Wednesday, March 03, 2010

Tell me if you've heard this one before

...they would have to more than double in order to pay for what will be spent under current law, insuring that future generations simply would not have the freedom and opportunity that Americans currently enjoy. According to CBO, by 2050, individual income tax rates would have to be increased by about 90 percent to finance the spending between then and now. By 2082, tax rates would have to more than double with a potential tax rate on the highest incomes of 88 percent. �Such tax rates would significantly reduce economic activity and would create serious problems with tax avoidance and tax evasion.This brings me a real sense of deja vu, as many years ago I was a research assistant to Prof. Craig Stubblebine at Claremont Men's College (now Claremont McKenna College.) Stubblebine was part of the early efforts in the late 1970s and early 1980s to get real spending limits on the Congress. (I arrived in Claremont in 1979, and worked with Prof. Stubblebine in 1981-83.) Known as S.J. Res 56 back then, it passed one chamber only to be shot down in the other chamber with much sleight of hand. They tried again later to get the amendment passed by attaching it to the Gramm Rudman Hollings bill, which Gramm at least supported including the constitutional provisions. But it missed a two-thirds passage by a single vote and was not included, and fervor died with passage of GRH.

(I'll note the spending limitation amendment now proposed -- SLA for short -- is not the same as what was tried thirty years ago. A balanced budget amendment was included in it, waivable by a 60% vote in each chamber. Taxes were limited as a share of national income. In some ways, that bill was closer to the Taxpayer Bill of Rights than is SLA, as its authors admit.)

While I doubt this bill will see the light of day in this Congress, the possibility that Republicans could take over the House of Representatives may make SLA a part of that party's platform for the elections. That will be a cheerful thing, but the 2/3 provision for constitutional change may make this not much more than advertising that that party is taking its spending problem more seriously. It's a good start, but it needs to do more to convince voters it has forsworn its past profligacy.

Labels: economics, it's the spending stupid, Republicans

Tuesday, February 16, 2010

An evening thought about prices

One element of stimulus that I think might not work as planned is infrastructure investment. Let�s look at the I-35 bridge that collapsed in Minneapolis and was rebuilt in 2007-8. According to Wikipedia, the original bridge cost $5.2 million to build in 1964-7, which is roughly $35 million in today�s dollars (admittedly not a bargain, given that it collapsed, but the collapse was due to a design flaw, not faulty construction or shoddy materials). The replacement cost $234 million. Public infrastructure, employing as it does an army of civil servants (and their pension obligations), union labor, and drawers full of lawyers, turns out to be one of the most expensive things in the world to buy. A sensible consumer, faced with an 7X increase in the real price of a good, would purchase less of that good rather than more.Philip Greenspun. Recall, of course, that we probably didn't go for the lowest cost on the replacement of that bridge -- we were in a hurry to get back a key artery of a major metropolitan area and speed was considered as a tradeoff to cost. And the 2008 bridge is not a replacement for the 1967 bridge -- you can't build that bridge any more, the design no longer is used by anyone (and considered unsafe.)

All that said, is it possibly true that the real price of government goods has risen? A bonding bill cannot pass without a provision that assures wages will be higher. A labor union claims the bill provides 21,000 jobs without asking "if that amount of money was spent by a private firm building its own infrastructure, how many jobs would that provide?" And for how long would those jobs last?

Government is not "a sensible consumer." In fact, thinking about a price of real government services, can we actually conceive of its demand curve?

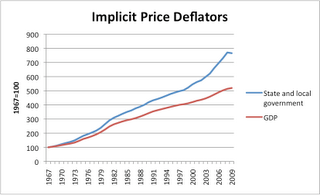

UPDATE: In comments Speed Gibson got me wondering about the implicit price deflators for state government spending, so I drafted a very quick graphic.

There are many ways to criticize a deflator, and many criticize them. But it's hard to find a better measure. I don't think they just take the deflator for all goods and add 1%, as SG suggests. It's late, someone else may find a better answer in the morning.

Labels: economics, it's the spending stupid

Friday, February 12, 2010

Don't feed the bears

Recreational wildlife feeding would be banned in Minnesota for four months each year under legislation being proposed by the Minnesota Department of Natural Resources.You have a budget to balance, fellas. What is the burning desire to deny corn to Bambi?

Exceptions would be made for farmers, bird feeders, bear hunters and trappers, but the legislation would prohibit placing grains, vegetables or other feed for wildlife from Sept. 1 to Dec. 31.

The goal is to stop people from feeding deer, an activity that leads to car collisions and encourages illegal deer baiting during hunting seasons, DNR officials said.

