, at its base, tries to reduce supply by not forcing the sale of homes through foreclosures. It might be, might be, cheaper to throw a few dollars into homes directly than to support the banks through the purchase of MBSs. From the Plan:

The new mortgage would be an FHA-guaranteed fixed-rate mortgage at terms manageable for the homeowner. The direct cost of this plan would be roughly $300 billion because the purchase of mortgages would relieve homeowners of �negative equity� in some homes. Funds provided by Congress in recent financial market stabilization bill can be used for this purpose; indeed by stabilizing mortgages it will likely be possible to avoid some purposes previously assumed needed in that bill.The relief of negative equity means that the banks would receive from the government the difference between the principal on the original mortgage and the mortgage "at terms manageable for the homeowner." I still need some flesh on that. I would want to know if the 31% payment-to-income ratio is the definition of manageable. I'd want to know if the government can be certain the initial purchase price on the home was not set in order to qualify someone for a shady mortgage. Those details aren't there, and don't look in Marty Feldstein's pitch from last Friday (which is not exactly the same proposal anyway, but a close cousin.)

I'll see if my contacts in the McCain campaign will provide any additional details.

Labels: economics, housing, McCain

Wednesday, October 01, 2008

Add two

Captain Capitalism has been at this much longer, and like at least one of the Schadenfreude bloggers has worked with real estate and lending. Indeed, he now has his own book on the collapse of the local real estate market, which I was privileged to read in advance of its general release. It is full of excellent stories that tell how loans were inflated. (Indeed, Arnold Kling in his podcast with Russ Roberts this week notes that no money down loans -- even loans on fraudulent values -- are not found out if real estate values are rising, which is why for many years nobody could understand why those fools in the old days insisted on 20% down for a house.) Aaron is far more critical of the bailout plan than me, and as a guy with insider knowledge is a viewpoint you should read.

Friday, September 26, 2008

And this is what you want?

Most U.S. stocks fell, dragging the Standard & Poor's 500 Index to its worst weekly retreat since February, as the government's $700 billion financial rescue plan stalled in Congress and Washington Mutual Inc. collapsed.Source. OpinionJournal's Political Diary (subscription) is reporting that Eric Cantor and other House Republicans who have balked at the Paulson plan say "there is no way there isn't a vote" and that they have an alternative.

Wachovia Corp. tumbled as much as 31 percent and National City Corp. as much as 60 percent after a group of House Republicans said they wouldn't support the bailout as outlined by Treasury Secretary Henry Paulson and regulators deemed WaMu ``unsound.''

Essentially, the alternative being drawn up by Messrs. Cantor, Ryan and Hensarling aims to free up private capital to buy distressed securities by pushing through a series of tax and regulatory reforms, and by creating government insurance for mortgage-backed securities that are now burning holes in financial firms' balance sheets. Washington has more experience running guarantee programs, they note, than running a hedge fund (the Paulson plan). Their proposal would avoid committing hundreds of billions of taxpayer dollars to the discretion of the Treasury Department to "save" the financial system. And it doesn't turn the U.S. government into a giant (and conflicted) owner of U.S. financial institutions.Details of the amended (by Congressional bargaining) Paulson plan (called Troubled Asset Relief Plan or TARP) are here. There are parts I don't like in that plan -- particularly the phase-in of the money and the uncertainty for financial markets that creates, as well as poison pills for banks that use the facility (you do want banks to use the facility, don't you?) -- but it's better than what Paulson sent them on Monday, and I prefer it to the GOP alternative.

Last year Willem Buiter and Anne Sibert argued that the central bank should take on a more modern role as a market maker of last resort. The Fed has the power to deal in a crisis with a large variety of companies in whatever type of securities it wishes (under the Federal Reserve Act of 1913.) Its decision to work only in Treasury or agency securities, and then only maturities under a year, is the result of agreements and custom. Over the last year the Fed has adopted more of a role as MMLR by allowing banks and some other financial houses to deal in other assets, including some mortgage-backed securities (MBS). The Fed's portfolio, however, now has a lot of this other paper on it, to the point where it may run out of Treasury securities with which it can conduct open market operations. In other words, they may run out of bullets.

