Tuesday, August 14, 2007

Do you look at the data first?

When the Fed pumps money into the economy, it does so through the banks. The Fed buys bonds from banks using money created from thin air. Yes, the money ends up flowing throughout the whole economy, but it hits the banks first. And flush with this excess cash, the bankers make loans, including loans to homeowners. And when they run out of reasonably good credit risks, they start lending to bad credit risks � such as all those sub-prime mortgage holders you�re now reading about.

In the year of the great money flood, sub-prime lending went from 4 percent of total lending to more than 10 percent. That�s in one year!

...But here�s what I think: The executive and legislative branches went the way of the supply-siders, cutting taxes on income and capital. These results are reflected in the growth-sensitive areas of the economy: GDP, unemployment, and stock market valuations. The Fed, however, didn�t believe the tax cuts would do the job, and turned on the money pumps. The results showed up in monetary phenomena such as inflation, loss of dollar value, and the sub-prime bubble.

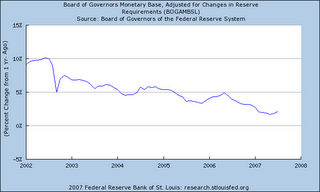

Where the results didn't show up are in the monetary base, the amount of money in the system under the control of the Fed. This has gradually decelerated since 2002. And if there was a massive influx of money into the system, why did none of it go to commercial and industrial lending, particularly when supposedly tax rates were being cut as much as Bowyer says?

Where the results didn't show up are in the monetary base, the amount of money in the system under the control of the Fed. This has gradually decelerated since 2002. And if there was a massive influx of money into the system, why did none of it go to commercial and industrial lending, particularly when supposedly tax rates were being cut as much as Bowyer says?

Labels: economics