"Wildlife and deer don't need supplemental food at that time of the year," said Maj. Rodmen Smith, manager of operations for the DNR's Division of Enforcement. "This will solve a lot problems with people attracting deer to their property, and it will clear up loopholes in the baiting law."

I don't doubt the issues Maj. Smith names are real issues. What I doubt is that this is a good use of a DNR officer's time. "Did you put this food here, son?"

Government now thinks it can control which animals get to eat, and when. Whatever did they do when the Minnesota Legislature didn't exist?

Labels: it's the spending stupid, Minnesota

Wednesday, February 10, 2010

I'm persuaded by your argument

"So, son, did you build a road today?" That's a question Ward Cleaver never asked the Beav.He's right of course: Government is NOTHING like a family budget. They're not even alike in how they take money. The editor says the family "takes money", by which he means the family needs an income. It's not just a matter of balancing a budget. Unlike the state of Minnesota, the family can conceivably borrow past the end of a biennium. But in the long run it must balance. And how does it get its income? By persuading someone to hire one of the family's resources -- the labor of one of its members, or its land and buildings, or its savings and perhaps machinery. The person it persuades believes it receives something of greater value for something of less value. So does the family.

But it's a question politicians are beginning to ask as an election year begins.

It seems that many politicians love the analogy of government's revenue and spending plans being like a family budget.

And my response is: Government is nothing like a family budget.

Excuse me. I should say, there is a similarity: They both take money.

The government's budget is nothing like that. It can force others to lend to it, as the current state budget forces school districts and its universities to do so. It can impose taxes, which involve coercion rather than persuasion. Its coercion may take something of greater value and convert it to something of less value; in fact, more often than not, it does. And it can claim some moral high ground while it coerces, claiming to do it for "those less fortunate" or "the children." My family could persuade a few dollars from people through begging. The government does not stand on street corners.

So good job, Winona Daily News.

Labels: it's the spending stupid, Minnesota, taxes

Monday, February 08, 2010

The Census ad: Thinking marginally

If 1% of folks watching #SB44 change mind and mail back #2010Census form, taxpayers save $25 million in follow up costsThe way the Hill reports this is "one percent of the more than 100 million people expected to watch this year�s Super Bowl football game opt to mail back their Census forms," but we have forms by households. Last year 48 million households, out of about 118 million (304 million people at 2.59 people/HH, via Census), watched the Super Bowl. The response rate from households to the 2000 Census was about 67%. So if 48 million households watch the game, 32 million can be expected to respond anyway. To get a million (actually, 1.18 million) more households to respond out of the remaining 16 million -- off a single ad, shown in the third quarter when many have stopped watching or are well into the adult beverages -- is a bit much. It's this failure to think on the margin that makes me shake my head at the Census' response.

By the way, does it really cost $25 to collect one more household of Census information? Back in my college days I worked one summer for R.L. Polk to get addresses and phone numbers for their directory, door to door. What are the arguments for not privatizing the Census?

Labels: economics, it's the spending stupid

Monday, February 01, 2010

Hey, I just cut 1/2 percent of the budget!

The largest three items of the $20 billion in reductions proposed are

- Completing the nationalization of the student loan program. Ed has already written on this one. It removes $8 billion in subsidies to banks for making student loans, using the Federal government's ability to borrow money instead of the banks using theirs. They'll argue it saves money. But it greatly expands the Federal control of education, permits the handing out of favors to students who become public sector employees, and subjects students to Congressional whim instead of financial market uncertainty. I'm not sure students will like that trade-off. The administration is calling a takeover of the student loan market 40% of its "budget cutting exercise".

- End the NASA Constellation program that sends astronauts back to the moon by 2020. $3.466 billion is to be saved by this. I'm usually inclined to like these privatizations, which is why I suspect it won't survive. There are states in the South that are already beneficiaries of this spending, and some people can't stand that other people are making money on space exploration. Most voters like space exploration (example) and it's just not something people will look at and want to kill.

- Kill the C-17 program. It's baaaack, after being rejected by the Senate last October. You want to really believe they'll change their minds this time? Fuhgeddaboudit. That's $2.5 billion of the $20 b.

But much like those larger program above, each of the smaller programs has someone backing them in Congress. While I completely agree that the Save America's Treasures program, established to help celebrate the millennium, is about ten years past its stated purpose, it does have a purpose to someone. Many of the ideas in here were ideas that existed before this administration. Many of them will outlive his administration, as well.

And at the end of the day, what will we have? If nary a one of these proposed cuts pass, what pain will be visited on the Congress? We will have a budget deficit of $1.29 trillion rather than a budget deficit of $1.27 trillion. Would anyone notice? That's what Congress hopes. Yes, I suppose someone will want to argue that it saves additional money down the road, but spending cuts are all about maintaining an option to cut later -- and favoring friends in the meantime -- rather than cutting now and losing those friends.