TARP would have Treasury working as MMLR for the more illiquid assets. Buiter argues separately that this is no function for the Fed; the Treasury, and therefore the taxpayer, has to bear the credit risk. It is this risk that House GOPers are fighting. Given that there aren't a thousand Warren Buffetts in the world, and that foreign sources are probably not forthcoming (and may not be politically palatable to some), it can cure the banks' insolvency problem with either forced debt-to-equity swaps for banks and their creditors, or by having government purchase preferred stock. The amended TARP has such a provision -- while Buiter would rather see those two items separated, and I would too, the forced provision of warrants to government and government's exercise of them might get it done. Neither of these options will appeal to conservatives, but banks need capital, not just liquidity.

Why do they need capital? Because, as Ed Morrissey pointed out yesterday, they have been incentivized by our regulatory and tax systems, on which many of us profited:

When prices fell, an entire class of overextended borrowers could no longer refinance their ARMs to get affordable mortgage payments, and they began to default. As I wrote earlier, it was similar to the margin calls in 1929, only in slower motion. The bottom fell out of the housing market, and thanks to the massive sale over the previous decade of MBSs based on marginal loans, the collapse didn�t just get limited to the lenders or the borrowers, but investors around the world.Who will be the politician that says the hard truth of that italicized line? Between now and Election Day, don't hold your breath.I�ve written this a couple of times, but this LA Times article from 1999 makes the case clearly � and maybe even more credibly, since it praises all of the stupidity and government intervention that created the bubble and the collapse. Clearly, this was not the fault of a free market out of control. Congress and the executive created this problem by extorting banks into poorly-considered lending practices under the threat of prosecution as �unfair lenders�. They compounded that extortion with an artificial mechanism to incentivize lenders by having GSEs buy the paper and resell it, with government imprimatur as its guarantee.

Normally, I�d say let the lenders drown. Unfortunately, this isn�t completely their fault, and we should have known better. Not too many of us complained about the rapid escalation of our own equity that came from this housing/lending bubble, and in the end most of us will still benefit from it, if not quite as much as it seemed a year ago. Three years ago, Alan Greenspan tried to get Congress to act, and only John McCain, Chuck Hagel, John Sununu, and Elizabeth Dole responded � while politicians of both parties made sure to keep the Ponzi scheme in full swing. And those MBSs were minted at the behest of Congress, the people�s branch of government. We broke it, and we own it.

Unfortunately, the government guarantee program offered by the House GOPers is no more helpful than the Paulson plan at solving this mess, and it does not help provide relief for the Fed as a MMLR. TARP at least takes care of one of these. We might have time to deal with recapitalization later, but not as much time as you think.

P.S. Tim Duy is very wise:

My hope is that a bailout is coming. But it will not change the path the economy is already on, it will only prevent activity from shifting to a new, less desirable path. I don�t quite see how the billions of dollars plowed into this program will be funneled to households. I see instead it will only cushion the process of deleveraging, and thus minimize the quantity of resources stripped from the economy. This is important and necessary, but will not provide a miracle cure for the economy�s travails.It's that or Mellon. Congress chooses this weekend.

Labels: banking, economics, housing

Wednesday, August 20, 2008

Minneapolis housing market woes

- Over the past year, the inventory of lender-mediated properties for sale has almost doubled, while traditional inventory has declined by 16 percent.

- Of all current active properties for sale, 21.7 percent are foreclosures or short sales.

- Traditional homes continue to hold their value better than foreclosures and short sales. The Q2 median sales price of foreclosures and short sales has fallen by 11.7 percent in the last tw

o years while traditional homes has declined by only 3.4 percent.

o years while traditional homes has declined by only 3.4 percent.

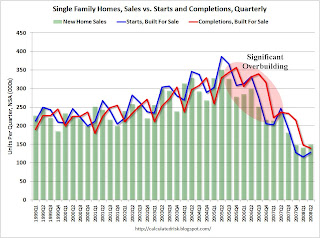

Data on the right (from Calculated Risk) shows that the overbuilding of 2004-06 has yet to be worked out nationally. The same appears to be true for the Twin Cities.

