Lower mortgage rates can help people buy housing, but only if they feel secure enough in their jobs, and confident enough in their financial future to take the plunge. Given that consumers are drowning in debt -- especially housing debt -- fearful of layoffs, and waiting for housing prices to hit bottom, it's unlikely that they'll react to this initiative with a spending spree.

But that's in fact what both

FDIC Chair Sheila Bair and now Treasury Secretary

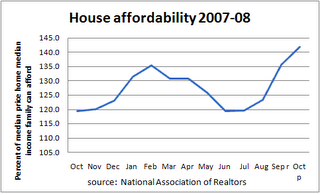

Hank Paulson are doing. The graph shows that affordability has only turned around for us over the last few months, and as the quote above by June Fletcher notes correctly, that is only part of what we're waiting for. If you have $25,000 on your credit card bill and have a $20,000/year job, cutting your card interest rate from 15% to 10% or even 5% isn't going to get you out of debt. Prices have to fall enough to get buyers into the market, and for long enough that sellers recognize that they are better off getting out of that house and facing whatever consequences the loss of investment puts on them.

Labels: economics, housing

Permalink here.

Posted

by King : 3:43 PM

|