Labels: economics, it's the spending stupid, Obama

Monday, January 25, 2010

Just to be sure I understand

And somehow Sen. Evan Bayh is happy?

�The president can say in this State of the Union address, �I�m going to include in my budget a freeze on discretionary spending, I�m drawing a line in the sand, and I�m going to use my veto pen to enforce that,�� Bayh said in an interview on Bloomberg Television�s Political Capital with Al Hunt.The president, of course, won't even be there to enforce the latter parts of this agreement. And it would be dwarfed in the out-years by the planned spending from health care.

Labels: economics, it's the spending stupid, Obama

Wednesday, December 09, 2009

Another parable

Suppose I go to a baseball game, with my teen-age son. I've just been to the bank, and the smallest bill I have is a $100.Haven't I seen that on a bumper sticker lately? The Dems reportedly are looking for $70 billion out of a plan Treasury Secretary Geithner says spent $42 billion out of a $700 billion dollar bill. Some people who want the change back.

I send my son up to get two hot dogs, some peanuts, and two diet sodas. I know that costs maybe $18.

He comes back with the stuff and sits down. I ask him for the change. He looks at me like I'm crazy. "That money is going to be spent on other things! That's leftover money!"

What would I do? I'd grab him by the belt, and shake the money out of his pockets! That's my money! I want my change back. I WANT MY CHANGE BACK!

Labels: it's the spending stupid

Wednesday, November 18, 2009

Waste, fraud and abuse

The federal government made $98 billion in improper payments in fiscal 2009, and President Obama will issue an executive order in coming days to combat the problem, his budget director announced Tuesday.Sheldon Richman says sarcastically "Yes, a well-worded executive order should do the trick." $24 billion of the improper payments came from Medicare according to this report; another report over the weekend suggested Medicare lost $47 billion. But the Feds are now saying they are going to count as improper incomplete or illegible documentation, which the Bush administration did not. This then permits them to "multiply by 10 the number of agents and prosecutors targeting fraud in Miami, Los Angeles and other strategic cities where tens of billions of dollars are believed to be lost each year." These will be claimed as savings ... which will be spent on expanded coverage.The 2009 total for improper payments -- from outright fraud to misdirected reimbursements due to factors such as an illegible doctor's signature -- was a 37.5 percent increase over the $72 billion in 2008, according to figures provided by Peter Orszag, director of the White House Office of Management and Budget.

Got that? Define a scribble as fraud, hire more government workers, get doctors to reduce scribbling, and claim savings of $9.7 billion. (The extra $1.3 billion is payroll for those new prosecutors and agents making our health care experience better.)

No word on how many agents and prosecutors will be used to find phantom districts receiving $6.4 billion in stimulus cash. Perhaps we should get another executive order wherein Obama calls for the elimination of phantom districts. Imagine the savings!

Labels: health care, it's the spending stupid, Obama

Wednesday, October 28, 2009

I did not know ...

I say let's make a deal: Your parent wants $2.8-5.6 billion more money in stimulus dollars? Stop the damn ads.

Labels: it's the spending stupid, Obama, taxes

Thursday, October 08, 2009

A JOLT of gross

Even though we are still experiencing a daily net loss of jobs it's important to remember that there are about 200,000 hires every working day Lots of firms are hiring. In order to increase employment a payroll tax cut need not shift firms "from firing to hiring" it need only increase the hiring rate of those firms already hiring or on the margin of hiring.Alex Tabarrok discussing data from the JOLTS report from BLS. In May I discussed the context of saying the stimulus had saved or created jobs. Vice President Joe Biden has now upped the 150,000 claim to a million, which has earned him some derision from conservative quarters.But the proper context for the number is that 29 million hires have happened since January, and he's claiming that the stimulus made one of those 29. Or he could say 32 million jobs were lost in the first seven months, and it would have been 33 without the stimulus. Or something in between. Fine, but in that context the number isn't so large. And, of course, many of those jobs may be temporary: Last week's job report showed that 1.4 million workers completed temporary jobs in September, up almost 500,000 from a year ago.

You can click the JOLTS report tomorrow and update my figures for August.

Labels: economics, it's the spending stupid

Monday, July 27, 2009

If California wanted to do this right

Markets exist for everything, even CaliCash, but we know that increased liquidity will increase the price of any asset ceteris paribus. It would be better to issue scrip of standardized denomination, divisible, and useful in paying state or local taxes. Someone should get on the phone to the Governator and get this proposal to him. Or does he want to make them harder to accept?

Even cooler markets in everything: speculators offering to buy CaliCash on Craigslist. You'd probably get more from SecondMarket, but there are forms to fill out. So someone is willing to save you that time, it appears.