Labels: economics, Feminists, housing, Minneapolis

Thursday, July 17, 2008

A line I wish I had used on radio

Whenever Congress does anything in the name of housing, if you take a good whiff, you'll smell pork.Arnold Kling, on the latest attempt of the Congressional Democrats to double down on their last great idea, allowing Fannie and Freddie to buy up jumbo mortgage loans. Greg Ransom is channeling a similar thought. He points to Franklin Raines, former head of Fannie, who says the reason we need to bail out the GSEs now is that Bush and the Fed didn't explicitly say they would bail them out years ago. Um, yeah. Justin Fox comments:

Raines's depiction of them as successful private companies that aren't really reliant on taxpayer backing sounds a lot like somebody who was born on third base hitting a triple.I'm sure I can steal that one in another context some day.

BTW, KNSI tomorrow, the Patriot Saturday. Show details tomorrow.

Wednesday, July 02, 2008

Heaven is 9% off

I have looked at the property values here and that median price covers a wide array of homes and there's quite a number here as monthly home sales fell 31% from last June. Condos go for half the price of homes.The median price of a single-family home on O'ahu tumbled 8.8 percent in June to $625,000 as dwindling demand convinced many sellers to take less than they probably could have gotten a year ago.

The drop, the largest this year, was due in part to the median price having set a record high of $685,000 in June 2007.

I spent time talking to a waiter at the hotel I'm at (which is really great) and pointed to the headline. He said, so, do you want to buy? I told him of yesterday's post and Mrs S, and he just smiled, "she doesn't know what she's missing." Perhaps she's missing a coming bargain. Those of us my age see retirement in a decade coming and wonder where it will happen. A 9% discount is an opportunity for some who've put themselves in a position to take advantage.

Labels: economics, housing, Mrs. S

Thursday, June 05, 2008

Read the fine print

I'm looking at that and thinking, "hmmm..., that doesn't fit what I think is going on." So I first get the OFHEO report discussed. Yup, there it is. St. Cloud for 1-year price change is ranked 212 of 292 metropolitan areas reported. I don't know that I would be too happy about being in the 212th best market.Where the two-county St. Cloud area saw declines in housing prices in the last half of 2007, it saw an increase in the first quarter of 2008, according to the data. Prices increased 1.19 percent in first quarter 2008. Before that, values changed negative 2.54 percent in the fourth quarter and negative 0.91 percent in the third quarter.

This report shows St. Cloud will likely see stable home values for at least the next two quarters, said Louis Johnston, associate professor of economics at the College of St. Benedict and St. John�s University. Values won�t grow as fast as they did during the housing bubble, he said, but they likely won�t collapse.

That�s good news for people looking to sell their homes, as well as for cities, counties and school districts� planning budgets, Johnston said. Taxes that fund government are based on property values.

Second, the OFHEO data looks both at sales and at refinancings, and only at single-family homes. In the FAQ of the report:

The House Price Index is based on transactions involving conforming, conventional mortgages purchased or securitized by Fannie Mae or Freddie Mac. Only mortgage transactions on single-family properties are included. Conforming refers to a mortgage that both meets the underwriting guidelines of Fannie Mae or Freddie Mac and that does not exceed the conforming loan limit, a figure linked to an index published by the Federal Housing Finance Board. The conforming loan limit for mortgages purchased in 2007 was $417,000. Legislation enacted in February 2008 has raised the limit on a temporary basis to as much as $729,750 in high cost areas in the continental United States. Conventional means that the mortgages are neither insured nor guaranteed by the FHA, VA, or other federal government entities. Mortgages on properties financed by government-insured loans, such as FHA or VA mortgages, are excluded from the HPI, as are properties with mortgages whose principal amount exceeds the conforming loan limit. Mortgage transactions on condominiums, cooperatives, multi-unit properties, and planned unit developments are also excluded.Well, that seems to exclude rather a lot. When you compare this to the sales report of the St. Cloud Area Association of Realtors, which shows prices falling 10% in the first quarter, you get quite a different story. Now some of that might be that the houses sold in the first quarter were of lower quality; the OFHEO measure looks at repeated sales (as does the Case-Shiller index), to hold quality relatively constant (though the improvements you put into the house don't get reflected, as I understand these measures.)

