Friday, January 28, 2005

GDP report: Sucking in capital, or just sucking?

American economic growth slows

2004's economy was the best in five years

I saw this glass half-full/half-empty thing this morning having two TVs at the bagel shop, one on Fox and other on CNN. You can guess which played which.

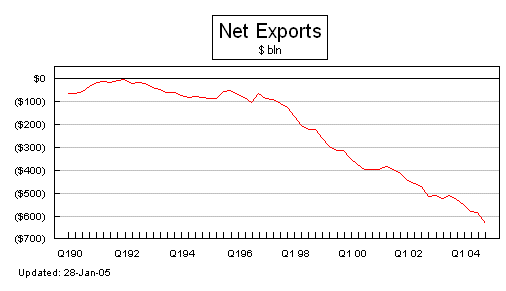

Here are two graphs that tell us useful things. First, the main story of that people will cover is the impact of the trade deficit. They will report to you that the deficit shaved 1.7% from GDP growth, which might make you think that we could have had 4.8% growth rather than the 3.1% we did. But the trade deficit has been growing for quite some time.

Now some people will want to point to this as a sign of trouble resulting from the budget deficit (the old "twin deficits" story) but this isn't so. The deterioration in the trade deficit began in 1998, while the budget deficit only became a problem after 9/11.

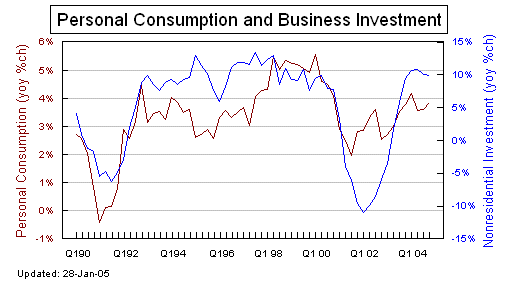

The second story worth understanding is that unlike the previous recession of 1991, this past recession has been characterized by a large downswing in investment in 2000-02 and a commensurate recovery in 2003-04.

Source (for WSJ subscribers only.) What this means really is that there has been a large sucking sound from businesses who are seeking to increase investment. Your basic principles student is taught that this should lead to an increase in interest rates, but that hasn't happened because of large capital inflows. Foreign investors, continuing to see opportunities here in America, are seeking dollars to invest here. The natural way to acquire them is to sell us imports: Thus do we have a large trade deficit.

This is an important point: We all know that the current account deficit -- a broader measure that includes the trade deficit, remittances from the U.S. abroad for things from servicing debt to sending Tia Maria a few dollars down in Guatemala -- has to be paid for by a capital account surplus. But one doesn't necessarily cause the other and not vice versa. It is entirely possible that a desire to send capital to the U.S. leads to an increase in our trade deficit. So while some are going to argue that the trade deficit represents something horrible, that we are living beyond our means, it could instead mean that the demand for U.S. assets (relative to foreign ones) has increased.

This isn't the view of everyone. For example, Stefan Karlsson argues the trade deficit is a "drag". Though he makes the interesting point that income accelerated somewhat due to the one-off dividend payment Microsoft made late last year, if the income wasn't spent on goods in the last four weeks of the quarter it had no effect. (Looking at the numbers from a couple of weeks ago, that appears to be right.) But largely the results have been ignored by the blogs and the media coverage has been various, as the headlines showed. Underneath, there may be great news. I see nothing in this report that causes me to revise my original 2005 forecast.