The forecast is rosy from the get go. The budget forecasters assumed that the economy would grow at a 3% annual rate starting in April, and that real GDP would fall just 1.2% in 2009, from 2008. Then, from 2010 through 2013, the administration assumes that real GDP will grow at a 4.0% annual rate. To put this in perspective, it is twice as fast as the economy�s 2.0% annual rate of growth between 2004 and 2008. This is not impossible, but the only other periods that came close to this 4% growth rate for such a prolonged period of time were in the late-1990s and mid-1980s. Forgive us for pointing this out, but both of these periods followed major shifts toward freer markets, and tax cuts, not bigger government and tax hikes.

There is no period in US history where tax rates and the size of government both increased, and yet real GDP growth accelerated as sharply as the Obama team forecasts.

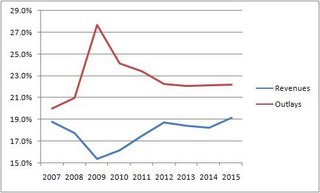

If real GDP grows 1% slower on an annual basis, federal spending would be 23% of GDP in 2013, not 22%. The last time government spending was anywhere near this level, was in 1982-83, in the wake of the worst recession in post-war history with unemployment at 9.7%. But by 2013, according to the Obama forecast, the US will be in the fourth year of recovery, with an unemployment rate at 5.2%.

In other words, it is the Obama team�s shift to an expanded government role in the economy and society that is boosting spending, not just spending to stimulate the economy. Deficits will remain extremely large because spending is so much above any historical ability of the economy to pay for it. And, the more taxes are lifted to pay for it, the slower the economy will grow and the less likely any economic data even remotely resembling the Obama Administration�s rosy scenario will come to pass.

From First Trust economists Brian Wesbury and Robert Stein

this week. Graph above, of federal outlays and revenues based on

OMB's new budget except for 2007 data, from

here. I tried to shift the GDP figures to those from Blue Chip (that OMB reported) but it doesn't make a big difference, and it appears the post-2010 forecasts are from last October, before the, um, fit hit the shan. I'd rather see some new long-term forecasts collected up before I tried that fix, and think Wesbury and Stein might be wise to provide an alternative long-term GDP forecast before speculating. But qualitatively, they seem right.

Labels: economics, Obama

Permalink here.

Posted

by King : 8:27 AM

|