But it's important to recognize the limited coverage of those data the Times' story uses. Looking only at Fannie and Freddie insured loans takes a more stable, less bubbly portion of the real estate market. Including refinances in the national index revises the data from a decline in the first quarter of 1.7% to a decline of only 0.2%. (I don't see a number for purchase-only for St. Cloud.) 82.3% of the data used nationally came from refinances. I think you'd have to account for that before writing a headline quite like what the Times uses.

Labels: economics, housing, St. Cloud

Monday, May 19, 2008

Real estate on sale! 33% off!

This month more than 2,600 houses were on the market at less than $120,000 -- a 608 percent increase over the same period in 2005, according to the Minneapolis Area Association of Realtors. The inventory for all price ranges increased 62 percent over 2005.The return of the starter house is the upside of the down housing market. And buyers are taking notice.

Now this may not mean the end of the housing slump is near, or that cutting prices is a good thing. But the overhang in housing inventory has to be worked through somehow, and with starts declining relative to sales, stories like this one might be the first sign of how we are working through the housing bubble.

Labels: economics, housing, Minneapolis

Friday, May 09, 2008

Housing bill follies

"The bill even includes a $35 million dollar slush fund for trial lawyers. And according to the Congressional Budget Office, the bill would help refinance the loans of only 500,000 people � less than 1% of homeowners � at the expense of the 51 million homeowners who pay their loans on time, however much they may be hard-pressed to do so.Hugh's request that we need more time to look at it would be met by the CBO report on the bill that Rep. Bachmann mentions. They estimate the subsidy at $1.7 billion, or $3400 per household refinanced. That on top of the Heritage report on the bill should be enough to convince most that it's a bad idea.

"The bill is so broad that homeowners covered could deliberately default on their loans to cash-in on the taxpayer bail-out. In others words, a taxpaying single mother working extra hours to pay her mortgage on time could be asked to help pay the loans of someone who intentionally defaulted.

"Lenders and servicers can game the system as well. The bill invites them to cherry-pick only their worst loans to dump onto American taxpayers � including loans people secured through outright fraud.

Unfortunately it passed, and thus gives the banks yet another fillip in return for bad decisionmaking. And, as Dean Baker points out, it is just delaying the needed price adjustment in housing.

For those Minnesota congresspeople who voted for the bill (read, all the Ds plus Rep. Ramstad), ask this: Do you think this money should be used to bail out the Parish Homes development? Are you sure it wouldn't be?

Tuesday, May 06, 2008

One in four home sales in Mpls market in Q1 "lender-mediated"

Not surprisingly, lender-mediated homes have seen a substantial increase in total market share over the last 24 months. The percent of total new residential listings in the Twin Cities 13-county region that are flagged as foreclosures or short sales using our methodology has shown steady growth, rising from 2.9 percent in Q1 2006 to 7.1 percent in Q1 2007 and 21.7 percent in Q1 2008.So people putting homes on the market has fallen, but the number of homes put up by traditional sellers and which sold fell by much, much more. 1828 houses either through foreclosure or through short sales has a very depressing effect on homeowners "holding steady" in their homes. They may be holding, but they're not steady.

...The actual number of traditional seller new listings has fallen by 27.4 percent over the last two years, with only 19,675 in Q1 of this year compared to 27,116 in Q1 of 2006. So clearly, homeowners are holding steady in their current residences with greater frequency and home builders are producing far less new inventory.

The market share picture is similar for home sales, with foreclosures and short sales comprising a larger portion of overall sales than they have before. In Q1 2008, 27.6 percent of total residential closed sales were mediated by a financial institution, up substantially from the first quarter of the two years prior. And the number of traditional closed sales fell from 8,896 in Q1 2006 to 4,790 in Q1 2008, while the number of bank mediated sales increased from 324 to 1,828 for the same time period comparison.

More of the short-sale and foreclosed homes are lower-price homes, so if the rate of those homes being put into the market accelerates, the report is right to point out, that makes the value of houses look like it's falling faster than it is. But there may be many more homes out there with people not able to sell, not able to make their payments, and not able to get out of the game. Even if traditional sale prices have only fallen 3.5% over the last two years, that still means a lot of homes with mortgages repricing this year are about to be in big trouble.

