Wednesday, January 30, 2008

GDP report on Fed rate decision day

Well, nice try. Without the foreign sector, gross domestic purchases rose only 0.2% in the quarter, and real final sales decelerated from 4% in the third quarter to 1.9%. (Which means, btw, that real final sales to domestic purchasers -- not overseas -- was lower at 1.4%.) So while we might have some explanation for missing the expectation of 1.2%, you could hardly say we should have beaten it. The very best interpretation would be that the numbers generated little new information about the state of the economy.

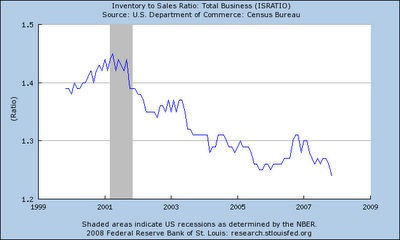

Moreover, I don't know that we should expect anything positive for first quarter 2008 out of the fact that inventories came in negative. As the following graph shows, firms have exhibited a desire to hold less inventories as a ratio to sales for years now, and with retail sales continuing to soften it could be argued that the decline in inventories in Q4 was planned. A negative report from the PWC survey is an argument in favor of this.

Moreover, I don't know that we should expect anything positive for first quarter 2008 out of the fact that inventories came in negative. As the following graph shows, firms have exhibited a desire to hold less inventories as a ratio to sales for years now, and with retail sales continuing to soften it could be argued that the decline in inventories in Q4 was planned. A negative report from the PWC survey is an argument in favor of this.The most negative news is the possibility that productivity growth turned negative this quarter, which could mean a stagflationary period, but there needs to be some more data to verify that.

UPDATE: Yup, half a point.

Labels: economics