Tuesday, February 16, 2010

An evening thought about prices

One element of stimulus that I think might not work as planned is infrastructure investment. Let�s look at the I-35 bridge that collapsed in Minneapolis and was rebuilt in 2007-8. According to Wikipedia, the original bridge cost $5.2 million to build in 1964-7, which is roughly $35 million in today�s dollars (admittedly not a bargain, given that it collapsed, but the collapse was due to a design flaw, not faulty construction or shoddy materials). The replacement cost $234 million. Public infrastructure, employing as it does an army of civil servants (and their pension obligations), union labor, and drawers full of lawyers, turns out to be one of the most expensive things in the world to buy. A sensible consumer, faced with an 7X increase in the real price of a good, would purchase less of that good rather than more.Philip Greenspun. Recall, of course, that we probably didn't go for the lowest cost on the replacement of that bridge -- we were in a hurry to get back a key artery of a major metropolitan area and speed was considered as a tradeoff to cost. And the 2008 bridge is not a replacement for the 1967 bridge -- you can't build that bridge any more, the design no longer is used by anyone (and considered unsafe.)

All that said, is it possibly true that the real price of government goods has risen? A bonding bill cannot pass without a provision that assures wages will be higher. A labor union claims the bill provides 21,000 jobs without asking "if that amount of money was spent by a private firm building its own infrastructure, how many jobs would that provide?" And for how long would those jobs last?

Government is not "a sensible consumer." In fact, thinking about a price of real government services, can we actually conceive of its demand curve?

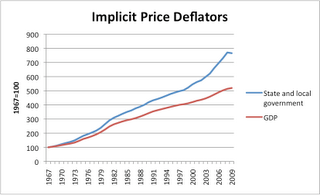

UPDATE: In comments Speed Gibson got me wondering about the implicit price deflators for state government spending, so I drafted a very quick graphic.

There are many ways to criticize a deflator, and many criticize them. But it's hard to find a better measure. I don't think they just take the deflator for all goods and add 1%, as SG suggests. It's late, someone else may find a better answer in the morning.

Labels: economics, it's the spending stupid