Labels: economics, housing, Minneapolis

Thursday, April 17, 2008

STC home prices down 12% in a year

Local single family home sales were down 4 percent in first quarter 2008 compared with first quarter 2007, according to data released this week by the St. Cloud Area Association of Realtors.Here's the sales report. Homes were discounted more than $6000 from their listing prices, and 13% fewer homes were listed in the first quarter of 2008 vs first quarter of 2007. It appears the mix of homes sold had something to do with the downturn, as single-family home prices fell 10%, but more condo, townhouse and patio home sales occurred this year than last.

That's a slightly larger drop from last year around this time, when first-quarter home sales decreased 1 percent from first quarter 2006.

Local home sale prices have dropped almost $20,000. The median price of a home was $143,000 in first quarter 2008 compared with $162,650 in first quarter of 2007. And the average number of days a home remains on the market is now 111, according to first quarter 2008 data. That's six days longer than first quarter 2007.

Meanwhile, local gas prices hit a high. It happens every spring, as we change blends for the Clean Air rules, but it's hard to argue with $115 oil.

Labels: economics, housing, St. Cloud

Wednesday, April 09, 2008

More on that real estate survey

Table 1 � How Do You Rate the Market?

| 2005 | | 2007 | ||||||||

| | Very Good | Good | Average | Poor | | Very Good | Good | Average | Poor | |

| Appraisal | 14% | 66% | 21% | 0 | Appraisal | 0 | 17% | 57% | 27% | |

| Development | 38% | 38% | 23% | 0 | Development | 14% | 57% | 14% | 14% | |

| Property Management | 29% | 57% | 10% | 0 | Property Management | 0 | 38% | 54% | 8% | |

| Mortgage Banker | 3% | 84% | 13% | 0 | Mortgage Banker | 0 | 12% | 35% | 53% | |

| Broker | 13% | 80% | 7% | 0 | Broker | 0 | 26% | 41% | 33% | |

| Assessor | 7% | 57% | 36% | 0 | Assessor | 0 | 0 | 73% | 27% | |

| Res-All | 11% | 63% | 25% | 0 | Res-All | 0 | 12% | 37% | 51% | |

| Comm-All | 19% | 71% | 10% | 0 | Comm-All | 1% | 23% | 52% | 21% | |

Table 2

| | 2005 | 2007 |

| Appraisal | 93% | 90% |

| Developer | 100% | 100% |

| Prop Mgt | 76% | 88% |

| Mortgage Banker | 91% | 59% |

| Broker | 100% | 92% |

| Assessor | 100% | 86% |

29% of respondents see the market improving in the next 1-3 years and 13% think it will get worse. (The rest believed it would "stabilize" -- at what level? I don't know.)

Labels: economics, housing, SCSU

Housing in campaigns

The Senate bill is likely to include several provisions aimed at shoring up the weak housing market. Among them are tax credits for buyers of foreclosed homes, along with billions of dollars to refinance problem mortgages and for cities to buy foreclosed properties.Last night we had another blogger conference call with Senator Norm Coleman, and I asked about this criticism. His response was that the tax breaks do help homeowners and that this distinction between direct and indirect help is a false one.But the bill also provides billions of dollars in tax breaks for businesses. Critics, including Democratic House Speaker Nancy Pelosi, say those tax breaks come at the expense of directly helping homeowners who are in trouble.

He also points out the issue I raised about that criticism being in conflict with the criticism in the story of there not being enough money for mortgage counseling. As Michelle Malkin has described, the mortgage counselors are often affiliated with left-wing groups like ACORN and La Raza. Coleman defended the idea of counseling; I did not bring up these groups as part of my question, wondering if he was aware of the issue. He made no mention of them. His support of the housing bill pointed to the residential construction industry, which suffered a 14% decline in employment in 2007.

I find no discussion of the mortgage issue on Al Franken's website.

Meanwhile, the Bush administration appears ready to double-down on last summer's FHA insurance expansion.

Under the expanded program, lenders could get FHA insurance for problem loans in exchange for "voluntarily writing down the outstanding mortgage principal," according to the testimony. That would entail the government being responsible for an increasing number of risky loans.The plan differs significantly from the Durbin plan, which Coleman criticized for its cram-down provisions in "turning mortgages into junk bonds." (Ed Glaeser writes about how to not use the bankruptcy courts to solve the mortgage crisis.) In the Bush proposal, the lenders are being told if you want the FHA insurance, you have to work out a haircut of the principal, reducing the debt of borrowers. Coleman had not seen the plan yet and had no comment.

