Monday, January 14, 2008

Pipe down, guv'ner!

From this morning's WSJ:

From this morning's WSJ:Federal Reserve Chairman Ben Bernanke, responding to criticism that the central bank has sent confusing messages about interest rates in recent months, has decided to speak more forcefully and more often about the outlook for the nation's economy.The complaint is that the presidents of the twelve Federal Reserve Banks have been out speaking more often, and that their views have been more contradictory of the views of the Board than usual. We have had presidents for tighter policy (Plosser) and for looser policy (Rosengren). But that just reflects the nature of the economy at this time -- peaks and troughs are naturally points of uncertainty and greater divergence of opinion. Apparently after responding to the Greenspan

...Fed officials are unlikely to cut rates before their scheduled Jan. 29-30 meeting, because Mr. Bernanke's speech has already recalibrated market expectations. But that could change if the outlook worsens sharply in coming days.

The Fed's new communications strategy comes after five months in which Wall Street analysts, academics and some former Fed officials have blasted the central bank for repeatedly implying it wouldn't cut rates further, and then doing just that, and for sending other contradictory signals.

(It could be worse, like in Europe.)

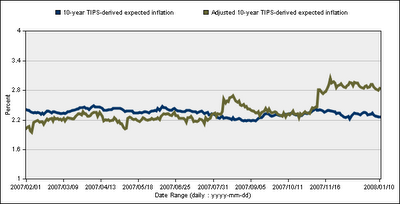

Tim Duy says that Bernanke is only paying lip service to inflation at this point. Perhaps they should pay more than that.

Labels: economics, Federal Reserve