Labels: California, economics, it's the spending stupid, money

Monday, July 20, 2009

Call to arms of the day

The United States is facing an urgent financial crisis that threatens our fiscal and economic stability. Our government is currently borrowing about 50 cents for every dollar we spend. Medicare is already paying out more in benefits than it collects in taxes and Social Security is expected to do the same in less than five years. The individual share of this year�s deficit for every American is $3,500 - by the fall that share will approach $6,000. The national debt currently stands at $11.5 trillion, costing every American $37,600. The total unfunded liabilities for the United States are $60.6 trillion, which exceeds the total net worth of America. Paying off this liability would require every American to write a check to the Treasury Department for $198,000. ...We must put a stop to the spending spree in Washington. The best way to stimulate the economy is to cut taxes and spending drastically.Graph at top courtesy John Rutledge, who was my professor at Claremont Graduate School for about two hours before joining the Reagan White House in 1981.

Labels: economics, it's the spending stupid, taxes

Why buy a state you already own?

The distribution of WPA employment was "a storm center from the beginning" (Howard 1943, p. 596), and charges of discrimination were common, most especially from governors who believed they were being shortchanged (Patterson 1969, pp. 54, 57, 77, 81, 198-200). Apprehension about the motives of WPA was promoted also by the fact that "the WPA was most reluctant to give out any information about the way in which state employment quotas were determined" (MacMahon et al. 1941, p. 223).Wright found that if a state was more "in play" -- by which was meant the degree to which states switched support between Republican and Democratic candidates in the prior half-century -- it was more likely to receive grants and WPA jobs.

Lott writes:

I would argue John needs a fuller analysis here of voting patterns. It makes no sense to be lavish on Washington DC in this view because the District is reliably Democratic. I would look for states that have had votes switch more often, swing states like Ohio or Missouri or Florida. If Obama's spending is politically motivated, you should be able to use that variability of voting with the measures Lott includes like unemployment, foreclosure and bankruptcy and find a result.Politico reported on June 5 that the �Stimulus tour� � visits by Mr. Obama and other administration officials �across the country to tout the massive spending program or hand out stimulus cash to grateful local officials� � overwhelmingly took place in states that voted for Obama: �52 of the 66 events were in states that backed Obama.� The other 14 events were in states that Obama lost only narrowly. A new study released by USA Today also finds that counties that voted for Obama received about twice as much stimulus money per capita as those that voted for McCain.

In our results, Obama's share of the vote accounted for only a small percentage of the variation in how the stimulus money is being allocated. A one percentage point increase in Obama's vote share means an additional $13.52 in per capita spending, but even then the relationship rests on the large amount of money given to D.C.

Looking at his regression, I see he's included per capita income and vote share for Obama -- I'd like to see a correlation of those two, because I suspect richer states voted for Obama. I would also think there's some multicollinearity in the various measures of economic hardship included. I'll send John a link, and suggest he try some additional tests to flesh out this result a la Wright or John Wallis (REStat 1987, JSTOR link.)

Labels: economics, elections, it's the spending stupid, Obama

Monday, July 13, 2009

Does MN government spending buck the trend?

Scott Beaulier adds that "The scale on the Y-axis is suspect and implicitly makes positive state budget spending [growth] look like the desirable, normal outcome!" Well, one will claim, particularly if one is a DFL legislator, that you haven't fixed this for inflation. So I thought I would, just for Minnesota. (Source data.)

Scott Beaulier adds that "The scale on the Y-axis is suspect and implicitly makes positive state budget spending [growth] look like the desirable, normal outcome!" Well, one will claim, particularly if one is a DFL legislator, that you haven't fixed this for inflation. So I thought I would, just for Minnesota. (Source data.)As a share of state GDP, sub-national government spending has stayed between 18-21% since 1992, and the DFL-passed spending bills are estimated to put that number a bit above 20% in the next biennium. Worth noting is that the unallotment planned by Governor Pawlenty represents only a half of a percent decline in that number. The graph below assumes no compensating changes by local governments or school districts in driving up taxes to replace lost revenue from state government. State real GDP is forecast to rise by 2.4% in 2010 and 3.8% in 2011.

It is normal for that number to rise during a recession, as government spending doesn't tend to fall as much as GDP when recessions happen. But to argue, as many do, that we're somehow starving government in Minnesota is not borne out by the data. Real spending still rises even with unallotment, though more in line with the restricted spending in the first years of the Pawlenty Administration than the 3.5-4% per year wishes of the DFL. I don't recall seeing people dying in our hospitals or our kids getting stupid then.

Labels: DFL legislature, economics, it's the spending stupid, Minnesota, Pawlenty