Mr. Montgomery emphasizes in the testimony that "while considering any changes to FHA, we must ensure that the financial solvency of the [FHA] must not be compromised." FHA is a division of the U.S. Department of Housing and Urban Development, which didn't return calls seeking comment.

Under the original program created last year, known as FHASecure, homeowners with high-interest, adjustable-rate mortgages currently can refinance into an FHA-insured mortgage and lower their monthly payments. To date, the administration says it's served 145,000 homeowners in need, and projections show that it will likely reach more than 400,000 by year's end. A temporary expansion of the program would be expected to add significantly to that total.

States are not missing the opportunity to posture for the voters or the media. In Minnesota, SF 3396, the Subprime Foreclosure Deferment Act continues to work through both houses of the legislature.

I'm troubled by the implication that boldness should be the criterion by which we choose how to resolve debt issues. Seems like boldness got us here."We have a crisis in mortgage foreclosures, and this seemed like the boldest way that we could respond to the problem," said state Sen. Ellen Anderson, a sponsor of a Minnesota bill that would let some borrowers with subprime loans or negative amortization mortgages defer paying a portion of the amount owed, without being considered delinquent. A negative amortization mortgage is one in which the loan balance can grow even if the borrower keeps up with the payments.

The Minnesota legislation would require a mortgage lender attempting to foreclose on a home to honor a borrower's request for a 12-month deferment. During that time, the borrower would have to continue paying either the monthly payment due on the loan at the time it was made, or 65% of the monthly payment at the time of default, whichever was less, though the borrower would eventually have to make up the deferred payments. The bill has passed committees in the Minnesota House and Senate, but the governor has said he probably will veto it. [Last] Wednesday, the bill's sponsors sent to the governor a letter suggesting that lawmakers work with him to craft a compromise.Contrary to some opinions, the bill does impose some real costs. The terms of the loan are changed. Who would lend again in a place where bad times means the power of government is shifted onto the depositors of a bank, its employees, and the taxpayers?

The legislation faces strong industry opposition. "It would significantly erode the confidence lenders and borrowers have about the stability of contracts in Minnesota," said Tom Deutsch, deputy executive director of the American Securitization Forum, an industry group.

One thing is for sure: Housing draws voters' attention, which leads it to draw politicians' attention. The latter should worry you.

Labels: Coleman, economics, housing

Thursday, April 03, 2008

It's a jungle out there

When he asked where they see themselves in five years. 59 percent of mortgage bankers say they would stay in their field, compared to 91 percent in 2005. In 2005, 100 percent of assessors said they would keep the same career, compared to 86 percent last year.The only thing I find really striking about that is the degree to which opinion seems to move in a herd-like fashion.

Professor of finance, insurance and real estate Steven Mooney says professionals are not expecting an improvement in the next three years. Most are rating the market as �poor to average�. A big contrast to just two years ago; not a single respondent described the market as �poor�.

I'll drop Steve a note and ask if I can see the survey.

Wednesday, April 02, 2008

Billions of mortgages subsidized

Bad news: The money goes for additional "mortgage counselors". Tell me who is in a bad mortgage right now that is just waiting to work out their problems but frustrated by a busy signal?

Instead, it will be Marquette Bank that gives out some bridge money for borrowers who need some cash to get through a work-out of their loans.

It would be interesting to watch political reaction to Holman Jenkins idea of supporting house prices by reducing supply. Would Marquette get praise for funding demolition teams?

Knocking down surplus homes would be the most efficient and equitable way to spend taxpayer dollars. It can proceed experimentally. It can be turned off quickly when the need evaporates. It would not be a lesson to Americans that housing debt is not real debt and need not be repaid. It wouldn't benefit the most irresponsible lenders and borrowers at the expense of responsible ones. The housing market would still have to hit bottom, but the bottom would be higher (and sooner).I'm not advocating that as the best plan, but it's the most interesting paragraph I read today.

UPDATE: Captain Ed gets it. I'm reminded of all the criticism of US aid to developing economies being mostly about hiring U.S. consultants to offer advice rather than giving money to the poor in those countries. (And yes, I say that as having been one of those consultants.)