Friday, December 17, 2004

An economy of Christmas cheer?

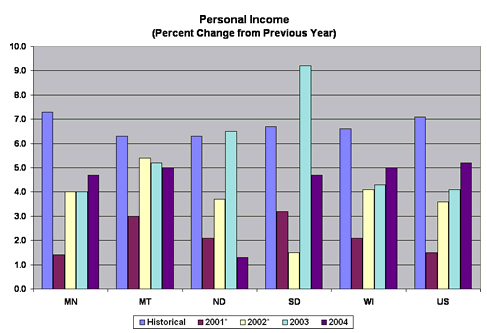

District business leaders are the most optimistic since the survey began in February 1989. They are confident that the national and district economies will grow at an average to above-average rate in 2005. Respondents are optimistic about their community�s economy, anticipating increases in employment, investment and consumer spending, though they see housing starts leveling off. At the same time, they expect average to above-average growth in inflation. Most of the respondents indicated that the results of the national elections will have a positive impact on their operations.The forecast for Minnesota calls for 0.8% employment growth versus a historical average of 1.7% (and down from the 1.2% forecast the Fed issued in June). While income probably grows at the historical average, much of the growth we're seeing is still due to increases in productivity rather than expanding payrolls. I hate to be curmudgeonly or even a Hindrocket pessimist, but I'm not as optimistic when I look at this graph:

With the Bush Administration indicating a national economic forecast of 3.5% growth in GDP for 2005, trade deficits likely to continue and with productivity growth likely to stay above 2%, I can see reasons for mild but not roaring optimism by consumers. (I am discussing with some people the concept of a local consumer sentiment survey; until then I mostly observe this by personal experience.) This is going to raise an interesting question -- under what conditions would we see extraordinary business confidence but flagging consumer confidence?